During the National Day holiday, where macro and crypto narratives intertwine, market enthusiasm far exceeded previous years. From the Korea Blockchain Week (KBW) that kicked off before the holiday to the Token2049 event held in Singapore during the holiday, these two of Asia's most influential crypto conferences heightened global capital, institutional, and project attention. Meanwhile, cryptocurrency prices and capital flows warmed up simultaneously—Bitcoin and gold both reached historical highs, BNB led the BSC meme craze, and projects like Polymarket, Aster, and Monad released significant news in quick succession. This series of events during the holiday outlines the restlessness and restructuring of the crypto market on the eve of a new cycle.

U.S. Government Shutdown, Bitcoin and Gold Hit New Highs

Stimulated by the U.S. government shutdown, concerns over U.S. fiscal policy and the depreciation of the dollar have intensified, prompting investors to shift funds towards assets like Bitcoin and gold to hedge against dollar depreciation risks, driving both gold and Bitcoin prices to new highs. On October 5, Bitcoin peaked at $125,689, surpassing the previous record of $124,514 set on August 14. A day later, spot gold broke the $3,900 per ounce mark, setting a new historical high, just under 10 days after first surpassing the $3,800 mark.

Market participants have referred to the U.S. government shutdown as a catalyst for "devaluation trades," with investors expecting this to drive funds towards "safe-haven" assets. Geoff Kendrick, Standard Chartered Bank's Global Head of Digital Asset Research, stated, "This shutdown is significant." He noted that Bitcoin is now more correlated with traditional risk assets and is expected to continue rising during this period.

Analysis indicates that Bitcoin's rise is also supported by institutional demand, technical factors, and seasonal influences. Notably, the market will closely monitor the progress of Congressional negotiations on federal funding issues and the impact of Federal Reserve monetary policy direction on the "devaluation trade" logic, as these factors will determine whether Bitcoin can maintain its current upward momentum and achieve further breakthroughs.

Citi Bank analyst Alex Saunders stated that Bitcoin is now viewed as "digital gold," which helps explain the correlation in price movements between the two. Based on sustained investor demand, he set a target price of $181,000 for Bitcoin within the next 12 months.

BNB Hits New Historical High, BSC Meme Craze Begins

Despite Bitcoin breaking historical highs during the National Day holiday, the entire crypto ecosystem's attention was clearly focused on the BSC ecosystem. On October 7, BNB surpassed $1,300, setting a new historical high. According to 8market data, BNB's market capitalization reached $177.78 billion, surpassing Tether ($177.5 billion), ranking 124th in the world among mainstream assets.

The primary reason behind this new high is that BSC has once again ignited a meme craze.

On October 6, CZ liked and replied to a tweet from crypto KOL "Lin Wanwan's Cat" on social media, introducing the concept of "Binance Life." This sparked a Chinese meme craze, leading to a series of meme concepts surrounding Binance, CZ, and He Yi. On October 7, Binance Alpha launched the meme coin "Binance Life," and with the ongoing ecosystem craze, the meme's market cap exceeded $500 million.

On October 8, YZi Labs announced the establishment of a $1 billion Builder Fund aimed at increasing support for founders of BNB ecosystem projects, particularly those on the BNB Chain, attracting more long-term entrepreneurs to focus on BNB-based innovations. This includes areas such as trading, RWA (real-world assets), artificial intelligence (AI), DeSci (decentralized science), DeFi, payments, and wallets, fully leveraging the high-performance, low-cost infrastructure of the BNB Chain, as well as enhanced tools, funding, integration capabilities, and an ecosystem of over 460 million users.

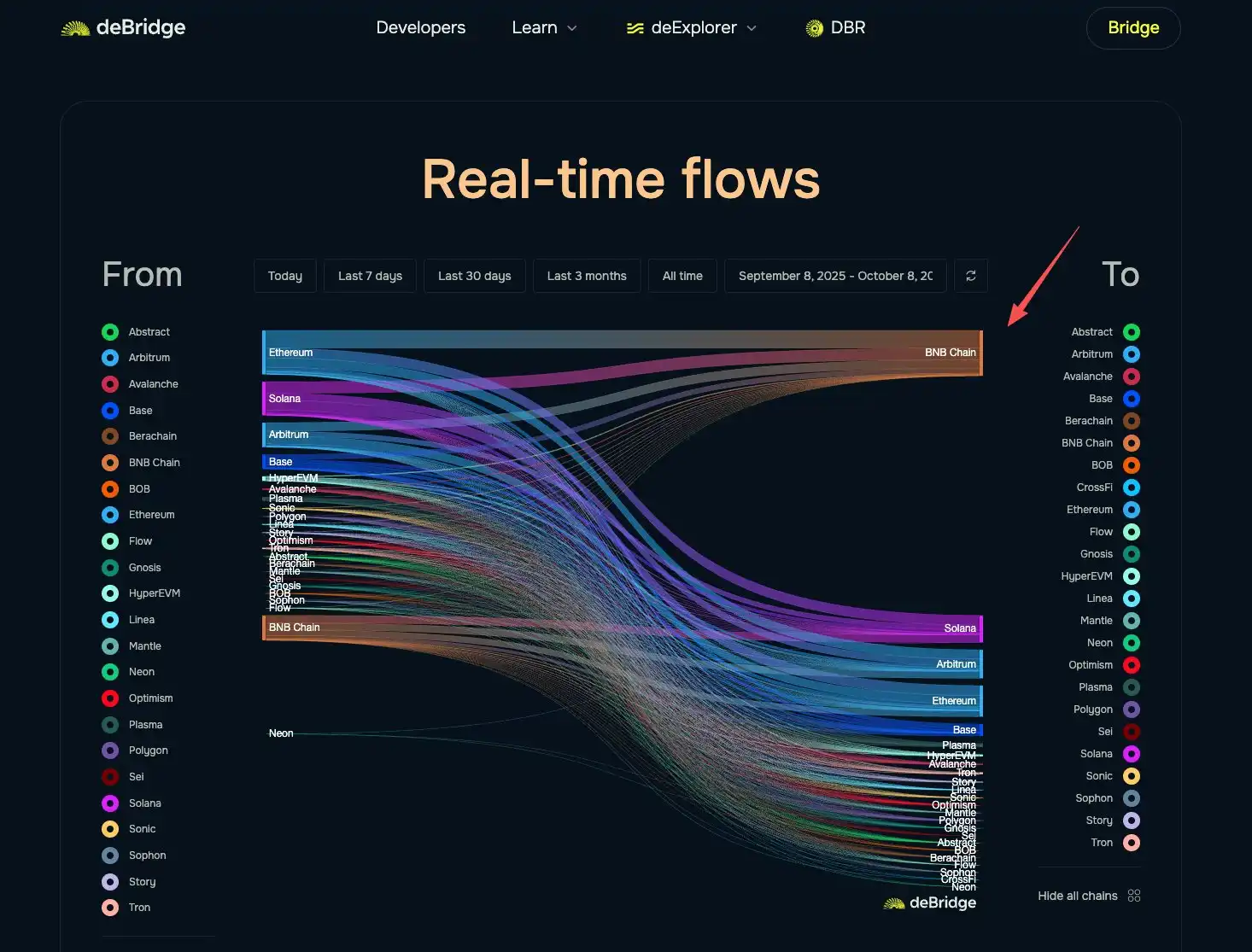

According to DeFillama data, BSC network fees reached $5.57 million in the past 24 hours, ranking first among public chains. The Tron network ($1.46 million) ranked second, and the Ethereum network ($1.2 million) ranked third. Additionally, from the overall capital flow situation, BSC has already shown signs of a capital siphoning effect.

Aster Launches "Dawn Phase," Second Season Faces Backlash?

On October 5, Aster officially announced that its Genesis plan has formally concluded Phase 2 and has fully entered a new phase—Aster Dawn (Phase 3). This successful upgrade marks the project's transition from early construction to a new stage that emphasizes both ecological deepening and user incentives.

At the same time, Aster CEO Leonard stated that each epoch will allocate 1% of the total ASTER supply (4% of the total supply will be allocated to Phase 2 as rewards). This means approximately 4% of tokens will be airdropped, determined by calculating and distributing 1% rewards separately for four cycles. Previously, due to the majority of the market community not believing that the official would make sudden major rule changes, many joined the trading mining army in the middle and end stages of S2.

According to the announcement, the Genesis Phase 2 ended on October 5 at 23:59 (UTC), and the airdrop query function will open on October 10, allowing users to claim token rewards starting October 14. This round of rewards has no lock-up period, allowing funds to be freely claimed and used, enhancing asset liquidity and user participation.

On the evening of October 6, Aster further announced the launch of a 1.2x trading reward boost, covering popular spot pairs like ASTER/USDT, BTC/USDT, ETH/USDT, as well as perpetual contract trading pairs like AIA, COAI, HYPE, and LYN, with no set end time for the boost.

Polymarket Returns to the U.S. Market, Secures $2 Billion Investment from Intercontinental Exchange, Valuation Soars to $9 Billion

On October 2, foreign media reported that the market platform Polymarket announced its return to the U.S. market, after being banned from operating by the U.S. Commodity Futures Trading Commission (CFTC) four years ago due to regulatory issues. According to regulatory documents, the platform has acquired QCX LLC, which holds a CFTC license, and self-certified multiple event contracts (covering sports events and election markets), with plans to officially open to U.S. users soon.

On October 7, The Wall Street Journal reported that the parent company of the New York Stock Exchange (NYSE), Intercontinental Exchange (ICE), will invest $2 billion in Polymarket, with the platform's valuation expected to reach $8 billion to $10 billion after the transaction is completed.

The next day, Polymarket CEO Shayne Coplan disclosed details of previously undisclosed financing rounds on the X platform: last year, the company completed a $55 million financing round, with a valuation of $350 million, led by Blockchain Capital; earlier this year, it completed another $150 million financing round, raising its valuation to $1.2 billion, led by Founders Fund. With the latest entry of the Intercontinental Exchange, Polymarket's valuation has now soared to approximately $9 billion, making it one of the most notable platforms in the global prediction market space.

Monad Hints at Upcoming Airdrop

On October 8, Monad posted an airdrop preview tweet on its official X account: "Airdrop claim loading (98% completed)." In mid-August, Monad hinted that it might launch its mainnet this year.

BitMine Continues Strategic Investments

On October 6, BitMine Immersion Technologies announced that its total holdings of crypto assets, cash, and "super potential investments" reached $13.4 billion.

As of 1:00 PM Eastern Time on October 5, the company's crypto asset holdings included: 2,830,151 ETH, 192 BTC, $113 million worth of Eightco Holdings (NASDAQ: ORBS) equity ("super potential investments"), and $456 million in unrestricted cash.

Tom Lee, Chairman of BitMine and a member of the Fundstrat Global Advisory Board, stated, "Last week, we met with many leaders in the crypto and blockchain industry at the Token2049 summit in Singapore. The team had in-depth discussions with Ethereum core developers and key ecosystem builders, and we clearly felt that the community is fully committed to driving Wall Street and AI to build the future on Ethereum. We firmly believe that the 'super cycle' investment theme remains in the AI and crypto sectors. With its high reliability and 100% operational stability, Ethereum is naturally the preferred platform."

On October 8, according to Lookonchain monitoring, a newly created address 0xedf1 (likely belonging to Bitmine) purchased 20,020 ETH (approximately $89.7 million) through FalconX two hours ago.

Related Reading: "Arthur Hayes and Tom Lee Discuss the Future of DATs, Stablecoins, and Prediction Markets"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。