CoinW Research Institute

Key Points

- The total market capitalization of cryptocurrencies is $4.46 trillion, up from $3.96 trillion last week, representing a 12.6% increase this week. As of October 6, the cumulative net inflow into U.S. ETFs is approximately $60 billion, with a net inflow of $3.24 billion this week; the cumulative total net inflow into U.S. ETFs is about $14.42 billion, with a net inflow of $1.3 billion this week. Bitcoin Spot Ethereum Spot

- The total market capitalization of stablecoins is $298.7 billion, with USDT having a market cap of $176.3 billion, accounting for 59% of the total stablecoin market cap; followed by a market cap of $75.3 billion, accounting for 24.6% of the total stablecoin market cap; and DAI with a market cap of $5.36 billion, accounting for 1.79% of the total stablecoin market cap. USDC

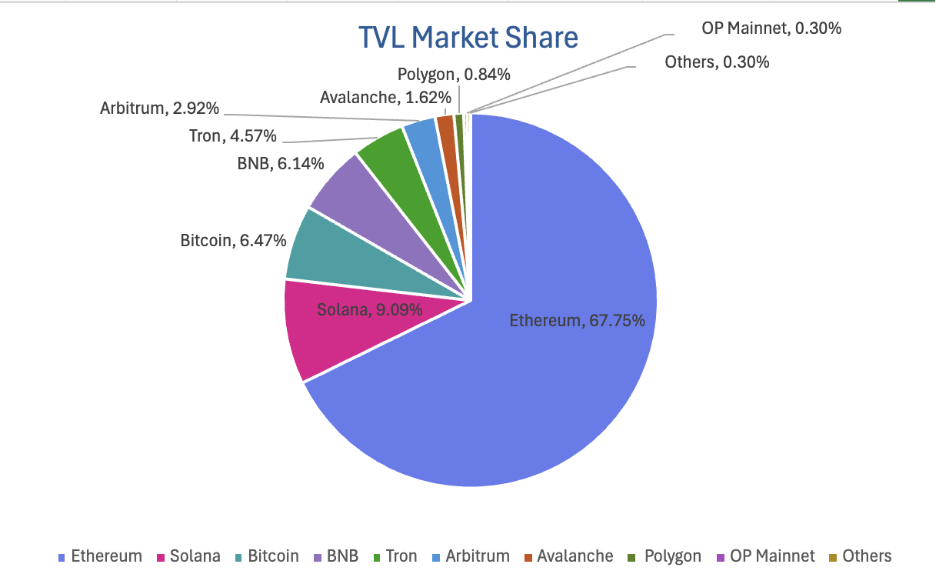

- According to data from DeFiLlama, the total TVL of DeFi this week is $169.1 billion, up from $155.5 billion last week, an increase of approximately 8.74%. By public chain, the top three chains by TVL are Ethereum, accounting for 67.75%; Solana, accounting for 9.09%; and Bitcoin, accounting for 6.47%. Ethereum

- This week, multiple public chains saw a general rebound in trading and ecosystem data. Except for Ethereum, which saw a daily trading volume decrease of 18.5%, all other chains increased, with Sui (+87.56%) and Aptos (+58.46%) showing the most significant growth. In terms of transaction fees, Solana surged by 105%, while Aptos and Sui increased by 39% and 8.79%, respectively. In terms of daily active addresses, Ethereum (+15.29%) and Solana (+7.14%) performed well, while BNB and Aptos declined by about 18.5%. Overall, TVL increased, with Sui showing the largest increase (+22.79%), followed by Solana, BNB, and Aptos, which rose by 14.23%, 13.39%, and 11.89%, respectively.

- New project highlights: Stable is a Layer 1 blockchain jointly launched by Bitfinex and Tether, featuring USDT as the native gas token, allowing for fee-free peer-to-peer USDT transfers. Limitless is a decentralized prediction market platform built on the Base chain, focusing on minute/hourly/daily short-term price predictions. StandX is a decentralized perpetual contract trading platform (PerpsDEX) that has launched a stablecoin DUSD that automatically earns interest; users can earn returns after minting with USDT/USDC and can use it as contract collateral.

Table of Contents

I. Market Overview

Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-chain Data

Stablecoin Market Cap and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Proportion

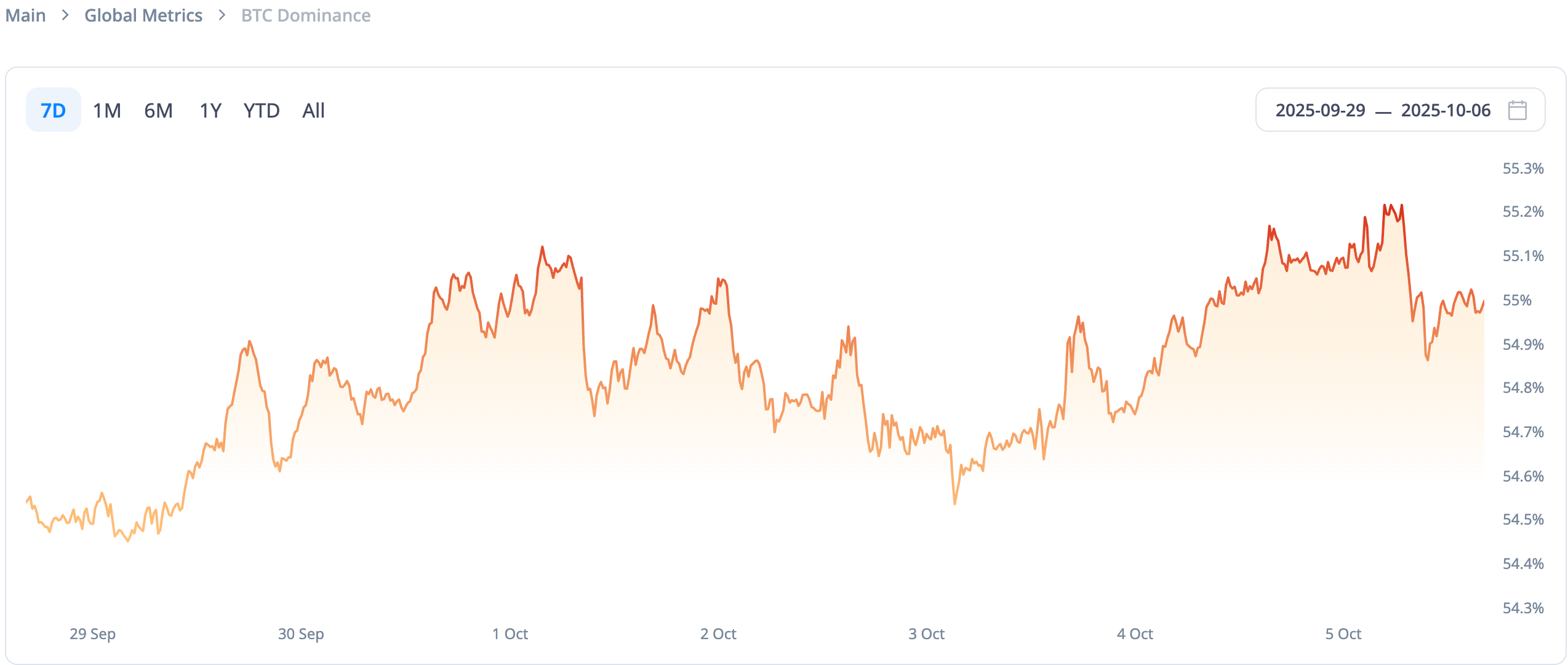

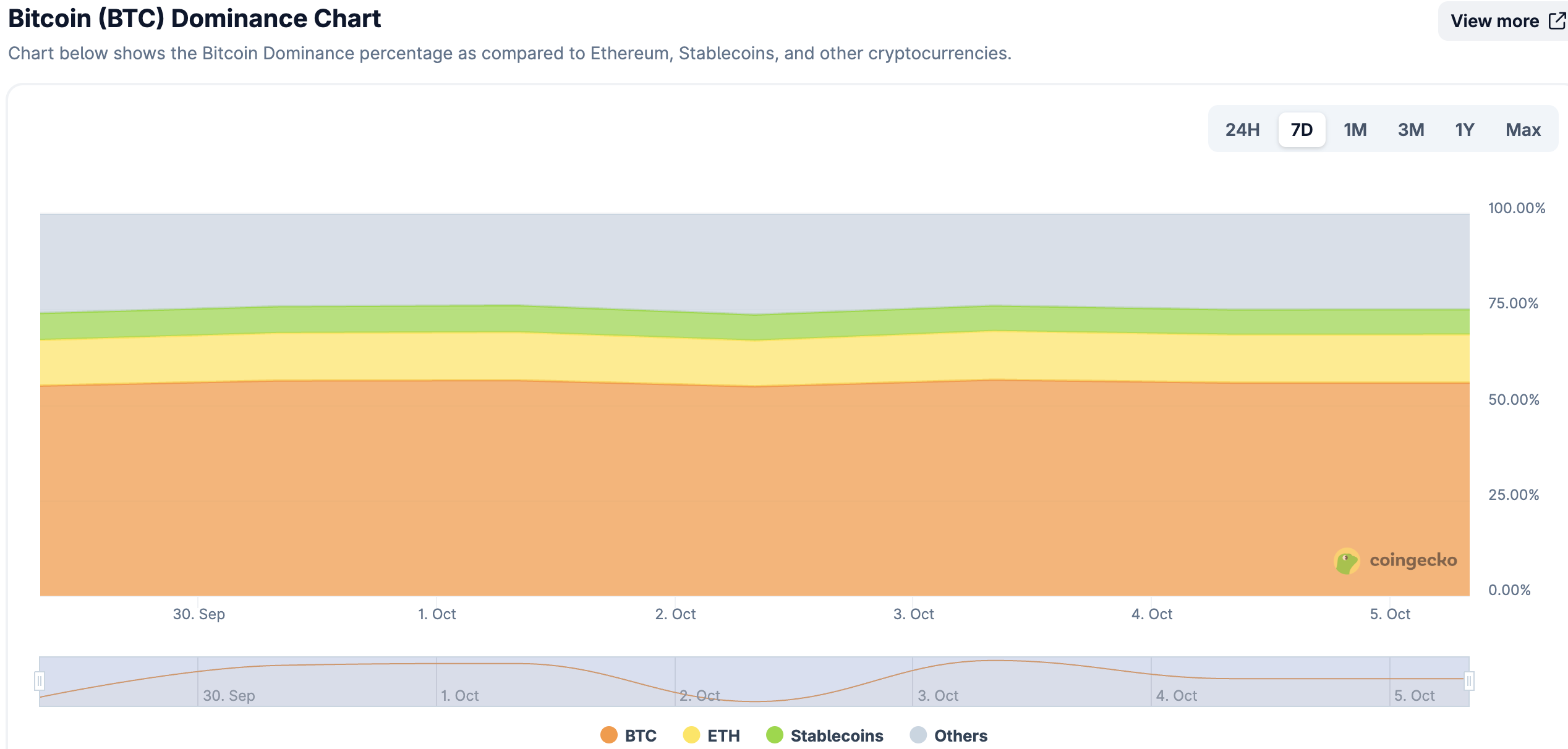

The total market capitalization of cryptocurrencies is $4.46 trillion, up from $3.96 trillion last week, representing a 12.6% increase this week.

Data Source: cryptorank

Data as of October 5, 2025

As of October 6, the market cap of Bitcoin is $2.45 trillion, accounting for 54.9% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $298.7 billion, accounting for 6.69% of the total cryptocurrency market cap. Bitcoin

Data Source: coingeck

Data as of October 5, 2025

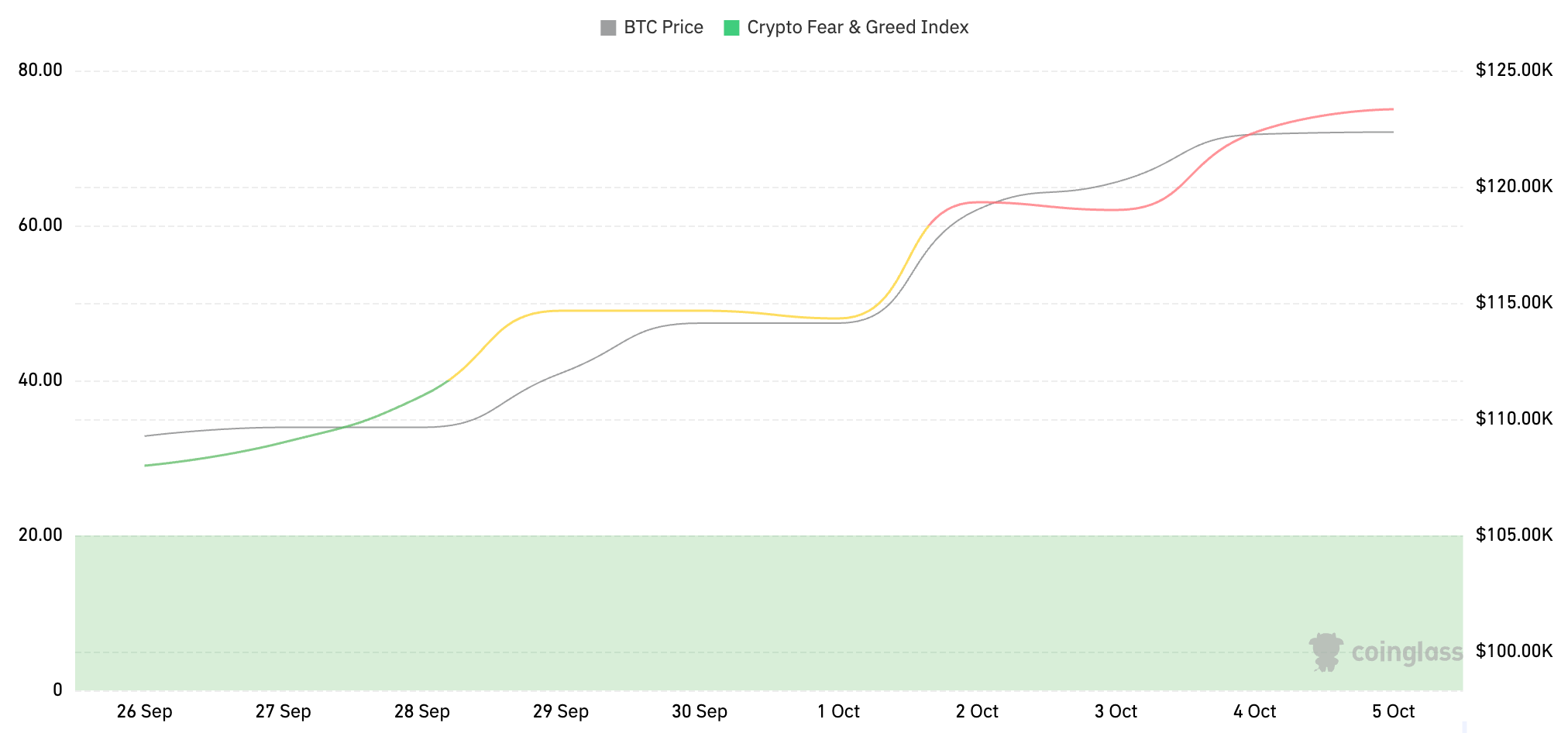

2. Fear Index

The cryptocurrency fear index is 75, indicating greed.

Data Source: coinglass

Data as of October 5, 2025

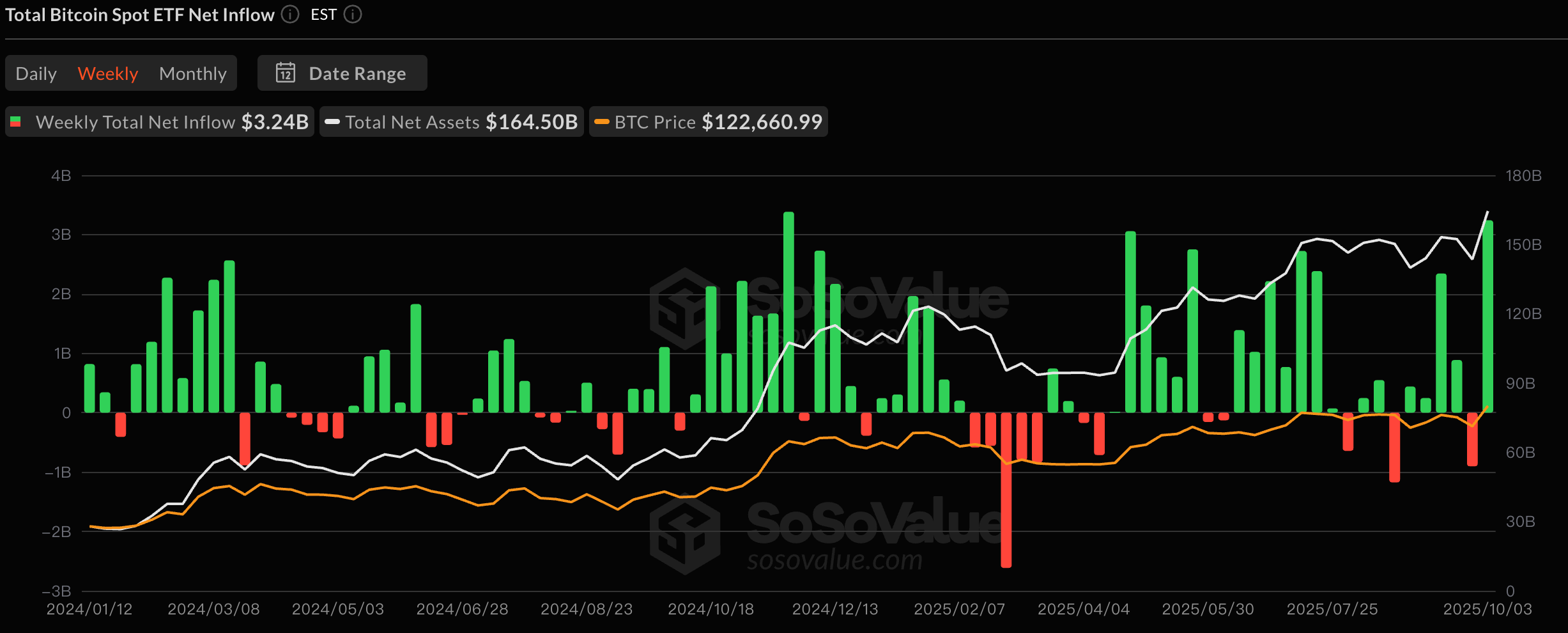

3. ETF Inflow and Outflow Data

As of October 6, the cumulative net inflow into U.S. Bitcoin spot ETFs is approximately $60 billion, with a net inflow of $3.24 billion this week; the cumulative net inflow into U.S. Ethereum spot ETFs is about $14.42 billion, with a net inflow of $1.3 billion this week.

Data Source: sosovalue

Data as of October 5, 2025

4. ETH/BTC and ETH/USD Exchange Rates

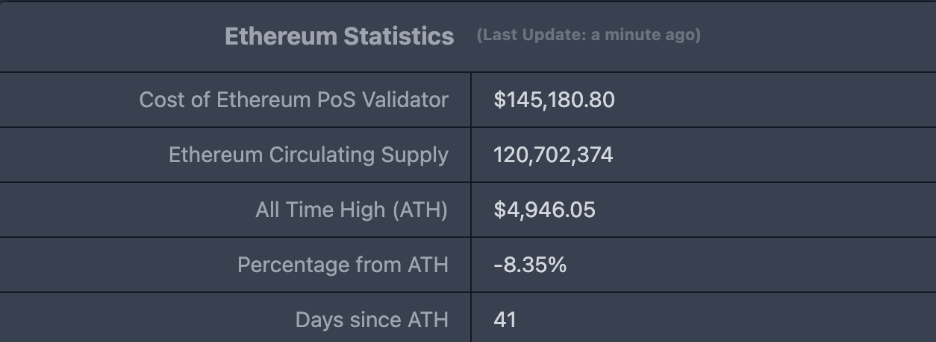

ETHUSD: Current price $4,537.29, all-time high $4,946.05, down approximately 8.35% from the all-time high.

ETHBTC: Currently at 0.036865, all-time high 0.1238.

Data Source: ratiogang

Data as of October 5, 2025

5. Decentralized Finance (DeFi)

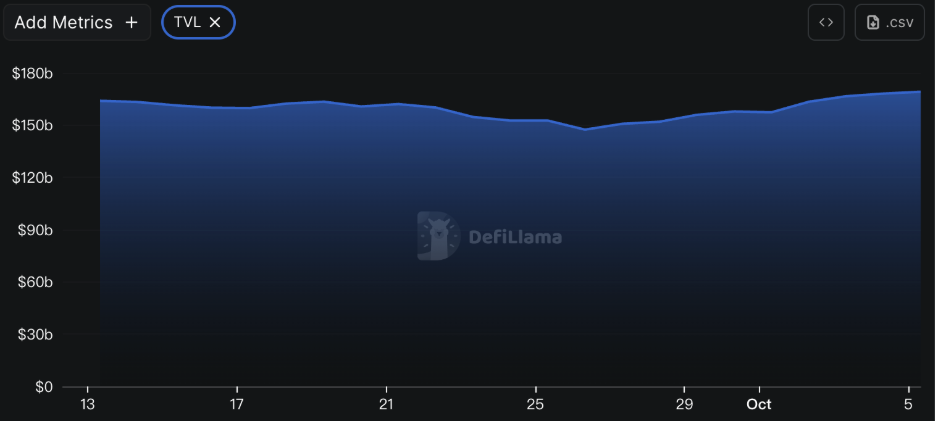

According to data from DeFiLlama, the total TVL of DeFi this week is $169.1 billion, up from $155.5 billion last week, an increase of approximately 8.74%.

Data Source: defillama

Data as of October 5, 2025

By public chain, the top three chains by TVL are Ethereum, accounting for 67.75%; Solana, accounting for 9.09%; and Bitcoin, accounting for 6.47%.

Data Source: CoinW Research Institute, defillama

Data as of October 5, 2025

6. On-chain Data

Layer 1 Related Data

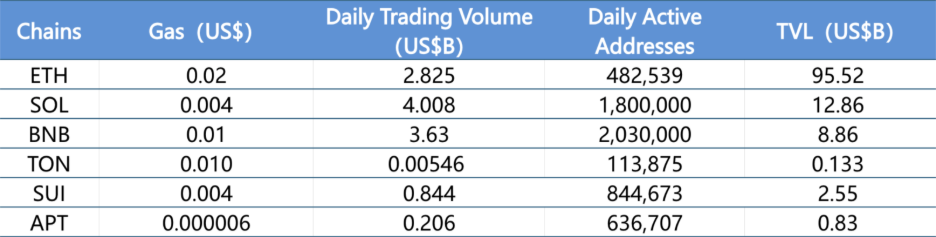

Mainly analyzing daily trading volume, daily active addresses, and transaction fees for the current major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APTOS.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of October 5, 2025

- Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. In terms of daily trading volume, this week only Ethereum saw a decrease of 18.5%, while all other chains increased, with Solana (48.4%), Ton (+36.5%), BNB (+26.4%), Sui (+87.56%), and Aptos (+58.46%). Regarding transaction fees, this week Ethereum, BNB, and Ton chains remained stable compared to last week; Solana surged by 105%; Aptos and Sui increased by 39% and 8.79%, respectively.

- Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects user trust in the platform. This week, daily active addresses for Ethereum (+15.29%), Solana (+7.14%), and Ton (+0.24%) increased, while all other chains declined. BNB and Aptos both saw declines of about 18.5%, and Sui decreased by 10%. In terms of TVL, this week Sui chain saw the largest increase of 22.79%, followed by Solana, BNB, and Aptos, which rose by 14.23%, 13.39%, and 11.89%, respectively, with Ton slightly increasing by 2.31%.

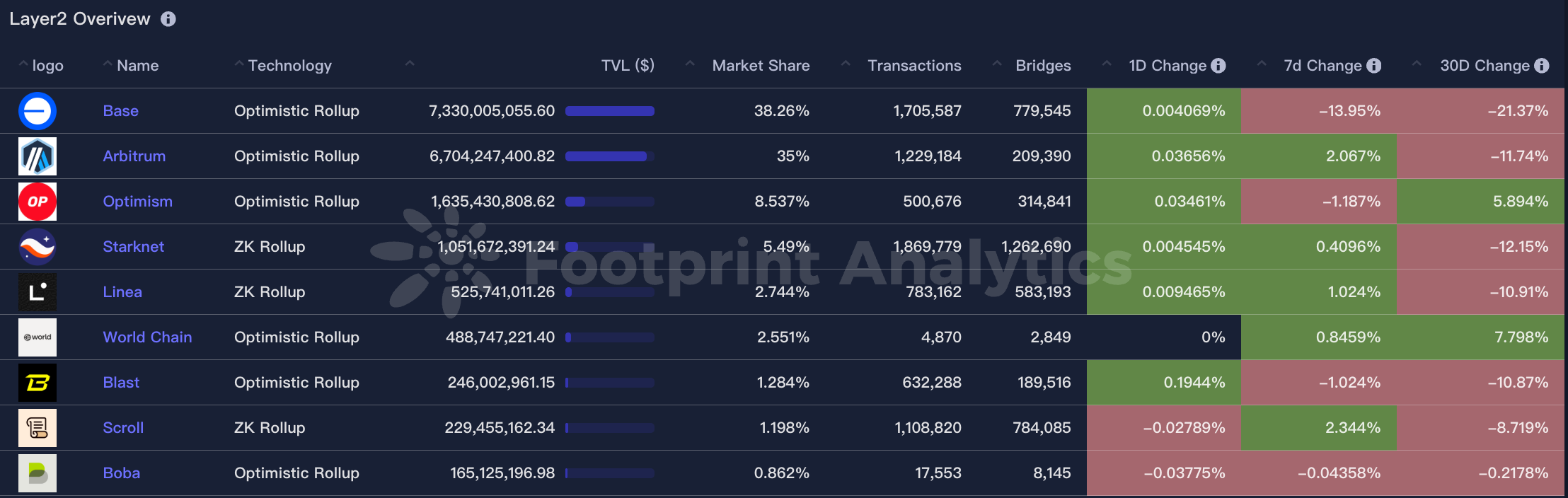

Layer 2 Related Data

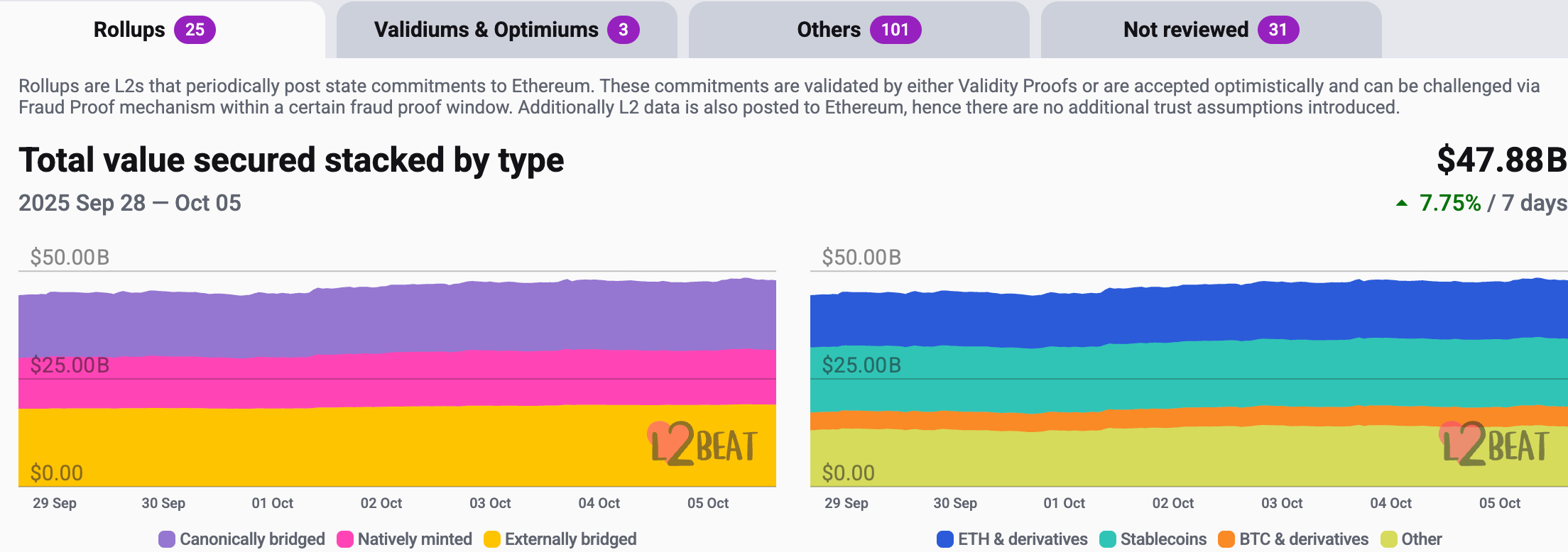

According to L2 Beat data, the total TVL of Ethereum Layer 2 is $47.88 billion, with an overall increase of 5.8% this week compared to last week ($45.23 billion).

Data Source: L2 Beat

Data as of October 5, 2025

Base and Arbitrum occupy the top positions with market shares of 38.26% and 35%, respectively. Base chain saw a slight decrease in market share over the past week, while Arbitrum saw an increase.

Data Source: Footprint Data as of October 5, 2025

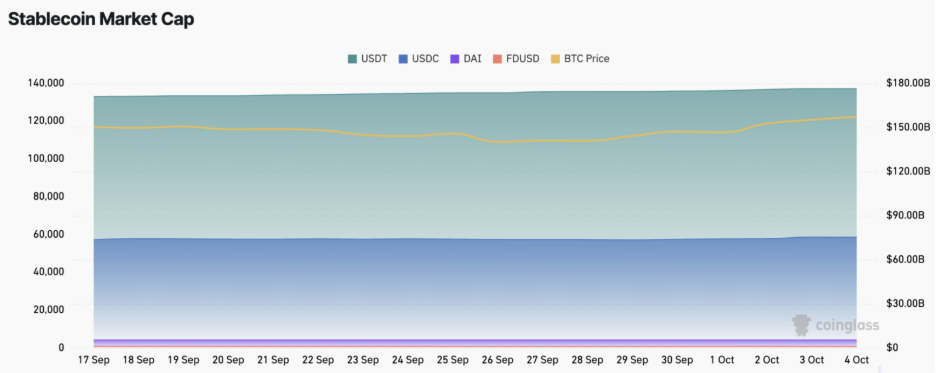

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $298.7 billion, with USDT having a market cap of $176.3 billion, accounting for 59% of the total stablecoin market cap; followed by USDC with a market cap of $75.3 billion, accounting for 24.6% of the total stablecoin market cap; and DAI with a market cap of $5.36 billion, accounting for 1.79% of the total stablecoin market cap.

Data Source: CoinW Research Institute, Coinglass

Data as of October 5, 2025

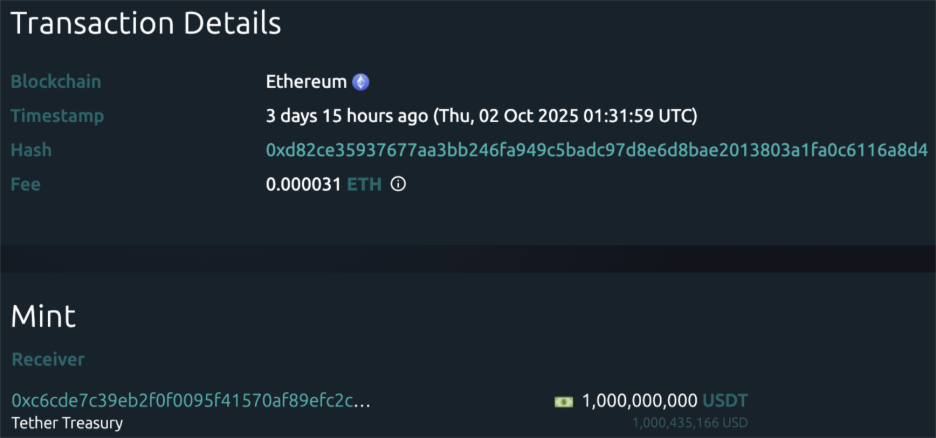

According to Whale Alert data, this week USDC Treasury issued a total of 4.04 billion tokens, and Tether Treasury issued a total of 2 billion USDT this week. The total issuance of stablecoins this week is 6.04 billion tokens, an increase of 4.49% compared to last week's total issuance of stablecoins (5.78 billion tokens). USDC

Data Source: Whale Alert

Data as of October 5, 2025

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

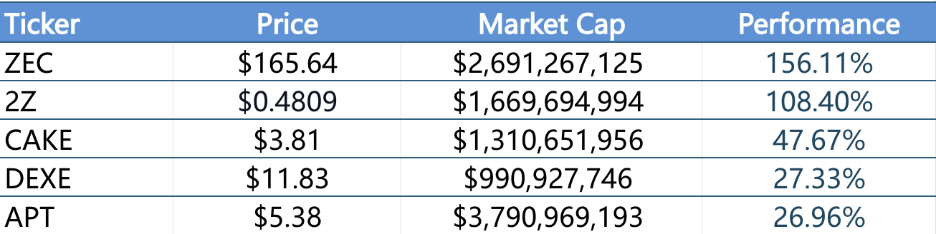

The top five VC coins by growth in the past week

Data Source: CoinW Research Institute, CoinMarketCap

Data as of October 5, 2025

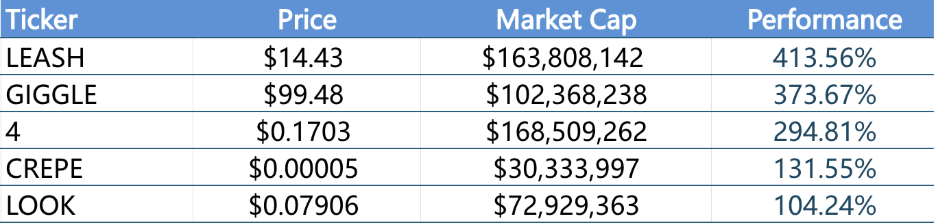

The top five meme coins by growth in the past week

Data Source: CoinW Research Institute, CoinMarketCap

Data as of October 5, 2025

2. New Project Insights

- Stable is a Layer 1 blockchain jointly launched by Bitfinex and Tether, featuring USDT as the native gas token, allowing for fee-free peer-to-peer USDT transfers. The chain also supports running smart contracts directly on stablecoins, providing a "no gas" user experience for applications, integrating local fiat currency channels, and enabling cross-chain transfers without bridging through USDT 0. It has also designed priority execution channels and compliance architecture aimed at providing predictable and stable infrastructure for institutional-level stablecoin use cases (such as payments, cross-border settlements, treasury management, etc.).

- Limitless is a decentralized prediction market platform built on the Base chain, focusing on minute/hourly/daily short-term price predictions. It has completed two rounds of financing, raising approximately $7 million, including a recent round of $4 million in strategic financing, and has launched a Points Farming program allowing users to accumulate points through trading, providing liquidity, and inviting others for future airdrops/token releases.

- StandX is a decentralized perpetual contract trading platform (PerpsDEX) that has launched a stablecoin DUSD that automatically earns interest; users can earn returns after minting with USDT/USDC and can use it as contract collateral. The project has received support from the Solana Foundation, with TVL surpassing $50 million, showing strong early growth momentum.

III. Industry News

1. Major Industry Events This Week

- On September 29, 2025, FalconFinance (FF) completed its token generation event (TGE) and launched several airdrop and incentive activities, including distributing tokens to early holders, launching small airdrops, and establishing a Launchpool reward pool, allowing users to participate by staking tokens to promote ecosystem growth and enhance community activity.

- On September 29, 2025, Anoma announced the official launch of its first-quarter XAN token airdrop query function, allowing eligible users to claim through the official website, with a claim deadline of October 5 at 09:00 UTC. Additionally, Anoma announced that the second-quarter airdrop activity is coming soon, which will be larger in scale, primarily rewarding members who continue to contribute and support the community after the token generation event (TGE), including Discord members, NFT holders, and application testers.

- On September 30, 2025, zkVerify officially launched its mainnet and initiated the first phase of the VFY token airdrop claim. Eligible ProofPoints contributors can start claiming tokens after the mainnet launch. The total supply of VFY tokens is 1 billion, with 37% unlocked at launch. The tokens are primarily used for paying transaction fees, staking, governance, and validator rewards.

- On September 30, 2025, OpenEden (EDEN) launched its token generation event (TGE) and airdrop activity, with the TGE going live at 14:00 UTC on Ethereum and BNB Smart Chain, with an initial circulating supply of 183.87 million tokens, accounting for 18.39% of the total supply; the airdrop pool size is 15 million tokens (1.5% of total supply), with a snapshot time from September 23 at 00:00 to September 25 at 23:59 UTC, and claims starting from September 30 at 10:30 UTC, with users able to check and claim through official channels.

2. Major Upcoming Events Next Week

- YieldBasis (YB) is a decentralized finance (DeFi) protocol launched by Curve founder Michael Egorov. The project is expected to hold its token generation event (TGE) in the fourth quarter of 2025, and the project has conducted a merit-based presale on the Legion platform from September 29 to October 5, 2025, and will conduct a public sale on the Kraken Launch platform from October 1 to October 2, with each token priced at $0.20. After the TGE, all tokens will be immediately unlocked with no lock-up period.

- Lern 360.ai (LERN) plans to launch its IDO from October 9 to 11, 2025, aiming to raise approximately $550,000, with about 1.25 million LERN tokens to be publicly sold, accounting for less than 0.3% of the total supply. The total supply of the project tokens is 1 billion, with 40% released at TGE, and the remaining portion will be linearly unlocked monthly over 6 months, aimed at promoting the development of its AI and education combined blockchain application ecosystem.

- FacilPay (FACIL) is a Web 3 project focused on simplifying digital payments and settlements, with a total token supply of 500 million, planning to launch its IDO from October 15 to 17, 2025, aiming to raise $400,000, with 16 million FACIL tokens to be publicly sold, accounting for 3.2% of the total supply. The token distribution mechanism will release 20% at TGE, with the remaining portion linearly unlocked over 5 months to promote the development of its decentralized payment ecosystem.

3. Important Investments and Financing from Last Week

- Flying Tulip completed a $200 million seed round financing, with a valuation of $1 billion, using a SAFT (Simple Agreement for Future Tokens) structure. Investors include well-known institutions such as Brevan Howard Digital, CoinFund, DWF Labs, FalconX, Hypersphere, Lemniscap, Nascent, Republic Digital, Selini, and Susquehanna Crypto. The financing funds will be used for platform construction, ecosystem expansion, and FT token liquidity assurance. Flying Tulip is a full-stack DeFi platform founded by Andre Cronje, integrating functions such as spot trading, perpetual contracts, lending, stablecoins, options, and insurance, aiming to create a one-stop on-chain financial ecosystem. (September 29, 2025)

- Bitcoin collateral lending platform Lava announced the completion of a $17.5 million Series A extension financing, with investors including Peter Jurdjevic from the Qatar Investment Authority and former executives from Visa and Block, following a previous Series A round led by Founders Fund and Khosla Ventures. The platform focuses on building decentralized financial tools based on Bitcoin, reducing risks associated with custody, issuance, repayment, and collateral management through on-chain verifiable collateral and automated processes. (October 1, 2025)

- Aptos ecosystem application KGeN (Kratos Gaming Network) announced the completion of $13.5 million in strategic financing, with investors including Jump Crypto, Accel, and Prosus Ventures, bringing the total financing amount to $43.5 million. KGeN was founded by Kratos Studios in 2022, aiming to bring gaming communities in emerging markets into Web 3 through its multi-chain gaming data network and P.O.G. (Proof of Gamer) engine. (September 30, 2025)

IV. Reference Links

- Flying Tulip: https://flyingtulip.com/

- Stable: https://www.stable.xyz/

- StandX: https://standx.com/

- Limitless: https://limitless.exchange/

- KGeN: https://kgen.io/

- Lava: https://www.lava.xyz/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。