Written by: Tia, Techub News

"This 'de-pegging storm' is actually a localized event on Binance: USDe on Bybit briefly dipped to 0.92 but quickly returned, while the main liquidity pool on Curve remained almost rock solid, with price fluctuations of only 0.3%. Other exchanges like Kraken and OKX were hardly affected."

The event occurred on the morning of October 11, 2025. The global crypto market experienced severe volatility due to external negative factors (such as Trump's comments on tariffs), leading to a sharp decline in BTC and ETH. Some whales or institutional users accumulated large positions through leveraged trading and circular lending. When prices fell rapidly, the liquidation engine was triggered, resulting in a massive sell-off of USDe, which in turn caused USDe to de-peg. The price of USDe on Binance once plummeted from nearly 1 dollar to 0.66.

However, if we broaden our perspective to the entire ecosystem, we find that this 'de-pegging storm' is actually a localized event on Binance: USDe on Bybit briefly dipped to 0.92 but quickly returned, while the main liquidity pool on Curve remained almost rock solid, with price fluctuations of only 0.3%. Other exchanges like Kraken and OKX were hardly affected.

Why did USDe de-peg on Binance?

In this round of USDe de-pegging, the high-leverage product design on Binance played a facilitating role.

In September, Binance launched a marketing campaign offering an APY of 12% on USDe. There were three ways to increase leverage by participating in this campaign:

- VIP loan, which can achieve 3.5 times leverage through circular lending;

- Easy lending, which can achieve 3.5 times leverage through circular lending;

- Leveraged trading, where large users can achieve 5 times leverage.

Some institutions and large users amplified their risk exposure through VIP Loan, Easy Lending, and leveraged trading. Since these products allow users to engage in circular lending or leverage at high multiples, these high-leverage positions are easily subject to concentrated liquidation when the market fluctuates.

Especially at the moment when the price of USDe began to loosen, the system would trigger a forced liquidation mechanism: circular lending users, in order to prevent liquidation, were forced to sell their collateralized assets, including USDe itself. Since these sell-off actions usually occur within a short time frame, the market's absorption capacity is insufficient, creating a "chain reaction" of downward pressure. In short, the initial price decline triggered liquidations, which in turn exacerbated the price drop, forming a vicious cycle.

'VIP Loan' and 'Easy Lending' had little impact, while 'Leveraged Trading' was the disaster zone

benmo.eth, in a series of analytical articles on the de-pegging of USDe from the perspective of lending and leveraged trading, stated that for these three products, 'VIP Loan' users were in a disaster-free zone. The funding side was unaffected. 'Easy Lending' had a minor impact, while 'Leveraged Trading' was the disaster zone.

'VIP Loan' is an institutional-level circular lending product, essentially a peer-to-peer over-the-counter credit line, with users mostly being large players or market makers with risk control systems. Although it nominally allows for 3.5 times leverage, the lending process typically involves net position management within the account, with collateral and liabilities monitored in real-time within the system, and not all converted to USDe. In other words, this type of funding did not form a concentrated "USDe buying leverage chain," and large players often reduce or adjust their positions before signs of de-pegging appear, so there was essentially no chain liquidation here.

'Easy Lending' is a semi-automated circular lending product aimed at retail or small to medium institutions, where users can automatically borrow more USDe by collateralizing USDe to earn interest or participate in subscriptions. Due to its more mechanical circular logic (the system automatically cycles), some funds were indeed repeatedly leveraged up to 3.5 times, but the overall funding volume was limited, and a large proportion of the borrowed USDe was redeposited back into Binance to earn fixed returns (e.g., 12% APY activity), forming a "locked-up leverage," which actually suppressed liquidity. Therefore, while there were localized liquidations during the de-pegging, it did not create systemic selling pressure like leveraged trading did.

The real trigger for the de-pegging appeared in the leveraged trading sector. Binance's leveraged products allow users to use mainstream assets like BTC and ETH as collateral to borrow USDT, then buy USDe or participate in circular arbitrage. On the surface, this is a safe two-way market, but since Binance's account system uses a unified margin mechanism, it means that users' positions across contracts, leverage, and lending share risks.

Thus, when BTC and ETH rapidly declined, those whale accounts using high leverage in circular trading first faced margin calls. The liquidation engine began to sell USDe to repay USDT liabilities, rather than buying back. As liquidations were triggered, the system continuously dumped USDe on the spot market, causing a spiral price drop.

The initial drop was not fatal, with USDe sliding from 1 dollar to 0.91 dollars, but as it broke below the critical liquidation threshold of 0.82 dollars (corresponding to the forced liquidation line for 5 times circular lending), the concentrated liquidation "dam break effect" completely erupted. Whale positions exploded in a chain reaction, and the selling pressure swept across the entire market like a flood, ultimately crashing the price to 0.66 dollars in just a few minutes.

Why did the price of USDe on Binance plummet, but the decline on Bybit was limited, and the on-chain price hardly moved?

USDe is a stablecoin that can be minted and redeemed on-chain at a 1:1 ratio at any time. This means that if you have enough underlying collateral (such as ETH, stETH, USDT), you can directly exchange it for USDe at the protocol level, and vice versa.

Due to this mechanism being open and automated, the on-chain price generally does not deviate significantly from 1 dollar for long. When the market price is below 1 dollar (for example, 0.99 dollars), arbitrageurs can buy USDe on the secondary market and then redeem it for 1 dollar worth of underlying assets, immediately profiting from the difference. As long as the arbitrage cost (including gas and fees) is below 0.1%, arbitrageurs will automatically initiate operations.

The special situation on Binance at that time was: during the de-pegging period (the morning of October 11), ETH withdrawals were blocked, meaning the path to transfer ETH out of Binance for minting/redemption was blocked.

Arbitrageurs were unable to complete the "buy low and redeem" closed loop within Binance, so the price of USDe on Binance was not corrected by arbitrage forces, leading to a worsening de-pegging.

In contrast, the situation on Bybit was different: Bybit itself integrated the USDe mint-redeem module, allowing arbitrage bots to complete the "buy low and redeem" operation internally within the exchange.

Thus, when arbitrageurs noticed that the price of USDe on Binance dropped to 0.8 dollars and 0.7 dollars, they cleverly transferred USDe via BSC to Bybit and sold it there.

This wave of selling pressure caused the price on Bybit to briefly drop to 0.92 dollars, but due to internal automated arbitrage, the price was quickly bought back and re-pegged close to 1 dollar.

Binance's official characterization and compensation

Subsequently, Binance officially acknowledged in an announcement that this de-pegging was not entirely due to market fluctuations, but was indirectly triggered by the platform's own withdrawal blockage mechanism. According to Binance's compensation statement, during the period from 05:36 to 06:16 (UTC+8) on October 11, 2025, due to the temporary restriction of the ETH withdrawal channel, users were unable to transfer USDe out for on-chain redemption, interrupting the arbitrage path and causing a sharp decline in the internal price.

This 40-minute period became the core explosion period of the entire de-pegging, and Binance identified it as a "non-market behavior period," compensating affected users for the difference in losses and liquidation fees.

As a result, the on-chain price of USDe remained stable, and Bybit, due to its internal mint-redeem mechanism, experienced limited declines, while only Binance formed a price island under the blockage of the arbitrage path, ultimately triggering chain liquidations and price collapse.

Aave's oracle and liquidation mechanism: protecting lending users from exchange volatility impacts

Although USDe briefly deviated from its peg on Binance, its stability remained robust in the on-chain lending market. Taking Aave as an example, its USDe and sUSDe lending pools experienced almost no cascading liquidations during the event. Other USDe-related assets (such as pt-sUSDe) have prices that are highly dependent on USDe, with limited inherent risk.

The lending funds for USDe on Aave are mainly distributed across Ethereum (approximately 1.1 billion dollars) and Plasma (approximately 750 million dollars), with sUSDe deposits on Ethereum around 1 billion dollars. Some users employed circular lending strategies, using USDe or sUSDe as collateral to borrow other stablecoins, then converting the borrowed funds and redepositing them into USDe/sUSDe, thereby forming a leveraged yield amplification strategy.

From Aave's oracle data, the price of USDe remained around 1 dollar, while the price of sUSDe stabilized at about 1.2. This indicates that lending users on Aave were hardly affected by the temporary deviation of USDe on Binance. Through monitoring third-party data platforms, although the overall market liquidation volume reached approximately 192 million dollars on October 10-11, liquidations related to USDe or sUSDe were minimal and negligible.

Aave's pricing logic for USDe is not hard-coded at 1 dollar, but rather calculated through a combination of oracles: USDe price = Chainlink USDe/USD oracle × sUSDe/USDe internal exchange rate × CAPO adjustment factor. This mechanism can reflect the weighted average price across multiple markets in real-time, avoiding impacts on lending users from short-term exchange volatility or liquidity imbalances. In fact, during the period of October 11-12, the Chainlink USDe/USD price stabilized in the range of 0.992-1.000 dollars, with almost no de-pegging risk.

Hard coding USDe = 1 or Not

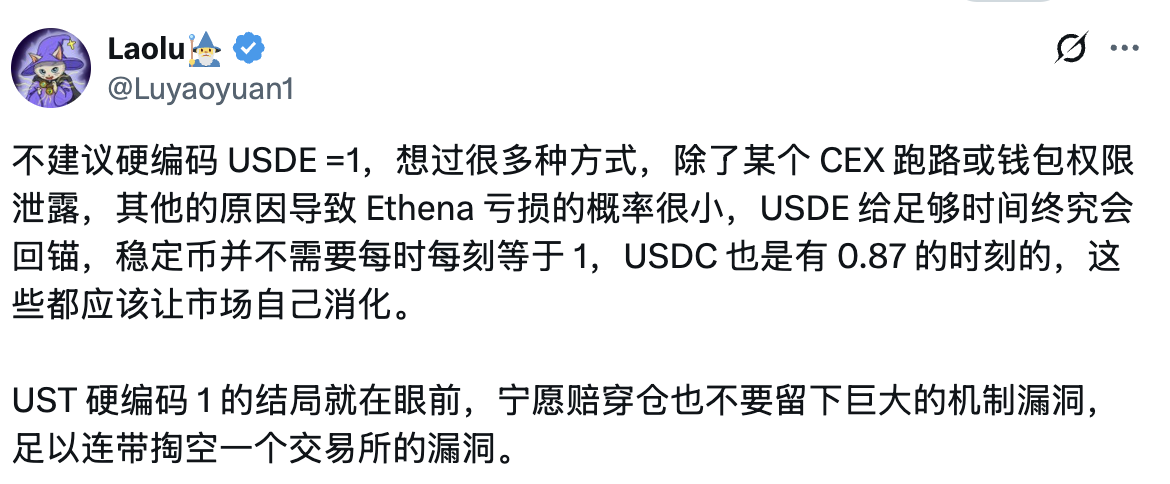

This USDe de-pegging event also exposed the tension between stablecoin design philosophy and the leveraged ecosystem. Laolu believes that stablecoins should not be rigidly pegged to 1, but should rely on market mechanisms and arbitrage mechanisms to gradually return. Even if there is a temporary deviation, USDe still has enough time and mechanisms to re-peg, and the market will ultimately self-correct. A rigid setting of 1 may instead embed systemic vulnerabilities, which, when extreme market fluctuations occur, could trigger chain liquidations like UST.

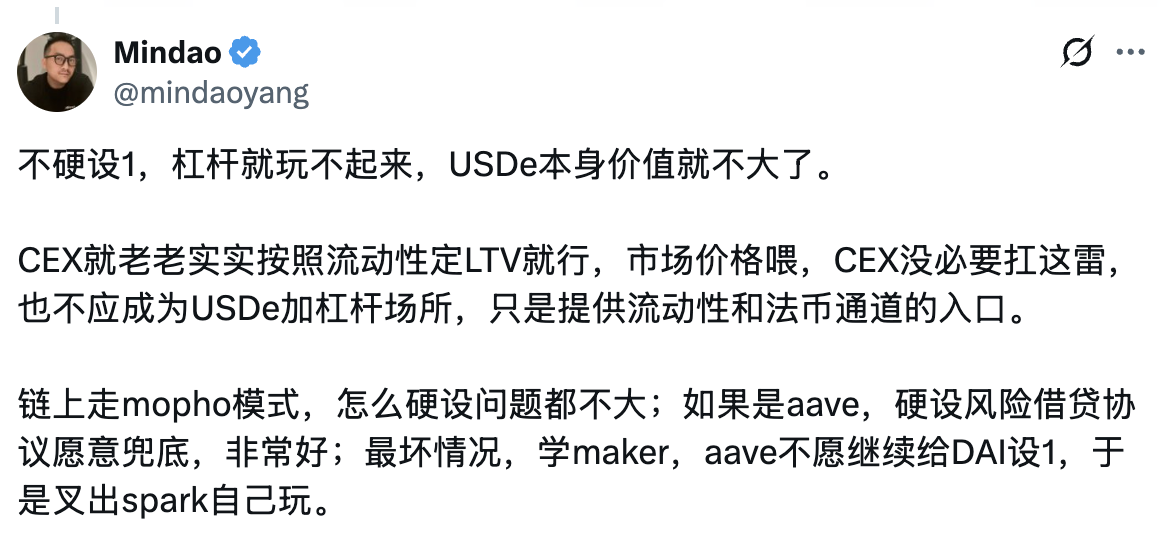

On the other hand, Mindao pointed out that if a stablecoin cannot maintain a value close to 1, its predictability as collateral and leveraged asset will significantly decrease, making it difficult for products like leverage and lending to operate normally. In a centralized exchange environment centered on leverage and lending, hard-setting 1 is an engineering compromise: it provides users with a predictable value benchmark, ensuring that collateral and liquidation mechanisms can be executed smoothly.

However, even so, centralized exchanges should not bear the systemic stability responsibility of USDe; their role should only be to provide liquidity and fiat channels, while on-chain protocols are the ultimate guardians of stablecoin pegs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。