Clovis's final battle is based on complete self-custody, transforming DEX from merely a trading function into a truly decentralized exchange on-chain, providing a seamless liquidity experience comparable to top centralized exchanges.

The Cycle of Technology and Finance: From Deconstruction to Reconstruction

Throughout the intersection of technology and finance, we have repeatedly witnessed a classic cycle: "The Great Unbundling" and "The Great Rebundling." Just as Craigslist's functions were deconstructed one by one by vertical applications like Airbnb and Zillow, traditional banking services have been disrupted individually by fintech newcomers like Stripe and Robinhood. However, once these vertical domain leaders reach a certain scale, they often move towards integration again, evolving into comprehensive super applications.

Today, this cycle is being replayed in the DeFi space at an unprecedented speed. In recent years, we have witnessed the era of DeFi's great unbundling: Aave deployed on dozens of chains, Uniswap's liquidity pools spread across various Layer2 networks, with each protocol instance becoming a single-function yet isolated liquidity island. This fragmentation of liquidity not only causes significant capital waste but also subjects users to unbearable operational friction and complexity.

However, the pendulum of history is swinging back to the other side. A new paradigm is emerging that no longer settles for building fragile bridges between islands but seeks to fundamentally bridge the gap and reunify the fragmented financial continent, marking the beginning of "The Great Rebundling."

The Fragmentation Era: DeFi's Babel Dilemma and the Liquidity Impossibility Triangle

The rise of DeFi can be likened to a Cambrian explosion, with hundreds of public chains, Layer2s, and application protocols creating a thriving ecosystem, yet also splitting capital across more than 400 isolated networks. Just as the builders of the Tower of Babel fell into chaos due to language barriers, today's DeFi ecosystem is trapped in an efficiency dilemma due to liquidity fragmentation—Aave's liquidity pools on Arbitrum and Base operate independently, and every new version of Uniswap must start from zero liquidity. Behind the surface of flourishing diversity lies enormous systemic friction and capital waste, forcing many emerging ecosystems to rely on ineffective liquidity driven by high token incentives.

This dilemma is particularly evident at the user level. Take seasoned trader Bob as an example; his assets are spread across multiple mainstream ecosystems: he has staked ETH on Arbitrum, pursued meme opportunities on Base, and participated in liquidity staking on Solana. Managing these cross-chain assets is akin to running a multinational company with offices in multiple locations but no inter-office capital flow—when a brief trading opportunity arises on Base, the ETH locked on Arbitrum cannot provide any assistance, trapping capital in a single-threaded operation. Although emerging chains may have enticing airdrop expectations, they resemble ghost towns, struggling to retain users and capital due to a lack of deep DEXs and stable lending markets.

More critically, the cross-chain operations Bob faces are a test of patience and luck: he must choose among dozens of cross-chain bridges, enduring high gas fees, slippage losses, and security risks. This predicament reflects a common pain point across the entire ecosystem: liquidity, composability, and user experience form an irreconcilable impossibility triangle.

Just as the Industrial Revolution transitioned from home workshops to centralized factories and efficient railway networks, DeFi is also undergoing a critical shift from decentralization to collaboration. The market urgently needs a unified command center capable of breaking down inter-chain barriers and intelligently scheduling global capital, which is not only a repair of the existing architecture but also a paradigm revolution concerning underlying logic.

Cognitive Leap: From Cross-Chain to Cross-Settlement Layer Evolution

For a long time, we have tried to solve cross-chain issues with better bridges, yet we have always treated the symptoms rather than the root cause. The crux lies in the fact that we are still moving assets at the physical level rather than unifying credit at the logical level.

What Clovis builds is not just a DeFi application but a unified cross-chain clearing and execution infrastructure, a blueprint aimed at ending the era of liquidity islands in DeFi.

Clovis brings a fundamental shift in thinking: separating logical clearing from asset settlement. Rather than struggling to reconcile among hundreds of independent ledgers, it is better to establish a unified central ledger, with local vaults acting in coordination as instructed.

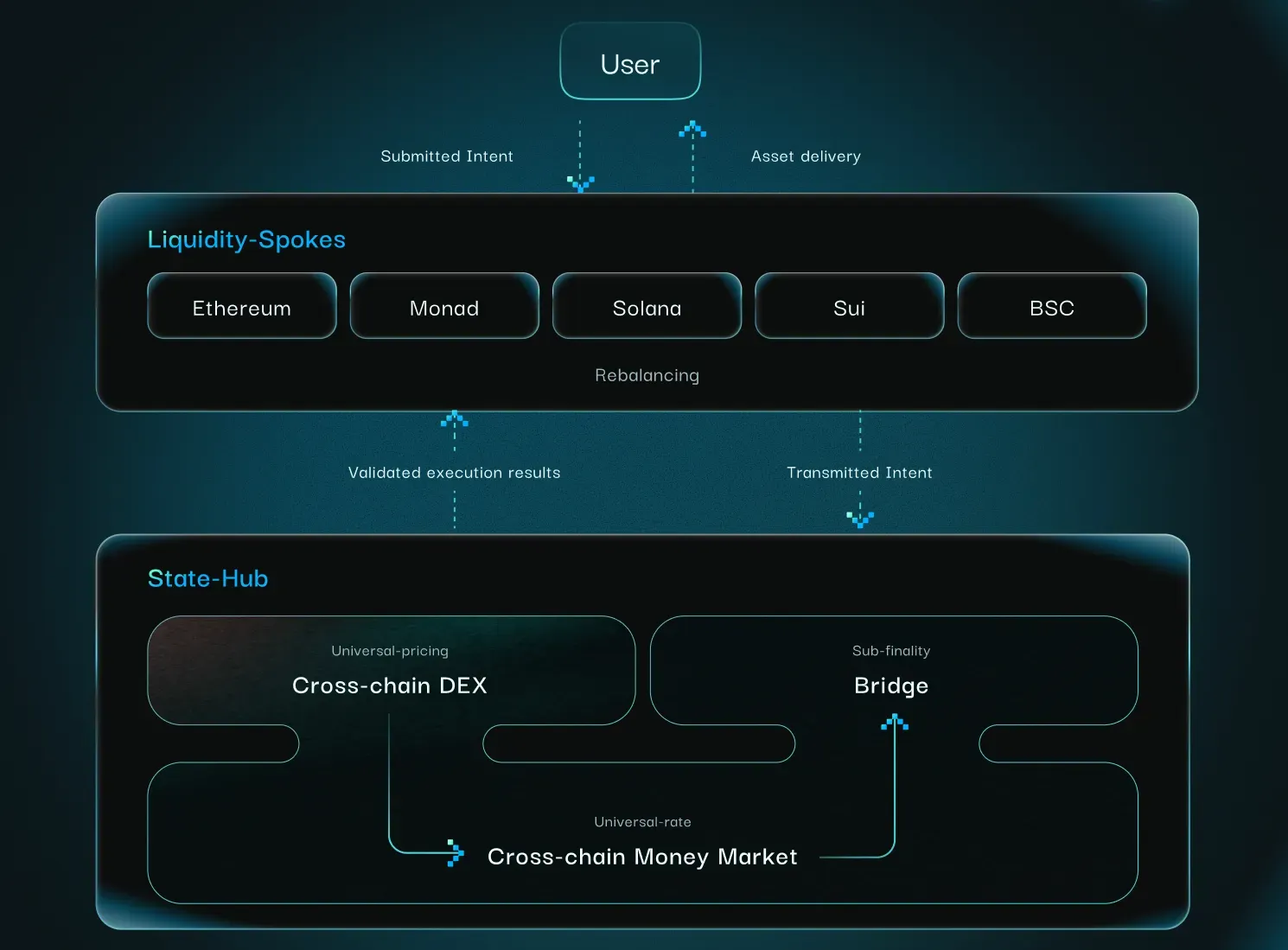

The Hub serves as the global risk control center, deployed on the high-performance Sei network, not directly holding assets but acting as the sole source of truth, uniformly processing global calculations: tracking users' cross-chain assets and liabilities, updating health factors in real-time, and setting unified interest rates and prices.

The Spoke is a lightweight vault contract deployed on each chain, acting as the protocol's appendage, holding local liquidity, and executing user operations instantly as per Hub's instructions, such as issuing loans.

This Hub-and-Spoke architecture reshapes the cross-chain interaction process: user credit synchronizes globally, and asset delivery occurs locally in real-time. The greatest friction point of cross-chain operations thus disappears from the user's view.

Architecture Analysis: Efficient Collaboration of Brain and Appendages

Clovis employs a "brain and appendages" model to elegantly address the multi-chain dilemma.

The clearing layer Hub functions like a central bank, setting rules, managing the ledger, and controlling risks to ensure economic logic is consistent and fair.

The settlement layer Spoke acts like branches spread across various locations, directly interacting with users. When Bob borrows on Base, the local vault immediately disburses funds because the Hub has confirmed he has sufficient collateral on Arbitrum.

In Clovis's system, Bob no longer manages multiple offices but has a unified global account. When he deposits ETH on Arbitrum, global credit updates in real-time; when he discovers an opportunity on Base, he can borrow or trade directly. The boundaries between chains quietly dissolve.

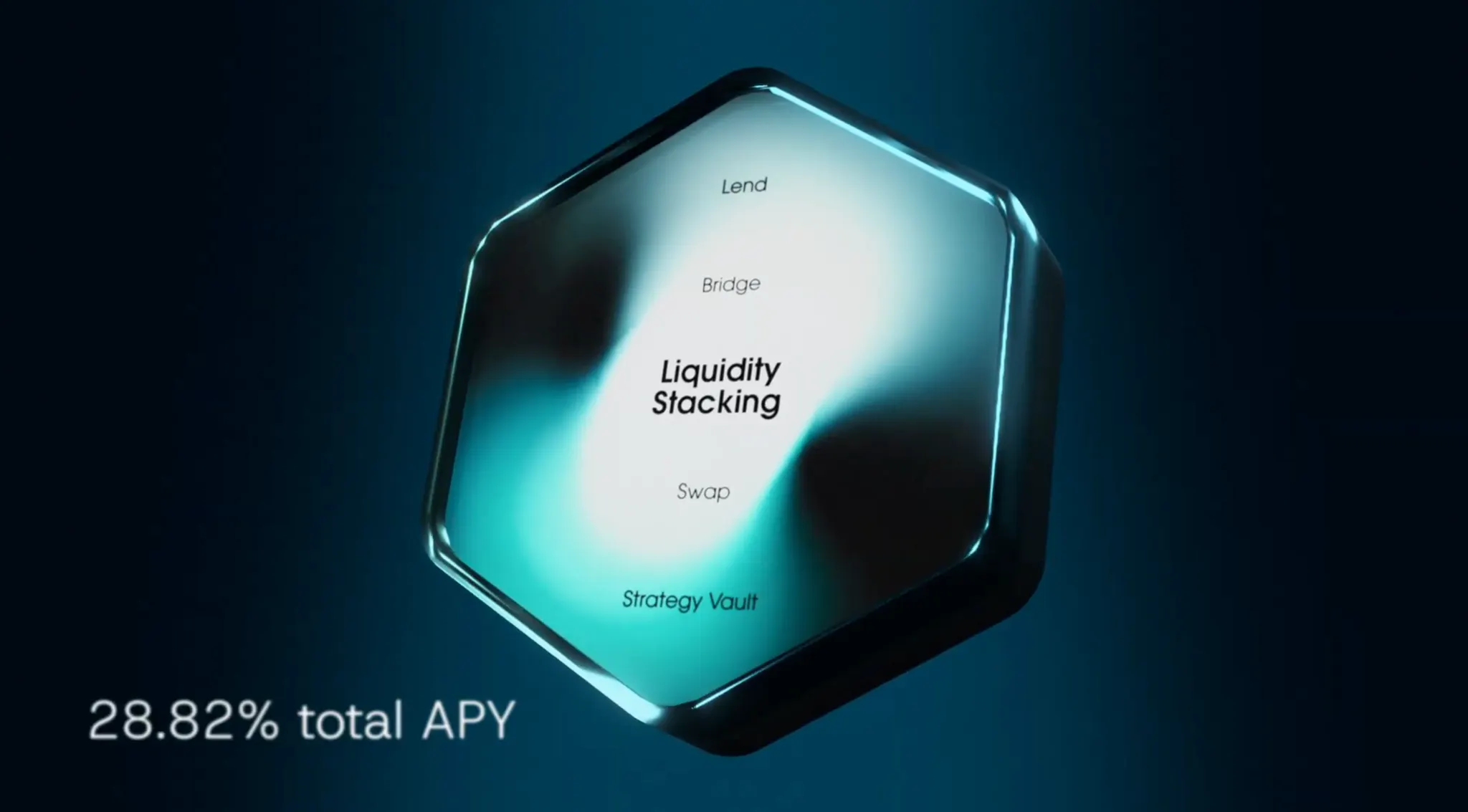

Based on a dual-layer architecture, Clovis has created four core products with deep integration and shared liquidity, aiming to ensure that every piece of capital operates efficiently and earns compounded returns.

Clovis Market (lending) serves as the cornerstone of liquidity, aggregating deposits from all chains to form a globally shared fund pool. Users deposit on Chain A and receive interest-bearing cloTokens, which can be borrowed instantly on Chain B. The shared fund pool achieves a globally unified interest rate, ending the fragmented status quo.

Clovis Exchange (DEX) is a revolutionary cross-chain exchange. Liquidity providers can directly create trading pairs with interest-bearing cloTokens, simultaneously earning quadruple returns: lending interest, trading fees, cross-chain fee sharing, and asset management returns, achieving the ultimate extraction of capital efficiency.

Clovis Transport (cross-chain) is not just a cross-chain bridge but an endogenous settlement network. By utilizing local liquidity buffers from each chain, it enables instant cross-chain transfers and organically integrates with lending and trading flows, reducing high-cost proactive cross-chain operations through intelligent rebalancing.

Clovis Vaults (asset management) serve as a yield enhancement layer, automatically deploying idle capital to external blue-chip DeFi protocols, earning zero-friction bonuses, and converting idle capital into additional returns without affecting liquidity.

Rebalancing Mechanism: The Invisible Efficiency Engine

To maintain a physically decentralized yet logically unified global liquidity pool, a powerful intelligent scheduling system is essential. Clovis Rebalancer is this invisible efficiency engine.

Clovis Rebalancer employs a multi-layered, market-oriented adaptive regulation strategy.

First, it sets healthy target positions for local inventories on each chain. When user behavior causes inventories to deviate from the optimal range, the system prioritizes economic leverage adjustments: it imposes a dynamic "deviation penalty" on withdrawal behaviors that exacerbate the imbalance and incentivizes subsequent depositors with part of the penalty, forming a market-based feedback loop that encourages users to maintain balance voluntarily.

Only when economic means are insufficient will Clovis Rebalancer initiate "forced bridging," intelligently selecting the third-party bridge with the lowest cost and optimal path to mobilize funds and restore balance.

This mechanism transforms the greatest friction point of cross-chain operations into a background automatic execution of occasional system maintenance tasks.

Security and Risk Control: An Isolated Defense System

In a complex cross-chain system, security is the cornerstone of innovation. Clovis's Hub-and-Spoke architecture inherently possesses a risk isolation mechanism.

The Hub, as the clearing layer, is responsible for bookkeeping and executing logic, not directly exposed to single-chain risks. The vaults on each Spoke chain are physically isolated; even if an extreme issue arises on a certain chain or asset, the risk will be contained within the local buffer zone, preventing contamination of the global liquidity pool. The Hub can immediately suspend interactions with that chain to protect system security.

Additionally, a clear global clearing process, reliable oracles, and strict asset caps collectively construct a multi-layered depth defense system.

Market Positioning: Not Just a Protocol, But an Infrastructure

It is not fair to simply view Clovis as a competitor to Aave. Clovis has pioneered an entirely new category: cross-chain clearing and execution infrastructure.

Compared to other protocols focusing on cross-chain liquidity for stablecoins, Clovis's vision is grander: to provide a unified liquidity settlement layer for all assets and various DeFi primitives (lending, trading, cross-chain). Competitors are like building intercity high-speed railways, while Clovis is dedicated to constructing a national financial clearing system.

Clovis's core advantage lies in providing plug-and-play liquidity capabilities for emerging ecosystems. New L2s only need to integrate once to have a fully functional and liquid DeFi ecosystem on launch day, completely bidding farewell to the cold start dilemma.

Ecosystem Strategy: Building the Future Together with Top Infrastructure

Clovis's grand vision is not a castle in the air but is built on deep collaboration with top infrastructures.

It cleverly utilizes mature cross-chain messaging layers like Wormhole and Layerzero to ensure secure transmission of instructions; during rebalancing, it intelligently aggregates mainstream cross-chain bridges like Stargate and CCTP to find the optimal path.

The core of its ecosystem strategy is to become the Chief Liquidity Officer (CLO) for new chains. By providing one-stop solutions for emerging L1/L2s, Clovis can not only rapidly expand network coverage but also form deep binding with new ecosystems, sharing the dividends of growth.

Business Model: A Proven Value Flywheel

Clovis's business model is clear and has been initially validated by the market. Its predecessor, Yei Finance, as a leading protocol in the Sei ecosystem, achieved over $400 million in TVL and $5.5 million in protocol revenue, demonstrating its product-market fit.

Clovis's revenue sources are diverse and sustainable, primarily including: lending interest margins, trading fees, and cross-chain service fees. As this mature model expands to more mainstream chains, its revenue potential is expected to grow exponentially, with an estimated annual revenue of $15.38 million by 2026.

As the creator of the cross-chain liquidity protocol Clovis, Yei Finance announced that its token CLO will launch on Binance Alpha for trading on October 14, 2025, at 19:00 (UTC+8), and at 19:30 (UTC+8) on the Binance contract platform for CLOUSDT perpetual contracts, with a maximum leverage of up to 50 times. A token airdrop will also be available for qualified users. For more details, please see the Binance announcement: https://www.binance.com/zh-CN/support/announcement/detail/afc87b1d3dbe4280bfdee237a017a013

Ultimate Vision: Paving the Way for the Next Billion Users in DeFi

Clovis's near-term roadmap focuses on integrating more mainstream chains, deepening blue-chip protocol integration, and optimizing Clovis Rebalancer. However, its ultimate vision goes far beyond this.

Clovis's final battle is to transform DEX from merely a trading function into a truly decentralized exchange on-chain under the premise of complete self-custody, providing a seamless liquidity experience comparable to top centralized exchanges. In the future, when users interact with Clovis, they will not need to worry about the underlying chains, Gas Tokens, or cross-chain bridges. They will only face a unified financial account that can mobilize all on-chain assets globally from a single interface, executing any operation from spot trading to leveraged lending.

This is not only a significant leap in the DeFi user experience but also a crucial step towards mass adoption. By completely hiding complexity in the backend, Clovis is paving the way for the next billion users in DeFi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。