Amid a recent sharp cryptocurrency market downturn, the price of XRP plunged by over 50%, wiping billions of dollars in value. The crash, which was one of the worst recent market events, saw XRP hit a low of $1.58 on Bitstamp and $1.25 on Binance, marking its lowest point since Nov. 22, 2024.

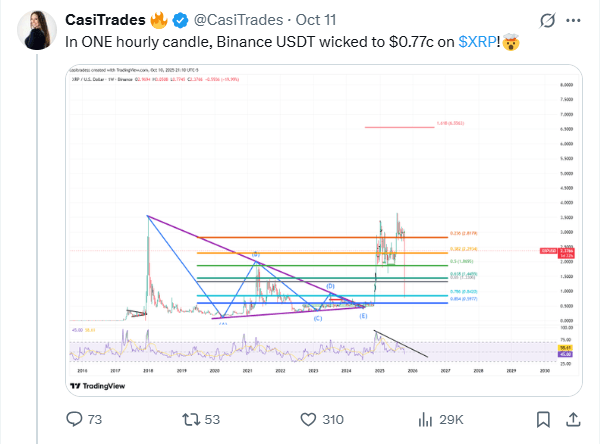

The speed and depth of the drop were dramatic. Coinglass data confirmed that XRP’s collapse alone triggered the liquidation of over $700 million in leveraged positions within 24 hours. Compounding the confusion, some social media users claimed the asset briefly dipped even lower, to $0.77, and expressed frustration that centralized exchanges prevented them from buying the dip.

Despite the severity of the flash crash, XRP quickly reversed a bulk of the losses. However, its price has since struggled to reclaim its previous resistance of $2.79, settling into a range between $2.30 and $2.50. As of 11:00 a.m. EST on Oct. 12, XRP was trading at $2.44.

Some analysts argued the slump did not fundamentally alter XRP’s bullish structure and suggested the spectacular collapse of XRP and other altcoins was caused by coordinated or “sinister” market action.

Crypto trader Casitrades pointed to the “very strong bounce” off the $1.25 low as evidence supporting a continued bullish outlook. Veteran trader Peter Brandt said XRP’s crash was “just a minor reaction in the bigger scheme of things.”

A key takeaway for market structure came from an X user named Protechtor, who posited that the crash provided a “master class in liquidity.” The user argued that differences in price lows across exchanges (the “size of the wick”) showed that some platforms had much stronger liquidity than others.

Protechtor concluded that the combination of high leverage and small liquidity pools creates a “smaller the exit door,” amplifying price drops. The user urged investors to stick with the most liquid pairs on the most liquid exchanges and avoid leverage on volatile assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。