On the night of October 10 to the early morning of October 11, an epic crash occurred in the cryptocurrency market. Bitcoin's volatility reached over 17 points, and altcoins were even more extreme, with fluctuations exceeding 90 points. This means that opening a leveraged contract could lead to liquidation if luck is not on your side. Having been bullish previously, I was not spared from this black swan event, and several platforms faced liquidation. Therefore, while the crypto market can make people rich, it can also lead to significant losses. The key is to manage risk effectively to avoid similar incidents in the future. If liquidation happens, there’s no need to fear; as long as you don’t give up, you will eventually recover. What’s truly frightening is the lack of courage to stand up again after a liquidation. This incident was triggered by U.S. President Trump’s announcement of a 100% tariff increase on China, causing panic selling in the market. Since a large portion of trading involved leveraged positions, it ultimately led to a cascading effect, causing USDE to depeg to around 0.68. This event once again highlights the importance of setting take-profit and stop-loss orders when trading contracts, and the necessity of reducing leverage. One should never be greedy when the market is overheated.

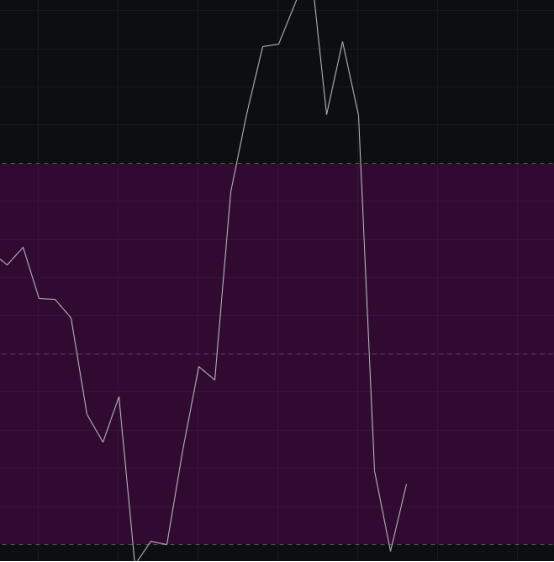

From the MACD perspective, the energy bars are rapidly declining, and both the fast and slow lines are moving downward, indicating an overall bearish trend.

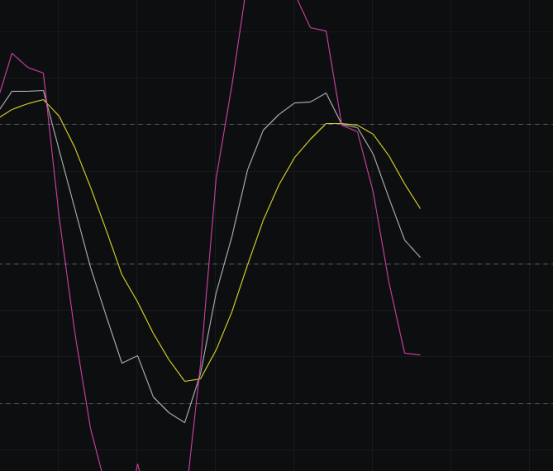

From the CCI perspective, after touching -100, the CCI began to turn upward, indicating that the bulls have not given up, and there may be a wave of upward movement.

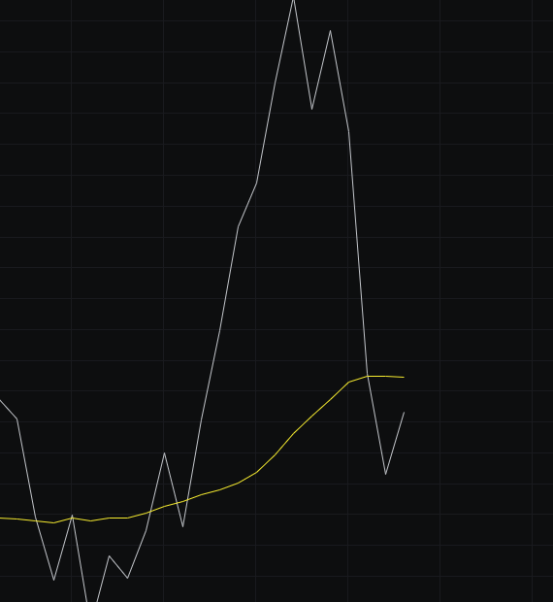

From the OBV perspective, the fast line has fallen below the slow line, while the slow line is flattening, which is unfavorable for the bulls. However, the flattening of the slow line also suggests that a trend may occur again, so attention should be paid to the OBV's movements.

From the KDJ perspective, the KDJ is currently above 50. If the market trend is weak, the KDJ will drop below 50 towards 20. If the market is strong, the KDJ will launch a counterattack near 50. Future observations should focus on the KDJ's movements.

From the MFI and RSI perspectives, the MFI is in a neutral range, while the RSI has dropped into a weak zone and is starting to rebound. The specific strength of the rebound will depend on future trends.

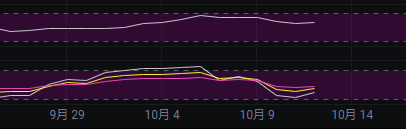

From the moving averages perspective, the price has fallen below several moving averages, and there is no support from moving averages below. The moving average trend is also poor; for the moving averages to improve, consecutive bullish candles are needed.

From the Bollinger Bands perspective, the upper and lower bands are flattening, and the middle band is also flattening, which can be defined as wide-range fluctuations. As the price drops from above, it should head towards the lower band. Currently, the lower shadow has already pierced the lower band once, but a second drop cannot be ruled out. Therefore, the price is expected to look down towards the lower band and up towards the middle band.

In summary: This black swan event has caused most of the bullish contracts to be wiped out, achieving the goal of the market makers. Since most bulls have been thrown off the bus, the overall direction still leans bullish. Whether there will be a second drop needs to be observed over the next few days. Today, the first target for the bulls is to hold above 110600, the second target is to rise above 114000, and the third target is to surpass 116000. Support is seen at 109500-107500, and resistance is at 114000-116000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。