"Uptober" has long been a meme in the crypto community, but there are reasons why October is always lively. The release of dense economic data, central bank decisions, and various crypto events often lead to increased market volatility. The good news is that you don't need to be a professional analyst to keep up with the pace. Just remember a few key dates, pay attention to one or two core signals, and execute your small plan to easily navigate through October without anxiety or panic.

TL;DR

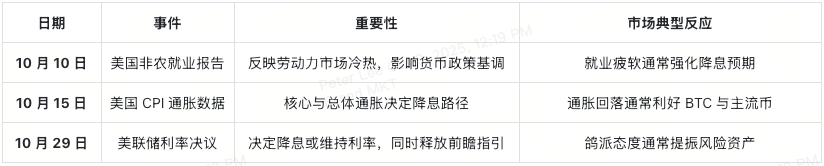

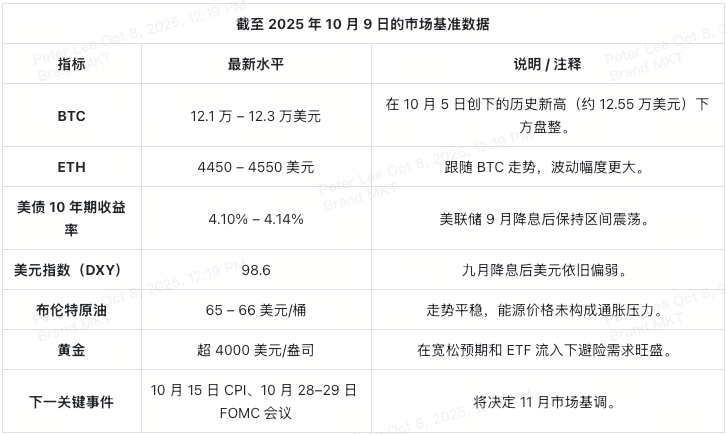

- The most important macro events this month are the U.S. CPI inflation data on October 15 and the Federal Reserve meeting on October 28-29, which will determine the liquidity and sentiment direction of global markets.

- Bitcoin is currently fluctuating in the range of $121,000 to $123,000, slightly below the historical high set at the beginning of October; Ethereum is stabilizing at around $4,500. Both remain highly sensitive to inflation data and Federal Reserve signals.

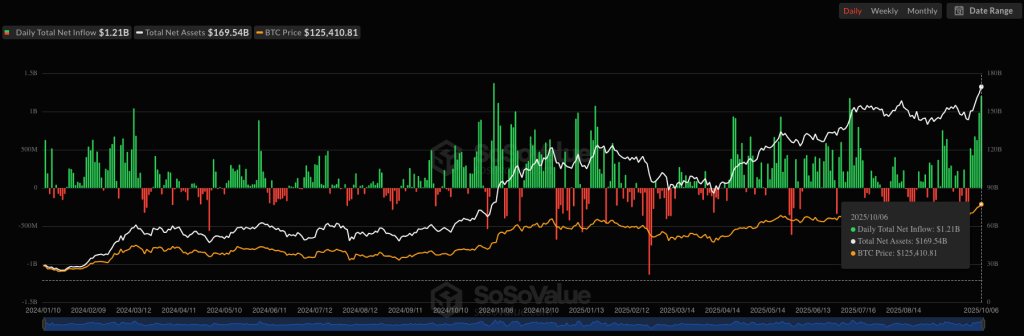

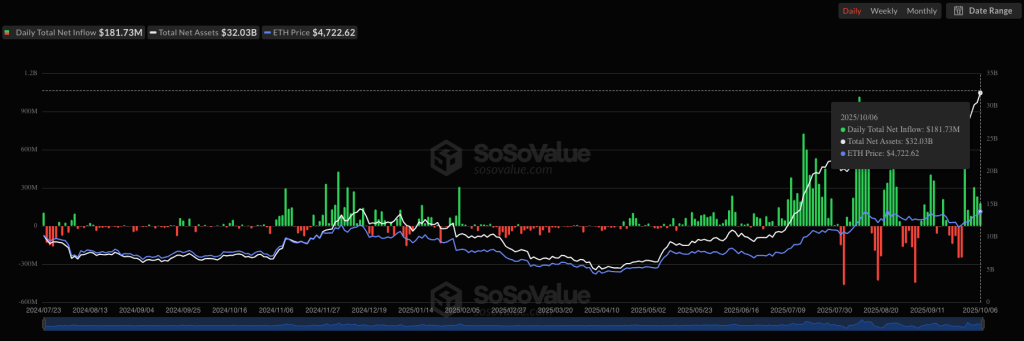

- ETF fund flows are the most direct indicator of institutional demand. At the beginning of October, a record net inflow of about $5.9 billion was recorded, showing that market interest in BTC and ETH remains strong.

- Projects such as Linea, Aptos, Aethir, BounceBit, Starknet, and Babylon will unlock tokens throughout this month, potentially bringing short-term supply pressure. Understanding the specific unlocking dates in advance can help you avoid volatility risks.

- Control your position, set stop-losses, avoid using high leverage before data releases, and prioritize focusing on high liquidity trading pairs like BTC and ETH to calmly handle "Uptober."

Table of Contents

1) October Market Outlook: Key Dates to Watch

2) Fund Flow Signals: ETF, Contract Funding Rates, and Position Changes

3) Overview of Crypto Market Catalysts: Token Unlocks, TGE Launches, and Hot New Stars

4) Three Market Paths in October and Response Strategies

5) Your October Action Manual: Operations, Reminders, and Execution

1) October Market Outlook: Key Dates to Watch

You don't need to pay attention to all economic data; just focus on the key indicators that can affect interest rate trends. This is because interest rates determine the risk appetite for capital, which often directly impacts the sentiment and trends in the crypto market.

– Inflation Data (CPI): If inflation cools down, central banks will have more room to ease policies. Moderate inflation is usually favorable for risk assets, including Bitcoin and Ethereum.

– Employment Data: If hiring slows or the unemployment rate rises, the market will expect lower interest rates. Such data typically benefits bonds first, followed by stocks and crypto assets.

– Central Bank Decisions and Speeches: Dovish signals will lead to lower real yields and a weaker dollar, which is usually positive for the crypto market. Conversely, hawkish remarks may suppress the market.

– Earnings Season and Volatility Events: When corporate performance is stable and market volatility is low, investors are more willing to take risks, which is when altcoins become active.

Keep your schedule simple and just set reminders for these key dates on your phone.

Two Small Rules

1. The 30-60 minutes after data release is usually the most volatile time window, so be extra cautious.

2. Set these dates as TradingView chart alerts now. Having alerts will help you maintain the pace and make it easier to execute your plan.

2) Fund Flow Signals: ETF, Contract Funding Rates, and Position Changes

You can think of the fund flow of spot ETFs as a "pipeline" for market demand. Inflows into Bitcoin or Ethereum spot ETFs represent new buying interest; outflows indicate short-term pressure. You don't need to stare at a bunch of charts; just take 15 seconds a day to glance at them.

How to Interpret Fund Flows

– Price Up + Net Inflow: A healthy trend, indicating active buying and support for the trend.

– Price Up + Net Outflow: Be cautious; this may indicate weakening upward momentum and reduced buying interest.

– Large Single-Day Subscriptions or Redemptions: These can influence market sentiment in the short term and will reflect in prices within a day or two. Make a simple note of this and observe the price reaction.

Reference Indicators: Total Net Inflow of Bitcoin Spot ETF and Total Net Inflow of Ethereum Spot ETF (Source: SoSoValue)

Funding Rates and Futures Basis

– Positive Funding Rate: Long positions are paying shorts to maintain their positions, indicating a bullish market, but if the price stagnates, longs can easily get squeezed out.

– Rising Quarterly Contract Basis: Indicates strong bullish sentiment in the market, and arbitrage positions will also participate. A moderate rise in basis is healthy, but if it gets too high, it will attract arbitrage funds to suppress prices.

Reference Indicator: Crypto Contract Funding Rates (Source: XT.com)

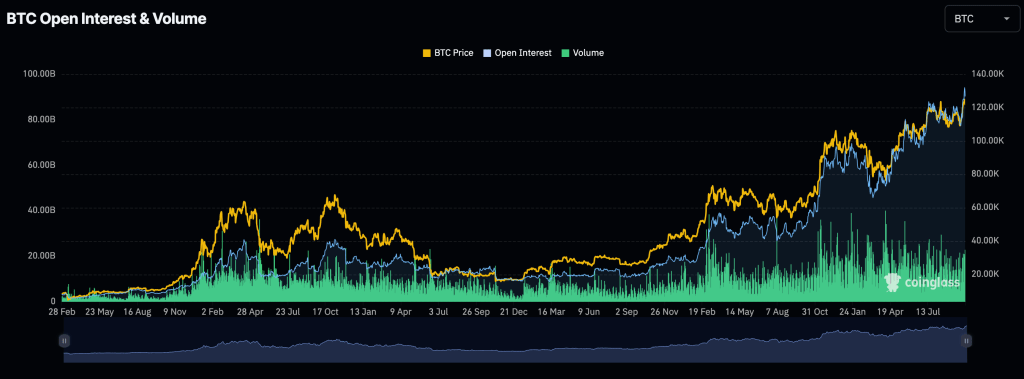

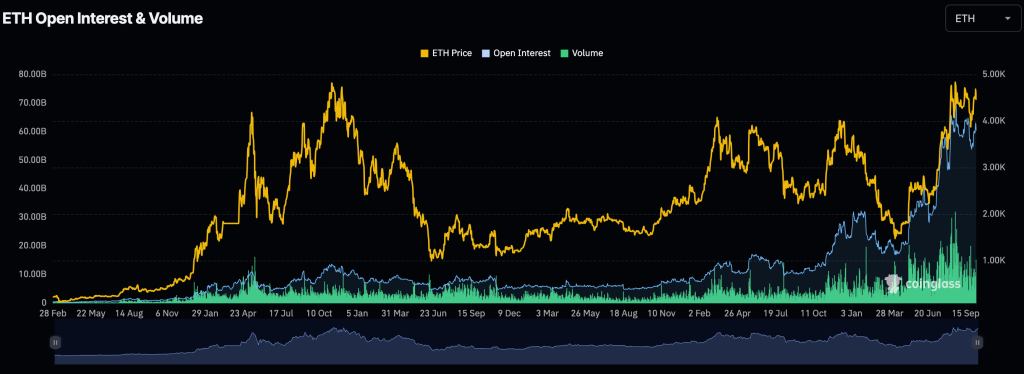

Open Interest Quick Assessment

– OI Rising with Price: Indicates new funds are driving the trend, a normal characteristic of a rising market.

– OI Rising but Price Flat: Suggests the market is brewing a breakout; the direction is uncertain, but once it breaks out, volatility will increase.

Reference Indicators: Open Interest and Trading Volume of BTC and ETH (Source: Coinglass)

15-Second Daily Routine

1. Check ETF fund flows once a day.

2. Briefly browse the funding rates of major trading pairs.

3. If participating in contracts, take a quick look at open interest.

4. Write a sentence in your notes, such as: "Inflow, price up, trend healthy." or "Outflow, price flat, stay cautious."

Consistently doing these few actions daily is more effective than staring at the screen all day.

3) Overview of Crypto Market Catalysts: Token Unlocks, TGE Launches, and Hot New Stars

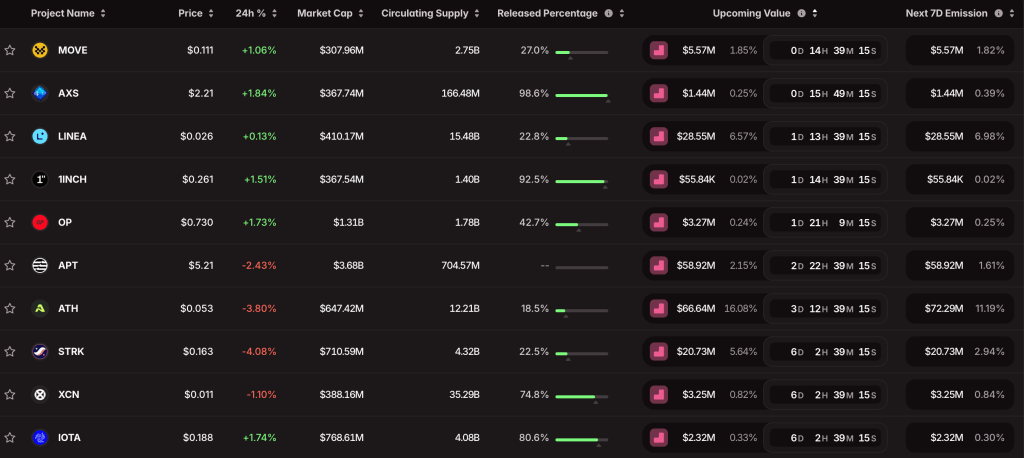

When locked tokens begin to unlock, the circulating supply in the market increases, leading to selling pressure. However, not all unlocks are worth worrying about.

A. Token Unlocks — Just Watch Two Numbers

Newcomers only need to focus on two core indicators:

1. Unlock Amount (in USD) — Regardless of the number of tokens unlocked, a $50 million unlock has a greater impact on the market than a $1 million unlock.

2. Unlock Percentage of Circulating Supply — If only half of the circulating supply is available but 5% is released all at once, the pressure is much greater than "5% of the total amount."

Additionally, it's important to understand: Who receives these tokens?

- Shares received by teams and early investors are often sold off more quickly.

- Community or ecosystem incentive distributions tend to have a more gradual selling pressure due to the dispersed holders.

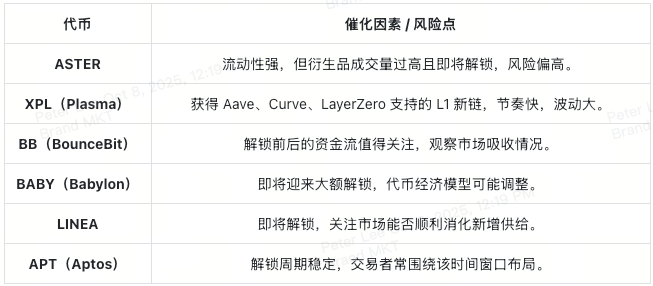

Key Unlock Events to Watch This Month:

- Linea (LINEA): Unlocking approximately 1.08 billion tokens on October 10 (about $29 million, accounting for about 6-7% of the circulating supply).

- Aptos (APT): Unlocking approximately 11.31 million tokens on October 11 (about $59 million), allocated to the team, investors, and the community.

- Aethir (ATH): Unlocking 1.26 billion tokens on October 12 (over $70 million), a large cliff unlock.

- BounceBit (BB): Unlocking 44.7 million tokens on October 12 (about $8-10 million), relatively small in size but worth noting due to exchange listings.

- Starknet (STRK): Unlocking 12.7 million tokens on October 15 (about $20 million), part of a monthly linear release.

- Babylon (BABY): Unlocking 321 million tokens, accounting for about 24.7% of the released amount, a large scale that requires caution.

Reference Source: October Token Unlocks (Source: Tokenomist)

B. New Products and TGE (Token Generation Events) — Catalysts with Built-in Momentum

The launch of new projects or TGEs that have real products, exchange support, or ecosystem backing often attract significant attention in the early stages. However, the hype can come quickly and dissipate just as fast.

Focus on the following four key points:

1. Initial Circulation Ratio — Projects with too small a circulating supply are prone to speculative bubbles followed by corrections.

2. Unlock and Vesting Rhythm — Large cliff unlocks may create selling pressure later on.

3. Launch Platforms — Top-tier exchanges (with deep liquidity) are preferable to smaller platforms.

4. The Project's Narrative and Implementation — Projects with real use cases or partners tend to have more sustainable price increases.

Highlight Projects This Month:

– Meteora (MET): TGE on Solana on October 23, with an initial unlock of about 48% of circulating tokens, with the remainder to be released linearly over the next 6 years.

Visit to view: Meteora (MET) Official X Channel

C. Rising Stars — Watch the Hype, but Set Safeguards

These projects have seen an increase in trading volume or narrative hype and can be added to your watchlist, but don’t chase blindly.

Five "Safeguard Questions" Before Acting:

1. What is the catalyst? (Launch, update, partnership, or news?)

2. Is the trading volume consistently appearing on multiple mainstream exchanges?

3. How thick is the depth of the main trading pair at 1%?

4. Are there any large unlocks in the next 7-21 days?

5. Have you set a stop-loss or exit plan?

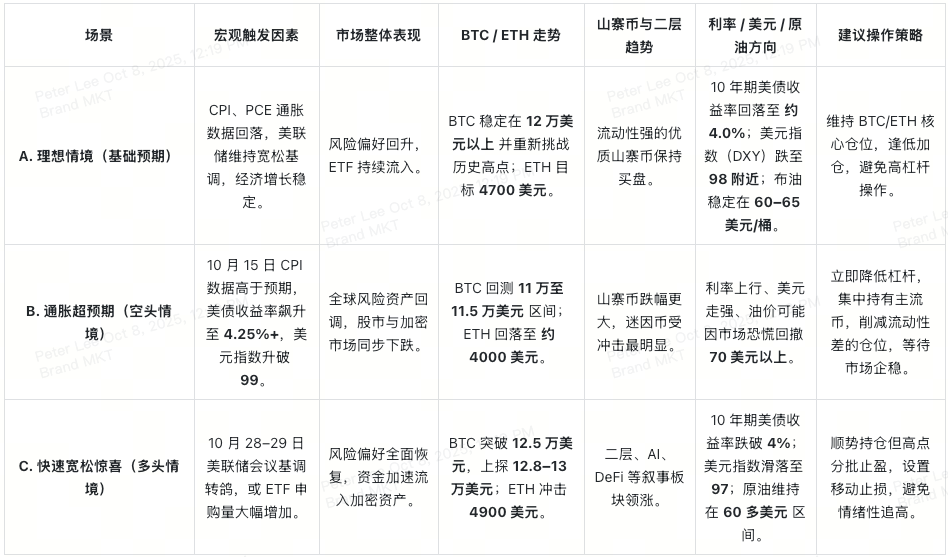

4) Three Market Paths in October and Response Strategies

You don’t need a crystal ball, just a simple “If this, then that” thinking framework. Below are three possible scenarios commonly referenced by traders, along with actions beginners can take in each case.

October Market Scenario Matrix

Risk Response Toolkit

Here are potential "landmines" to pay special attention to in October:

– If the October 15 CPI is higher than expected, it may trigger market panic.

– If oil prices suddenly break above $70/barrel, inflation expectations will be reignited.

– If ETFs experience consecutive net outflows after record inflows (with $5.9 billion inflow for the week ending October 4), it indicates a cooling of institutional sentiment.

– Mainstream protocols facing hacking attacks or large token unlocks could trigger short-term selling pressure.

– Sudden geopolitical events (such as war or escalation of sanctions) may drive up energy prices and exacerbate liquidity risks.

One-Minute Response Plan

– If data continues to weaken: Buy on dips, maintaining core positions in BTC/ETH.

– If inflation unexpectedly strengthens: Reduce leverage and only trade high liquidity assets like BTC/ETH.

– If the Federal Reserve turns more dovish: Hold positions in line with the trend, but take partial profits during rapid increases.

Let these rules replace your guesses. The market changes quickly; a clear plan is the best advantage.

5) Your October Action Manual: Operations, Reminders, and Execution

This is the most practical part—six steps, simple and direct:

1. Set reminders first. Set reminders for the three key dates mentioned in Section 1 (employment data, CPI, Federal Reserve meeting), ideally reminding yourself 15 minutes before and at the time of the release.

2. Trade high liquidity pairs. On the day of important data releases, consider reducing your position size, as market depth will noticeably thin out in the minutes before the data.

3. Set stop-losses before entering. Write down your stop-loss price before entering; execute it if the price falls below. You can note it in your trading log or on the chart and strictly adhere to it.

4. Spend 15 seconds daily checking fund flows. If inflows align with the trend, the market is healthy; if prices rise but fund flows weaken, start tightening risk.

5. Pay attention to the unlock times of the tokens you hold. If the unlock amount (in USD) is large or accounts for a high percentage of the circulating supply, consider reducing your position before the unlock if the price is strong, or use perpetual contracts to hedge risk.

6. Maintain a light position mindset. Survive first, then talk about profits. It’s better to earn a little than to be washed out by volatility.

If you’re unsure of the direction, stick with BTC and ETH. Let the market calendar and fund flows guide you, rather than emotions of "fear of missing out." A stable rhythm is more reliable than any "insider information."

Remember

You don’t need to trade every day or catch every wave.

What you really need is:

– A few clear dates

– Two or three key indicators

– A plan you can execute

This way, the October market can become controllable and rhythmic.

Log into your XT account now, set reminders for employment data, CPI, and Federal Reserve decisions, and print the checklist and plan above.

By maintaining a relaxed pace and simple rules, you can easily navigate this "Uptober" without being led by market emotions.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with over 1 million monthly active users and user traffic exceeding 40 million within the ecosystem. We are a comprehensive trading platform supporting over 1,000 quality cryptocurrencies and 1,300 trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading options including spot trading, margin trading, and contract trading. XT.COM also has a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。