The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome all cryptocurrency friends to follow and like, and I refuse any market smoke screens!

Recently, the favorable trends in the cryptocurrency market often make people overlook Trump, the biggest unstable factor; discussing tariffs is not so easy. I mentioned tariffs at the beginning of the year, and as negotiations progressed, I also overlooked this issue. Fortunately, I was blessed, and I was on vacation, not involved in the contract market. According to my thoughts, I might continuously go long, which is also the charm of the cryptocurrency market. Trump's statements may get an answer on November 11; once tariffs are imposed, it will inevitably lead to an overall decline, without a doubt. However, based on Trump's style of action, I am more skeptical about whether he is bottom-fishing. Not only does the cryptocurrency market suffer from needle-injection trends, but the entire stock market is also severely impacted, and he may have the possibility of backtracking. Everyone can pay attention to a key piece of news: the U.S. and Pakistan have begun cooperating to mine rare earths; perhaps this event is a turning point and may involve leaks.

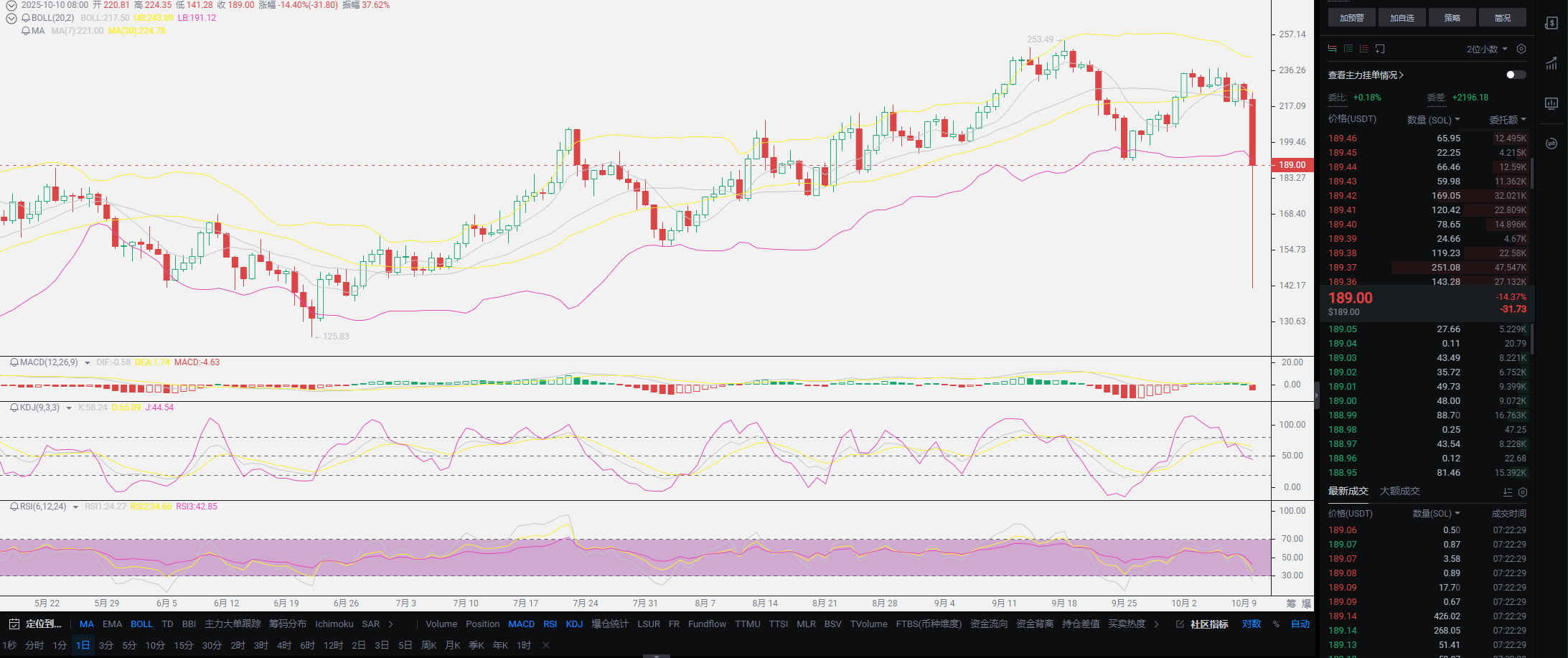

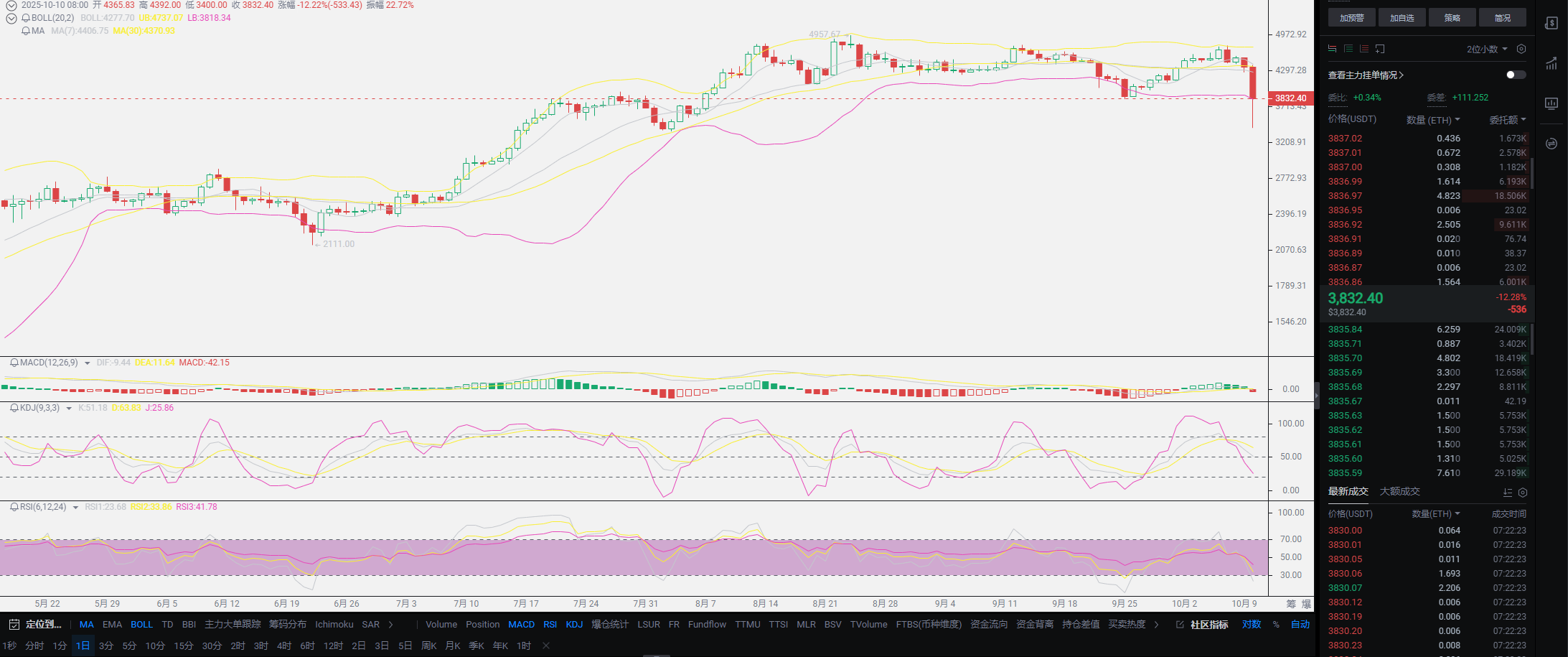

During the holiday, I won't digress too much; this wave of decline also belongs to the cryptocurrency market taking advantage of the situation, directly liquidating all long positions. Let's think from the perspective of a market maker; from this wave onwards, it is highly likely that the upward trend will dominate. However, the downward trend before interest rate cuts cannot be changed, and the core issue is clear to everyone: this is not a disaster belonging to the cryptocurrency market, but to the entire financial sector. Everyone should also be concerned about the opening of Old A. I won't talk nonsense; it is definitely impossible to create new lows, but it is possible to solidify the bottom. Once tariffs are indeed as Trump mentioned, and rare earths are unrestricted, the market will definitely continue to crash. As long as the tariff issue does not expand its impact, signs of recovery will appear. Let me summarize the recent factors that can affect the cryptocurrency market: 1. Trump, 2. Tariffs, 3. Interest rate cuts, 4. The listing of small coins. If these four negative factors are eliminated, a new round of increase will be achieved, and the tariff issue can play a decisive role.

As long as there are no countermeasures, assets related to the U.S. will appreciate; it is not that simply increasing tariffs will lead to a decline. The key still lies in our response measures; if corresponding sanctions occur, everyone should quickly liquidate their positions. As long as no countermeasures appear, the growth pattern in the cryptocurrency market may become even more terrifying, and assets linked to the dollar will appreciate. The turning point is to bet on whether he can retract his statements in the near future; after all, this is not the first time he has done this. Secondly, it is to bet on countermeasures; if he remains silent, one can confidently go long. In the short term, everyone should try to avoid contracts and focus on spot trading; I also cannot gauge Trump's pulse, so I won't say much. I am still on vacation, wishing everyone well, waiting for my return! If you have questions, feel free to message me directly; if I don't reply in time, you can find your own way!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。