This drop is actually a necessary cleansing for the market.

On one hand, potential system-level issues in exchanges, including Binance, have been identified and fixed during this volatility, reducing the likelihood of greater risks in the future. On the other hand, it has helped the entire market complete a new round of deleveraging.

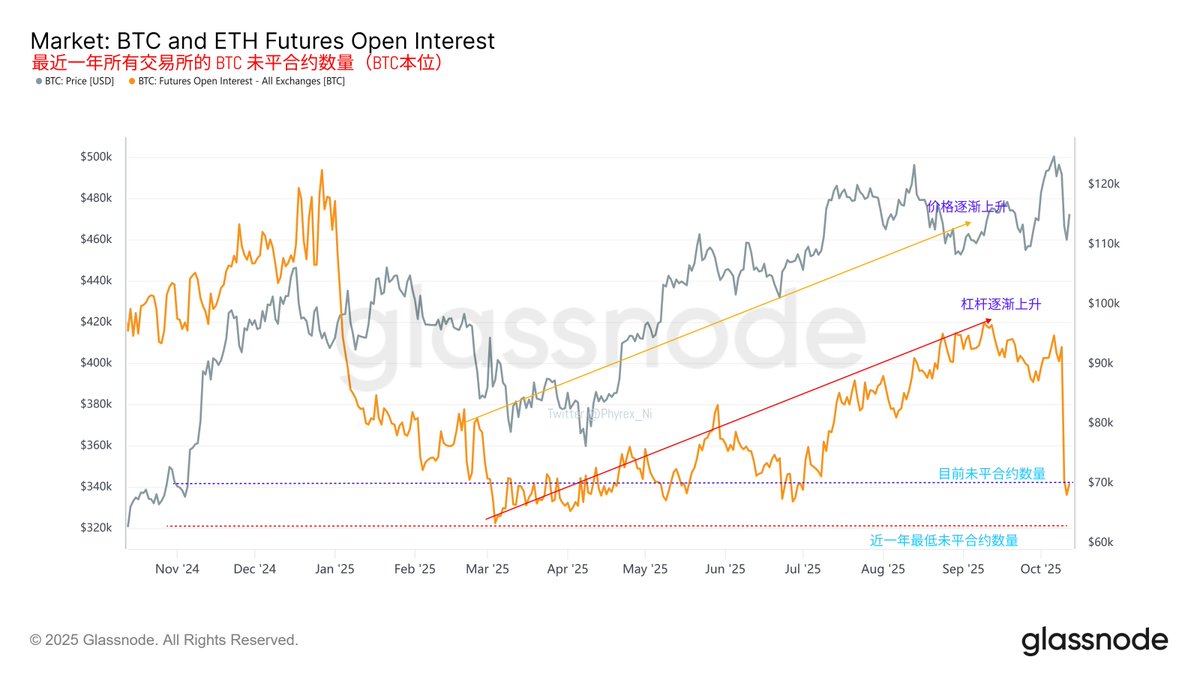

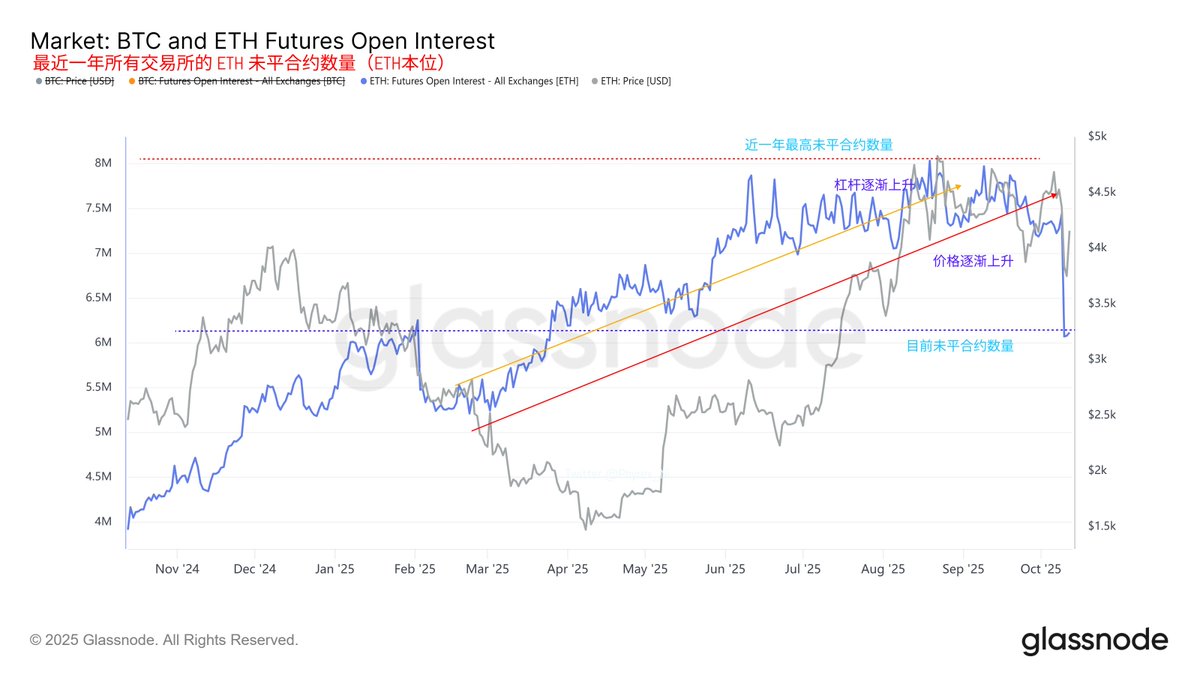

From the data, it is clear that the open contracts for $BTC have significantly decreased in a short period. Although it has not yet reached the lowest level in nearly a year, it is not far off. The deleveraging for $ETH is also notable, with the number of open contracts dropping by about 30% compared to its peak.

This means that a large number of speculative positions in the market have been cleared, either passively or actively. Although prices are under short-term pressure, this type of drop is more of a technical liquidation rather than a deterioration in fundamentals.

Structurally, the prices of BTC and ETH are oscillating at relatively high levels, and the withdrawal of leveraged funds means that the sources of volatility are decreasing, thereby reducing the probability of significant fluctuations in BTC and ETH.

Once the market completes this deleveraging process, new leverage space will gradually reopen. Typically, during this phase, prices tend to be relatively stable and more likely to rise.

In simpler terms, this deleveraging has actually made the market healthier, and the spot support for BTC and ETH has become more stable, potentially allowing for greater upward movement.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。