Author: Eric, Foresight News

Jeff Yan, co-founder of HyperLiquid, shared some insights early yesterday morning regarding HyperLiquid's performance during the market crash over the weekend, mentioning that "this is the first time in over two years of HyperLiquid's operation that cross-margin auto-deleveraging (ADL) has been activated."

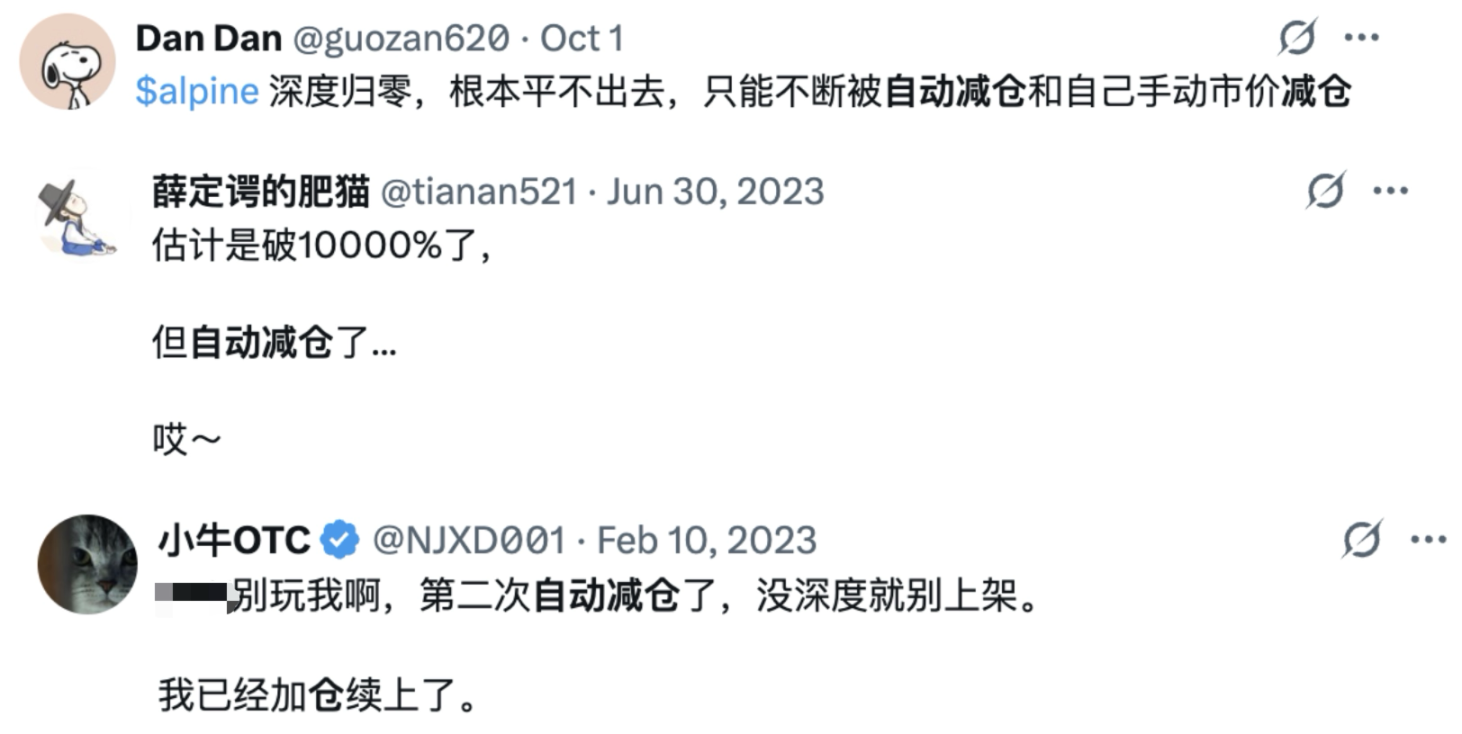

Auto-deleveraging, or automatic margin reduction (ADL), is something many centralized exchanges (CEX) dread and is a frequent topic of complaints among users on X. Of course, we can fully understand why people are complaining: auto-deleveraging means that the exchange forcibly closes users' positions, resulting in users "earning less." We often see complaints on X about exchanges triggering ADL, which prevents investors from realizing the returns they see on illiquid altcoin contracts.

Extreme market conditions always provoke new thoughts. This time, HyperLiquid did not experience any issues with trading or withdrawals during the crash, while some perpetual DEXs were forced to suspend withdrawals, prompting many to reconsider the true value of ADL.

Insurance Fund and ADL

Since GMX, protocols that allow external deposits have almost become standard for perpetual DEXs, essentially serving as an on-chain version of an "insurance fund."

For example, during last week's extreme downturn, a large number of leveraged long positions were liquidated, but the market simultaneously lacked sufficient buying pressure to absorb them (the buying pressure from active long and short positions was not enough to catch the market sell orders resulting from liquidations). If the situation were allowed to develop unchecked, some long positions would find their margin insufficient to cover the losses incurred.

At this point, the insurance fund plays a role by absorbing market buy orders resulting from liquidations at certain liquidation prices to maintain market balance. Afterward, when prices stabilize and new investors enter, these previously absorbed positions can be gradually closed to release the locked funds. HyperLiquid's insurance fund is HLP, and Jeff stated that to optimize risk management, HLP is divided into numerous sub-funds, with only one sub-fund taking over during each liquidation.

The triggering of the insurance fund essentially indicates that market conditions are developing towards an extreme, and the lack of orders in the opposite direction also signifies that the trend is so clear that even the most reckless gamblers hesitate to go against it. If the insurance fund also finds itself unable to absorb the continuously liquidated positions, it will have to resort to the undesirable but necessary ADL.

According to my research, there are two mainstream methods of ADL in the market. One is to start auto-deleveraging in advance when the usable funds of the insurance fund drop to a certain ratio to minimize overall system risk. The other occurs after the insurance fund is exhausted, where profitable positions are forcibly liquidated at the liquidation prices of losing positions until the system rebalances. According to HyperLiquid's documentation, it adopts the second method, meaning that the appearance of cross-margin ADL for the first time in two years indicates that HLP's funds have already been or are at least close to being exhausted.

Some CEXs use the first mechanism. While there may be malicious actions to reduce profits for some smaller exchanges, more often, the situations of various circular collateral and borrowing in CEXs are quite complex. Once extreme market conditions arise, the intensity of liquidations may be greater than what is merely reflected in the contract market, necessitating some margin for error.

When ADL occurs, there are certain design rules regarding who is forced out first, usually considering profitability, leverage, and position size. In other words, the largest, most profitable, or most leveraged whales will be prioritized for exit from the market. Doug Colkitt, founder of DEX Ambient Finance on Scroll, commented on ADL on X, stating: "The beauty of the contract market is that they are all zero-sum games, so the entire system can never go bankrupt. Even Bitcoin will not truly depreciate; it’s just a pile of boring cash. Like thermodynamics, value is never created or destroyed in the entire system."

Zero-sum games are the premise of this game. Once you clearly understand this, you may gain a deeper insight into the financial game you are involved in.

How to Accept "Earnings Have Decreased"?

As mentioned earlier, whenever ADL is discussed, users almost always express complaints. For most users, every liquidation or loss is a solid hit, but profits can be automatically liquidated by the system due to insufficient liquidity, which feels extremely unfair. Users feel that since the money lost is taken by other users, market makers, or even the exchange, then when they make a profit, the exchange should also obediently give the money back.

Therefore, you need to understand the true meaning of "zero-sum game." In the perpetual contract market, ignoring transaction fees, the amount of money lost is always equal to the amount of money gained. Your opponents are other retail investors, institutions, market makers, and trading teams of exchanges. When even the insurance fund, which is purely for user experience rather than profit, is almost unable to hold up, it indicates that other participants have no willingness to be your counterparty.

At this point, when you hope that a profit-driven company will exchange your unpredictable losses for certain gains, the possibility is almost zero. In some cases, for example, unfounded FUD causing a temporary drop in certain tokens, even if the ADL criteria are triggered, the exchange may still take your profitable position due to confidence in the project's future (not excluding the possibility of temporarily freezing profits through withdrawal or liquidation restrictions).

If you only know that perpetual contracts have isolated and cross-margin modes, know about funding rates, and know how to calculate leverage and liquidation prices, then you are not yet prepared to participate in this game. "Zero-sum game" means that when your profits exceed the system's capacity, you cannot take a single penny from outside the system (i.e., from the exchange itself). In other words, your profits always have an implicit ceiling, but if you start shorting Bitcoin at $1, as long as Bitcoin maintains an upward trend in the long run, your losses will have no limit.

Of course, we can also interpret this matter from an optimistic perspective: when you encounter ADL, it indicates that there are no sufficient counterparties in the market to hedge your position, meaning you chose the right direction before this trend began and held on until everyone unanimously believes that this direction is correct; it also means that the exchange's insurance fund can no longer or is unwilling to take on more liquidation orders.

If the exchange does not maliciously reduce your profits, then congratulations, you have earned the maximum profit allowed within the rules of this game and the tolerance of a profit-driven company, making you the ultimate winner of this game.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。