With the announcement from the parent company of the New York Stock Exchange, Intercontinental Exchange (ICE), on October 7, to invest $2 billion in the prediction market platform Polymarket at an estimated valuation of about $9 billion, just three days later, another prediction market giant, Kalshi, also announced the completion of a $300 million financing round, reaching a valuation of $5 billion.

Meanwhile, Polymarket founder Shayne Coplan has previously retweeted or liked posts about the platform potentially launching a token. This time, he listed a series of mainstream crypto asset symbols on social media, adding the $POLY ticker, which can be seen as an implicit indication of issuing a token. This series of news has triggered FOMO among community members. As the news develops, the prediction market sector has once again become a hot topic of discussion.

Rhythm BlockBeats has compiled some practical tips and tools to help everyone better participate in the airdrops of various prediction market platforms. Below, we will introduce the volume-boosting strategies for platforms such as Polymarket, Kalshi, Myriad, and Limitless.

Polymarket

Although there are rumors that Polymarket has already taken airdrop snapshots, there is still a necessity to participate.

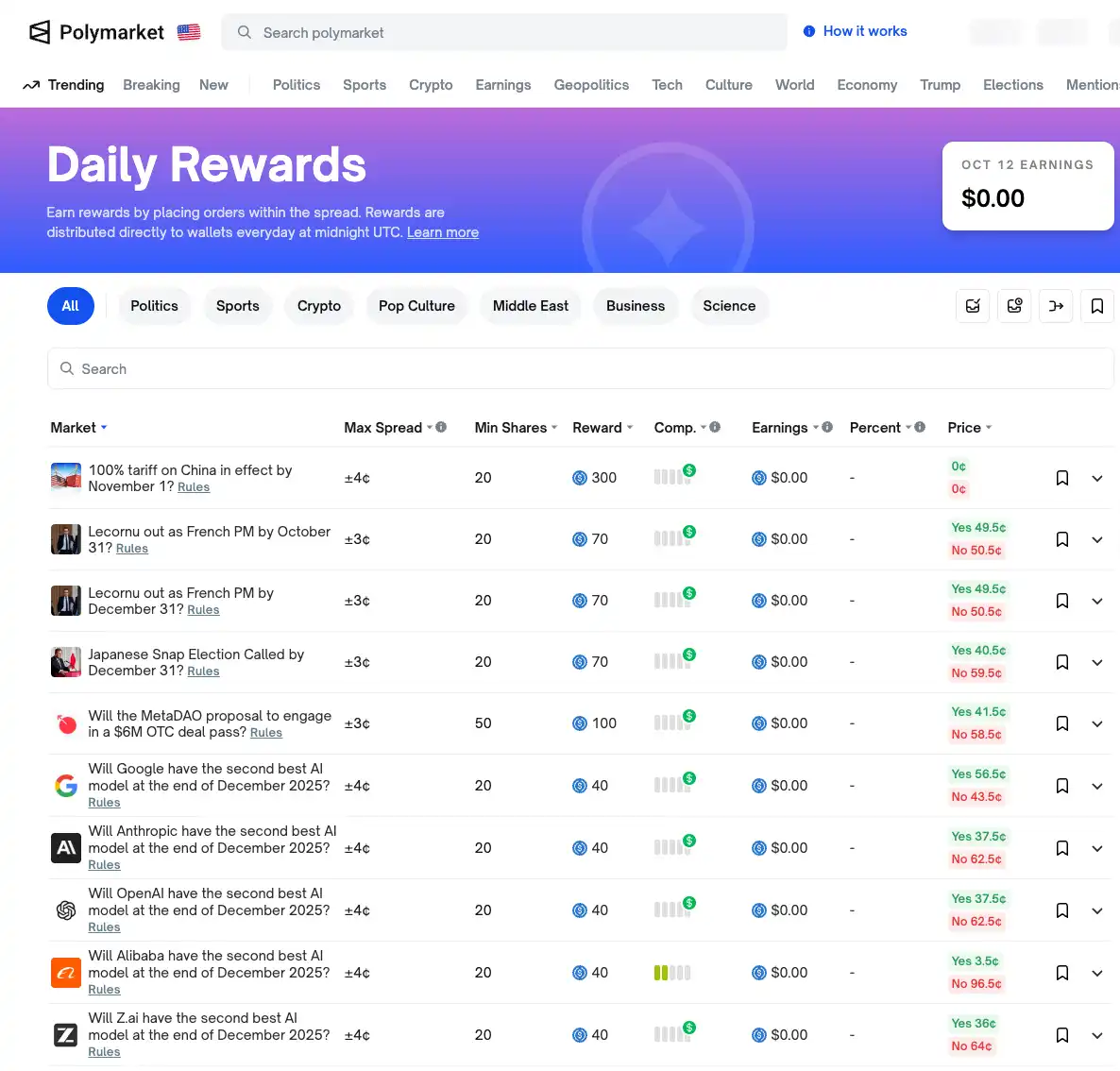

As one of the largest decentralized prediction markets currently, Polymarket has left room for "liquidity incentives" in its mechanism design. To encourage users to provide liquidity by placing orders on the order book, Polymarket has launched a limit order liquidity reward program. Users who place buy or sell orders close to the market midpoint on the order book (effectively acting as market makers) can receive daily rewards. The reward funds come from Polymarket's treasury and are calculated based on the depth of the orders and their proximity to the midpoint price. In simple terms, the closer the order price is to the current market midpoint and the larger the order quantity, the higher the reward.

This mechanism has given rise to an extreme order arbitrage method. Some users place a large number of buy orders at the extreme endpoints of the price range, so when the market fluctuates sharply and the event probabilities are temporarily underestimated, these low-priced buy orders will automatically execute, allowing them to pick up cheap chips, which can then be sold for profit when prices return. Since these orders are usually far from the midpoint price, the cost is minimal, yet they can absorb the market's panic selling pressure, achieving a high cost-performance ratio for building positions. Meanwhile, these unexecuted orders can earn liquidity rewards while waiting. However, it is important to note that this strategy also carries certain risks.

In addition to liquidity incentives, Polymarket also has a long-term holding interest mechanism aimed at stabilizing the prices of long-term event markets. The platform offers an annualized holding reward of 4% for certain long-term markets. Users holding positions in these markets will have their position sizes randomly sampled every hour, and interest will be distributed daily. Therefore, one volume-boosting strategy is to hold positions in these markets for the long term to obtain stable returns, and then hedge in related markets to reduce price volatility risk. For example, if one holds a large "yes" position in the "certain candidate elected" market to earn interest, they can short an equivalent position in the related "other candidates elected" market to hedge the risk, only profiting from the holding interest.

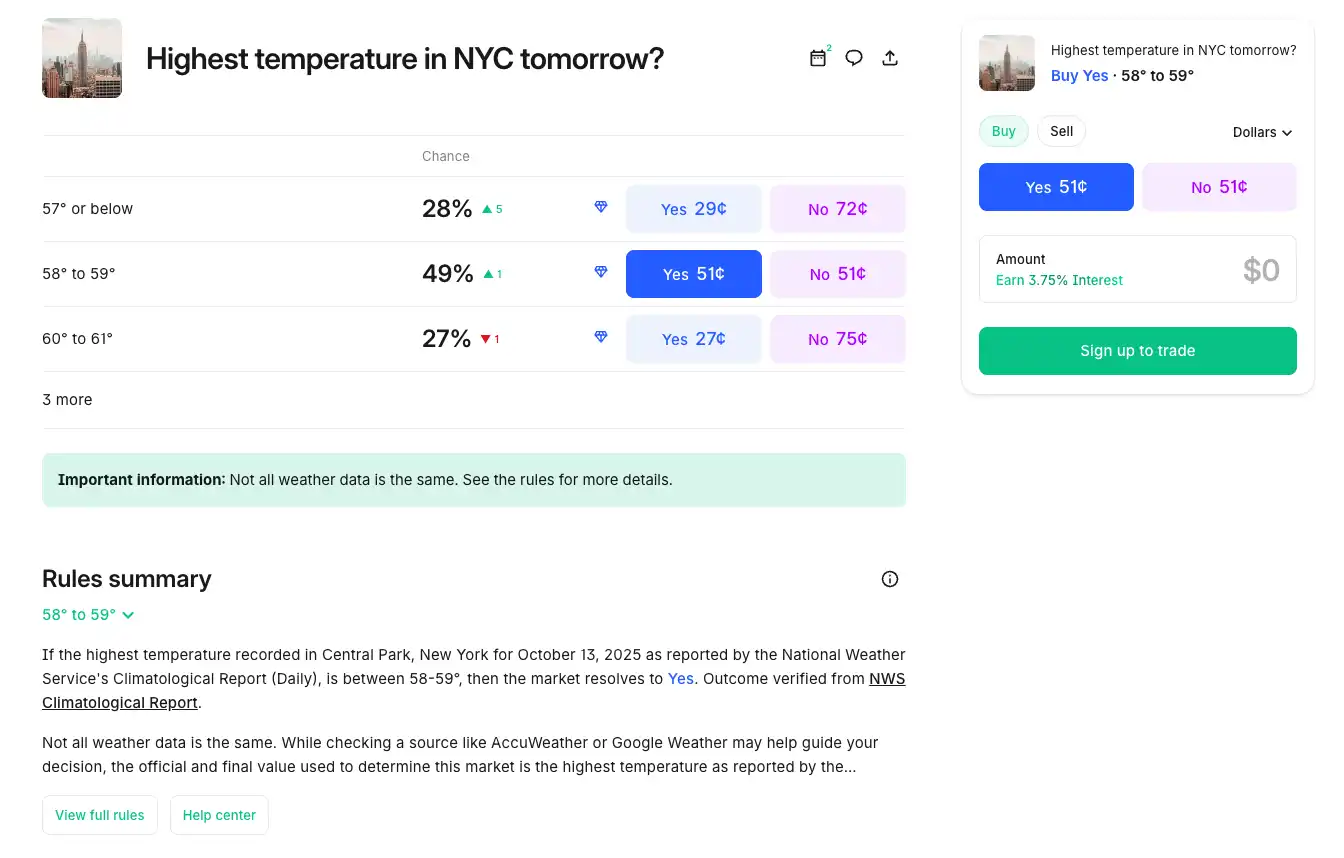

Another common technique is to use related markets for risk-free arbitrage. The principle is similar to hedging in contract trading to earn rate differences. If there are multiple related markets for the same event, players can monitor whether their prices deviate from reasonable probability relationships. When they find that the combined prices of two markets do not equal 1 (i.e., the sum of the probabilities deviates from 100%), they can simultaneously buy the undervalued side and short the overvalued side to lock in risk-free profits.

For example, when the price of the "A wins" market is 0.40 (implying a 40% probability) and the price of the "B wins" market is 0.50 (implying a 50% probability), the combined probabilities only total 90% instead of 100%. This means the market overall has underestimated the likelihood of a certain outcome occurring. At this point, one can buy A wins (undervalued) and sell (short) an equivalent contract in the B wins market, with the total cost of both sides being less than $1, holding until settlement to achieve risk-free profit.

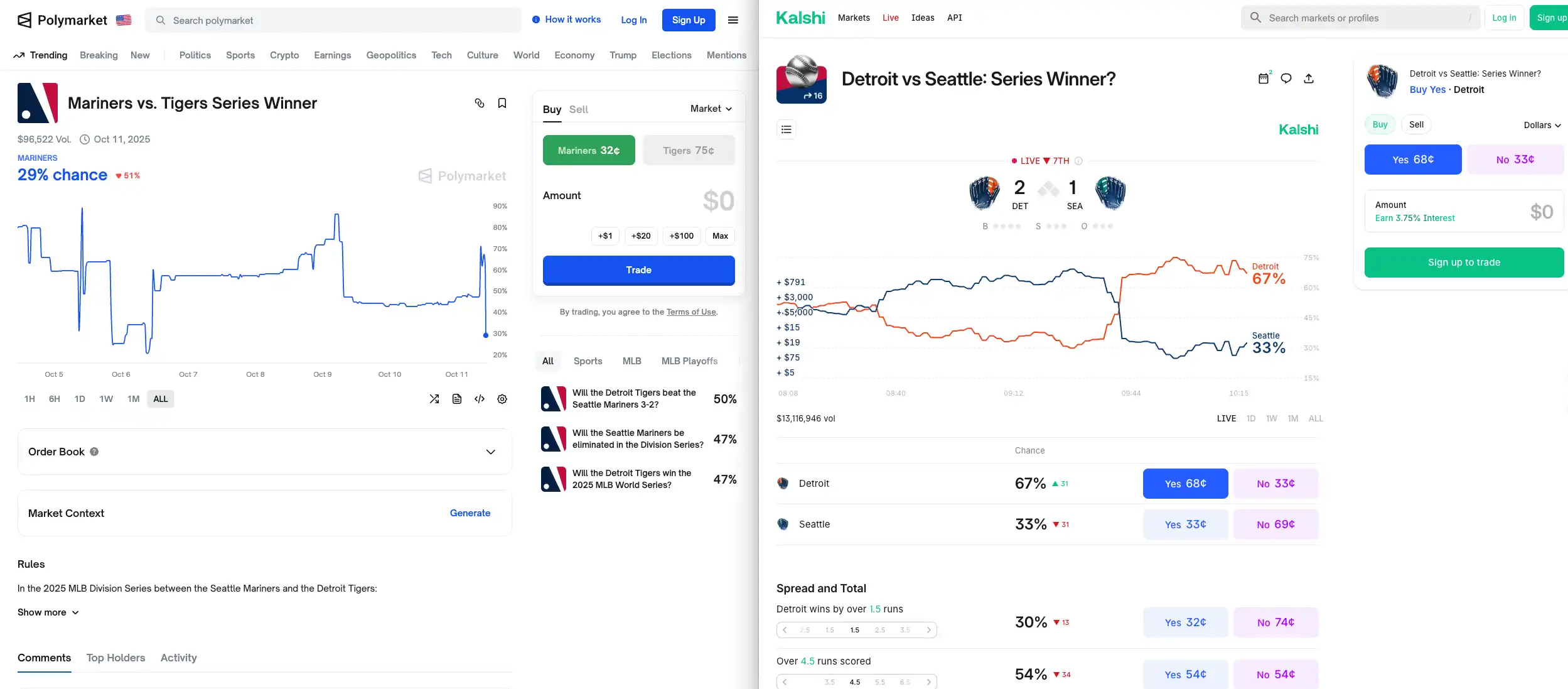

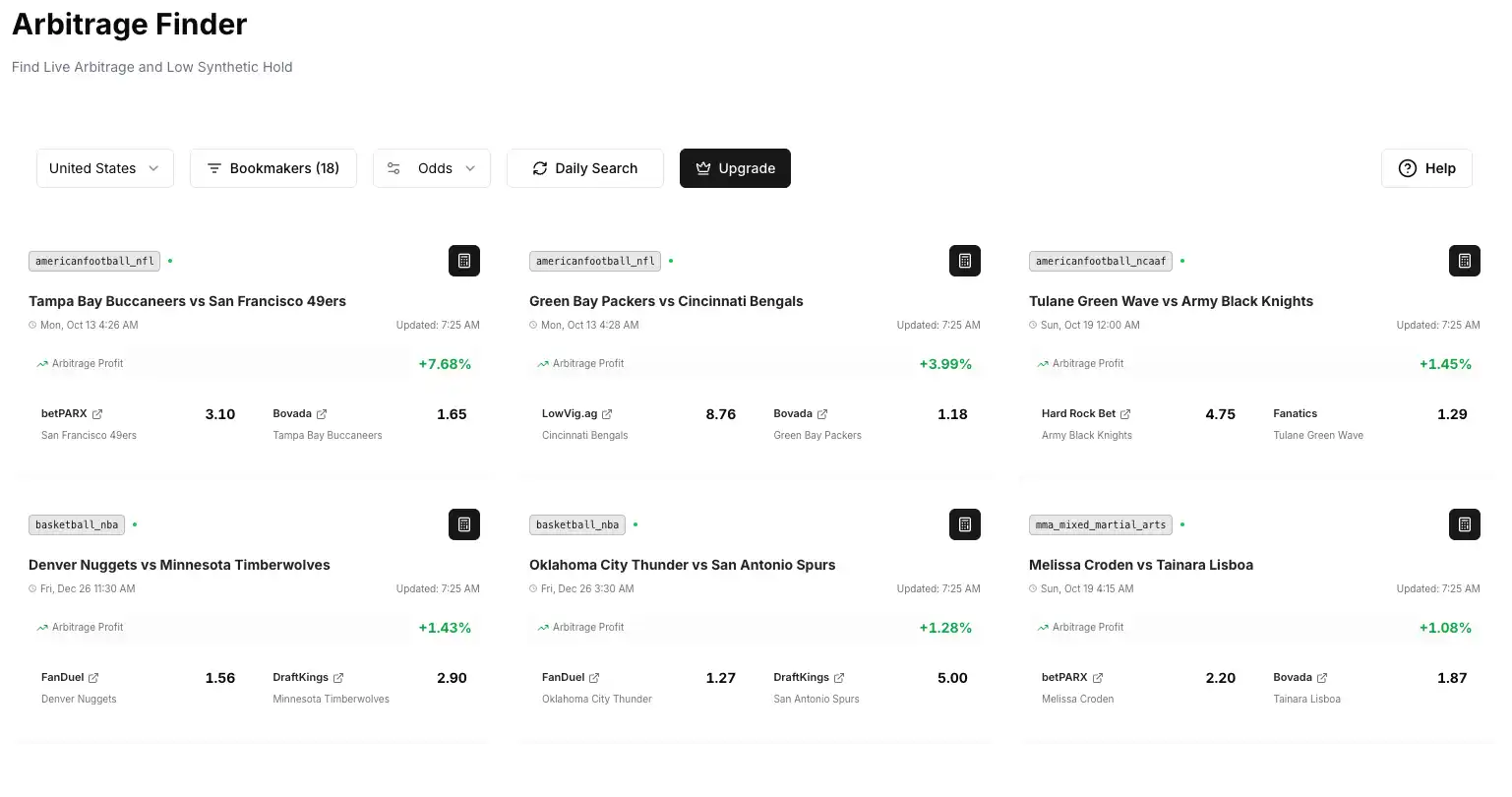

Thanks to Polymarket's ecological support and active community, various specialized arbitrage tools have emerged in the market. For example, the Polyfactual platform operates cross-platform arbitrage bots that continuously monitor the quotes of the same events on multiple platforms, such as Polymarket and Kalshi, and once they discover price difference opportunities, they buy and sell simultaneously to lock in profits. This platform has also issued tokens, allowing holders to share arbitrage profits based on their holdings. Nevua Markets allows users to set keyword alerts to capture price difference opportunities between different markets in real-time.

Additionally, the community has developed tools like PolySights and Polyburg for real-time monitoring of market price differences, depth, and transaction data. These data, combined with simple Python scripts, can help identify arbitrage or high win-rate opportunities. There is also the officially recognized Polymarket Analytics platform, which provides very stable data and supports querying detailed metrics such as trading volume, open positions, price trends, and account profit and loss changes by market or address.

In summary, small-position users are more suited to boost volume by earning liquidity rewards through placing limit orders; while large-position users can hold positions in specific markets for the long term to earn holding interest and reduce risk through hedging in related markets.

Kalshi

Kalshi's annual trading volume has surged from $300 million last year to an estimated $50 billion this year, and in recent months, it has surpassed Polymarket to capture over 60% of the prediction market share. Kalshi has also significantly increased the accessibility of prediction markets among ordinary investors by embedding event contract trading into investment apps commonly used by millions of retail investors through partnerships with mainstream brokers like Robinhood and Webull, making it an opportunity that absolutely cannot be missed.

Kalshi charges a transaction fee of approximately 0.7% to 3.5% of the contract amount for each transaction (varying with price), and the platform does not directly profit from users' gains or losses. All pending limit orders are exempt from transaction fees, and this Maker incentive ensures that the order book has ample liquidity.

By utilizing Kalshi's fee policy, users can significantly reduce trading costs through placing orders, thus boosting trading volume with small funds. For example, by using limit orders to provide liquidity, Kalshi does not charge fees for unexecuted orders, and once the order is executed, market makers (Makers) are also exempt from transaction fees. Therefore, users looking to boost trading volume should avoid directly "eating orders" and instead wait for execution at more favorable price levels.

For instance, if one believes a certain event will occur, there is no need to immediately eat into sell orders; instead, one can place buy orders at slightly lower prices and wait. Conversely, even if the placed orders cannot be executed temporarily, no fees will be incurred, and users can withdraw or adjust prices at any time. By continuously placing orders and frequently adjusting quotes based on market changes, one can accumulate trading volume as price differences narrow while avoiding high fees from frequent order eating.

Choosing information-asymmetric "niche markets" is also a path to boost volume with small investments. Popular markets on Kalshi (such as Federal Reserve interest rate decisions or presidential elections) are highly competitive and efficient in pricing, making it difficult for ordinary users to gain an advantage. In contrast, some obscure markets have greater information gaps, making them more suitable for meticulous cultivation and small investments for high returns.

Experienced traders suggest focusing on niche markets such as "quarterly performance of small-cap listed companies" or "weather indicators in specific regions." If you have research in related fields or possess official statistical data, you may be able to assess the probabilities of these events more accurately than most people. These markets often experience light trading and significant price fluctuations in the early stages, and through repeated small limit order trading, one can not only boost considerable trading volume but also potentially gain excess returns due to price corrections.

A user from platform X, Argona0x, shared his practical experience, starting with just $10, specifically targeting markets with significant information gaps, conducting 20-30 small transactions daily, and utilizing Kalshi's free events and points activities to earn an additional $40 weekly. Although it varies from person to person, focusing on niche areas and leveraging one's information advantage is indeed an effective way to boost volume at low cost.

To control risk, it is crucial to avoid betting most of the funds on a single market; moderate diversification is very necessary. Especially for markets with lower liquidity, it is essential to set stop-loss lines in advance, such as exiting when losses reach 5-10% of total funds, to avoid significant losses from unexpected market movements. Experienced traders share that they usually participate in 3-5 different categories of markets on Kalshi simultaneously, with each market's investment not exceeding 20% of total funds, effectively reducing the impact of "black swan" events on overall returns.

The openness of the Kalshi ecosystem has also fostered a variety of third-party tools and strategies to help users improve volume-boosting efficiency and win rates. Some community developers have aggregated data from multiple prediction platforms to create cross-platform market dashboards, making it easy to monitor price differences between Kalshi and Polymarket simultaneously.

For example, ArbBets is an arbitrage scanning tool that can scan for arbitrage opportunities across betting and prediction markets. It can simultaneously monitor over 100 traditional betting and prediction platforms, including Polymarket and Kalshi, to identify inconsistencies in quotes for the same event in real-time, prompting users to buy contracts on both sides to lock in risk-free profits. In addition, ArbBets also provides positive expected value (+EV) betting filters to help users identify investment opportunities on Kalshi or Polymarket where the win rate exceeds the implied probability of the odds.

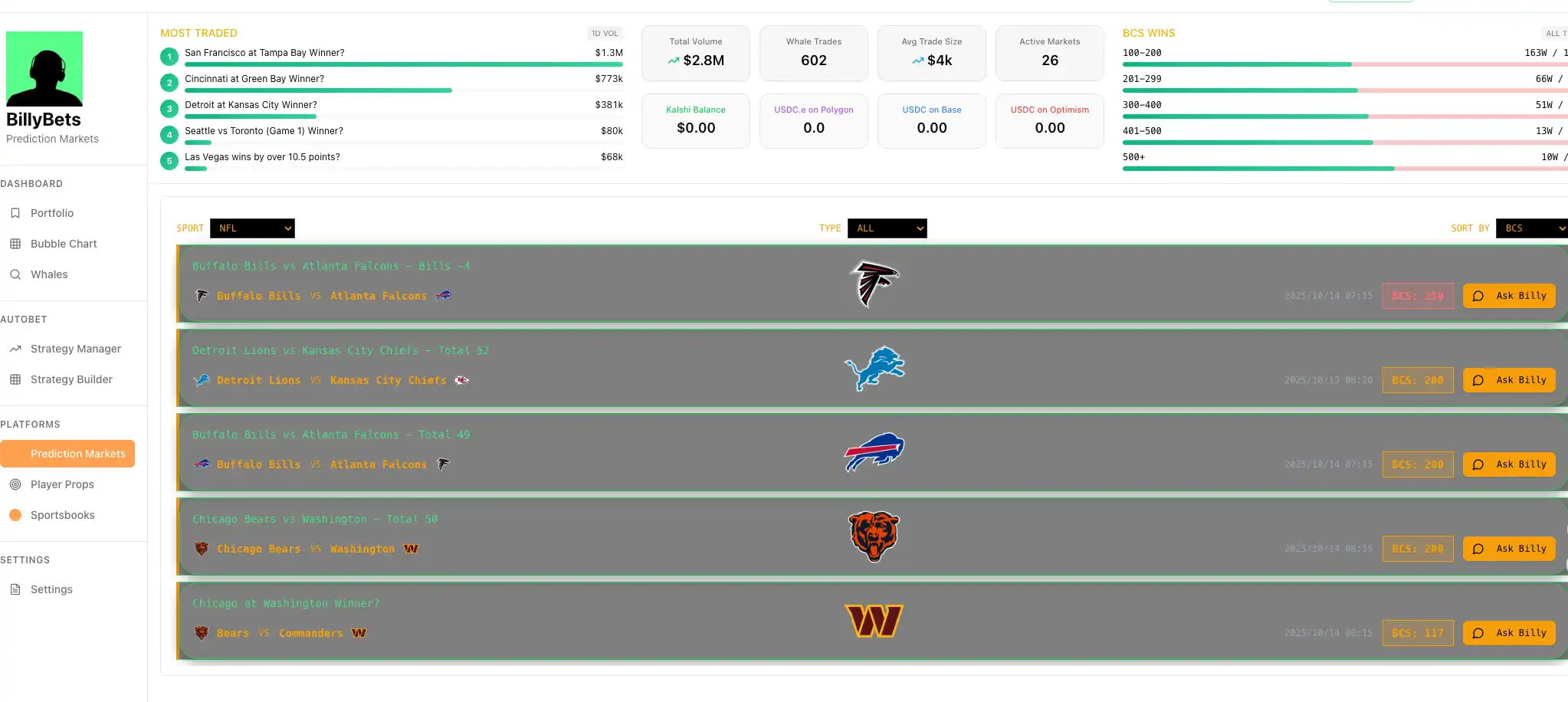

Another example is Billy Bets AI Agent, which combines real-time data and machine learning models to automatically discover higher win-rate betting options and execute orders on behalf of users. For instance, Billy provides a natural language trading terminal that allows users to input commands like "What are the positive EV bets for tonight's NFL games?" The system will immediately return matching odds and automatically place orders while providing real-time ROI tracking.

According to official disclosures, since its launch in June 2025, the Billy terminal has routed over $1 million in betting transactions, with a weekly trading volume growth rate of 23%. This AI agent lowers the barrier for users to analyze and make decisions, making it very user-friendly for those looking to passively obtain high win-rate trades.

Myriad

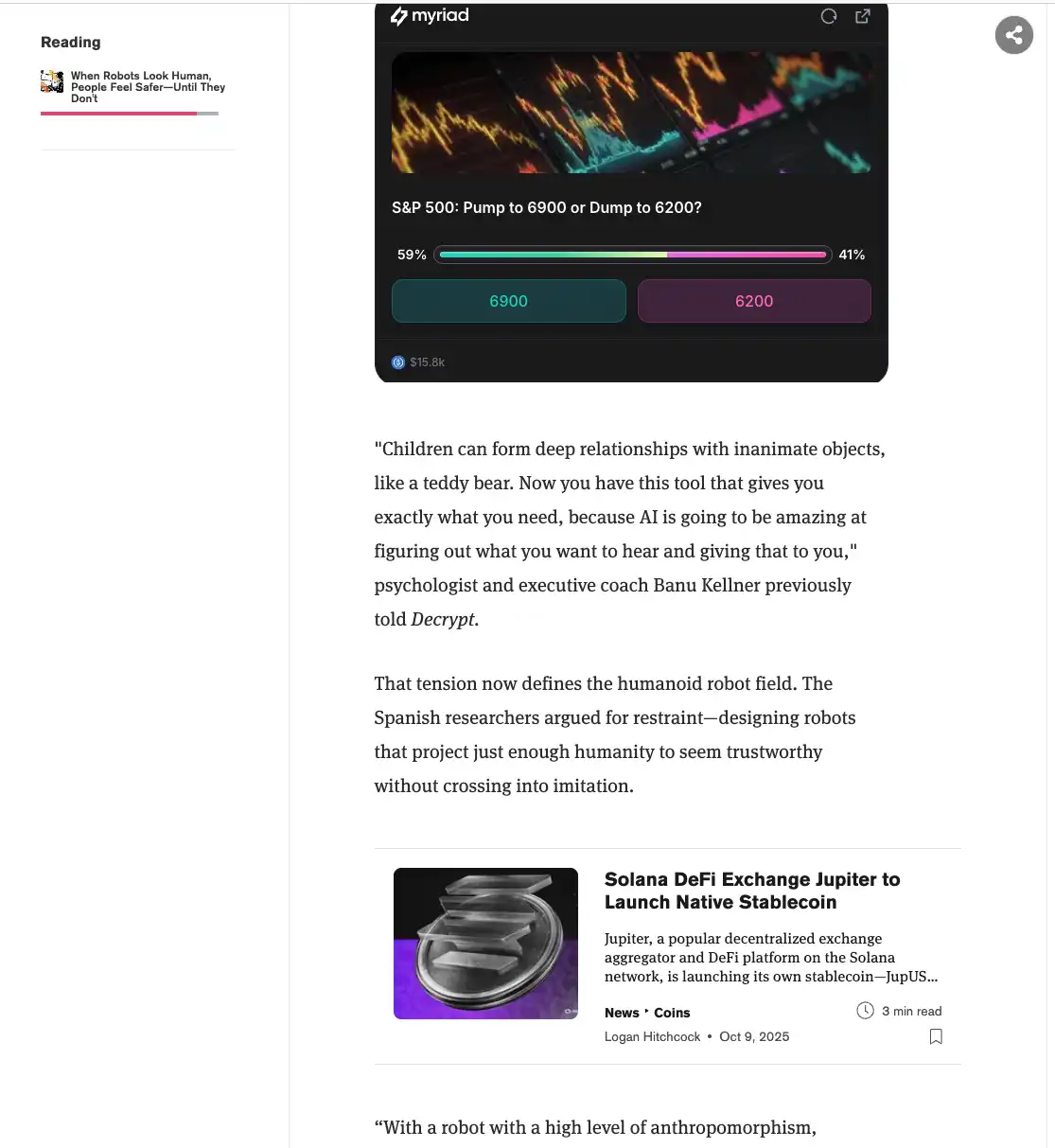

Myriad is a Web3 prediction market protocol incubated by DASTAN, the parent company of Decrypt, with its most notable feature being the embedding of prediction markets within news media content. This means that when you read articles from Decrypt or listen to the Rug Radio podcast, you can directly participate in prediction voting on related topics on the page. As of early October 2025, the Myriad platform has achieved approximately $18.5 million in USDC trading volume, with over 5 million transactions.

On Myriad, users can participate in prediction markets using Points. Points can be obtained for free through various means, such as connecting social media accounts, reading Decrypt articles, watching Rug Radio videos, daily logins, and completing designated tasks. Although Points cannot be directly exchanged for fiat currency, high Points and high win rates can elevate your username on the leaderboard, and this prestige may translate into community recognition or special rewards in the future.

Using Points to boost trading volume and level up at zero cost is the preferred strategy for participating in the Myriad platform. Even if your predictions are incorrect, there will be no financial loss, so beginners should start with Points predictions, trying out different types of markets and betting strategies to quickly improve their win rates through practical experience. Additionally, by completing daily check-ins and content sharing tasks, users can earn more Points to increase their "capital."

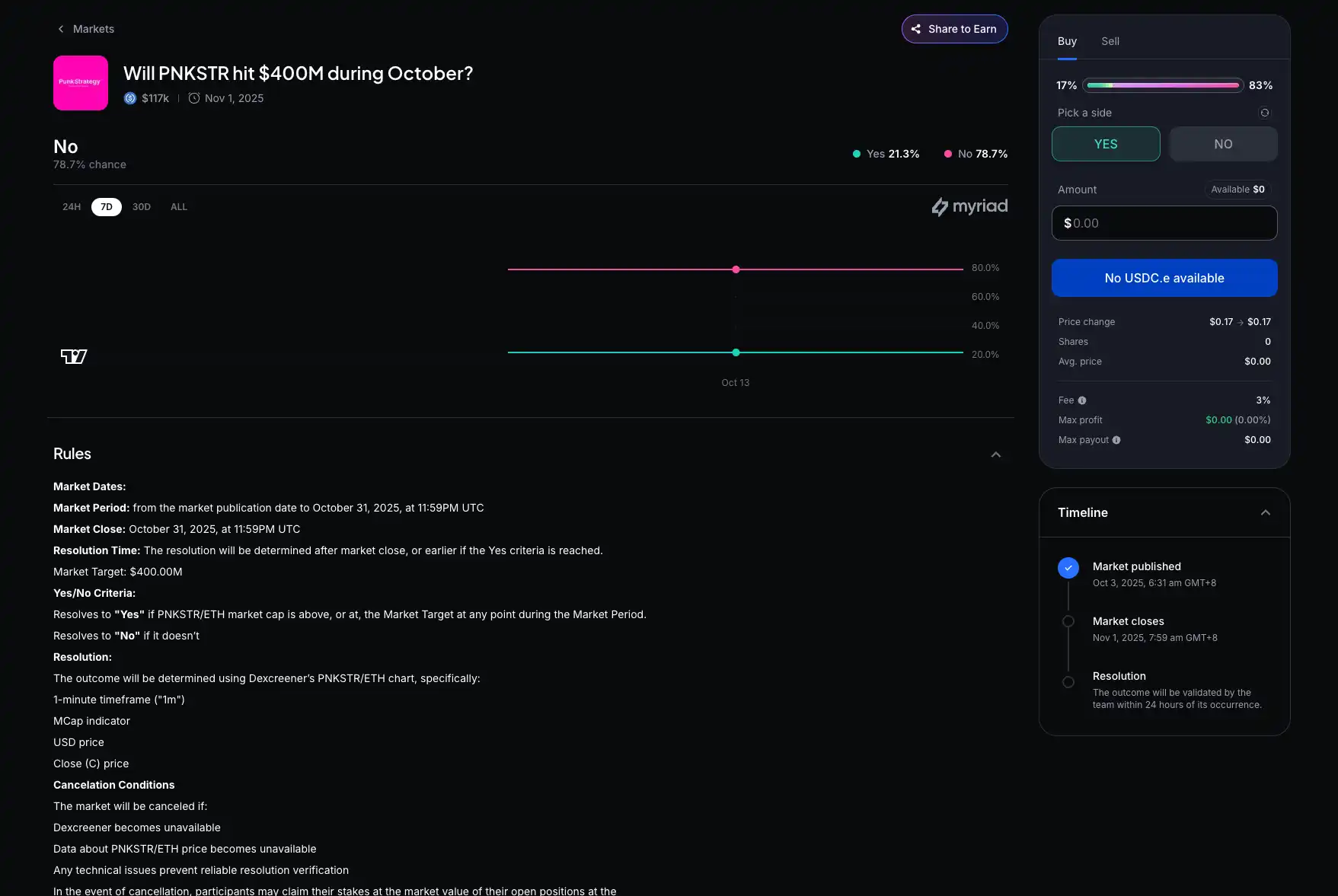

Experienced players also create low-friction markets to boost volume. Myriad allows users to customize and create new markets, and some veteran players act as "landlords," setting up short-cycle, low-controversy small markets and using Points as initial liquidity to place depth on both the buy and sell sides. For example, they might choose a straightforward crypto or sports event (e.g., "Will PNKSTR surpass a market cap of $400 million by October?").

Since these niche markets have few participants at the start, creators can use a small number of Points to place thick orders on both the buy and sell sides, making the market appear active and attracting other users to participate. Of course, the platform also has mechanisms to detect and prevent purely self-executing volume-boosting behaviors, so it is still necessary to ensure that transactions have a certain degree of genuine randomness, rather than simply buying and selling to oneself like a robot. Overall, by leveraging the characteristics of freely creating and matching in the Points market, players can significantly increase their account transaction counts.

As Myriad is still in its early development stage, active users often receive unexpected rewards. For instance, in a recent official Points leaderboard competition, the top 100 users received priority subscription qualifications for future $MYR tokens. Users who participated in community testing and provided valid feedback were also included in the first airdrop whitelist. Therefore, in addition to boosting trading volume itself, actively engaging with the community and keeping an eye on updates in the official Discord often yields additional hidden benefits.

In summary, Myriad provides users with an innovative low-threshold space to practice and participate in prediction markets. By fully utilizing the Points system and the media embedding feature, users can accumulate experience points without taking on financial risks. Once the platform issues tokens or launches more reward mechanisms in the future, these accumulated quantitative changes may have the opportunity to transform into qualitative changes.

Limitless

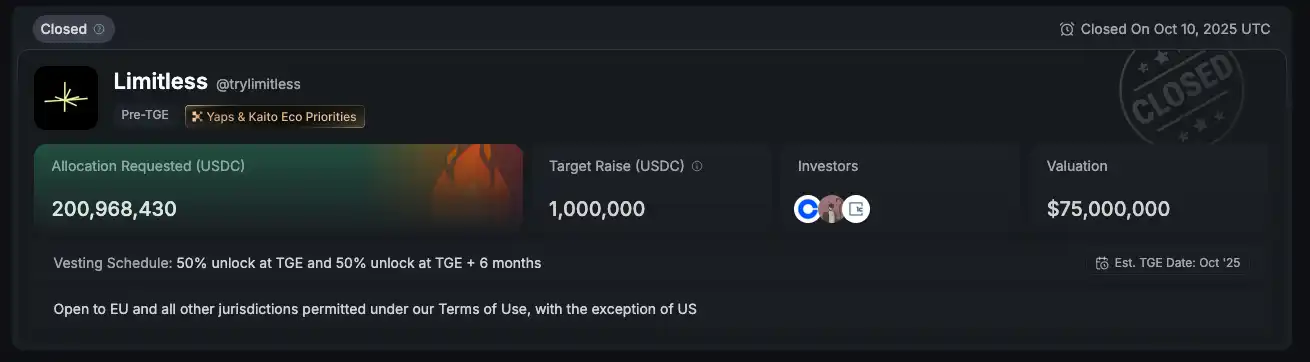

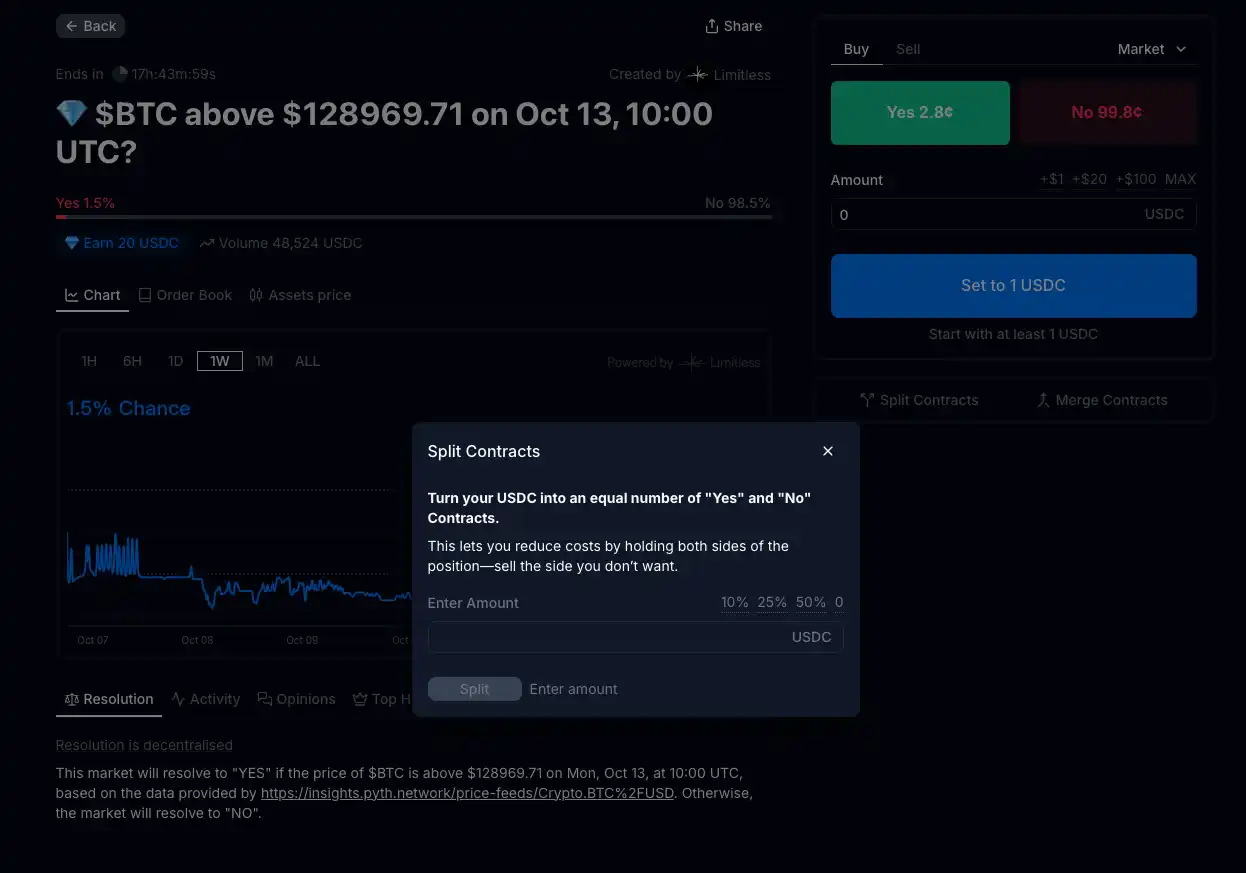

Limitless is an emerging prediction market platform deployed on the Base blockchain. Since its launch in 2024, it has experienced rapid user growth, with a cumulative trading volume exceeding $400 million and over 37,000 active users. Its product design draws from the order book model of centralized exchanges, supporting the splitting and merging of Yes/No positions to improve capital utilization efficiency, and allowing users to trade event markets that include multiple options.

Limitless has announced the upcoming issuance of its platform token $LMTS. Although it has faced skepticism regarding "inflated" trading volumes, its experienced investors still generate considerable enthusiasm in the market, with the pre-sale during the National Day holiday being oversubscribed by 200 times. The first season of the Points program, which served as the basis for airdrops, has ended, and the Points program has now entered its second season (starting September 22, 2025, and lasting until January 26, 2026). During this period, users can still earn Points through trading, providing liquidity, and inviting newcomers.

There are two hard requirements for participating in the Limitless Points program. First, the cumulative trading volume of the account must reach $200 to qualify for the Points leaderboard. Second, the platform places a strong emphasis on trading quality, stating that it will filter out purely random trading behaviors, and only actively participating in real markets and providing "meaningful" liquidity will earn higher scores.

In other words, if you merely engage in repeated small orders that are inconsequential, your Points earnings may be minimal or not counted at all. Conversely, by seriously participating in popular markets and improving order book depth through limit orders, the system will assign higher weight to your contributions. Additionally, actively providing liquidity is also an important way to earn stable Points. At the end of each season, the platform categorizes users into silver, gold, platinum, and diamond levels based on their Points, with different levels enjoying Points bonus rewards (the highest diamond level can receive an additional +20% Points).

Given that small transactions alone are unlikely to quickly accumulate substantial Points, volume-boosting players often consider using hedging methods to lock in large trading volumes. The method involves betting against oneself using both large and small accounts in markets where the outcome is almost certain.

For example, if an event is about to expire and the outcome is nearly certain, the Yes contract price has reached $0.998, while the No contract is only $0.002. At this point, you can use account A to buy 1,000 No contracts at $0.002 (costing about $2), while using account B to buy 1,000 Yes contracts at $0.998 (costing about $998). These two opposing trades essentially result in you self-executing 1,000 contracts with two accounts, creating approximately $2,000 in trading volume. However, regardless of the final outcome, one account's profit almost perfectly offsets the other's loss: if the result is Yes, account B receives $1,000 in payout, and account A's No position goes to zero, resulting in both accounts retrieving about $1,000, nearly breaking even; if the unexpected result is No, account A retrieves $1,000, and account B loses $998, also resulting in a near break-even.

The core idea is to place bets on both sides of the market, one with a 99% chance of winning and the other with a 1% chance, in markets that are close to settlement (around the last minute) and where the outcome is almost determined, using an almost certain event to hedge and achieve large transaction volume.

Another strategy is to place wide-ranging limit orders to earn market-making Points. Since Limitless considers any limit order that enters the order book as providing liquidity, there is no need for actual execution. Players can take advantage of this by placing large orders at extreme prices to occupy market depth. For example, placing a sell order for 1,000 contracts at a price of 99.9% (equivalent to being willing to sell Yes at $0.999 or buy No) requires less than $1 in margin due to the price being close to 100%. In other words, with just $1 in capital, you can provide 1,000 contracts of depth to the market. Once the system samples your limit order during Points statistics, it will grant corresponding Points rewards. You can place similar depth orders at multiple markets and price levels to exchange for high Points at a very low cost.

Of course, these limit orders are unlikely to be executed (unless extreme market conditions occur), posing almost no risk of loss. However, it is important to be aware of the platform's monitoring mechanisms; overly deliberate and mechanical large limit orders may attract attention, so it is best to choose active markets to spread out your orders, making your liquidity provision appear more natural.

Although Limitless encourages volume boosting, the consideration of trading quality means that users should pay attention to strategy combinations when boosting volume to avoid low Points ratings. Simply trading in obscure markets may be viewed as invalid trading. It is advisable to choose some popular markets for volume boosting, and to arrange hedging operations in these markets with real trading volume to avoid being too conspicuous.

On the other hand, it is beneficial to participate in some normal trading to create genuine profit or loss records. Some community users share that they combine volume boosting with real betting; after meeting the trading volume requirements for Points, they use a small portion of their funds to select one or two events they are confident in to bet for profit, which helps to offset the fees paid during the volume boosting process and makes the account's profit and loss curve appear more natural. On public leaderboards, accounts that have both a large number of trades and maintain a good win rate are likely to receive favor from the officials in the future.

Currently, Limitless has clearly stated that it will distribute $LMTS tokens through an airdrop at the end of this season. The second season will last until the end of January next year. Additionally, as a part of the Base ecosystem, Limitless benefits from the potential airdrop opportunities already certified by Base, coupled with support from top institutions like Coinbase Ventures, making its long-term development prospects generally optimistic.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。