A historic short squeeze is sweeping the silver market.

Author: Ye Zhen

A historic short squeeze is sweeping the London silver market, with severe spot shortages pushing silver prices to unprecedented heights, breaking the record set in 1980 when the Hunt brothers attempted to manipulate the market.

According to Bloomberg data, the London spot silver price once rose by 0.4%, reaching a historic high of $52.5868 per ounce. This price surpasses the $52.50 peak set in January 1980 at the Chicago Mercantile Exchange (now defunct), when Texas billionaires the Hunt brothers attempted to corner the market by hoarding silver.

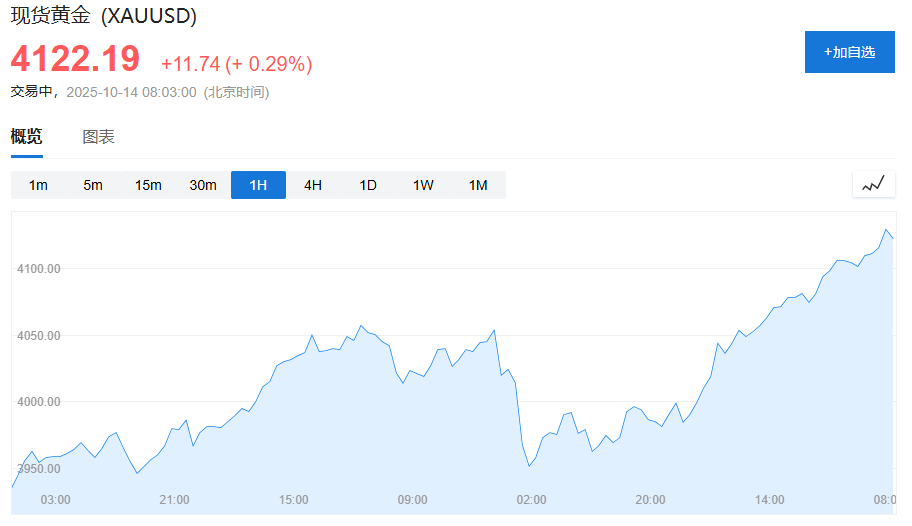

Driven by silver, spot gold also climbed to $4150 per ounce, setting a new historical high.

Wall Street Journal previously mentioned that under the combined effects of strong safe-haven demand, a surge in Indian buying, and concerns over potential tariffs from the U.S., London’s silver inventory has been rapidly depleted, leading to a global rush for silver amid this liquidity crisis.

At one point, the London spot price was $3 higher than the New York futures price, an unprecedented premium that prompted traders to take extreme measures—chartering cargo holds on transatlantic flights to airlift silver bars, a costly operation typically reserved for transporting gold. Although the premium fell back to about $1.55 in Tuesday morning trading, market tensions have not eased.

Liquidity Crisis in London, Borrowing Costs Soar

Liquidity in the London silver market has nearly dried up, putting immense pressure on traders holding short positions. Struggling to find physical silver for delivery in the market, they are forced to pay exorbitant rollover costs. Data shows that the one-month lease rate for silver in London (the cost of borrowing silver) has surged to over 30%, while the annualized overnight borrowing cost even briefly exceeded 100%.

“I have never seen anything like this before,” said Anant Jatia, Chief Investment Officer of Greenland Investment Management. “What we are seeing in the silver market is completely unprecedented, and there is almost no liquidity in the market.”

The extreme lack of liquidity stems from the sharp reduction in available silver inventory in London’s vaults. According to Bloomberg data, since mid-2019, the freely available silver inventory in the London market has plummeted by 75% from about 850 million ounces to only around 200 million ounces. Former JPMorgan Managing Director and precious metals trader Robert Gottlieb pointed out, “Banks are unwilling to quote each other, leading to extremely wide bid-ask spreads. This has created a significant liquidity shortfall.”

This round of short squeezing is the result of multiple converging forces.

First, against the backdrop of global economic uncertainty, investors have flocked to safe-haven assets like gold and silver to hedge against U.S. debt risks, fiscal deadlock, and currency devaluation risks. Secondly, the unexpected surge in demand from India in recent weeks has further drained London’s already tight inventory. Additionally, concerns over the U.S. government potentially imposing tariffs on key minerals, including silver, under Section 232 have led to some metals being pulled from the market early, exacerbating supply tightness. The London Bullion Market Association (LBMA) has issued a statement saying it is “actively monitoring the situation.”

Goldman Sachs Warns of Severe Adjustments

In the face of historic prices, market institutions have differing views on the future of silver. Bank of America analysts have raised their silver price target for the end of 2026 from $44 per ounce to $65, citing ongoing supply shortages, high fiscal deficits, and a low-interest-rate environment.

However, Goldman Sachs has issued a warning, stating that the current rally is primarily driven by physical tightness in the London market, and as large amounts of physical silver flow in from China and the U.S., this tightness is expected to ease in the next 1-2 weeks, but the adjustment process will be “extremely volatile.”

Goldman Sachs analysts wrote in a report: “The liquidity in the silver market is worse, with a scale about one-ninth that of gold, which amplifies price volatility. Without central bank buying as a price anchor, even a temporary drop in investment flows could trigger a disproportionate pullback.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。