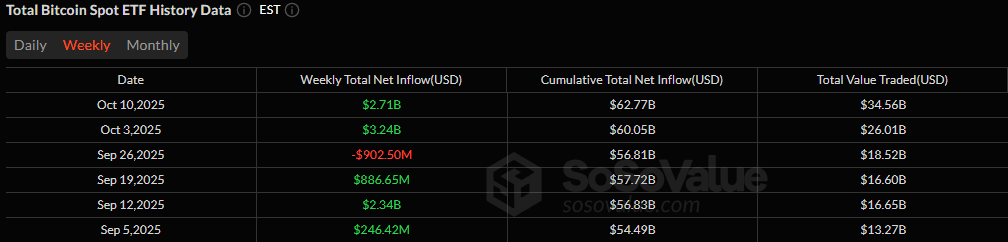

Momentum in crypto exchange-traded funds (ETFs) continued to build through the second week of October, with investors piling into bitcoin and ether funds despite Friday’s pullback. Institutional demand showed no signs of fatigue as bitcoin ETFs clocked $2.71 billion in inflows and ether ETFs drew $488.27 million.

Bitcoin ETFs: Blackrock Leads Another Blockbuster Week

Bitcoin ETFs recorded inflows every day between October 6 and October 9, before ending the week slightly in the red on October 10. Even so, the five-day tally was overwhelmingly positive.

BlackRock’s IBIT once again dominated the market, pulling in a staggering $2.63 billion, accounting for nearly 97% of the week’s total inflows. Fidelity’s FBTC followed with $88.96 million, while Bitwise’s BITB added $42.68 million. Grayscale’s Bitcoin Mini Trust attracted $25.97 million, and Vaneck’s HODL saw $15.10 million in gains. Smaller contributions came from Invesco’s BTCO with $7.51 million, Wisdomtree’s BTCW with $5.99 million, Valkyrie’s BRRR with $4.81 million, and Franklin’s EZBC at $3.64 million.

Bitcoin ETFs Weekly Inflows. Source: Sosovalue

However, not all funds ended the week in the green. Grayscale’s GBTC (-$93.37 million) and ARK 21Shares’ ARKB (-$11.83 million) put a little blemish on another billion-dollar week. Despite the late dip on the last trading day of the week, total bitcoin ETF net assets surged to $158.96 billion, highlighting robust investor confidence.

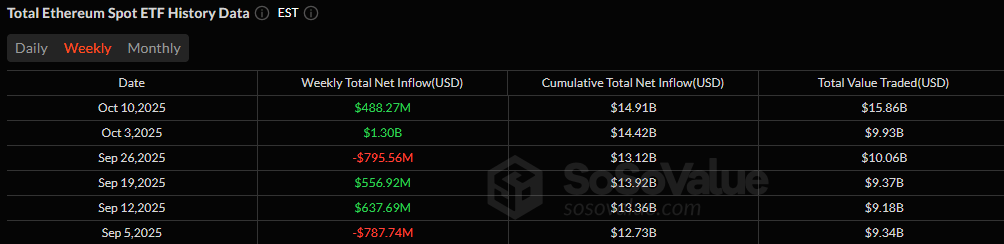

Ether ETFs: Solid Gains Despite Friday’s Pullback

Ether ETFs enjoyed four consecutive days of inflows before Friday’s correction. The group added $488.27 million in net inflows for the week, led by Blackrock’s ETHA, which dominated with $638.07 million. Grayscale’s Ether Mini Trust gained $11.75 million, with modest inflows of $983.09K and $416.20K for 21Shares’ TETH and Vaneck’s ETHV.

Ether ETFs Weekly Inflows. Source: Sosovalue

Significant outflows trimmed the week’s total, with Fidelity’s FETH seeing a net weekly outflow of -$125.63 million. More net outflows for the week were seen on Grayscale’s ETHE (-$32.51 million), Bitwise’s ETHW (-$2.66 million), and Invesco’s QETH (-$2.16 million).

Despite that, net assets stood firm at $27.51 billion, showing continued strength in the ether ETF segment. Back-to-back weeks of billion-dollar inflows for bitcoin ETFs and significant inflows for ether ETFs show that institutional enthusiasm for crypto ETFs is once again on the rise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。