Original Title: "With $300 Million in Funding and CFTC Approval, Kalshi is Competing for Prediction Market Dominance"

Original Author: 1912212.eth, Foresight News

In the wave of convergence between crypto and finance, prediction markets are becoming the next billion-dollar track. On October 10, the U.S. compliant prediction market platform Kalshi completed a funding round exceeding $300 million, with its valuation soaring to $5 billion. This round was led by Sequoia Capital and a16z, with follow-on investments from existing shareholders like Paradigm. Kalshi also plans to allow customers from over 140 countries to place bets on its platform.

Just four months ago, Kalshi was valued at $2 billion in a $185 million round in June, and now it has doubled, reflecting investors' fervent confidence in prediction markets.

Luxurious Team and VC Lineup

Kalshi was co-founded by Tarek Mansour and Luana Lopes Lara. Mansour graduated from the Massachusetts Institute of Technology and is a seasoned player in quantitative trading, having served as an executive at the Chicago Mercantile Exchange (CME), with expertise in derivatives pricing and risk management; Lara comes from a fintech background in Brazil and previously worked at Morgan Stanley focusing on emerging market strategies. The two are targeting the "event contracts" in traditional finance that have been overlooked—bets on future events.

Unlike Polymarket's blockchain-native path, Kalshi chose to build a compliant platform from scratch, obtaining regulatory approval from the Commodity Futures Trading Commission (CFTC) early on, becoming the first regulated prediction market in the U.S. This "difficult but responsible path," as described by a16z growth fund partner Alex Immerman, has allowed Kalshi to stand out amid regulatory storms.

The team composition is Kalshi's core competitive advantage. In addition to the founding duo, Kalshi has attracted several Wall Street elites and tech experts. Chief Technology Officer (CTO) Eli Levine comes from Google Cloud, where he led large-scale data infrastructure projects, ensuring low latency and high throughput for the platform. Product lead Sarah Chen joined from Coinbase, where she spearheaded Kalshi's expansion into sports and political markets, seamlessly integrating complex parlay betting.

Notably, Donald Trump Jr., the eldest son of Trump, joined Kalshi's advisory board in January 2025. He not only brings political insights but also helps the platform explode in the election market—Kalshi's presidential win probability predictions during the 2024 U.S. election had an accuracy rate of up to 85%, far exceeding traditional polls. The team has grown to over 150 people, covering quantitative modeling, compliance, and user growth, with an average industry experience of over 10 years. This "Wall Street + Silicon Valley" hybrid model allows Kalshi to lead in product iteration: expanding from single event contracts to multidimensional markets like sports, weather, and economic data, with an average daily active user count exceeding 100,000.

The VC lineup behind the funding is impressive, highlighting the strategic value of prediction markets. Sequoia Capital, a legendary name in Silicon Valley, led this round, with a portfolio that includes Airbnb and Stripe, having early bets on Kalshi's regulatory advantages; a16z, as a crypto-native fund, has publicly praised Kalshi for "redefining event-driven finance." Paradigm, which led the $185 million round in June, has now added to its investment, bringing its total to over $200 million. Other investors include Coinbase Ventures and Bond Capital, led by former a16z partner Mary Meeker, focusing on data-driven platforms. Kalshi's total funding has reached approximately $591 million across three rounds: a $15 million seed round in 2021 (led by SV Angel), a $50 million Series A in 2023, and now the Series D.

Kalshi's competitor Polymarket was founded in 2020 by Shayne Coplan, positioning itself as a blockchain-native prediction market relying on the Polygon chain, allowing users to bet directly with USDC. On October 7, 2025, Polymarket announced it had received up to $2 billion in investment from Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange.

Comparing to Polymarket

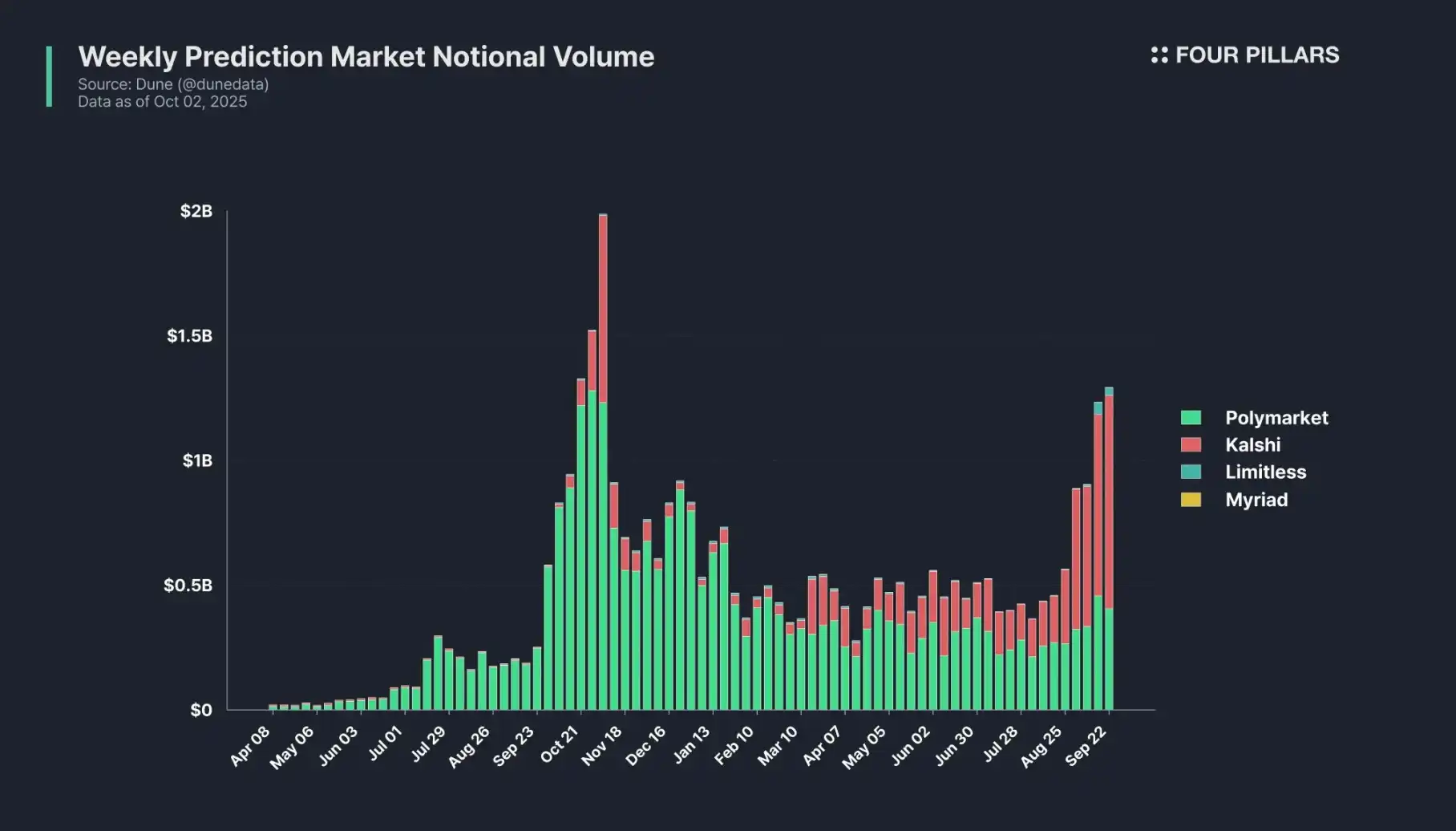

Data performance is the hard support for Kalshi's funding. Kalshi's liquidity pool has an average slippage of 0.1%, far below the industry average. Financially, the platform has become profitable, with revenue exceeding $200 million in the first half of 2025, mainly from a 0.5%-1% trading fee. According to Dune data, Kalshi's weekly prediction market transaction volume has rapidly risen, surpassing Polymarket.

Kalshi outperforms Polymarket on multiple dimensions. First, regulatory compliance: Kalshi is a CFTC-designated contract market (DCM), so U.S. users do not need a VPN; Polymarket lost U.S. traffic due to a ban in 2022 and has recently returned to the U.S. by acquiring QCX LLC, but the specific launch date remains unknown.

Second, user experience: Kalshi supports USD deposits and simplified KYC, making it suitable for institutions; Polymarket relies on crypto wallets, with higher gas fees and volatility. In terms of market coverage: Kalshi occupies a significant share of the U.S. market, but its share in other countries is low, with a richer offering of sports and economic contracts; Polymarket focuses on political and crypto events, but its penetration in the U.S. remains low due to compliance issues.

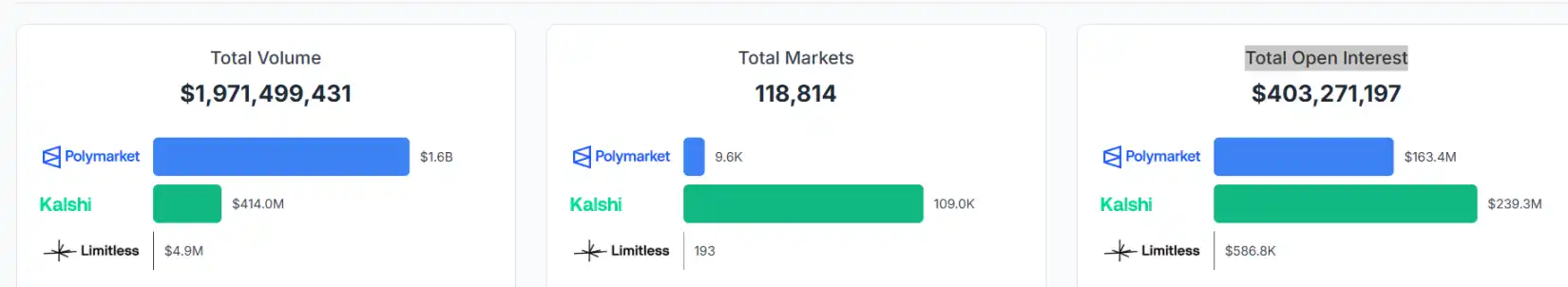

Latest data from polymarketanalytics shows that although Kalshi's total transaction volume is only $400 million, far behind Polymarket, it leads Polymarket in total number of prediction markets and total open positions.

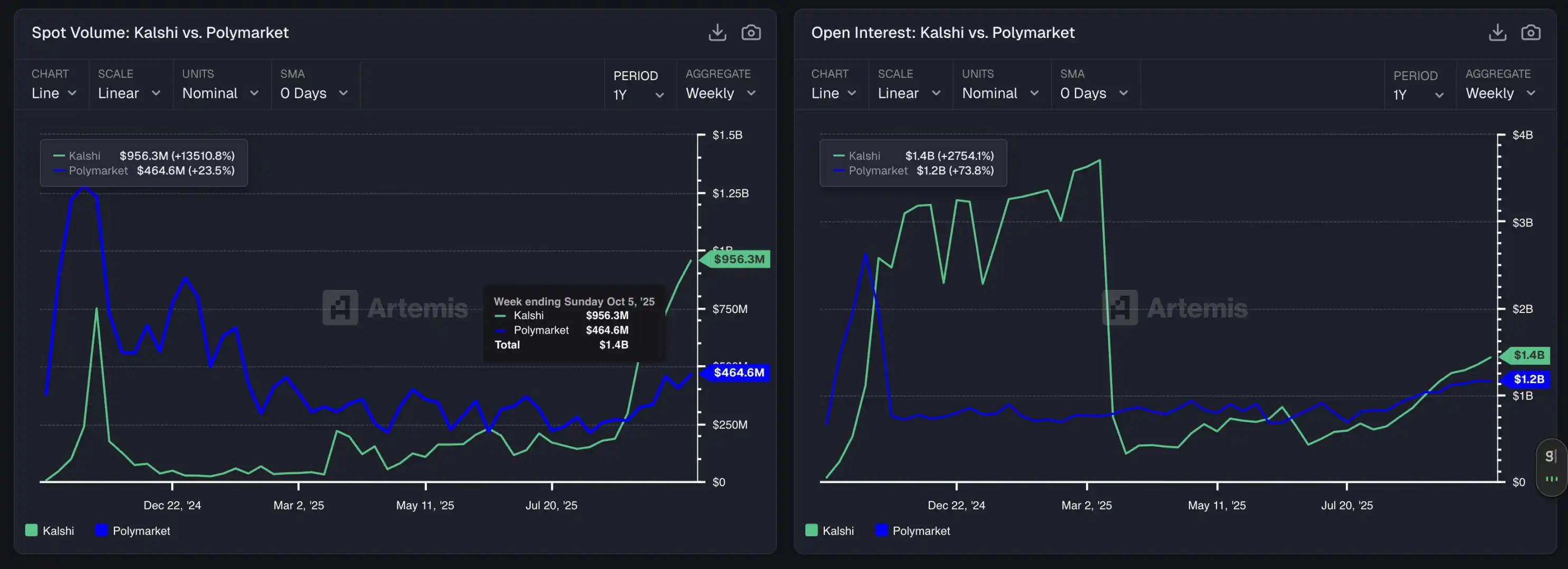

If we narrow the time frame, we can see Kalshi's rapid development momentum. Data monitored by Artemis shows that in the past year, Kalshi's market transaction volume skyrocketed 135 times to $956.3 million, while Polymarket only reached $464.6 million.

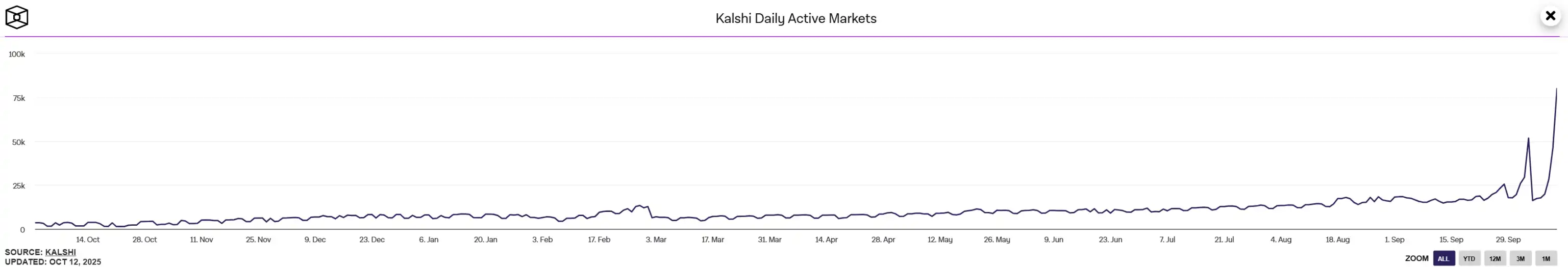

The latest data from The Block shows that Kalshi's daily active prediction market count has reached a historic high, exceeding 75,000.

Notably, Kalshi topped the Apple App Store's free chart on November 6, 2024, surpassing Polymarket. In October of this year, Kalshi's cryptocurrency head John Wang stated in an interview with The Block at the Token2049 conference in Singapore that Kalshi would appear on "every major crypto application and exchange" within the next 12 months.

Polymarket's founder hinted on Twitter about launching a token, POLY, and the market is beginning to pay attention to whether Kalshi will also launch a token in the future. Although there are some market rumors speculating that it may explore tokenization in the future, neither official channels nor funding announcements have mentioned the launch of a token.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。