SEC Solana ETF Approval Deadline Today: Will Shutdown Fuel $SOL Crash?

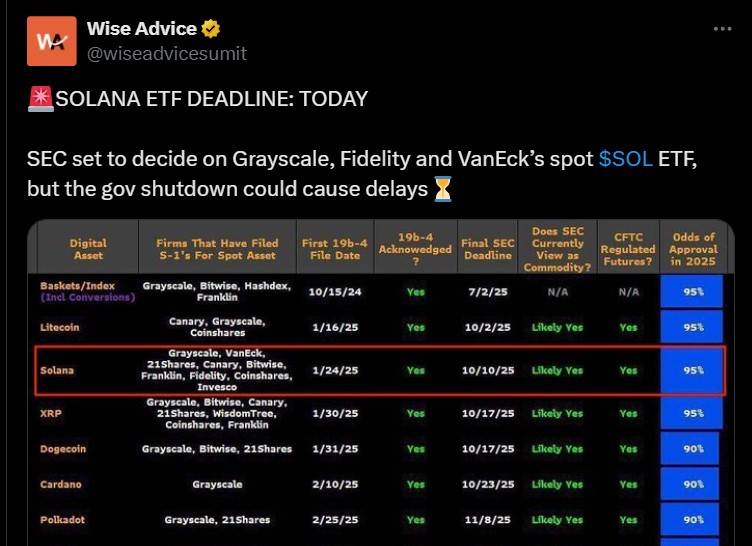

Today is a big day for the $SOL coin as it faces the Solana ETF approval deadline. The U.S. Securities and Exchange Commission (SEC) will decide whether to approve Grayscale, Fidelity, and VanEck exchange traded funds.

But there’s a twist—the ongoing US government shutdown might delay the decision. If that happens, it could have a big impact on $SOL’s price and its future. Let’s explore what’s going on.

Solana ETF Approval Deadline: Will Institutional Money Flow Into $SOL?

Today''s deadline is a huge deal as experts believe there’s a 95% chance that the SEC will approve it. If that happens, $1.5 billion could flow into the asset in just one year.

Source: Wise Advice Official X Account

This $SOL news today means a lot more to traditional investors because it will reflect the asset’s price momentum as more institutional money will influx in the token.

But now the main question is, will the Solana ETF SEC decision October get green light or will the U.S. government shutdown delay it?

Government Shutdown: Could This Delay Solana ETF Approval Deadline?

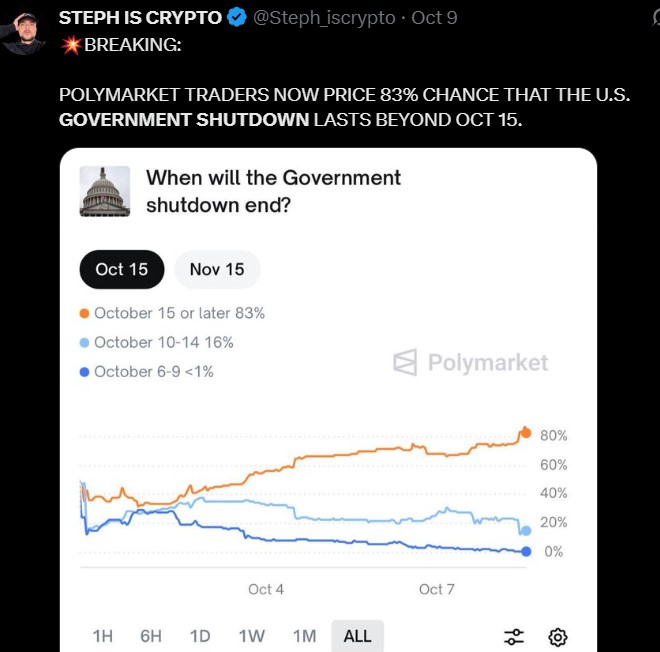

This United States event is the biggest risk right now. The shutdown has lasted for 10 days, and it's affecting federal agencies, including the SEC.

Over 34,000 IRS workers are on furlough, and 1.5 million military personnel could miss their paychecks. Top cryptocurrency experts believe this could delay today’s decision adding even more volatility in the $SOL price crash today.

According to Steph Is Crypto latest X post , Polymarket traders show that there’s an 83% chance the government shutdown will last beyond October 15.

Why Is Solana Falling: Check Reasons Before the Big Decision

As of now, $SOL’s price is at $222.88, down by 4% in the past week, but it has been steady around $223.22 in the last few hours. Here’s a breakdown as per TradingView chart:

-

RSI Analysis: The RSI is at 66.53, meaning the asset is in overbought territory. This could mean a small pullback is coming.

-

MACD Analysis: The MACD shows a slight positive momentum, but a small drop may be near before the surge.

-

Support and Resistance: The nearest support is at $220 and resistance levels are at $230 and $240. The ETF impact on its price is going to be huge, so if the asset breaks these levels, it could go higher.

What’s Next for $SOL Post-ETF Decision?

The Solana ETF approval deadline is very important for its price momentum. If the $220 support level holds, $SOL price could rebound to $230.

But if $220 doesn’t hold, it might fall to $210. If the long awaited exchange traded funds gets approved today, Solana price prediction 2025 might target $240–$250.

But if it is delayed due to the government shutdown, the price could dip to $200.

Conclusion: Traders Should Watch These Key Things

The Solana ETF approval deadline is a critical moment for the asset's future.

-

If the SEC approves it today, then it could open the floodgates for institutional investment, pushing the asset’s price higher.

-

But the U.S. government shutdown is a big unknown—it could delay the decision and cause prices to dip even further.

In the long run, this altcoin still has a strong future so keep an eye on the support and resistance level and stay updated on the major news today.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。