In the face of the cryptocurrency market's extreme volatility, how can one achieve steady profits using scientific investment strategies? The Dollar-Cost Averaging (DCA) method, a widely popular and easy-to-operate strategy, offers a solution.

This article will delve into three aspects: why choose DCA, how to use DCA, and how to select targets, with an in-depth analysis of mainstream altcoins such as XRP, DOT, AVAX, LINK, SHIB, LTC, BCH, HBAR, and XLM.

1. Why Use DCA: Smoothing Risks, More Suitable for High-Volatility Markets

● Dealing with High Volatility

Cryptocurrencies are characterized by significant volatility. For instance, the mainstream altcoin XRP once plummeted over 30% within 24 hours, while HBAR experienced a rapid surge of nearly 20%. In such a market environment, the DCA strategy can effectively reduce the risk of losses from a single trade. By regularly buying in batches, even if prices drop sharply in a short time, one can achieve a lower average purchase price through cost averaging.

● Overcoming Emotion-Driven Investment Mistakes

Market emotionality is a major pitfall in investing—namely panic selling and fear of missing out (FOMO). For example, when some investors see SHIB or AVAX rapidly rising, they may impulsively buy at a high point, often leading to losses. DCA establishes a disciplined investment plan, investing a fixed amount at regular intervals regardless of market fluctuations, helping investors avoid the traps of emotional trading.

● Increasing Long-Term Return Stability

According to historical backtesting, initiating long-term DCA at the bottom of bear markets for Bitcoin and its major competitors like DOT and LINK can yield significant returns. Especially when assets have clear growth potential, DCA helps investors gradually accumulate exposure, reaping substantial profits when the market recovers. For instance, at the beginning of 2024, LTC's price rebounded over 280% from its low, but capturing this window with a one-time bottom-fishing strategy is challenging. The DCA strategy can continuously seize such upward opportunities.

2. How to Use DCA: Simplifying Processes, Automating Execution

Key Steps to Set Up a DCA Strategy:

Here are the detailed steps for implementing a DCA investment strategy, suitable for both novice and experienced investors:

Step

Description

Determine Investment Targets

Choose altcoins with long-term growth potential, such as XRP, DOT, and LINK, supported by strong fundamentals.

Set Period and Amount

The most common periods are weekly or monthly; it is recommended to allocate a fixed amount, such as setting 100 USDT for weekly investment in any coin, to create a regular investment action.

Specify Trigger Conditions

Combine technical indicators, such as RSI or MACD, to trigger buy points, avoiding large purchases at high points and enhancing strategy precision.

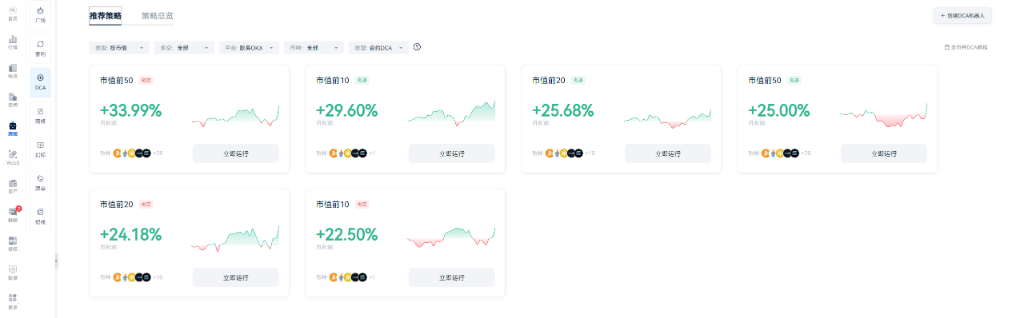

Use Automation Tools

Utilize AiCoin's all-coin DCA tool, which supports fully automated operation without the need to monitor the market, allowing flexible parameter adjustments, including "stop-loss" and "profit reinvestment" features to optimize profit outcomes.

Monitor and Rebalance

Regularly check the performance of holdings. If a project shows sustained weakness (e.g., XLM's recent lack of rebound), consider adjusting the strategy to ensure overall risk management of allocated funds.

Specific Operational Steps:

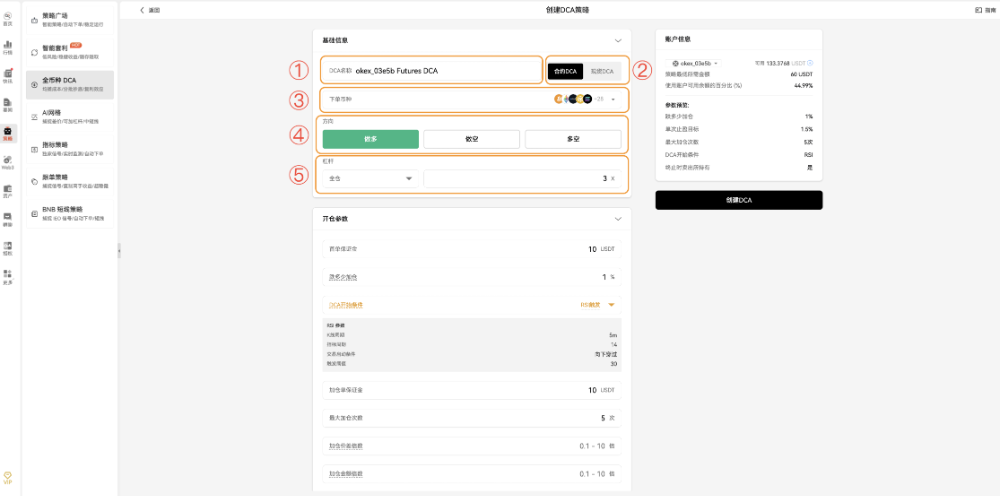

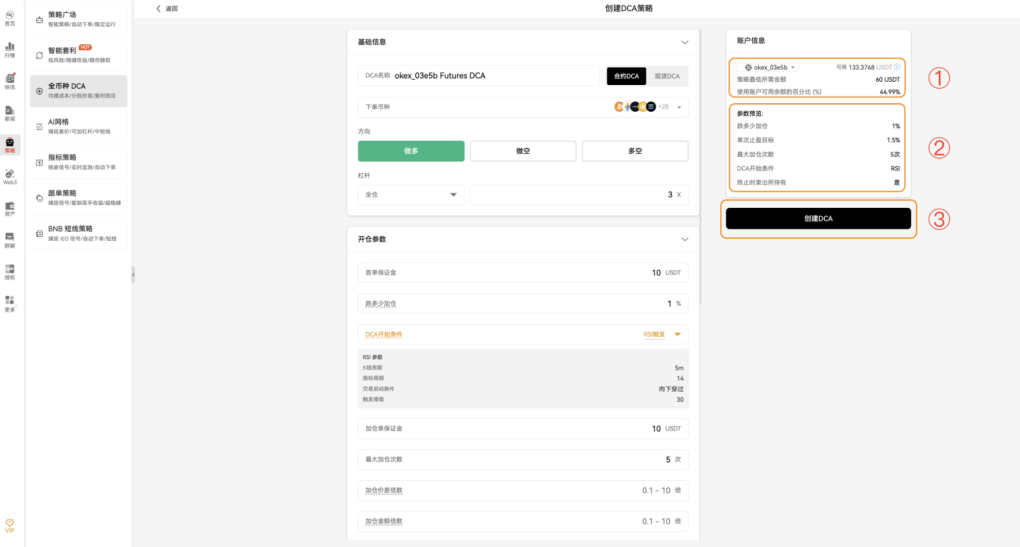

1. Enter the Manual Creation Page for All-Coin DCA Strategy

2. Set Basic Information

a. Strategy Name: Enter the strategy name

b. Type: Choose "Contract DCA" or "Spot DCA" based on trading preferences

c. Order Coin Type: Market cap combination, sector combination, custom combination

d. (Contract) Direction: Choose "Long," "Short," or "Both"

e. (Contract) Leverage: Select leverage multiple and account mode

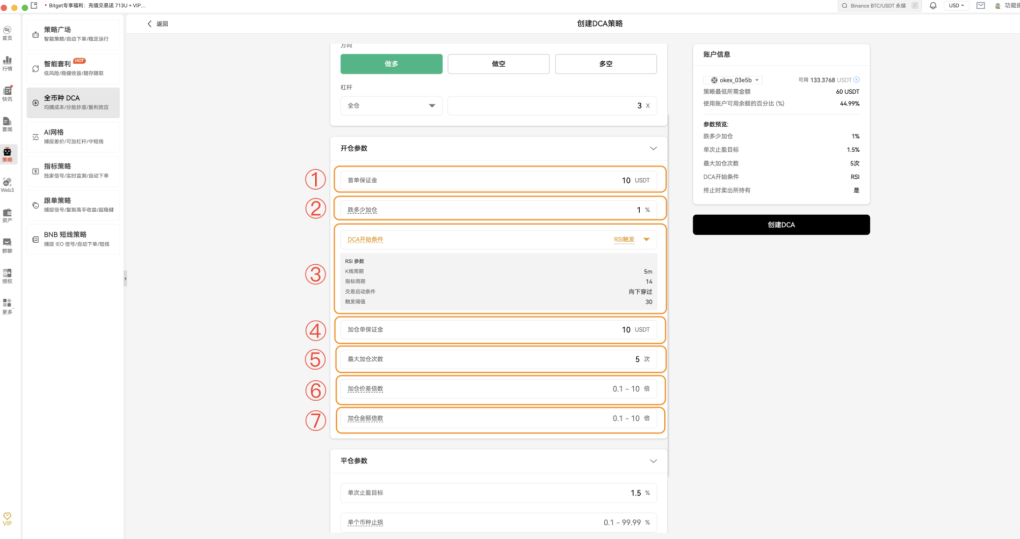

3. Set Opening Parameters

a. Initial Margin: Set the amount for the first position

b. Price Difference for Adding Positions: Set the percentage change in price that triggers additional purchases

c. DCA Activation Conditions: Choose one of the following four trigger conditions: RSI trigger, TD trigger, TD13 trigger, MACD trigger

d. Margin for Additional Positions: Set the amount for each additional purchase

e. Maximum Number of Additional Positions: Set the maximum number of additional purchases

f. Price Adjustment Multiple for Additional Positions: Set the adjustment multiple for additional position prices

g. Amount Adjustment Multiple for Additional Positions: Set the adjustment multiple for additional position amounts

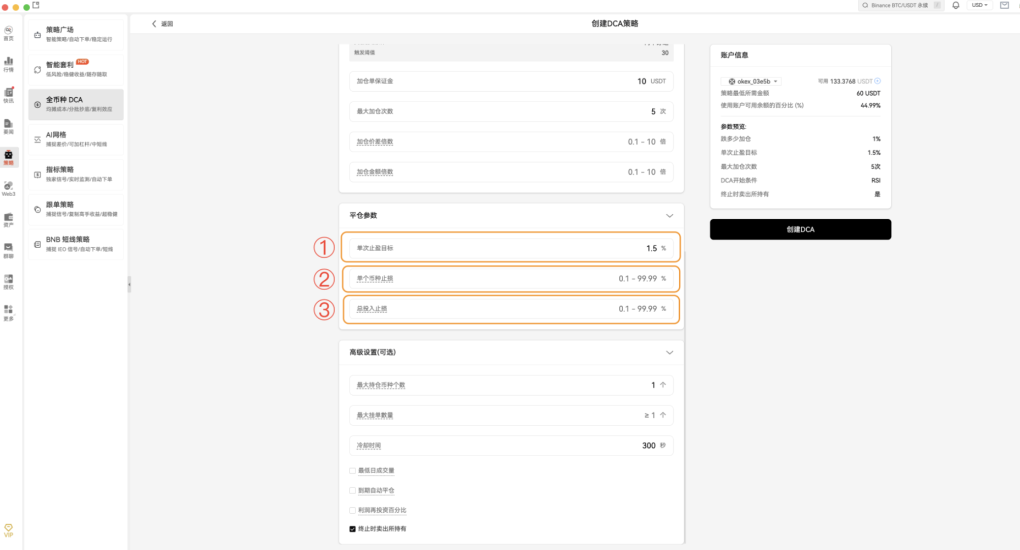

4. Set Closing Parameters

a. Single Profit Target: Set the profit target for each trade

b. Individual Coin Stop-Loss: Set the stop-loss percentage for individual coins; once reached, the coin will be liquidated

c. Total Investment Stop-Loss: Set the stop-loss percentage for total investment; once reached, the DCA strategy will terminate

5. Confirm and Create

a. Check the "Account Information" section to ensure sufficient account funds

b. Check the "Parameter Preview" section to confirm parameter settings

c. Click "Create DCA" to create and run the strategy

Specific Operational Case Analysis:

Assuming an investor wishes to use the DCA strategy to invest in DOT:

● Total Investment Budget: 1200 USDT.

● Period Setting: Invest 100 USDT weekly.

● Buying Condition: Automatically trigger purchases when DOT's current price is below the average price of the previous week by 5%.

Simulated Operation Results:

Date

DOT Price (USDT)

Investment Amount (USDT)

Cumulative Holdings (DOT)

Average Purchase Cost (USDT)

Week 1

4.50

100

22.22

4.50

Week 2

4.40

100

45.45

4.45

Week 3

4.49

100

66.72

4.46

Week 4

4.37

100

89.56

4.44

In a bear market or volatile market, controlling costs through batch buying achieves stable asset accumulation.

3. How to Select Targets: Locking in Blue-Chip Altcoins

Selection Criteria:

● Reliable Fundamentals

○ Targets need to have clear application scenarios and long-term development potential, such as DOT's cross-chain ecological advantages and AVAX's high-performance smart contract capabilities.

○ Extremely risky meme coins (e.g., SHIB imitators lacking team support) should be excluded.

● High Liquidity

○ Altcoins should have high liquidity, allowing easy buying and selling on major trading platforms, such as XRP and LINK, which have sufficient depth on multiple mainstream exchanges, reducing the risk of going to zero.

● Fund Support and Community Recognition

○ Pay attention to whether they have institutional support or strong community recognition. For example, the builder fund for BNB Chain in 2025 and the influx of funds in the NFT sector have enhanced the stability of LINK and XLM.

Target Coin Classification and Analysis:

Coin

Core Advantages

Potential Risks

XRP

Extensive global payment network ecosystem, close collaboration with banks

Facing regulatory compliance pressure, high volatility risk

DOT

Mature cross-chain architecture, continuously growing developer ecosystem

High proportion of edge applications requires caution against project exits

AVAX

High throughput smart contracts, strong appeal in DeFi

Intense competition in Layer 2, slowing user growth rate

LINK

Leading independent position of decentralized oracle products

Weak on-chain activity may affect market enthusiasm

SHIB

Strong community-driven momentum, meme-based marketing empowerment

Weak fundamentals, adverse public opinion may directly drag down coin price

LTC

Technologically synchronized upgrades with Bitcoin, high payment efficiency

Market preference shifting to other alternatives (e.g., SOL), reducing retail participation

BCH

Highly scalable design, with practical application cases in payment scenarios

Limited competitiveness compared to mainstream coins, weak long-term performance

HBAR

Deeply innovative data governance model, strong enterprise support

Market perception bias, may be overlooked by investors

XLM

Outstanding performance as a fast payment tool, stable collaboration with NGOs

Slow growth in daily active users may limit practical development

4. Risk Management and Control Techniques

Although the DCA strategy has the advantage of smoothing risks, it is still necessary to avoid the following common pitfalls and improve risk control measures:

Risk Warnings:

● Unreasonable Indicator Design

○ Not using technical indicators to filter buy points may lead to excessive investment at short-term price peaks.

○ It is recommended to at least combine RSI or TD trigger conditions to avoid blind buying.

● Over-Diversification

○ Investing in too many coins can complicate fund management; it is advisable to select 5-8 related targets as a core investment pool, such as focusing investments on XRP, DOT, LINK, and LTC.

● Insufficient Funds

○ In the event of consecutive market declines, not retaining reserve funds for additional purchases may result in missing numerous low-price buying opportunities.

Specific Risk Control Measures:

Risk Control Plan

Specific Actions

Dynamic Fund Check

Monthly review of remaining funds, adjusting investment ratios based on market trends, ensuring that the position of any single coin does not exceed 20% of total funds in the long term.

Set Stop-Loss Levels

Set stop-loss lines based on the historical volatility of coins; for example, LINK's significant support level can be set around 6 USDT.

Initiate Simulated Backtesting

Run small test accounts for different coins first to verify whether the DCA strategy can generate positive cash flow.

Conclusion: DCA Strategy Makes Altcoin Investment Simpler

● In investing in mainstream altcoins (XRP, DOT, AVAX, LINK, SHIB, etc.), the DCA strategy not only reduces the risk of emotional decision-making in high-volatility markets but also provides a low-threshold way for medium to long-term investors to enter the cryptocurrency market. Additionally, through the meticulous planning of technical indicator settings, fund allocation optimization, and target selection, the probability of profit can be further increased.

● Whether you are a novice or a seasoned investor, the DCA strategy can become an important tool for coping with future market uncertainties. By choosing the right targets and reasonably planning periods and fund distribution, one can achieve steady investment returns in the cryptocurrency market.

● If you want to get started quickly, it is recommended to try using AiCoin's all-coin DCA tool, which supports real-time monitoring and automated investment management, helping you earn passively in the crypto world!

Join our community to discuss and grow stronger together!

Official Telegram Community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。