The heat of the BSC ecosystem is experiencing an inward-to-outward diffusion. Since Aster completed its TGE in mid-September and launched the second phase of Genesis, the trading activity and on-chain liquidity of the entire ecosystem have significantly increased. With the opening of the "Aster Dawn" phase, this momentum has further amplified—not only has it led to the concentrated launch of multiple BNB meme coins, but it has also made the decentralized trading sector a focal point of market attention.

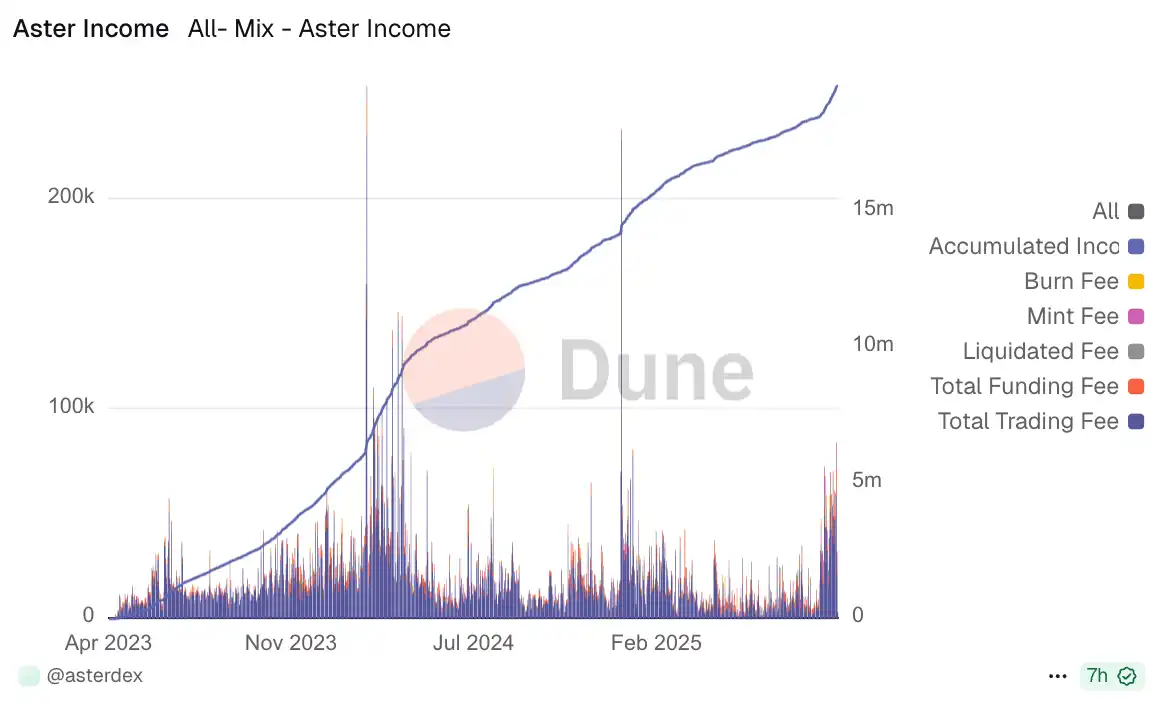

As of October 9, the spot trading volume on Aster DEX saw $4/USDT reach $45.88 million within 24 hours, second only to the mainstream trading pair $ASTER/USDT, making it one of the most outstanding emerging assets on the platform. For a decentralized trading platform that has just entered the third phase of its incentive cycle, such trading activity is sufficient to reflect its driving force in market sentiment and liquidity.

From "Incentive Mining" to "Capital Efficiency": A New Paradigm for DEX Growth

After entering the "Aster Dawn" phase, the Aster platform introduced a multi-dimensional point system that comprehensively considers factors such as trading volume, holding duration, asset types (e.g., asBNB, USDF), actual profits and losses, and team contributions. Compared to traditional incentive methods that rely solely on trading volume or locked amounts, this system encourages users to engage in deeper and more sustained trading behaviors.

From a strategic perspective, this means Aster is attempting to find a balance between "high-frequency trading" and "long-term contributions." The result is a significant increase in the platform's liquidity utilization rate, a more diverse trader structure, and the formation of a trading ecosystem that can accommodate both short-term speculative demand and long-term incentive stickiness.

Even though the market capitalization of $ASTER is still lower than many mature projects, Aster's capital efficiency (volume/TVL ratio) ranks among the industry's top, demonstrating a more compact capital cycle and active trading structure.

Unlike most emerging DEXs, Aster's growth is not solely driven by single-point incentives but has formed a natural amplification effect through the resonance between the Meme sector and on-chain liquidity. In just the past two days, Aster has listed multiple BSC ecosystem memes, including CSXH, PUP, SZN, DUST, etc. Several trading pairs have seen daily trading volumes exceeding one million dollars, reflecting a concentrated influx of market funds.

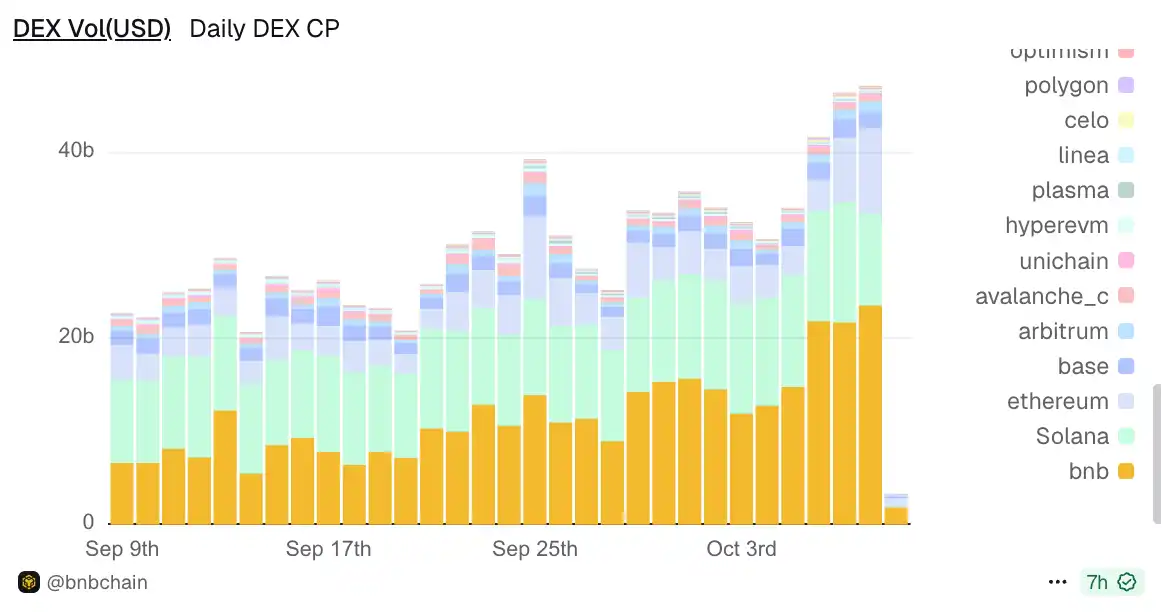

The Decentralized Shift of the BNB Ecosystem

From a macro perspective, Aster's popularity is not just a phenomenon of a single platform but more like a signal of a turning point in the BNB Chain ecosystem. In the past week, the initial liquidity of several new tokens within the BNB ecosystem has chosen to deploy on Aster before spreading to other platforms. This "first on-chain, then overflow" model shows that preferences on both the funding and trading sides are beginning to lean towards native on-chain scenarios.

In recent years, BNB Chain has continuously strengthened its DEX ecosystem layout. With the dual push of official resources and community support, Aster has become an important carrier of on-chain trading activity. Its ongoing listing rhythm, incentive activities, and multi-dimensional point system are gradually establishing a circular system that can absorb new traffic within the ecosystem.

In the process of gradually decentralizing liquidity, Aster plays the role of the "BNB flagship symbol DEX." It not only offers high multipliers and diverse trading pairs but also attracts a large number of quantitative teams and community traders through team bonus mechanisms and an open-point system.

After entering the third phase "Dawn," Aster has systematically upgraded its overall incentive system. The platform has introduced a more layered bonus mechanism—certain spot and perpetual contract trading pairs can earn additional point rewards to encourage active trading behavior; the team incentive rules have changed from being reset weekly to spanning the entire phase, reinforcing long-term collaboration and cumulative effects; at the same time, for the referral program, Aster allows users who reach specific trading volume thresholds to apply for higher rebate ratios, further incentivizing high-frequency users and community traders to participate.

These designs make Aster's incentive structure closer to a model that combines "gamification + quantitative incentives," no longer relying solely on short-term mining stimulation. Notably, the platform also offers dual reward options for second-phase participants—either directly receiving $ASTER airdrops or refunding all trading fees to achieve "zero-fee trading."

This flexibility reduces the exit risk for speculators and enhances the stickiness of long-term traders. In other words, Aster is transforming "short-term mining activities" into "sustained trading behaviors" through institutional design.

In the fiercely competitive DEX market, Aster's rapid rise not only reflects the innovation of its incentive structure but also reveals the trend of decentralized liquidity regaining market favor. For BNB Chain, Aster has become one of the strongest indicators of its "on-chain activity." The user migration brought about by its phased activities is driving systematic changes in the trading data and liquidity structure of the entire ecosystem.

In the coming weeks, the point system and liquidity changes of the "Aster Dawn" phase will remain key observation indicators. Regardless of the outcome, Aster has provided a clear signal for the DEX track—liquidity is returning to the chain, and the narrative of decentralized trading is being redefined.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。