Gold Breaks Barriers: Surge to $4,050 Signals Ongoing Bull Market Momentum

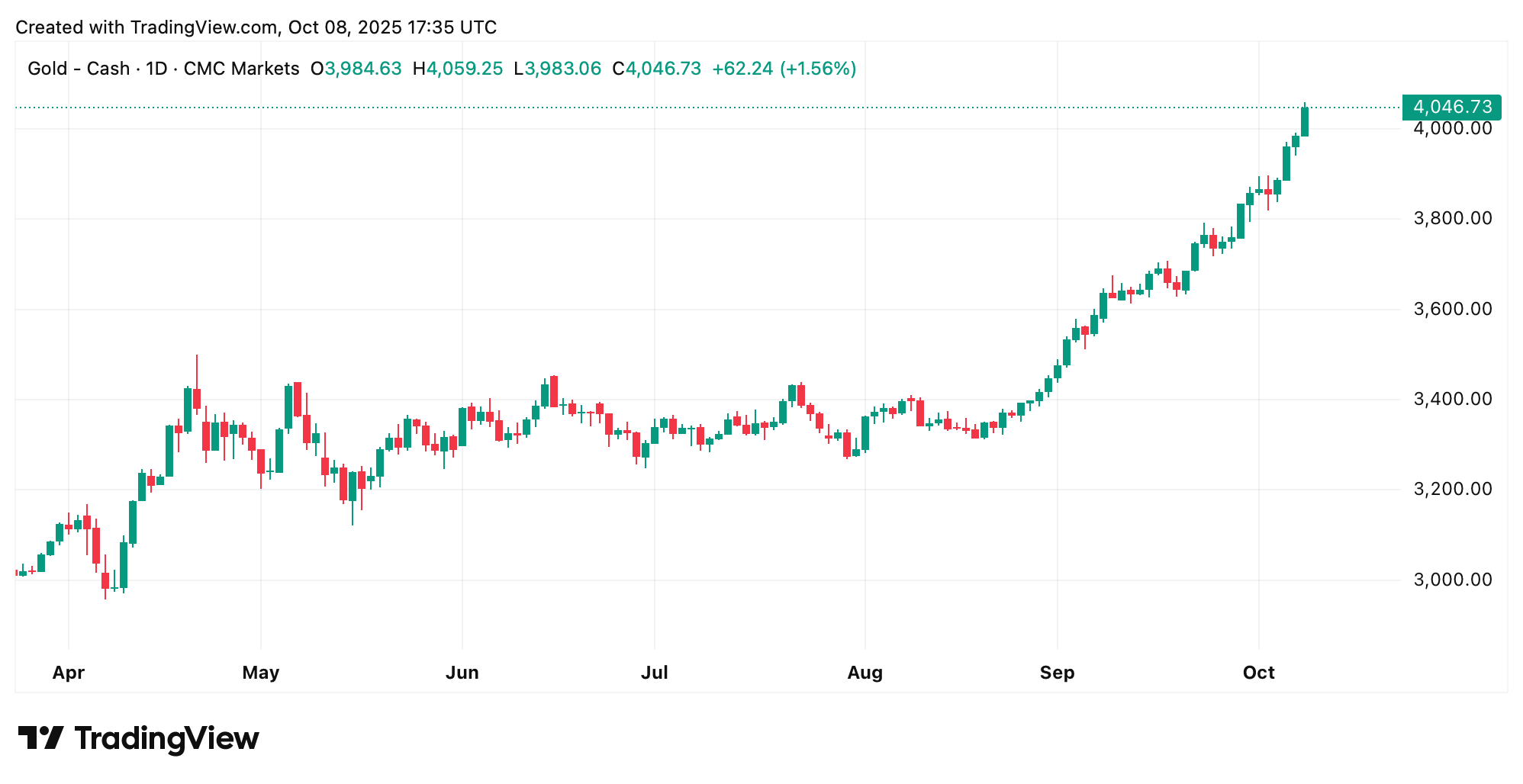

Over the past week, the yellow metal climbed from $3,984 per ounce on October 6 to an intraday peak of $4,059 on October 8, before settling near $4,046. The move represents an 11.7% monthly increase and a staggering 55% gain in 2025.

Analysts attribute the surge to a convergence of catalysts — including the U.S. government shutdown, ongoing conflicts in Europe and the Middle East, and heightened central bank gold accumulation amid fears of a weakening dollar.

Gold price on Wednesday, Oct. 8, 2025.

Several precious metals proponents believe gold is once again proving its role as the ultimate safe-haven asset, noting that exchange-traded fund (ETF) inflows and central bank purchases remain near record highs. Meanwhile, Goldman Sachs has lifted its price forecast to $4,900 by Q2 2026, and UBS projects $4,200 in the near term as investors brace for prolonged volatility.

However, with the relative strength index (RSI) above 90, some technical analysts warn the metal may be temporarily overbought. Short-term corrections could emerge if profit-taking accelerates, especially as traders monitor developments in U.S. fiscal policy, geopolitical flashpoints, and Federal Reserve rate decisions.

Still, the long-term outlook remains decisively bullish. Several veteran market watchers see prices potentially reaching $10,000 by 2030, driven by relentless demand from nations diversifying away from fiat holdings and toward hard assets.

As gold’s record-breaking ascent captures global headlines, silver’s rise toward $50 per ounce adds fuel to speculation that the precious metals supercycle has only just begun.

📊 FAQ: Key Questions About Gold’s Surge

Q: What triggered gold’s breakout above $4,000?

A: A mix of inflation pressures, geopolitical risks, and central bank buying pushed gold to new highs.

Q: Is the rally sustainable?

A: While near-term pullbacks are possible, strong fundamentals — including currency diversification and inflation hedging — suggest continued support.

Q: How does this impact mining stocks?

A: Gold miners have lagged spot prices, creating potential for catch-up growth if the rally persists.

Q: Could gold hit $10,000?

A: Some analysts believe it’s possible by 2030, assuming continued global instability and sustained demand for tangible assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。