I. Trade Friction Heats Up Again, Three Signals Ignite the Market

The market has experienced a complete process in just one week, from China's rare earth export control upgrade → Trump's tariff threat → Vice President Pence's calming statement.

China Strengthens Rare Earth Export Controls

In early October, the Ministry of Commerce of China announced strengthened export controls on rare earths, superhard materials, and core lithium battery raw materials, explicitly including some high-performance rare earth magnets and semiconductor equipment raw materials in the approval scope. This move directly strikes at the "vital point" of the U.S. semiconductor and high-tech industry chain and is seen as a "reciprocal countermeasure" against the U.S. export blockade of semiconductor equipment.

Trump Issues 100% Tariff Threat

In mid-October, Trump declared a 100% tariff on Chinese goods starting November 1, reinforcing export restrictions in an attempt to gain negotiation leverage through extreme pressure. However, this action is facing institutional challenges: the U.S. Supreme Court is reviewing multiple cases regarding the legality of the president unilaterally imposing tariffs. If the ruling is unfavorable, Trump's "tariff weapon" may become completely ineffective.

Vice President Pence Sends Rational Signals

As the market became tense, Pence publicly stated that Trump "values cooperation with China" and hopes to resolve differences through negotiation. This calming statement led to a rapid rebound in U.S. stock futures and the cryptocurrency market, with short-term risk appetite recovering.

Conclusion

The three signals combine to form a clear conclusion—Trump's "shout but don't strike" TACO model (Trump Always Chickens Out) is being constrained by reality, and intimidation-based trading is nearing obsolescence.

II. MSX Research Institute's View: Under Three Constraints, "The Wolf is Coming" Fails

Legal: The Supreme Court as the Institutional Valve for TACO's Continuation

Lower courts have expressed negative opinions on broad taxation under IEEPA. If the Supreme Court ultimately confirms that the president lacks the authority to impose such tariffs without congressional authorization, the feasibility of Trump changing trade rules through "unilateral administrative threats" will significantly decrease, fundamentally weakening the market transmission mechanism of "threat equals deterrence."

Industry: Rare Earth Control Constitutes Substantial Reciprocal Countermeasure

China's global dominance in rare earth mining, separation processing, and magnet manufacturing gives it "physical leverage" over the U.S. semiconductor and high-end manufacturing sectors. In the short term, the U.S. is unlikely to establish complete alternative capabilities in heavy rare earths (dysprosium, terbium) and refined magnet manufacturing, as alternatives and recycling will take years to scale.

Market: From "Being Scared" to "Learning"—Declining Marginal Effect of TACO

Multiple rounds of "threats—concessions" in history have dulled the market's sensitivity to verbal threats: investors are gradually shifting their focus to legal adjudication nodes and industry data rather than single statements.

It can be seen that Trump's TACO model rhetoric seems to have its limitations, and it all started with the Ministry of Commerce of China announcing strengthened controls on rare earths. So, what is the current global rare earth environment like?

III. The Contest Between Technical Barriers and Industrial Resilience

China's Countermeasures Upgrade and Technical Blockade

- Itemized Control: Overseas magnets and semiconductor materials containing ≥0.1% Chinese heavy rare earths require export licenses, covering all high-end dependent products.

- Technical Export Freeze: Core technologies and blueprints for rare earth mining, separation, and magnet manufacturing are included in the control list, blocking the U.S. and Europe from obtaining advanced processes.

- Control of Secondary Resource Recycling: China controls 70% of global rare earth waste recycling technology, and prohibiting technology exports will extend the U.S. and Europe's supply chain reconstruction period.

The Real Dilemma of U.S. Domestic Rare Earth Industry Chain Reconstruction

- Heavy Rare Earth Resource Gap: Heavy rare earths (dysprosium, terbium) account for 5% of the U.S. proven reserves, while China's heavy rare earth reserves account for over 70% of the global total. Even if the U.S. restarts light rare earth mines, it cannot meet the demand for high-end magnets.

- Processing Technology Gap: U.S. ores still need to be sent to China for separation and processing. MP Materials produces 6,000 tons of NdPr oxide annually, which is only 1/5 of a single plant in northern China.

- Policy Execution Bottleneck: U.S. environmental regulations and community resistance lead to new mine construction cycles lasting 10–15 years, with huge capital investment; China's mining cycle is only 3–5 years.

Stage Breakthroughs and Limitations in Alternative Technology R&D

- Performance Gap: Germany's VAC's non-rare earth neodymium-iron-boron magnets have a magnetic energy product that is 15–20% lower, failing to meet high-end aerospace and wind power scenarios.

- Mass Production Bottleneck: U.S. Niron Magnetics produces only 5 tons of iron-nitride permanent magnets annually, while Japan's Proterial's non-neodymium magnets are still in the laboratory stage, costing more than three times that of Chinese neodymium-iron-boron.

- Technological Path Dependence: Production equipment still relies on Chinese companies (80% of global rare earth processing equipment is made in China).

Partial Supply Chain Repair and Replacement Attempts

- Acceleration of U.S.-European Corporate Cooperation: Critical Metals and REalloys have reached an agreement to supply 15% of the rare earth concentrate from Greenland's Tanbreez project to the U.S., but the ore still needs to be sent to Malaysia for processing.

- Inventory Cycle Adjustment: Companies like Tesla and Siemens Gamesa have increased their inventory (from 2 months to 6 months), alleviating short-term supply pressure, but rising costs have led to a 1-2 percentage point compression in profit margins.

- Price Transmission Mechanism: The rise in rare earth prices has partially been passed on to end products, for example, the cost of permanent magnet synchronous motors has increased by about $800 per vehicle, leading to a price increase of 1.2% for the Tesla Model Y in the Chinese market.

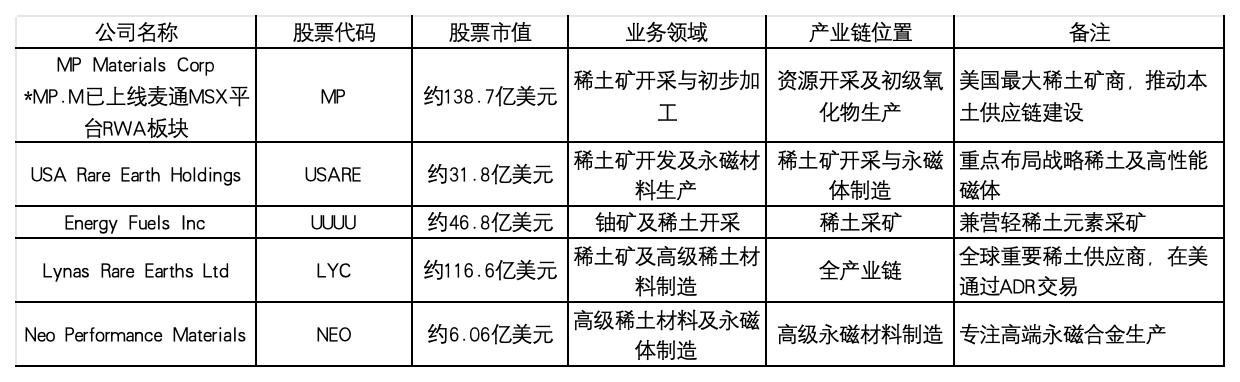

Against the backdrop of escalating U.S.-China rare earth disputes, U.S. upstream rare earth/permanent magnet alternative stocks have attracted attention, and here are some related stocks:

IV. Conclusion

- Trump's TACO strategy faces backlash from legal, industrial, and market fronts, making the "wolf is coming" game difficult to sustain.

- The Supreme Court ruling will become a watershed moment for tariff strategies, and China's rare earth export controls mark the starting point of substantial gamesmanship.

- Short-term volatility, structural differentiation, and legal variables will dominate the global market keywords in the coming months.

- Investors should respond to policy fluctuations with "tactical flexibility + strategic stability," seeking growth opportunities amid contradictions.

Epilogue: Policy noise is easily dispersed, but structural logic endures. When the "wolf is coming" game fails, the real market trend is just beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。