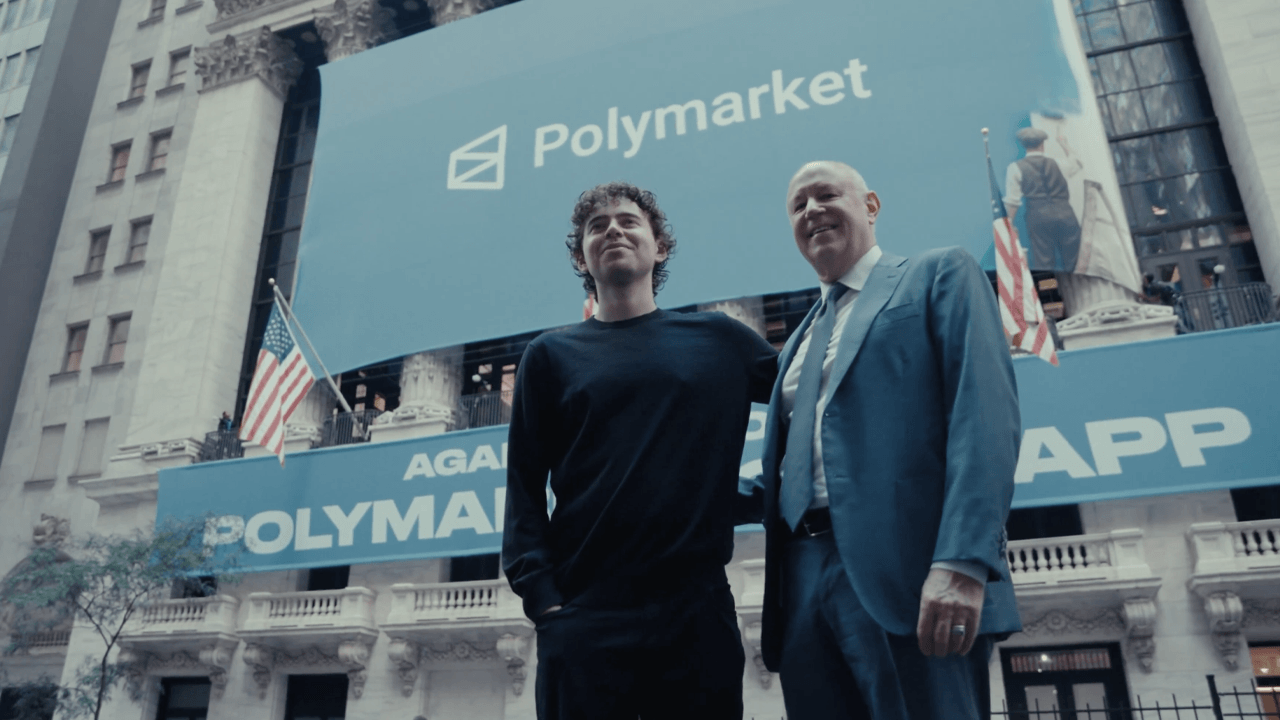

Polymarket, a decentralized prediction market built on the Polygon blockchain, is entering a new phase of growth following a $2 billion investment from the Intercontinental Exchange (ICE), parent company of the New York Stock Exchange (NYSE). The deal, announced on Oct. 7, 2025, values Polymarket at up to $10 billion and positions the platform as a key bridge between Wall Street and the expanding crypto economy.

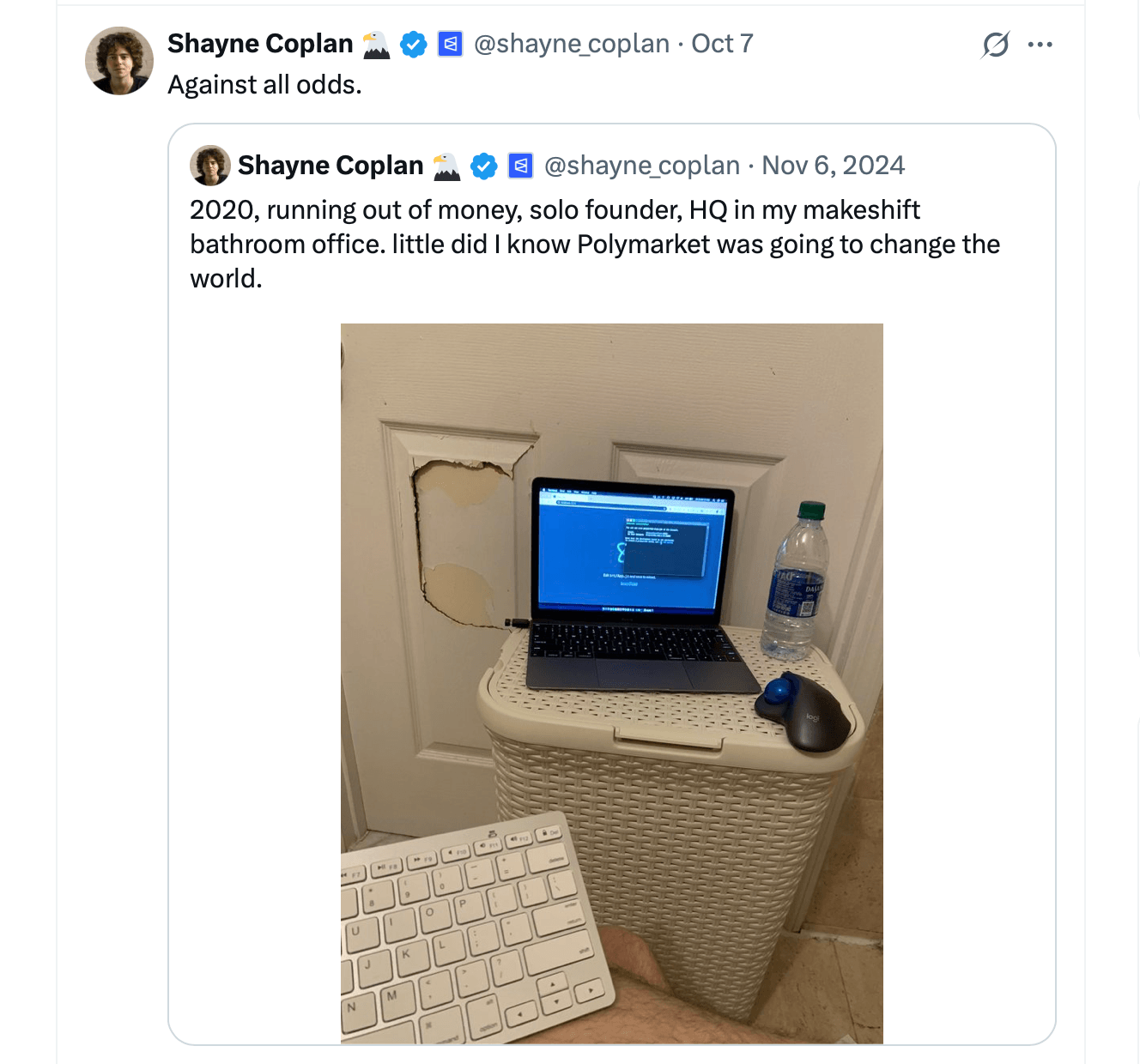

Founded in 2020 by New York entrepreneur Shayne Coplan, Polymarket allows users to trade on the outcomes of real-world events—from elections to sports—by buying and selling shares tied to “yes” or “no” results. Each share represents a probability of an event occurring, providing a market-based signal of public sentiment. Its rapid rise, particularly during the 2024 U.S. election cycle, showcased how decentralized markets can outperform traditional polling in predicting outcomes.

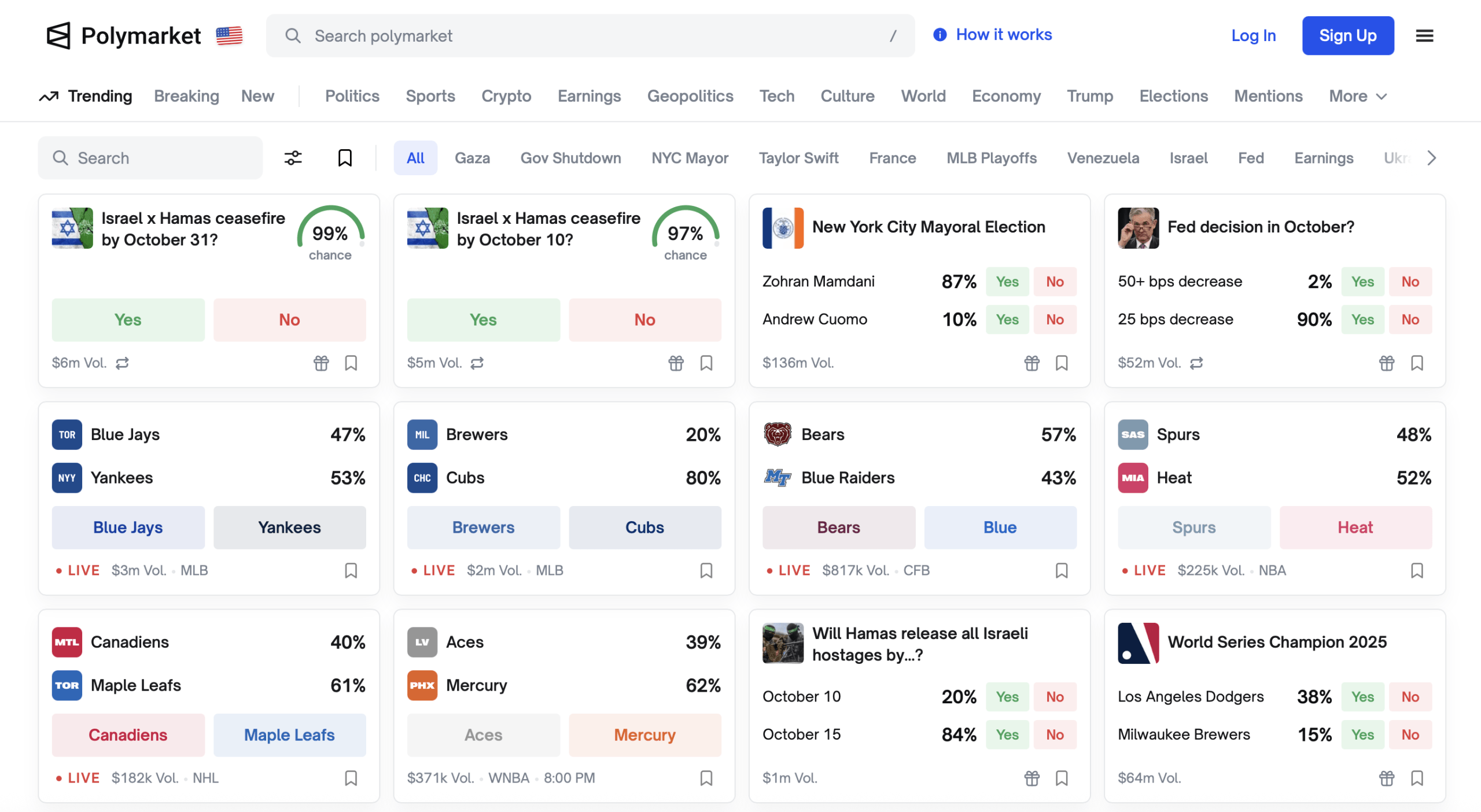

Homepage of the prediction marketplace Polymarket.

The ICE investment marks one of the largest by a TradFi institution in a crypto-native company. ICE, best known for operating global exchanges and clearinghouses, aims to integrate Polymarket’s data and market infrastructure into its broader financial ecosystem. CEO Jeffrey Sprecher said the partnership aligns with ICE’s efforts to expand digital asset data services and prediction-based analytics.

The funding follows Polymarket’s acquisition of QCX, a crypto derivatives exchange, for $112 million in July 2025. That move signaled the company’s push to re-enter the U.S. market under compliant structures following earlier regulatory issues. In 2022, the Commodity Futures Trading Commission (CFTC) fined Polymarket $1.4 million for operating without registration, temporarily barring U.S. users. With the Trump administration, the CFTC and Department of Justice (DOJ) recently dropped its probe against Polymarket.

Polymarket operates as a peer-to-peer market where users wager cryptocurrency—mainly USDC stablecoins—on event outcomes. Liquidity is managed by automated market makers (AMMs), ensuring smooth trading and price discovery. The platform currently runs on the Polygon network, providing low transaction costs and high-speed execution. It integrates with Web3 crypto wallets, offering a user-friendly gateway into decentralized finance (DeFi).

The investment’s timing coincides with Polymarket’s rollout of bitcoin (BTC) deposits on Oct. 6, 2025. The feature enables direct BTC funding for trading, responding to user demand amid bitcoin’s rally to $126,000. The integration broadens accessibility for global users and ties Polymarket more closely to the world’s largest digital asset. Industry observers noted the pairing of ICE’s investment and bitcoin support as a strategic alignment between traditional capital and crypto liquidity.

Polymarket also announced a major technical advancement: integration with Chainlink, the decentralized oracle network that connects smart contracts with verified off-chain data. The partnership, unveiled Sept. 12, 2025, enhances the reliability of event resolutions by automating data feeds and market settlements. Chainlink’s data streams and automation tools allow Polymarket to resolve prediction markets faster and with reduced human intervention.

The man pictured on the left is Shayne Coplan, the 27-year-old founder and CEO of Polymarket, and the man on the right is Jeffrey Sprecher, the founder, chairman, and CEO of ICE. Intercontinental Exchange is the parent company of the New York Stock Exchange (NYSE).

Chainlink’s oracles are particularly vital for markets based on objective data—such as crypto prices or economic indicators—where instant verification improves user trust. Together with its existing UMA Optimistic Oracle, Polymarket now employs a dual-resolution framework that blends decentralization with accuracy. The collaboration strengthens the platform’s credibility, especially for institutional participants monitoring blockchain-based forecasting tools.

Polymarket’s growth also points to the maturation of prediction markets in finance. Long regarded as a niche within DeFi, these platforms are now drawing interest from hedge funds and data firms seeking alternative forecasting models. ICE’s participation suggests institutional belief in prediction markets as legitimate financial instruments rather than speculative curiosities.

Social media reaction to the deal was immediate. Crypto analysts on X (formerly Twitter) described the move as a bullish signal for Web3 adoption, while others pointed to its implications for competitors such as Kalshi and Draftkings. Analysts said ICE’s endorsement could accelerate mainstream awareness and regulatory normalization of decentralized forecasting platforms.

Polymarket’s moves reflect broader trends in blockchain adoption. As data-driven finance continues to evolve, prediction markets like Polymarket are positioned to serve as sentiment indices for global events, from elections to asset prices. With ICE’s infrastructure and compliance expertise, the platform may soon achieve full access to the U.S. market, pending regulatory review.

From its origins as a small DeFi experiment to its new position as a Wall Street-backed powerhouse, Polymarket exemplifies how blockchain innovation is reshaping financial data. Its embrace of bitcoin and oracles like Chainlink, coupled with ICE’s strategic investment, places it at the intersection of information, speculation, and finance—an increasingly vital nexus as markets seek real-time insights into an unpredictable world.

Q1: What is Polymarket?

Polymarket is a decentralized prediction market that lets users trade on the outcomes of real-world events using blockchain technology and cryptocurrency.

Q2: Who invested in Polymarket in 2025?

The Intercontinental Exchange (ICE), parent of the New York Stock Exchange (NYSE), invested up to $2 billion in Polymarket in October 2025.

Q3: Why is the ICE investment significant?

It marks one of the largest traditional finance (TradFi) investments in a blockchain platform, signaling greater institutional confidence in prediction markets.

Q4: What cryptocurrencies does Polymarket now support?

Polymarket accepts USDC stablecoins and recently added bitcoin ( BTC) deposits for global accessibility.

Q5: How does Chainlink enhance Polymarket’s operations?

Chainlink’s oracle network provides verified, tamper-proof data to automate market resolutions, improving accuracy and efficiency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。