Crypto Market Retreats After Bitcoin’s Record Surge Above $124K

The crypto market declined 2.17% over the past 24 hours, marking a temporary pullback after reaching fresh record highs. Despite the short-term decline, the markets still shows a strong weekly performance, with a 6.7% gain over seven days.

Crypto Market Retreats as Traders Take Profits After Record Surge

Bitcoin shot to over $124,000, causing almost 700 million liquidations in the market, which prompted investors to start realizing a profit. The action was after a long run of the rally that boosted major digital assets to several-month highs, and then the momentum slowed.

There was a fear of the possible shutdown of the U.S. government and appreciation of the U.S. dollar, which led to a reserved trading market. The wider risk sentiment became weaker with the investors becoming defensive in the face of the increasing economic uncertainty.

Perpetual futures information had open interest growing at 4.9% with a 24% decrease in funding rates. The move indicates that traders can be selling leveraged long positions, which can further exert downward pressure.

BNB has set a new all-time high and then slightly declined, and Bitcoin (BTC) is, on the other hand, above $123,000. Ether (ETH) is just below the mark of $4,400 following a slight correction, which means that the coin is consolidating.

Canary Capital’s Litecoin and HBAR ETFs Near Launch

Canary Capital is approaching the close to getting its Litecoin (LTC) and Hedera Hashgraph (HBAR) exchange-traded funds (ETFs) approved , and the crypto market is seeing the anticipation. The company has just filed corrected reports, and other details, including a 0.95% charge and the tickers of LTCC and HBAR ETFs, are finalized. These updates are characterized by the analysts as characteristic of the last pre-launch phase.

According to Bloomberg ETF analyst Eric Balchunas, such filings appear complete, but an actual launch schedule is unclear. The government shutdown in the U.S has paralyzed operations in the Securities and Exchange Commission (SEC), postponing further approvals. The crypto ETF market is getting crowded even though the launch has been delayed. Tuttle Capital has applied to 60 leveraged 3x ETFs, with GraniteShares and ProShares being others entering into crypto-linked products. According to analysts, some 250 3x leveraged crypto ETFs have been registered, which indicates the increasing profitability of this segment.

BitGo Gains Regulatory Footing in Dubai

BitGo, one of the largest companies offering digital asset infrastructure, revealed that its subsidiary in the Middle East and North Africa (MENA) has received a broker-dealer license from the Virtual Assets Regulatory Authority (VARA) in Dubai. With this development, BitGo will have the capacity to provide institutional clients in the region with regulated digital asset trading and intermediation services.

The general manager of the BitGo MENA Ben Choy pointed out that the license signifies institutional scope and confidence in the operations in Dubai. The announcement came at the same time as the recent wave of enforcement of VARA that involved the financial penalties against 19 companies because of unlicensed activities. Some of them included TON DLT Foundation and Hokk Finance.

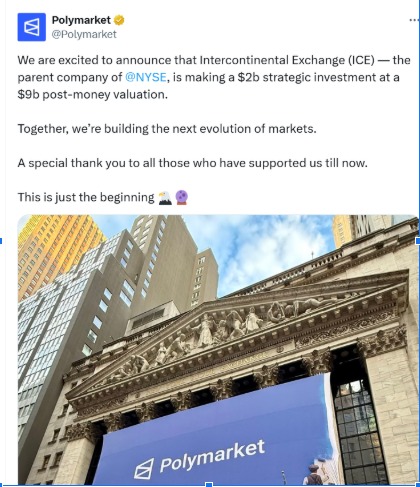

NYSE Parent Makes Massive Bet on Polymarket

The mother company of the New York Stock Exchange, Intercontinental Exchange (ICE), has dominated the crypto market by investing $2 billion in Polymarket, a blockchain-based prediction platform. The valuation of Polymarket after money is worth $9 billion.

Polymarket is a speculation market where people can bet on real-world events that can happen, where prices are based on the collective probabilities. Although limited to users in the United States because of regulatory concerns, this action is an indication that blockchain predictive tools are becoming institutionalized in conventional finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。