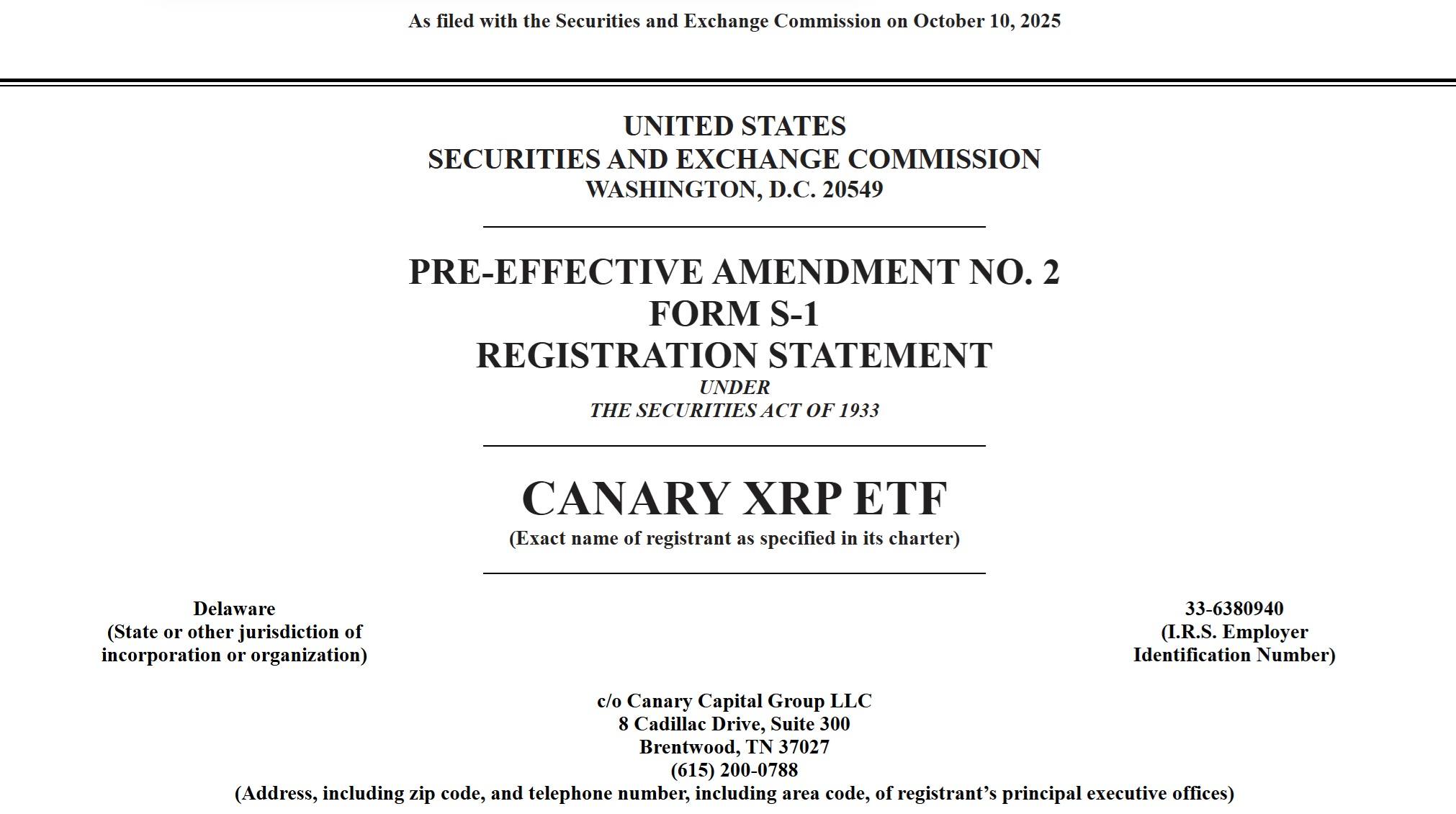

A wave of XRP spot exchange-traded fund (ETF) filings hit the U.S. Securities and Exchange Commission (SEC) on Friday, signaling accelerating institutional momentum toward regulated XRP exposure. Among the submissions, Canary Capital Group LLC filed pre-effective Amendment No. 2 to its Form S-1 registration statement for the Canary XRP ETF, a Delaware statutory trust structured to hold XRP directly and track its spot market value, net of expenses.

Filed on Oct. 10, the amendment outlines plans to list the XRP ETF’s shares on the Cboe BXZ Exchange under the ticker symbol “XRPC,” giving investors access to XRP’s price performance through a traditional exchange-traded format.

“The Canary XRP ETF is an exchange-traded product that issues shares of beneficial interest that trade on the Cboe BXZ Exchange Inc. The Trust’s investment objective is to seek to provide exposure to the value of XRP held by the Trust, less the expenses of the Trust’s operations and other liabilities,” the filing details, adding:

In seeking to achieve its investment objective, the Trust will hold XRP and establish its net asset value (NAV) by reference to the Coindesk XRP CCIXber 60m New York Rate.

“The Trust provides investors with the opportunity to access the market for XRP through a traditional brokerage account without the potential barriers to entry or risks involved with acquiring and holding XRP directly,” the filing further explains.

Moreover, the filing notes:

The Trust will not use derivatives that could subject the Trust to additional counterparty and credit risks.

The Canary XRP ETF will hold XRP in custody with Gemini Trust Company and Bitgo Trust Company, two regulated digital asset custodians. Pricing will be determined using the Coindesk XRP CCIXber 60m New York Rate, which aggregates real-time data from major XRP trading platforms. U.S. Bancorp Fund Services will serve as administrator and transfer agent, while U.S. Bank N.A. will act as cash custodian.

Although the filing highlights risks tied to XRP’s volatility and evolving regulatory oversight, analysts view the move as a pivotal step toward bridging cryptocurrency markets with regulated finance. If approved, the ETF could mark a milestone for institutional XRP access in the United States.

- What is the Canary XRP ETF and why is it significant?

The Canary XRP ETF is a proposed exchange-traded fund that directly holds XRP, offering investors regulated access to the cryptocurrency’s price performance without needing to buy or store XRP themselves, signaling a major move toward institutional crypto adoption. - Where will the Canary XRP ETF be listed and what is its ticker symbol?

The ETF is planned to be listed on the Cboe BXZ Exchange under the ticker symbol “XRPC,” allowing investors to trade XRP exposure through traditional brokerage platforms. - How does the Canary XRP ETF ensure security and compliance?

The ETF’s XRP holdings will be securely custodied by Gemini Trust Company and Bitgo Trust Company—both regulated digital asset custodians—ensuring compliance and minimizing counterparty risk. - Why do analysts view the Canary XRP ETF filing as a milestone for the crypto industry?

Analysts see this filing as a pivotal step in bridging traditional finance with cryptocurrency markets, potentially opening the door for broader institutional investment in XRP under a fully regulated U.S. framework.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。