Let me share my thoughts on the U.S. stock market and some opportunity ideas after the "TACO" incident.

First, I want to talk about "TACO," which has recently become a popular term on Wall Street. Trump Always Chickens Out is a sarcastic phrase used to describe how Trump initially shouts about increasing tariffs and adopting tough policies, causing market panic, but then backs off or eases up when the market drops and pressure mounts.

In fact, this time, early Saturday morning in the Asia-Pacific time zone, creating a policy expectation shock is a common political maneuver: giving the market a "first-mover shock" to force China to respond in negotiations while also leaving himself some buffer space. Then over the weekend, Vance softened his stance. This typical short-term political game has become quite familiar, but this time it triggered a significant shock in the U.S. stock market and cryptocurrency, which was unexpected. Therefore, during our company meeting today, we established a strict rule: to take a flat position over the weekend, retreating to leave liquidity available to prevent such uncertain events from happening again.

To summarize, Trump's actions have several intentions:

• Apply pressure and take control of the agenda: Start with strong words, forcing the other side to react and make statements;

• Create negotiation leverage: Make the market and the other side feel that if they do not concede, there will be serious consequences;

• Test the red line: See how much China can bear regarding rare earths and export controls, and whether it can make concessions in negotiations;

• Guide market psychology: When the market drops due to tariff concerns, he may choose to "concede" to stimulate a rebound (TACO-style operation).

Therefore, we not only need to analyze and dissect this typical game strategy used by Trump, but also flexibly improve our investment strategies and ideas. Since we cannot prevent every move, the best approach is to simply exit the market at critical time points and not participate.

📝 The impact of this "TACO" on the U.S. stock market and market confidence

In terms of market confidence, I believe the impact this time is likely to be a typical "short-term panic + medium-term recovery":

1️⃣ Short-term: Market sentiment is suppressed, leading to a "risk appetite withdrawal."

Because this touches on the highly sensitive areas of rare earths, technology, and supply chains between China and the U.S., any combination of "export restrictions + increased tariffs" will put pressure on sectors like technology, semiconductors, and electronics. This is similar to the significant drop seen in the S&P 500 recently. Investor panic may increase in the short term, and "safe-haven buying" (such as U.S. Treasuries and gold) will rise.

2️⃣ Medium-term: Potential softening of policies and easing of negotiations may drive a recovery rebound.

If Trump ultimately does not implement the tariffs or if China makes concessions on rare earth exports, then this "first pressure then release" path could lead to a wave of "buying after a drop"—isn't this the TACO trading opportunity of "buying when the market is most panicked"? Moreover, many strategic funds and hedge funds may also repeatedly bottom-fish and clear positions during this wave of policy fluctuations, engaging in swing trading.

3️⃣ Long-term, the fundamentals remain key.

Whether the market can stabilize depends on the "degree of concessions and transparency" between China and the U.S. regarding rare earths, technology exports, and supply chains. If it is just tough talk without concrete policies or eventual concessions, market confidence may experience short-term fluctuations but will not collapse. Conversely, if substantial restrictions and retaliation are truly implemented, it could evolve into a larger systemic risk.

Overall, I do not view this operation as a signal of "collapse in U.S. stock market confidence," but it is indeed a catalyst that exacerbates volatility and shakes short-term confidence. As a U.S. stock investor, I will remain vigilant, strictly control positions, and keep some liquidity on hand for opportunities.

At the same time, I will observe several key points:

• How does the U.S. stock market react at the opening: If it opens under heavy pressure again, it may indicate that market fears regarding policy implementation remain strong;

• The Chinese government's response + whether rare earth export policies will tighten further or make concessions;

• Whether negotiation news in the coming days or weeks can bring about "softening steps," especially the APEC meeting at the end of the month.

🎯 Opportunities may exist in U.S. stocks related to rare earths and key minerals.

Because rare earths and key minerals (including rare earths, lanthanum, neodymium, praseodymium, heavy rare earths, magnetic materials, and permanent magnets) inherently carry "strategic + industrial + policy orientation" attributes, there may be potential favorable factors in the recent game. Here are a few representative companies that I personally think are worth keeping an eye on.

1️⃣ MP Materials (NYSE: #MP)

MP Materials is the largest rare earth mining company in the U.S. and the only rare earth asset operator in the U.S. with both mining and processing capabilities. It owns the Mountain Pass mine in California and is advancing the integration of the complete chain downstream, including processing magnets and permanent magnets. Recently, it has had significant cooperation with the U.S. Department of Defense: the DoD invested $400M to become its largest shareholder and set a price floor of $110/kg for NdPr (lanthanum-praseodymium oxide). This price floor can reduce the impact on #MP from market price suppression due to Chinese subsidies. It also has a partnership with #Apple (supplying rare earth magnets) to ensure the stability of its downstream orders.

Investment logic:

• National security + non-China supply chain

In the context of the U.S.-China tech war and supply chain localization, #MP's vertical integration + U.S. domestic rare earth resource attributes make it a favored target for policy.

• Guarantee mechanism + government commitment

The price floor commitment + government investment + contract order guarantees can, to some extent, reduce the damage caused by significant price fluctuations on the company's operations.

• Long-term upward demand for rare earths/magnetic materials

From electric vehicles, wind power generation to robotics, defense, and aerospace components, rare earths are indispensable, providing solid long-term demand support.

• "First to eat crabs + technological scale barriers"

Although many companies talk about entering the rare earth industry, the technical barriers, capital investment, environmental approvals, and policy permits are very challenging. But #MP is already on the path, and if China tightens export controls on rare earths or imposes new restrictions in the future, companies like MP may usher in an investment trend of "supply substitution."

2️⃣ USA Rare Earth (#USAR)

USA Rare Earth is another well-known rare earth and permanent magnet supply chain company in the U.S., attempting to layout a full industry chain plan in "mining + magnet manufacturing." The company proposes to build mining and magnet facilities in Texas, aiming to complete a more comprehensive chain from the U.S. Recently, company executives stated they are maintaining close communication with the Trump administration, possibly seeking policy and funding support.

If the government is truly willing to support "U.S. domestic rare earth + magnet manufacturing," #USAR could be one of the "potential dark horses."

3️⃣ Other noteworthy targets, including some small companies and ETFs

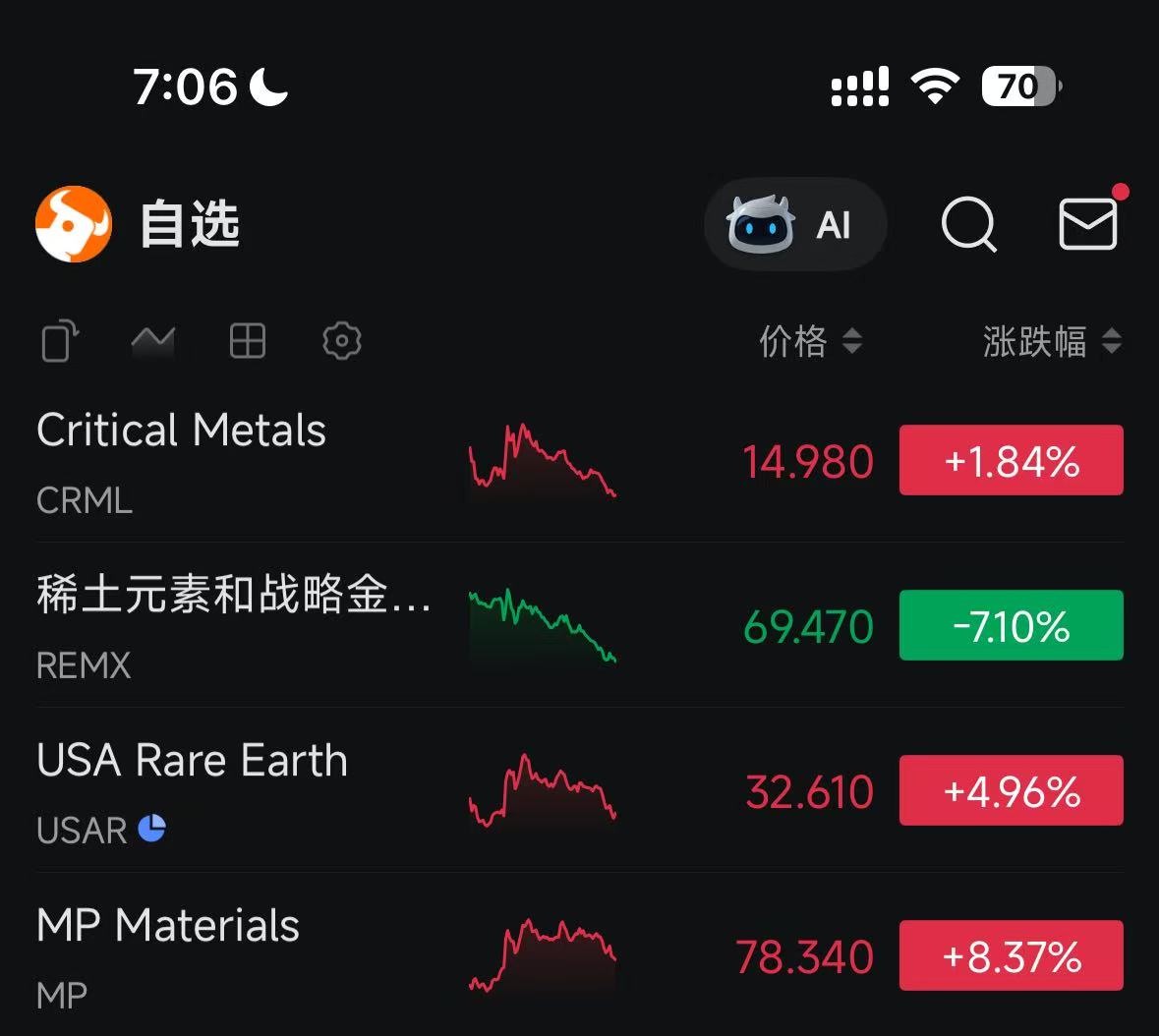

• Critical Metals (#CRML): Recent media reports suggest that the U.S. government may invest in this company (Greenland's rare earth project) to ensure control over strategic minerals.

• Rare earth strategic metals ETFs, such as VanEck Rare Earth (#REMX), can also be considered as a way to diversify risk.

Overall, the recent TACO is merely talk and has not escalated into a serious conflict, so we still need to observe. In terms of operations, it is advisable not to take large positions, operate with light positions, maintain some backup, and keep liquidity. Always pay attention to policy and news developments. Watch for several key points: how China's rare earth export policy will change next; whether the U.S. government or Department of Defense will truly implement subsidy contracts and procurement; whether high-level negotiations will take place in international settings (such as APEC). Nowadays, being cautious is the best approach!

Currently, #Mystonks has the stock code for the leading rare earth company MP Materials (NYSE: #MP), which can be traded. For the other three, only traditional U.S. stock brokers like Futu Securities have them for now.

For trading U.S. stocks, I choose to use the RWA tokenized platform #Mystonks to invest in the U.S. stock market: http://mystonks.org/?code=Vu2v44

Message me for early access to our U.S. stock research group, free investment banking research reports, and passwords! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。