Original | Odaily Planet Daily (@OdailyChina)

At 5 AM, the market collapsed.

Last night, Trump announced a 100% tariff increase, which is on top of the existing tariffs, and this news acted like a lit fuse, igniting the market and causing the fear index to soar.

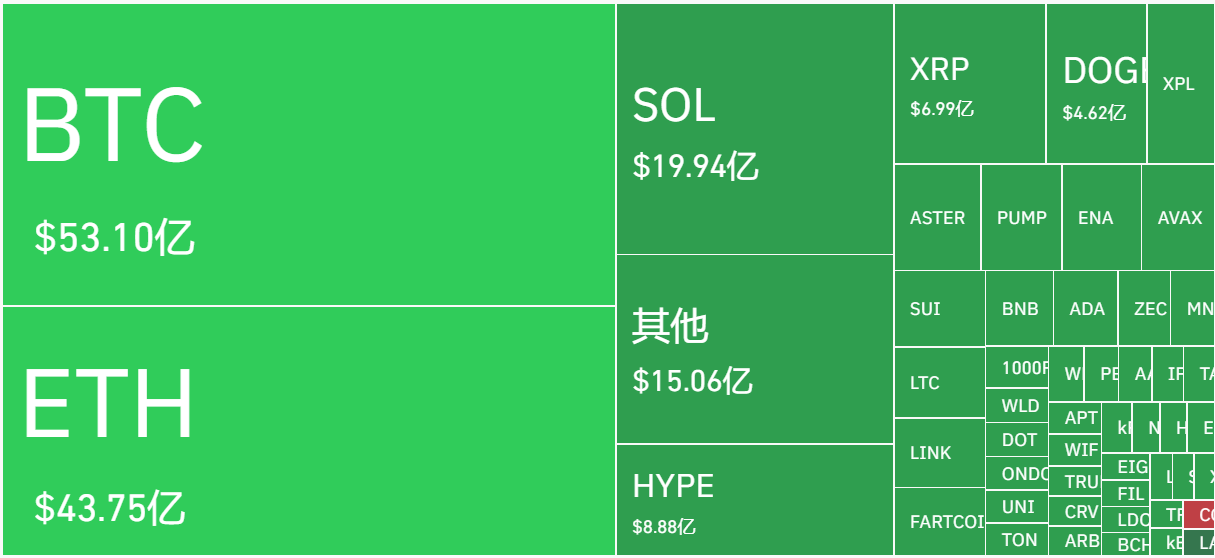

BTC briefly fell below $102,000, hitting a low of $101,516, with a 24-hour drop of 16%; ETH reached a low of $3,400, with a 24-hour drop of 22%; SOL fell below $150, hitting a low of $141.3, with a 24-hour drop of 31.83%.

Mainstream coins were not spared, and altcoins fared even worse. Among them, IP dropped from $7.8 to around $1 within an hour, a decline of 87%, currently rebounding to $4.8; PUMP fell from $0.00488 to a low of $0.000411, now recovering to $0.00385.

The staking financial products WBETH and BNSOL launched by Binance also fell victim. WBETH dropped to a low of $430.65, a decline of over 800%, while BNSOL fell from $213 to a low of $34.9, also a drop of over 500%. Even stablecoins were not spared. USDE briefly touched $0.65, a de-pegging of 54%, currently rebounding to around $0.96.

The derivatives market was the most direct amplifier of this collapse. Coinglass data shows that in the past 24 hours, 1.6 million people globally were liquidated, with a total liquidation amount reaching $19.13 billion, the highest single-day liquidation amount in history. Among them, long positions accounted for $16.679 billion, and short positions for $2.454 billion, with the largest single liquidation occurring on Hyperliquid - ETH-USDT, valued at approximately $203 million.

This time, it was a comprehensive and indiscriminate attack on the entire crypto market.

Initially, everyone thought it was just a normal small correction. After all, just a week ago, BTC had just broken through $126,000 to set a new historical high. Standard Chartered Bank raised its forecast to $135,000, while JPMorgan was even more optimistic, targeting $165,000.

No one expected that such a high point would become the starting point of an abyss.

Divine Operation - Clear Exit

Even in such a market, there were still remarkable operations.

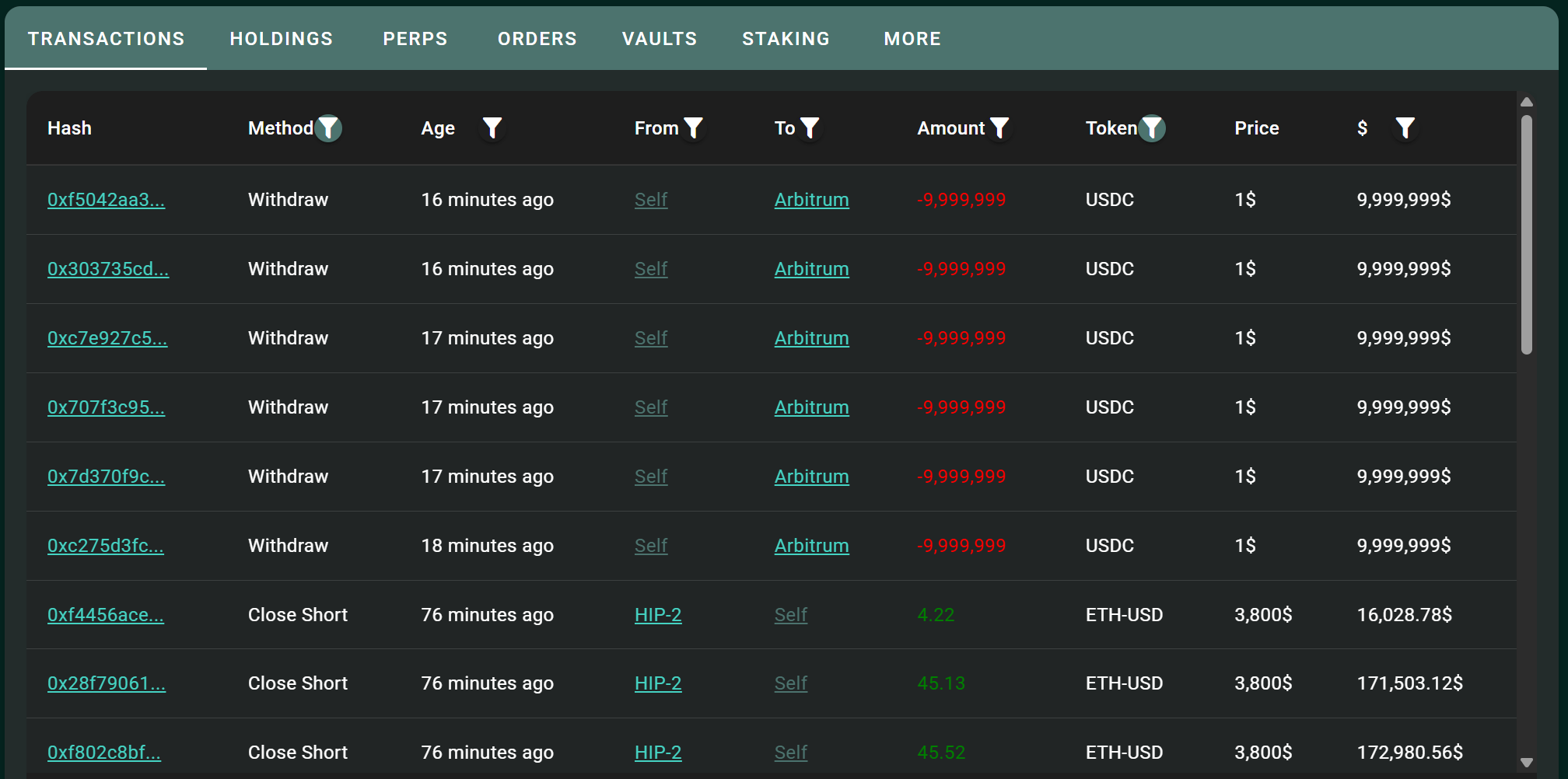

Yesterday, a Bitcoin whale increased its short positions on BTC and ETH, with a total position exceeding $1.1 billion. Currently, on-chain data shows that its position has been completely cleared, withdrawing $60 million from the Hyperliquid platform. According to on-chain analyst Lookonchain, this OG may be associated with Trend Research under Yi Lihua.

In fact, Yi Lihua has indeed expressed a "bearish" stance multiple times on social media in recent days.

According to on-chain analyst Lookonchain's monitoring, since October 3, Trend Research has gradually deposited 145,000 ETH into exchanges, valued at approximately $654 million at the time. As of October 5, only 7,163 ETH remained on-chain. It is roughly estimated that this institution should have made a profit of up to $303 million on ETH in this round.

Conclusion

Just 2 hours were enough to rewrite the fate of many market participants.

Some became a speck of dust in the $13.4 billion liquidation wave, while others steadily seized the $60 million opportunity from the crumbling tower.

Most assets are recovering from the lows of 2 hours ago, while some coins are "taking the opportunity" to lie flat. Odaily will continue to follow up in real-time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。