Written by: Elvin, Mars Finance

When the name of Binance founder Zhao Changpeng's pet dog can spawn hundreds of imitation tokens, the essence of this carnival bubble has become glaringly obvious.

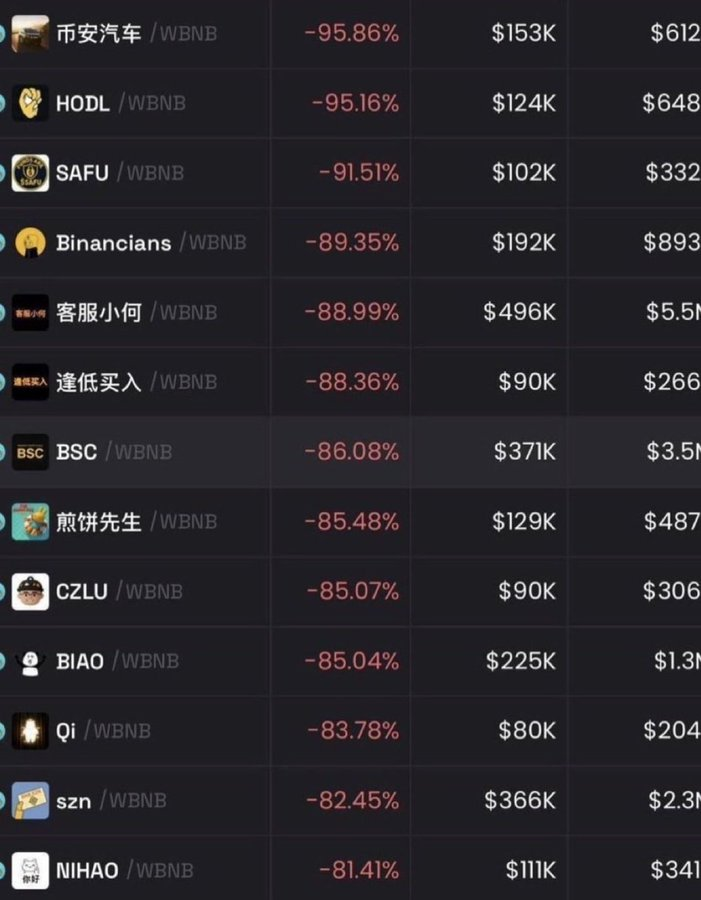

A sudden crash swept through the Memecoin market on the BNB Chain. Multiple popular tokens plummeted over 80% on Thursday, with tokens like Customer Service Xiao He and Binance Car seeing declines of up to 90%.

At the same time, BNB itself fell nearly 6.5% from its historical high of $1357 to around $1246.

This crash occurred after Binance launched the "Meme Rush" launchpad, a new platform in collaboration with Four.Meme, which was supposed to curb false trading volumes through KYC requirements and a fair issuance mechanism, but unexpectedly triggered a sell-off. Traders rushed to sell their existing tokens in preparation for migration to the new platform, exposing the fragile nature of the BNB Chain Memecoin ecosystem.

False Prosperity: The Bubble Nature of the BNB Chain Memecoin Ecosystem

Before the crash, the Memecoin market on the BNB Chain exhibited a facade of false prosperity.

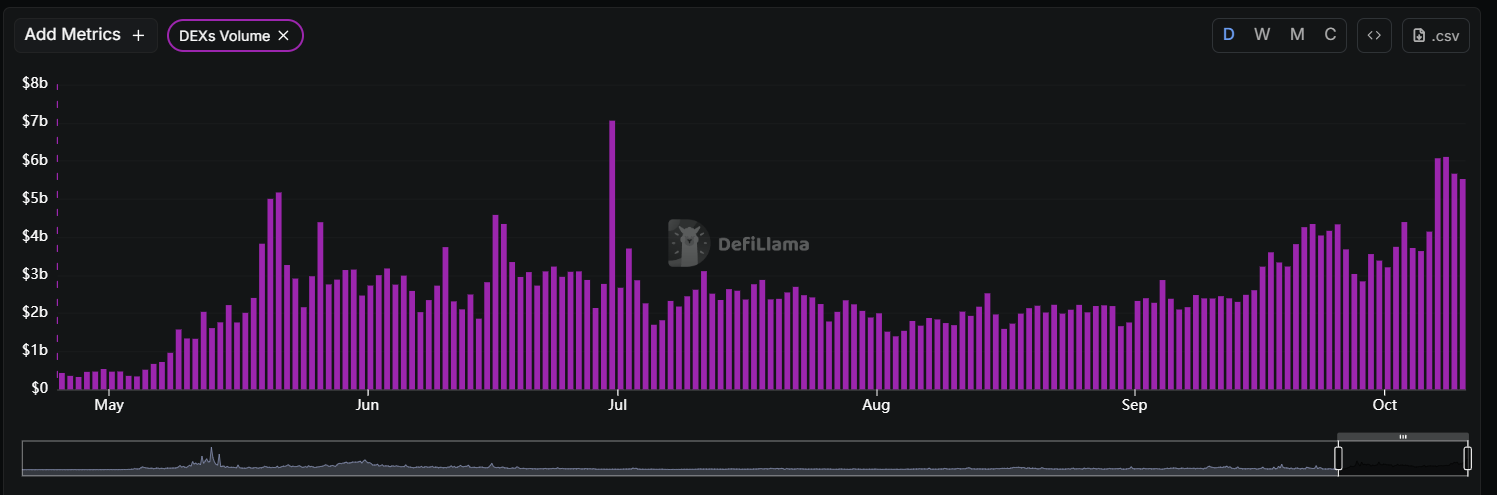

According to DeFiLlama statistics, the trading volume on the BNB Chain reached $14.3 billion in the past week, even surpassing Ethereum and Solana, ranking first in the industry.

The DEX 24-hour trading volume peaked at $900 million, with PancakeSwap accounting for over 86%. This apparent prosperity hides the reality of manipulation and false trading.

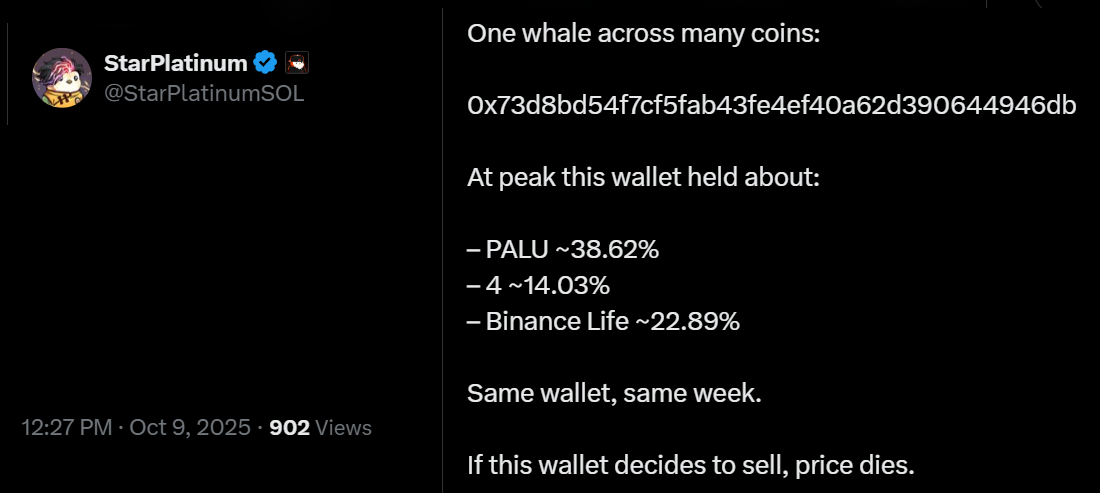

Source: X/StarPlatinumSOL

Source: X/StarPlatinumSOL

X user StarPlatinumSOL claimed that a single wallet controlled nearly 39% of PALU's supply at its peak, as well as 23% of Binance Life and 14% of 4 tokens. This highly concentrated holding allowed whales to easily manipulate market prices.

Even more concerning is the extremely weak liquidity pools of many Memecoins.

Tokens launched on the Fourmeme platform had less than 2.5% of their total supply stored in liquidity pools, a structure that allows a small influx of funds to inflate market value, but once sell orders increase, it can also accelerate price crashes.

Previously, the test token TST created by the BNB Chain team for educational videos unexpectedly became popular, with a market cap once exceeding $600 million, but it quickly plummeted after being listed on Binance, having dropped 95% from its peak as of the time of writing.

This rollercoaster price movement reveals the speculative nature of the BNB Memecoin market, perhaps this is the final destination of "Binance Life."

Star Effect and Traffic Game: CZ as the Catalyst for Memecoin Volatility

Binance founder Zhao Changpeng played a core role in the BNB Chain Memecoin craze. In early 2025, CZ continuously generated topics through high-frequency Twitter interactions, first unexpectedly promoting the educational token TST, and then revealing the name of his dog, Broccoli, leading to the emergence of hundreds of Memecoins with the same name.

Defillama data shows that trading volume on the BNB Chain approached $30 billion in the past week, with a weekly increase of 49.07%, ranking first among major public chains. This growth is closely tied to CZ's "shouting effect." However, this star effect has also brought significant controversy.

Just minutes before CZ posted an image with the PALU memecoin logo, a wallet purchased approximately $100,000 worth of PALU, raising questions about coordinated trading activities. The potential for insider information to be exploited undermines market fairness.

KOL Yuyue publicly criticized, stating: "The professional ability and overall quality of the BNB Chain team are hard to assess, basically relying on the influence of CZ and Binance to monetize." This sharp comment, while pointed, reveals to some extent the driving force behind the BNB Chain Memecoin craze.

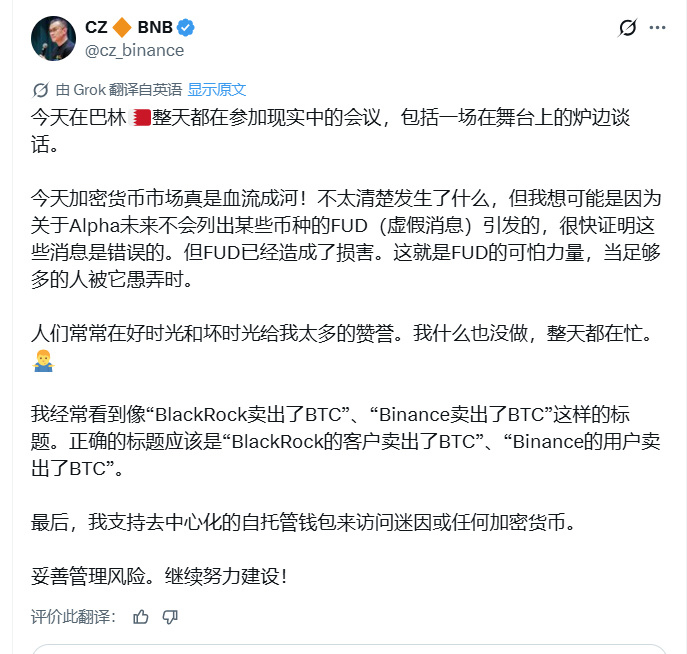

In response to criticism, CZ had to clarify that he "has tried many wallets" but "has never bought Meme coins," while promising to improve the user experience of Binance Wallet and Trust Wallet.

Speculation and Zero-Risk: Essential Reflections on Memecoins

The trading of Memecoins is essentially a highly speculative behavior. As one observer noted: "The number of Memecoins is a vanity metric, similar to likes and followers on social media platforms, with no substantive content." This view, while somewhat extreme, reveals the value dilemma of Memecoins.

From historical data, the daily token trading volume on the BNB Chain has dropped from about 17 million transactions per day in 2021 to around 5 million transactions currently. Moreover, according to BSC Scan data, most tokens transferred on-chain "are either meme coins or fraudulent scam tokens." Many of these tokens are designed to deceive users into trading to steal funds.

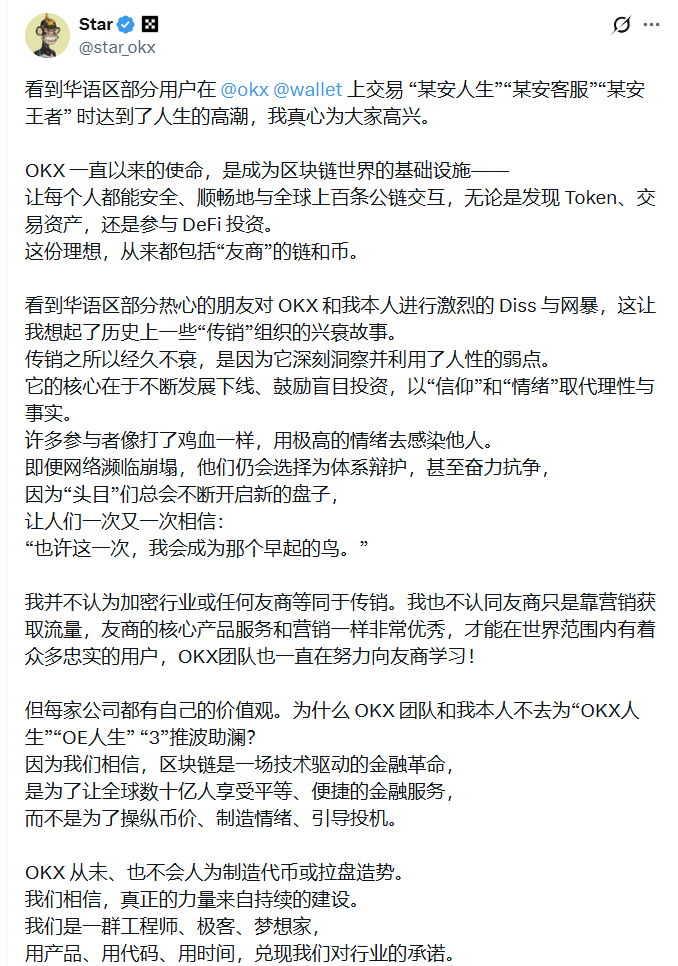

OKX founder Xu Mingxing expressed his views on this, and while he did not directly accuse competitors, he hinted that certain behaviors might exploit human weaknesses. He stated: "The reason pyramid schemes endure is that they deeply understand and exploit human weaknesses. Its core lies in continuously developing downlines and encouraging blind investment, replacing rationality and facts with 'faith' and 'emotion'." Xu Mingxing emphasized that OKX "has never and will never artificially create tokens or hype," which stands in stark contrast to the phenomena on the BNB Chain. This difference may reveal the differing attitudes of the two exchanges towards the Memecoin craze.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。