We analyze today's global capital market turmoil: it all stems from a statement by U.S. President Trump—announcing a comprehensive 100% tariff on Chinese goods and implementing key software export controls, triggering shocks across financial markets, commodity markets, and the digital currency market. Below are the core information of the event and a panoramic analysis of market reactions:

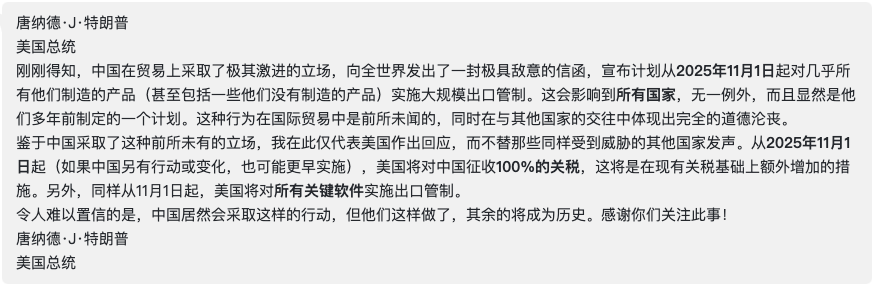

(Image: Trump's social media statement)

(Image: Translation)

1. Event Background

According to sources, Trump clearly stated in his announcement that a series of policies, including tariff upgrades and export controls, will be implemented to accelerate the containment of China's development in international trade and technology exports. This statement marks a shift in U.S.-China relations from "competition" to a stage of full confrontation. Previously, the main impacts of the U.S.-China trade war were concentrated in certain commodity sectors, but this new round of tariff increases and technology export bans has a wide-ranging impact, directly affecting global capital markets.

2. Market Reactions

Different asset classes and sectors reacted differently to this policy, with some phenomena particularly noteworthy:

1) U.S. Stock Market Plummets

After Trump's statement, the U.S. stock market reacted violently, especially companies in the technology sector were severely hit. On that day, the technology stock index fell sharply by 3.5%, and widespread selling sentiment emerged in the international market. Additionally, oil prices plummeted by 4% in a short time, and copper prices have recently declined, indicating that market concerns about the impact on the real economy have intensified.

(Source: AiCoin PC Client Index - Nasdaq Composite Index)

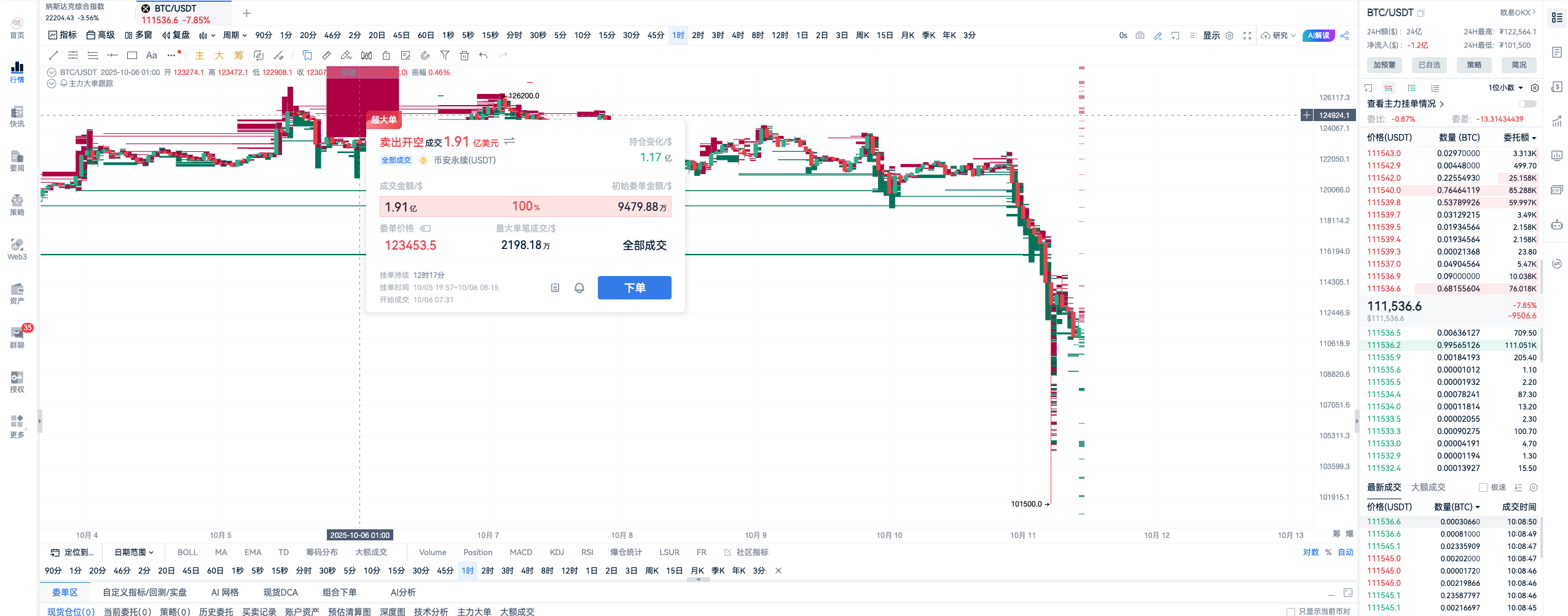

2) Cryptocurrency Market Crashes: Bulls Completely Defeated, Bears Profiting Significantly

The cryptocurrency market initially showed a slow response, but as market sentiment intensified, BTC sharply dropped over 4%, with multiple mainstream coins experiencing significant declines, and some smaller coins even seeing single-day drops of over 30%. Statistics show that the overall liquidation scale set a record, with approximately $10 billion in forced liquidations in the cryptocurrency market within just 24 hours.

Price Tracking: BTC directly plunged to 101,500 USDT

(Source: AiCoin PC Client OKX-BTCUSDT Spot)

Main Order Tracking: The main player closed a $190 million short position opened on October 6 for profit during this drop

(Image 1: Opening position at 123,453.5 USDT with a $190 million short position)

(Image 2: Closing position at 114,200 USDT with $101 million buying to close the short position)

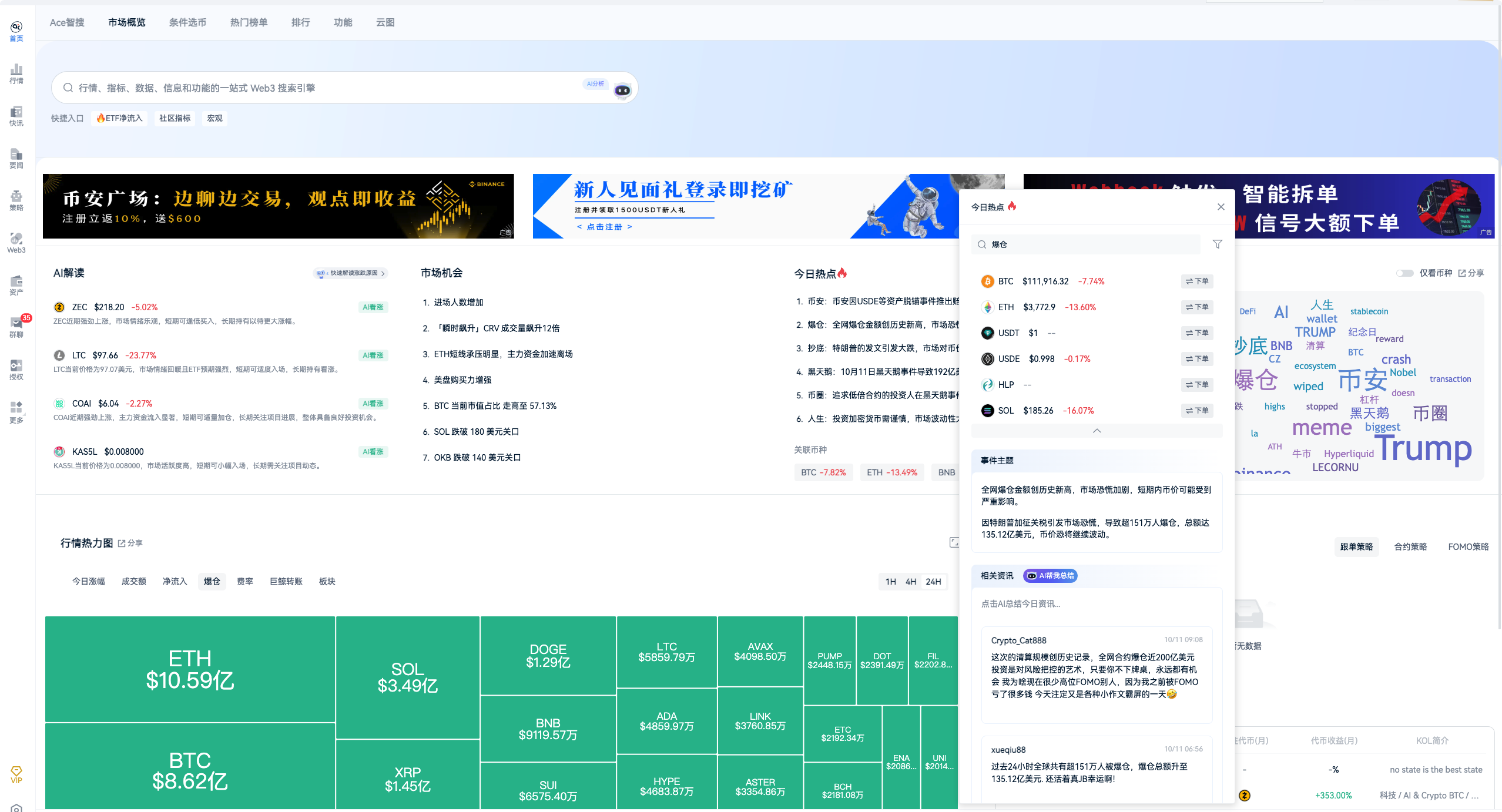

Liquidation: Total liquidation amount exceeds $13 billion, with over 1.5 million people liquidated

(Source: AiCoin PC Client Homepage - Market Overview)

3) The "Windfall" of Arbitrage Funds

In this extreme market situation, we have seen the efficiency of large players who master technology and strategies in "hunting." In contrast to the many small players in the market who suffered liquidations, those who understand how to use quantitative tools have become the biggest winners in this storm.

For many players with large funds, it may be more prudent to consider building quantitative arbitrage tools rather than relying solely on active trading. In a market like today, the significant fluctuations in funding rates can allow for risk-free arbitrage, potentially yielding annualized profits of 100% in just two to three days!

In fact, in the cryptocurrency space, such high-quality arbitrage opportunities do arise during extreme market conditions. In comparison, achieving an annualized return of 20%-30% with large funds in traditional investments is already considered excellent, let alone such "windfall" scenarios.

(Source: AiCoin PC Client Strategy - Intelligent Arbitrage)

4) Gold Data: Strong Rebound After Decline, Performance Remains Steady

Overall, recent performance of gold has once again confirmed the importance of safe-haven assets. Whether to avoid extreme risks or to serve as a stabilizer in asset portfolios, gold remains a "safe harbor" in market cycles. The current bullish trend remains relatively solid, and the gold market deserves more attention and cautious positioning from investors.

(Source: AiCoin PC Client Index - London Gold)

3. Future Situation and Key Observations

Trump's statement not only subjected global capital markets to a round of pressure and screening but also provided investors with some profound insights:

1) Short-term risk aversion sentiment will continue to dominate the market

Traditional safe-haven assets like gold and the U.S. dollar may continue to be sought after in the near term, while the market liquidity of stablecoins (such as USDC) is also expected to further increase.

2) In the cryptocurrency field: Risks and opportunities coexist

For cryptocurrency investors, the liquidation risks brought about by the market crash need to be closely monitored, while the emerging arbitrage and innovation opportunities should not be overlooked. It is recommended to closely observe the performance improvements of DEX platforms and the price performance of related tokens; arbitrage logic may become a short-term investment hotspot.

3) U.S.-China trade conflict will become the main line of long-term competition

As policies gradually tighten, structural changes in global capital markets may accelerate. In the future, investors need to pay more attention to the far-reaching impacts of trade conflicts on supply chains, especially the shocks to technology and resource-based companies, to seek structural opportunities.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Permanent 20% Rebate:

https://jump.do/zh-Hans/xlink?checkProxy=true&proxyId=2

OKX Benefits Group:

https://aicoin.com/link/chat?cid=l61eM4owQ

Binance 10% Rebate + $600:

https://jump.do/zh-Hans/xlink?checkProxy=true&proxyId=3

Binance Benefits Group:

https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。