Bitcoin and Ethereum ETF Inflows Surge—Will Prices Follow After Crash?

Crypto markets are buzzing as big investors are buying more BTC and ETH—but prices are constantly shifting, moving up and down. While Bitcoin and Ethereum ETF inflows are at record highs, both cryptocurrencies are seeing small dips. This makes the market exciting but a bit tricky to follow.

So where will the price lead, why are exchange traded funds surging for around 7 consecutives days now, keep reading the article.

Bitcoin and Ethereum ETF Inflows Open Floodgates Of $1.3B

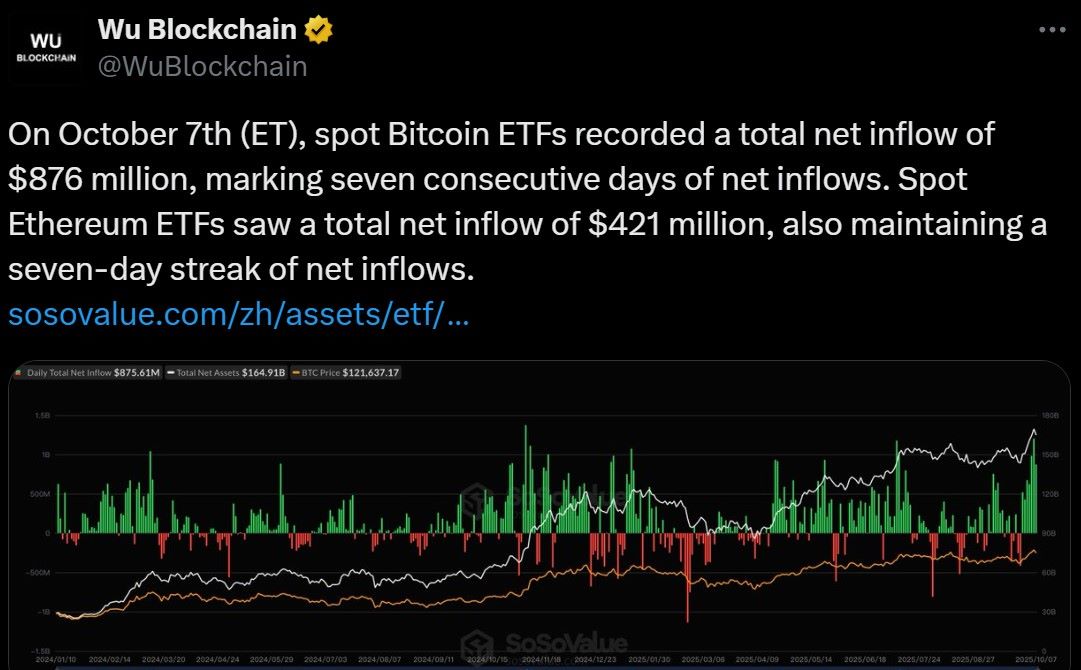

Data from Wu Blockchain shows $BTC ETF inflows surge recorded $876 million on October 7th, keeping a seven-day streak of bull run. On the other hand, $ETH ETF hit the record high of $421 million in the same week.

Note: Total “$1.3B inflows in just seven days show big investors are confident in both the world's top crypto coins”

These numbers clearly show that big crypto whales/investors are actively buying and trusting these cryptocurrencies for the long term.

Why BTC ETH Inflows Are Rising: Reasons Here

There are several reasons behind this massive capital influx, let’s understand them.

-

Inflation Hedge: Investors are buying both of these assets like gold or silver to protect their money from rising prices. Which means people are now seeing them as safe haven digital assets.

-

Fed Rate Cut Coming : On October 29, the Fed might cut interest rates. There is a 94.6% chance of this happening, which is fueling Bitcoin and Ethereum ETF inflows surge continuously.

-

Positive Market Mood: The Crypto Fear & Greed Index is 60 (Greed), meaning investors feel confident.

These are some of the major reasons behind exchange traded funds surge happening right now, and it may continue for a while.

Short-Term Correction: Why Prices Aren’t Following ETFs Mania

Even with a big influx, prices have dipped a little, this latest Bitcoin Ethereum market update is fueling buzz in the industry.

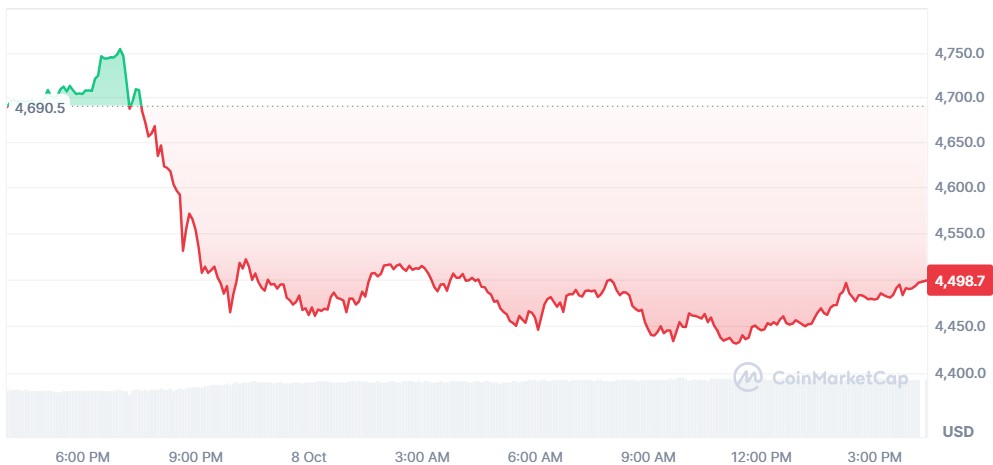

Ethereum Price Crash Analysis

-

The asset dropped from $4,690 to $4,498 in a few hours because some traders took profits.

-

Trading volume went up 20.89% to $56.09B, showing active buying and selling.

-

Price is now stable around $4,450–$4,500. If support holds, it could bounce back to $4,600–$5,000, which indicates that it is just a short term correction and the price will bounce back soon following a traditional market rally.

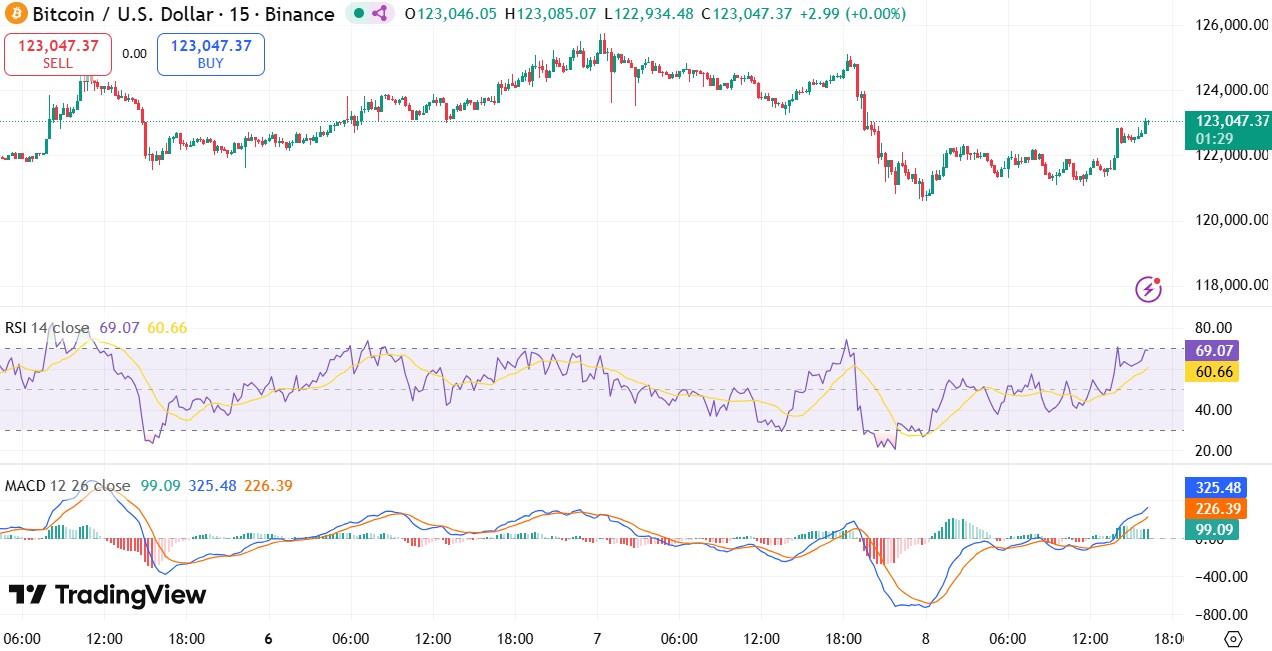

Bitcoin ETF Inflows Impact Price , But How?

-

The asset fell from $124,000 to $122,000 and then bounced back to $122,954.

-

RSI at 69 and MACD turning positive show momentum is coming back.

-

Trading volume rose 19.26% to $82.22B, showing big investors are still buying.

As per my TradingView price chart analysis of both the assets, this looks like a normal pullback, not a market crash.

Continuous Buying: How Institutional Interest Could Shape Crypto’s Future

Big investors buying like Grayscale, MSTR, and BlackRock are driving the Bitcoin and Ethereum ETF inflows into continuous surge , and it can affect the market in many possible ways.

It can result in less market circulation supply, helping prices go up which ultimately lifts the whole cryptocurrency market mood up because both of these assets are becoming a major part of investments against too many political, and financial dramas.

Conclusion

The crypto market is at a turning point, with record breaking Bitcoin and Ethereum ETF inflows and token’s small price dips happening together.

BTC ETF and ETH short term price crash, but rising trading volume are showing strong investor interest, making this a key time for traders and investors.

When short term correction like this happens investors must take a note and plan their actions for the long term growth.

Disclaimer: This article is for information only and not financial advice. Always do your own research before investing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。