Selected News

Chinese Meme Token "Haqimi" Market Cap Surpasses $87 Million, 24-Hour Increase of 160%

Privacy Token ZEC Breaks $275 Against the Trend, Nearly 2-Week Increase of 352%

U.S. Crypto Stocks Plummeted Last Night, CRCL and BMNR Dropped Over 10%

ZeroBase Founder States No Conversion of Stablecoins to USDe, Nor Staking of USDe

Selected Articles

October 11, 2025, will be a nightmare for global crypto investors. Bitcoin's price plummeted from a high of $117,000, falling below $110,000 within hours. Ethereum's decline was even more severe, reaching 16%. Panic spread through the market like a virus, with numerous altcoins crashing 80-90% in an instant; even with a slight rebound afterward, they generally fell 20% to 30%. In just a few hours, the global crypto market's market cap evaporated by hundreds of billions of dollars. On social media, cries of despair echoed, with languages from around the world merging into a single lament. However, beneath the surface of panic, the real transmission chain is far more complex than it appears.

October 11, 2025, will be etched in the annals of crypto history. Following U.S. President Trump's announcement to restart the trade war, global markets instantly entered panic mode. Starting at 5 AM, Bitcoin began a nearly unsupported cliff-like drop, with the chain reaction quickly spreading to the entire crypto market. According to Coinglass data, the total liquidation amount across the network reached a maximum of $19.1 billion in the past 24 hours, with over 1.6 million people liquidated—both the amount and the number of people set historical records in the ten-year history of cryptocurrency contract trading. Why was this liquidation so severe? Has the market bottom been reached? Rhythm BlockBeats has compiled the views of several market traders and well-known KOLs, analyzing this epic liquidation from the perspectives of macro environment, liquidity, and market sentiment, for reference only.

On-Chain Data

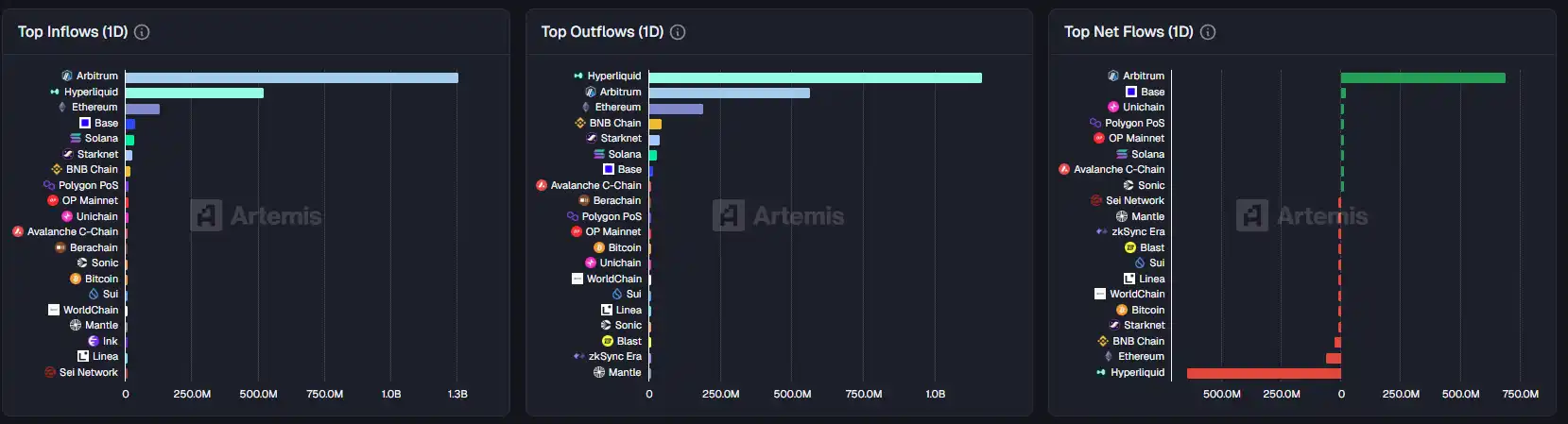

On-Chain Fund Flow Situation on October 11

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。