Due to the impact of the black swan event, last week closed with a long lower shadow big bearish candle, which changed the entire weekly chart pattern, so we should all remain calm here.

Weekly Level

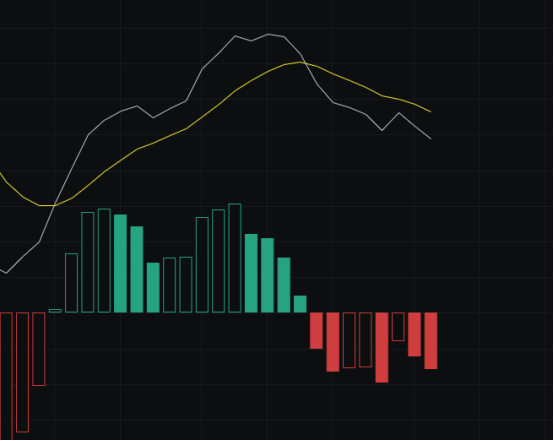

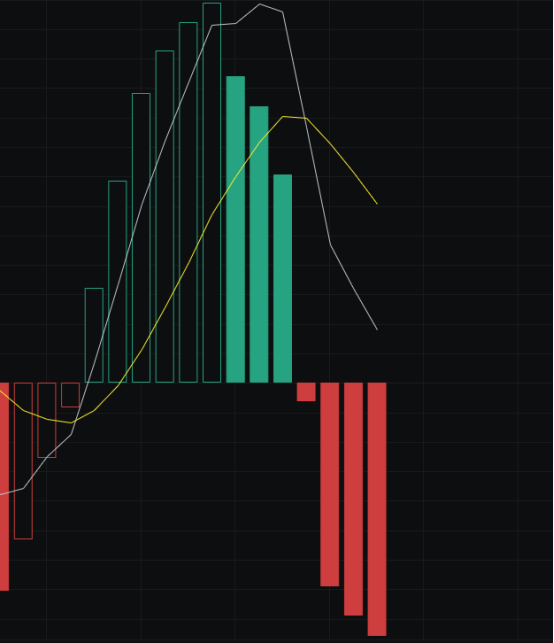

From the MACD perspective, the energy bars are moving downwards, and both the fast line and the slow line are under pressure, indicating a bearish trend on the MACD.

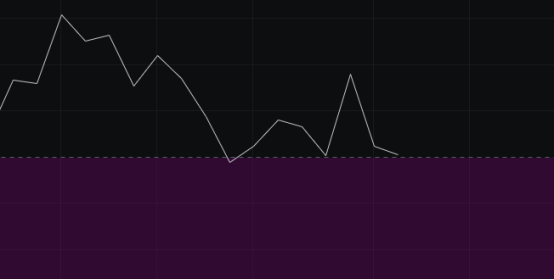

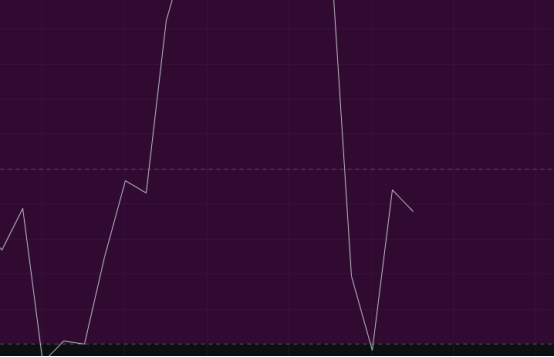

From the CCI perspective, the CCI has once again approached 100, marking the third time it has touched 100 during this wave of market movement. The previous two times resulted in rebounds, but since this is the third time, a rebound is not guaranteed.

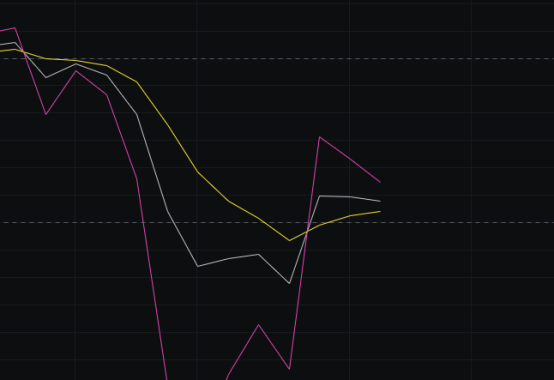

From the OBV perspective, there has been continuous outflow, and the fast line has already fallen below the slow line. Due to last week's bearish close, the OBV could not continue its upward movement, making the current position of the OBV quite unfriendly. The only friendly aspect is that the slow line has not flattened out, giving the OBV a glimmer of hope. We will observe whether the slow line continues to rise or flattens out.

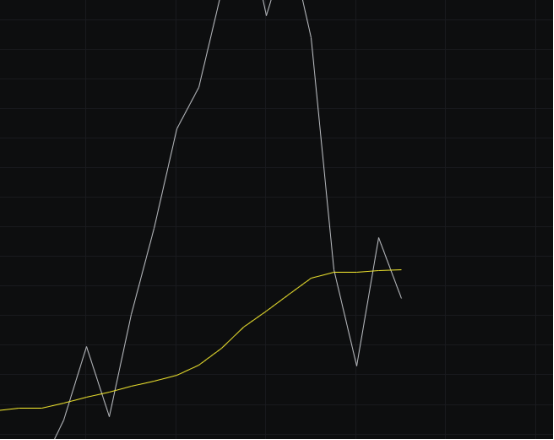

From the KDJ perspective, after the golden cross, the KDJ is currently in a flat state. It does not indicate any clear upward or downward movement and requires further observation.

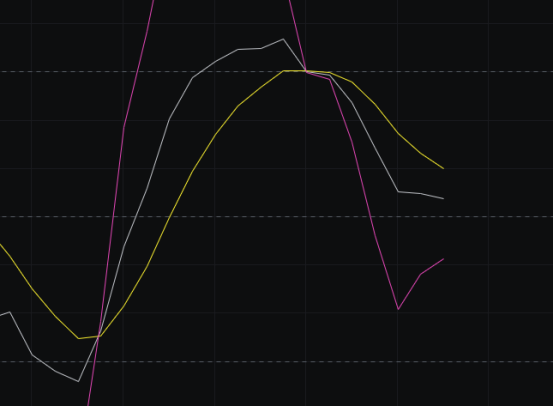

From the MFI and RSI perspectives, both indicators are in the neutral zone, allowing for movement either up or down. Pay attention to the final direction choice.

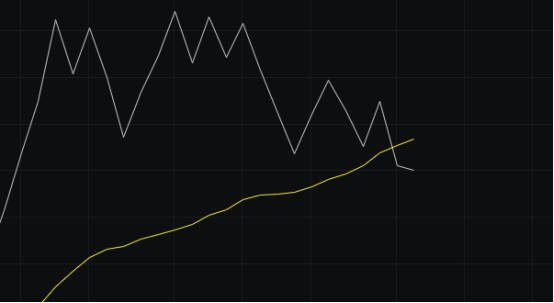

From the moving average perspective, last week's lower shadow broke through the 30 line, but ultimately rebounded and closed above the BBI. Although the pattern has been maintained, the lower shadow has already exhausted most of the bullish momentum, making it meaningless to look at this point. We will observe whether the BBI can continue to hold.

From the Bollinger Bands perspective, the upper band has flattened out, disrupting the upward trend, while the lower band is rising. It can currently be defined as wide-range fluctuations. We will observe whether the middle band can hold; if it cannot, it will approach the lower band.

Daily Level

From the MACD perspective, the energy bars are moving downwards, and both the fast line and the slow line are under pressure, indicating a bearish trend, similar to the weekly chart pattern. This could potentially develop into a downward trend with multi-period resonance.

From the CCI perspective, yesterday's rebound did not allow the CCI to rise above the zero line, indicating that the market is still weak. It is best to be cautious here.

From the OBV perspective, the fast line is currently below the slow line, while the slow line is flattening out. After flattening, it will choose whether to move up or down. We will observe the subsequent movement of the slow line.

From the KDJ perspective, the KDJ has fallen from a dead cross and is currently above 50. If it weakens, the KDJ will drop below 50 and continue downwards. We will see if it can hold above 50 in the next two days.

From the MFI and RSI perspectives, both indicators are near the neutral zone but overall are weak, indicating that the market situation is not ideal.

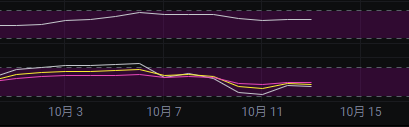

From the moving average perspective, several moving averages are currently tending to flatten out, also hovering in a direction choice. We will observe whether it chooses to move up or down.

From the Bollinger Bands perspective, the upper band is flattening out, and the lower band is also rising, similar to the weekly trend. We will observe whether the price can hold above the middle band; if it can, there is still a possibility of upward movement.

In summary: The big bearish candle from last week has caused a sudden halt in the upward movement, so we need to calmly observe the market. We also notice that the indicators are starting to weaken, so the focus should be on waiting and watching. Today's first target for the bulls is not to fall below 113800, the second target is to rise above 116000, with support at 113800-112000 and resistance at 116000-117000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。