Binance Futures Deploys $188M as Crypto Market Face Extreme Volatility

The cryptocurrency market faced one of its most volatile periods in 2025, with massive liquidations and sharp price declines shaking traders worldwide. Bitcoin (BTC) and Ethereum (ETH) led the sell-off, while Binance Futures deployed significant insurance funds to stabilize the market. Here’s a detailed look at the crash and its implications.

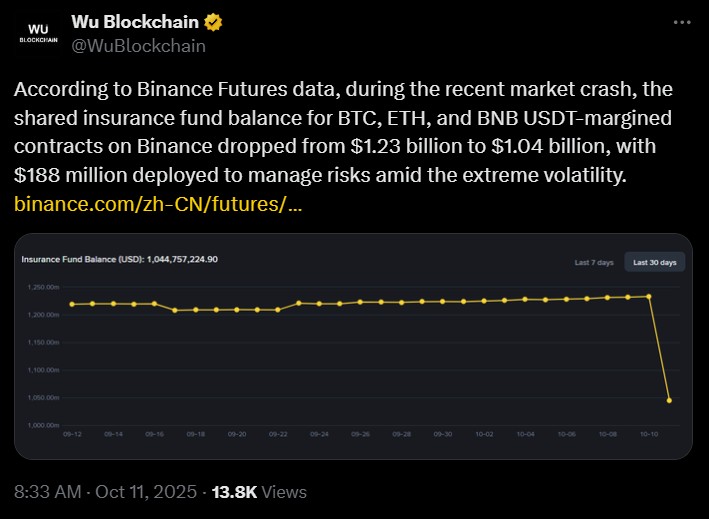

Binance Futures Insurance Fund Deployed Amid Market Crash

According to Binance Futures, the shared insurance fund for BTC, ETH, and BNB USDT-margined contracts dropped from $1.23 billion to $1.04 billion, with $188 million deployed to cover risks.

The insurance fund safeguards traders and the platform by covering losses that exceed margin balances. Its significant usage highlights the extreme volatility faced over the past 24 hours.

"Binance’s insurance fund ensures that traders never owe more than their collateral, even during sharp price swings," said a Binance analyst.

Source: Wu Blockchain X

Bitcoin and Ethereum Prices Take a Hit

Amid the crypto market crash today , Bitcoin (BTC) fell to a 24-hour low of $101,516.5 before recovering to $112158.5, marking a 7.64% drop.

Meanwhile, Ethereum (ETH) touched $3,400 and rebounded to $3,781.60, representing a 13.23% decline.

These movements triggered panic among leveraged traders, resulting in one of the largest single-day liquidations of the year.

Source: CMC

Record Liquidations Across the Market

Data from Coinglass shows that total liquidations reached approximately $19.134 billion in the last 24 hours, with $16.679 billion coming from long positions. On BNB Futures alone, $706.2 million was liquidated, with $648.5 million in long positions — the largest single-day long liquidation so far in 2025.

Key liquidation stats:

Total Crypto liquidations : $19.134 billion

Long positions wiped out: $16.679 billion

Binance Futures liquidation: $706.2M

Long position on BNB: $648.5M

These figures underscore the risks of leveraged trading in highly volatile markets.

Hyperliquid and HLP Vault Performance

Hyperliquid recorded the largest share of liquidation, totaling $10.28B, including $9.3 billion from long positions. The massive sell-off shows how centralized and decentralized platforms are affected during extreme volatility.

Meanwhile, the HLP Vault saw profits surge from $80M to $120M, an increase of $40 million in just 24 hours. This demonstrates how some market participants benefit from volatile conditions while others face severe losses.

Conclusion

The recent crash highlights the inherent risks of crypto trading, especially for leveraged positions. With billions wiped out, funds heavily deployed, traders must exercise caution, manage risk, and stay informed. This event serves as a stark reminder of the volatility that can shake even major cryptocurrencies like BTC and ETH.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。