Introduction

Since China first ventured into the cryptocurrency space over a decade ago, the landscape of cryptocurrency in China has undergone significant changes. From the early dominance of Bitcoin mining to the severe crackdown by regulators in 2021, which ultimately led to a near-total ban on cryptocurrency trading and mining, the stance of mainland China on cryptocurrency has spanned the entire spectrum: from embracing the industry to a complete purge.

In 2021, the People's Republic of China (PRC) banned cryptocurrency trading and mining on the mainland. Meanwhile, as a special administrative region with an independent legal system, Hong Kong established a regulated framework for digital assets through the Hong Kong Monetary Authority (HKMA) and the Securities and Futures Commission (SFC). Some analysts believe that Hong Kong's development may provide a reference for future policies in mainland China.

As of 2025, under mainland Chinese law, the government continues to prohibit cryptocurrency trading and mining. However, subtle shifts in regulatory posture and developments in Hong Kong indicate that the central government's stance may have softened.

Summary

- China once dominated global Bitcoin mining and centralized exchanges, but regulatory bans quickly undermined its leading position in the industry.

- Most of China's mining operations and centralized exchanges have moved overseas, with many still holding dominant positions globally.

- Following the passage of the GENIUS Act in the U.S., which strengthens the dollar-backed stablecoin, China emphasizes the development of the digital yuan to reduce reliance on the dollar.

- Analysts describe Hong Kong as a regulatory sandbox within China's "one country, two systems" framework, with Hong Kong's 2025 stablecoin regulations serving as a bridge between mainland China's strict controls and global cryptocurrency innovation.

Background of Cryptocurrency in China

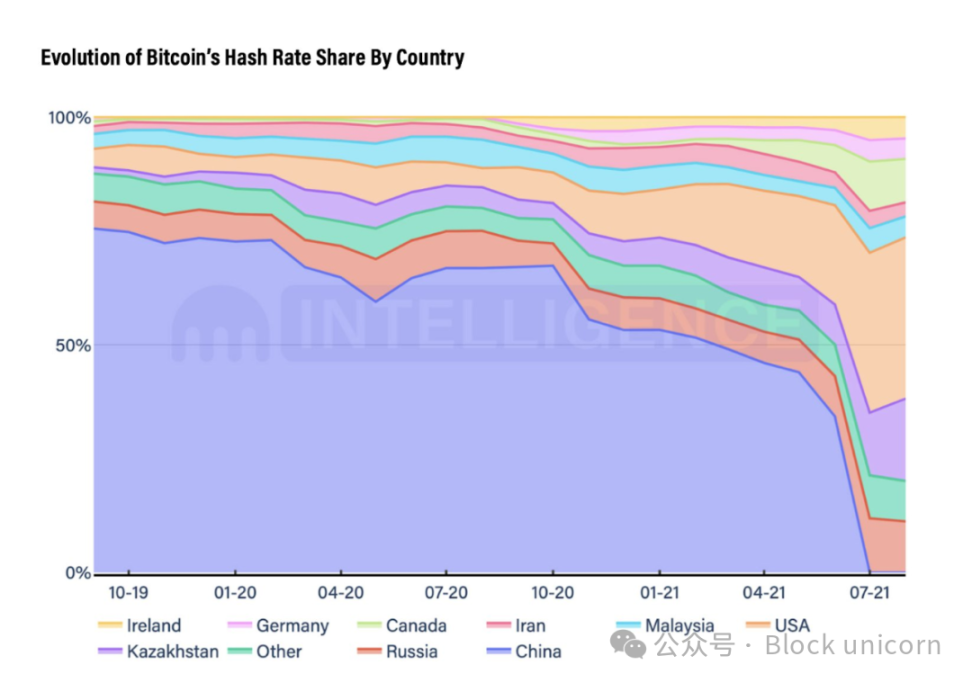

China was an early adopter of cryptocurrency, particularly in the field of Bitcoin mining. The year 2013 marked a turning point for mining in China as Bitcoin began to attract national media attention. This led to the establishment of several companies in the field, including miners themselves and ASIC mining hardware manufacturers. Notably, Bitmain, the largest ASIC mining hardware manufacturer today, was founded during this period. Many mining operators in the country also relocated to areas with cheaper electricity to further optimize operations. The rapid proliferation of Bitcoin mining in early China led to the country dominating the share of Bitcoin's hash rate, peaking at 60-75% during the period from 2017 to 2020.

China's dominance in Bitcoin mining gradually declined from 2019 to 2021 - Kraken

During these six to seven years, China's cryptocurrency boom also gave rise to several exchanges, including Huobi, OKX (formerly OKCoin), and Binance, which eventually developed into industry giants. In fact, Binance still maintains its leading position among centralized exchanges, accounting for about 35% of spot trading volume and 50% of derivatives trading volume.

Huobi, OKX, and Binance were all established in mainland China between 2013 and 2017 but relocated overseas after the regulatory crackdown in 2017, continuing to operate as global exchanges. With the arrival of 2021, the regulatory environment gradually tightened, initially targeting Bitcoin mining operations and later expanding to buying, selling, services, and trading. Despite the strict bans, China's global influence remains, as miners and exchanges have shifted their operations to neighboring Kazakhstan and Russia.

Cryptocurrency Held by the Chinese Government

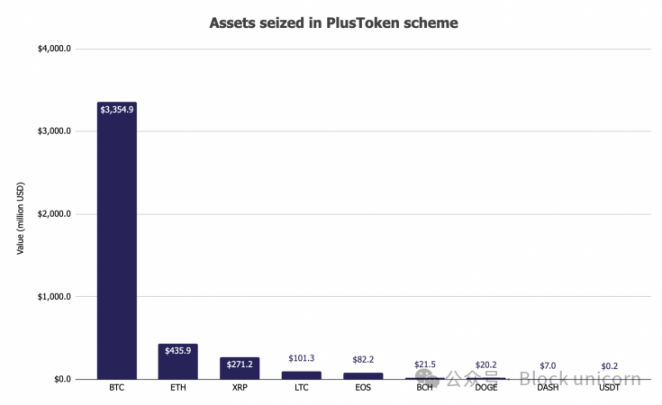

Despite the ban imposed by the Chinese government, it may still hold cryptocurrency. Like many other governments, these assets are largely believed to have originated from criminal confiscations related to cryptocurrency, particularly the PlusToken Ponzi scheme.

PlusToken was a Ponzi scheme that exploited a non-existent arbitrage trading platform, enticing users with attractive daily returns. The scheme surfaced in April 2018 and lured over 2.6 million users within a year, primarily from China and South Korea. As of now, the PlusToken team is estimated to hold $2.2 billion in assets, predominantly in Bitcoin. Other tokens held by PlusToken include ETH, XRP, LTC, and EOS.

Assets confiscated in the PlusToken scheme - The Block

After the scheme collapsed and its manipulators were arrested, Chinese authorities confiscated these assets. According to court rulings, these assets will be "handled according to the law, and the proceeds will be turned over to the national treasury." However, there has been no clear confirmation from officials regarding whether the Chinese government still holds these assets or if they have been sold.

On-chain analysts, such as Ki Young Ju, CEO of CryptoQuant, believe that Bitcoin may have been sold, transferred through mixers, and sent to several exchanges, including Huobi, for liquidation. Additionally, the movement of over $445 million in ETH from PlusToken-associated addresses in 2024 also indicates some form of redistribution or liquidation is underway.

ETH transfers from PlusToken-associated addresses in 2024 - Arkham

China's Cryptocurrency Ban

The first blow to China's cryptocurrency industry occurred in December 2013 when the People's Bank of China issued a notice prohibiting financial institutions from handling Bitcoin, classifying it as a commodity rather than currency.

During the initial coin offering (ICO) boom in 2017, the People's Bank of China and six other government departments issued a ban on ICOs and token financing activities, requiring all domestic centralized exchanges to cease operations.

In 2021, regulatory efforts intensified further. In May 2021, financial institutions and payment companies were prohibited from providing services related to cryptocurrency. In June 2021, major mining centers such as Inner Mongolia, Xinjiang, and Sichuan implemented measures to crack down on Bitcoin mining activities, citing the environmental impact of electricity consumption. This crackdown led to a mass migration of large Bitcoin mining companies from China to neighboring countries like Kazakhstan and Russia, which now account for a significant share of global hash rate.

Mainland China bans cryptocurrency trading and mining - Reuters

The most severe blow came in September 2021 when China's most authoritative regulatory bodies, including the People's Bank of China, issued a joint statement formally banning all cryptocurrency trading, including trading between cryptocurrencies and fiat currencies, regardless of the platform used. This ban effectively declared all cryptocurrency trading illegal, marking the strictest prohibition to date.

Despite restrictions on transactions and services involving cryptocurrency, personal ownership of cryptocurrency is not explicitly illegal.

Stablecoins

In 2025, the U.S. established a comprehensive regulatory framework for stablecoins through the Stablecoin Act (GENIUS Act), which was signed into law by President Trump in July. This legislation marks a historic step toward clarity and oversight in the regulation of stablecoin issuance and use, particularly regarding its issuance and collateral requirements. The Stablecoin Act restricts the issuance of stablecoins to insured deposit institutions and approved financial institutions, ensuring that all issued stablecoins are backed by high-quality liquid assets (such as cash, U.S. Treasury securities, and other low-risk securities) on a 1:1 basis. The act also imposes strict transparency, anti-money laundering (AML), and consumer protection requirements. By establishing predictable standards and enhancing trust, this legislation promotes broader adoption of stablecoins, further solidifying the dollar's dominant position in global digital payments and settlements, and strengthening the dollar's status as the preferred global reserve currency.

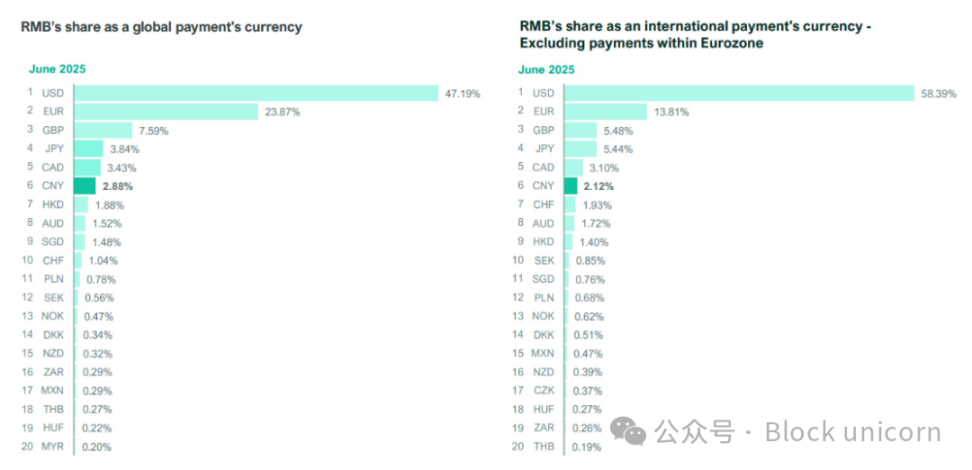

The yuan accounts for 2.88% of global payment share - Trade Treasury Payments

In response to the enhanced dominance of the dollar, China has increased its investment in the stablecoin sector to promote the internationalization of the yuan. The yuan currently accounts for only about 2.9% of total global payments. China's primary focus remains on promoting its central bank digital currency (CBDC) — the digital yuan (e-CNY), aimed at enhancing monetary sovereignty and reducing reliance on the dollar-based international financial system.

This move contrasts with its stringent stance on cryptocurrency since 2021 and may signal a softening of China's hardline anti-cryptocurrency position. Although mainland China maintains a broad ban on cryptocurrency-related activities, Hong Kong has been conducting controlled innovations under its own regulatory bodies (the HKMA and the SFC). Some commentators believe that Hong Kong's evolving regulatory framework can serve as a testing ground for central government policymakers. In August 2025, the HKMA implemented the Stablecoin Regulations in Hong Kong, establishing a licensing system for stablecoin issuers.

Hong Kong

With the latest developments in the stablecoin sector, Hong Kong has emerged as a leading center for cryptocurrency innovation in Greater China, based on a comprehensive regulatory framework for stablecoins and growing institutional interest.

In August 2025, the HKMA launched a licensing system for stablecoin issuers under the Stablecoin Regulations, setting strict requirements for capital adequacy, reserve asset segregation, and anti-money laundering controls, while allowing licensed banks and fintech companies to issue dollar and asset-backed tokens for retail and wholesale use. This regulatory clarity has attracted prominent advocates, including Eric Trump, who has interacted with Hong Kong legislators and industry forums to support cryptocurrency startups, indicating confidence in Hong Kong's legal certainty and its role as a bridge between East and West.

Observers believe that the central government's attitude towards Hong Kong's thriving crypto ecosystem is strategic rather than lenient, effectively positioning the special administrative region (SAR) as a controlled testing ground for digital asset integration. By allowing Hong Kong to be the first to launch a stablecoin framework and pilot cross-border settlement projects, the central government can monitor risks and benefits before considering broader adoption in the mainland. Some analysts refer to this as a "sandbox model," enabling Chinese authorities to observe operational resilience, compliance challenges, and market dynamics, potentially providing references for future policies regarding the interoperability of decentralized cryptocurrencies and the digital yuan, while maintaining strict cryptocurrency bans in the mainland.

Conclusion

At first glance, China's relationship with cryptocurrency in 202 is somewhat contradictory: firmly banning the use of decentralized cryptocurrencies domestically while cautiously observing and learning from the controlled digital asset experiments underway in Hong Kong.

While the central government remains committed to positioning the digital yuan as the primary vehicle for its financial innovation and monetary influence, the establishment of a regulated stablecoin ecosystem in Hong Kong indicates an acknowledgment of the growing role of cryptocurrency in global finance. This dual-track model allows mainland China to maintain strict domestic regulation while still monitoring (and in some aspects benefiting from) international developments, especially as the U.S. consolidates its dominance through comprehensive stablecoin regulation.

For investors, entrepreneurs, and policymakers, the message is clear: while mainland China remains closed to an open cryptocurrency market, Hong Kong is rising as a strategically significant hub that could shape the future of digital assets in the region. Whether this will ultimately lead to a further softening of the central government's stance will depend on the balance it strikes between national control, economic opportunities, and global competition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。