Powell Speech Sparks Confusion as He Stayed Silent on Monetary Policy

What happens when the most powerful voice in finance says nothing? Recent Powell Speech has left global investors puzzled.

He offered no insight into monetary policy, inflation, or the U.S. economy.

The absence of any signal was unexpected and yet, for markets already leaning dovish, his silence may have been the strongest message of all.

Powell Speech Sends a Subtle Message

The Powell Speech was expected to bring clarity on whether the Federal Reserve plans more rate cuts in 2025. Instead, it delivered complete silence on inflation, the labor market, and economic growth.

Analysts believe this was a deliberate way for the central bank to maintain flexibility while waiting for more data before making its next move.

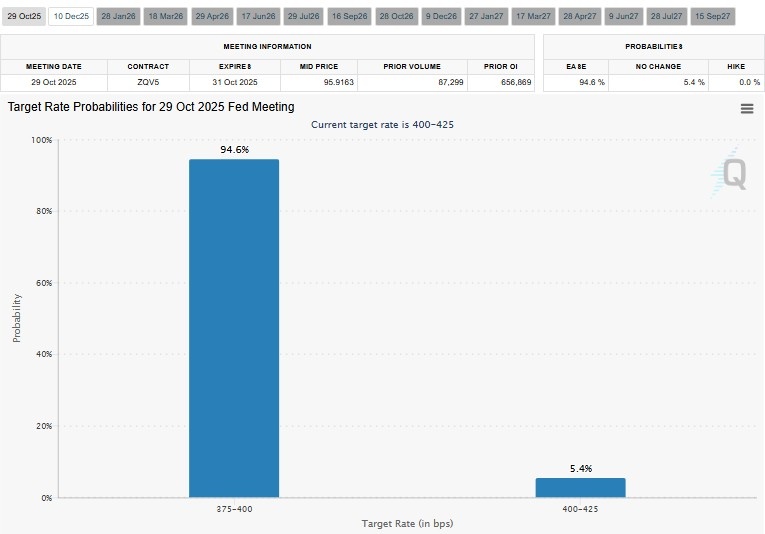

Market sentiment, however, has already turned decisively toward easing. Futures data by CME FedWatch tool, now show a 94.6% probability of a rate cut at the October 29–30 FOMC meeting , and traders expect a second cut in December.

Source: FedWatch Tool

For investors, Powell’s silence is as good as a hint that the central bank still intends to support the economy into the fourth quarter.

Fed Officials Show Divided Views

While Powell avoided the topic altogether, other Federal Reserve officials stepped in with strong opinions.

As reported by the Reuters, New York Fed President John Williams said he would support more rate cuts, citing rising risks in the job market. He noted that the labor market is softening faster than expected, which could justify additional easing.

San Francisco Fed’s Mary Daly agreed , saying the slowdown in employment data was becoming “worrisome.” Both officials argued that further rate cuts could help balance the Fed’s twin goals of price stability and full employment.

However, not everyone at the central bank shares that dovish tone. Fed Governor Michael Barr cautioned against moving too aggressively to cut rates, citing ongoing inflation worries.

He urged caution, stating that the Federal Reserve should wait and see more before acting again. Other policymakers were also on his side, with a view that bold cuts would spark inflationary pressure again.

This continued divergence serves to show exactly as unsure as the economic outlook still is despite ongoing market pricing in further easing.

Market Reaction: Dovish Bets and Crypto Volatility

After the Powell Speech, stocks and bonds responded with caution. Equities edged down a notch, while bond yields retreated as investors bet twice on two additional rate cuts before year-end.

The cryptocurrency market, meanwhile, was typically impatient to respond to macro indicators and experienced mixed movements.

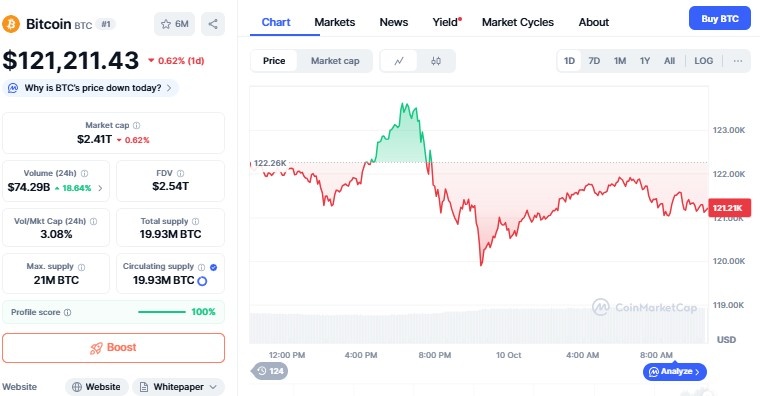

Bitcoin Price

Bitcoin price dipped below $120,000 briefly, provoking more than $700 million in long liquidations before recovering.

Source: CoinMarketCap

The overall crypto market dropped some 0.85% in the last 24 hours, as risk was trimmed by investors prior to influential U.S. jobs data.

Open interest in Bitcoin perpetuals fell by 6%, indicating lowered speculative positioning.

However, crypto liquidity is improving quietly. Increasing inflows into Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) indicate that traders are gearing up for better financial conditions.

With crypto and equities being highly correlated, digital assets may be the ones to initiate the next risk-taking wave once fed rate cut finally occur.

What's Next for Markets?

Now with no obvious message from the Powell Speech, focus now moves on to the next labor and inflation reads.

Stronger job numbers could delay cuts, while weaker data might force the Fed to move faster.

The next big moment will come at the end of October, when the Fed meets again to decide on rates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。