As the next difficulty adjustment approaches next week, estimates anticipate a notable reduction in mining difficulty, potentially offering short-term relief but pointing to broader volatility across the bitcoin mining ecosystem.

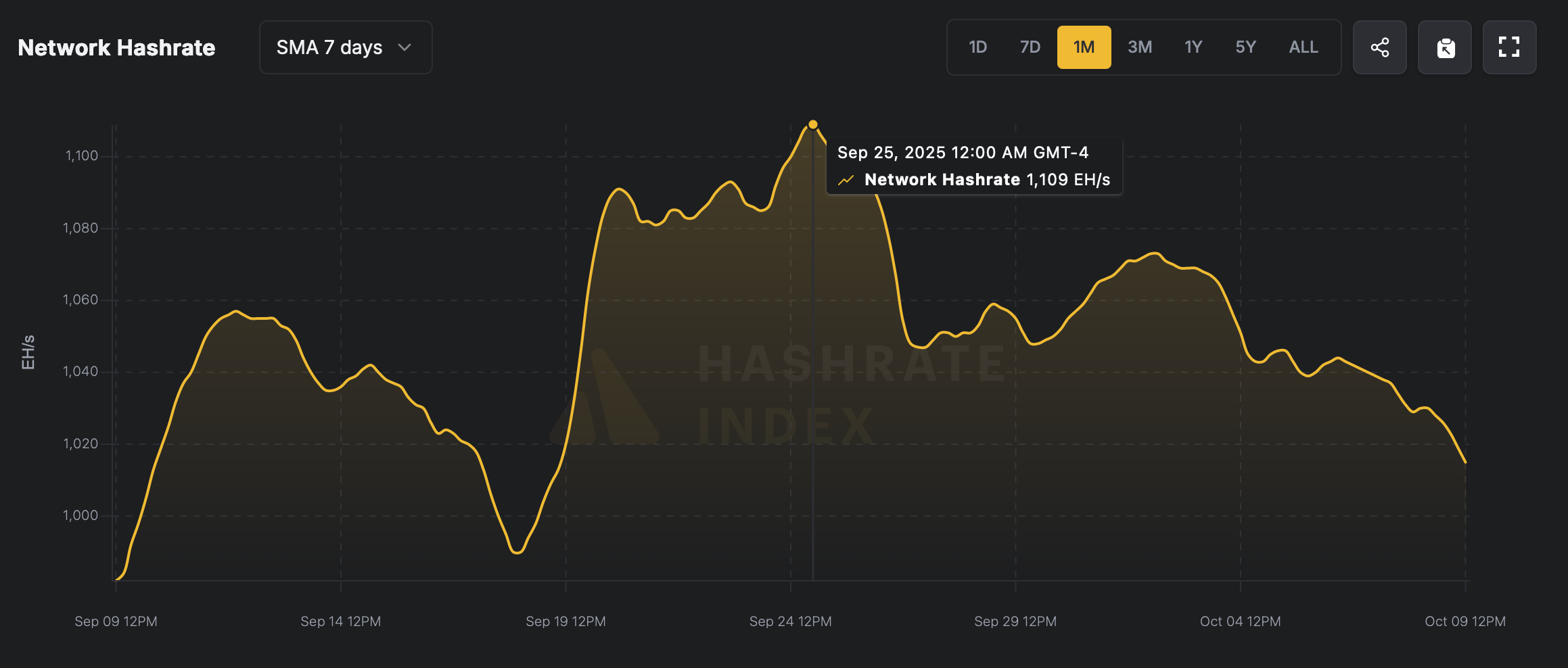

Roughly two weeks ago, Bitcoin’s total network hashrate reached a record-breaking peak of 1,109 EH/s — marking the highest level of computational power in its history. Since then, the network’s strength has eased, with the current hashrate hovering around 1,011 EH/s, signaling a measurable contraction in mining activity and network efficiency.

Much of this decline stems from Bitcoin’s mining difficulty climbing to an all-time high of 150.84 trillion, following seven consecutive difficulty increases — a sustained trend that has tightened miner profitability and amplified network competition across the global Bitcoin ecosystem.

As of Oct. 10, projections indicate that Bitcoin’s mining difficulty is set to decrease by roughly 7.57%, offering a potential reprieve for miners after several weeks of tightening margins. This difficulty reduction could help operators recover from the recent hashrate downturn and restore balance to the network’s economics.

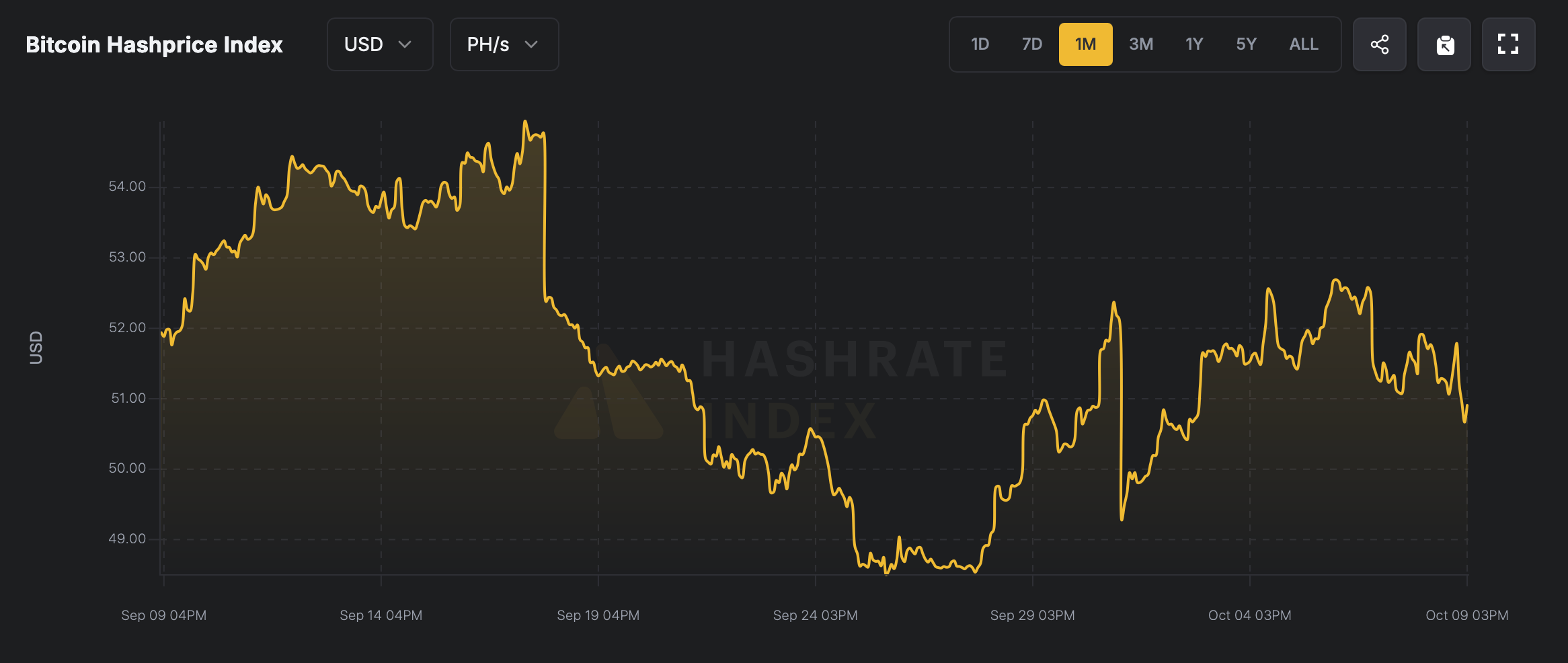

Mining revenue briefly improved when bitcoin’s price surged to new price highs earlier this week, pushing the hashprice — the estimated value of one PH/s — close to $53. At the time of writing, the hashprice stands at approximately $51.20, reflecting a modest cooling that still remains favorable compared to prior months.

In the weeks ahead, the bitcoin mining landscape will hinge on how miners adapt to the coming difficulty adjustment and the broader market dynamics shaping profitability. A 7.57% reduction in difficulty could provide short-term relief, but sustained recovery depends on bitcoin’s price stability, energy costs, and global network participation.

Historically, such cycles of hashrate contraction and rebound have served as natural recalibrations for the network — filtering out less efficient operations while rewarding those able to innovate and scale. For now, the dip in hashrate and the easing of mining difficulty signal a potential stabilization phase, offering miners a window to optimize operations before the next major shift in the BTC economy.

💡 FAQ: Bitcoin Hashrate & Mining Difficulty

- What caused Bitcoin’s hashrate to drop recently?

The decline stems mainly from rising mining difficulty and reduced profitability margins across the network. - How much is the Bitcoin mining difficulty expected to change?

Estimates from hashrateindex.com suggest a 7.57% decrease, marking the first significant difficulty drop in several weeks. - What is Bitcoin’s current hashprice per PH/s?

The hashprice is hovering near $51.20 per petahash, slightly below its recent $52 peak. - How will this difficulty drop affect miners?

Lower difficulty could temporarily boost miner rewards and help stabilize operations amid recent volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。