Author: Tuo Luo Finance

October 11th is a day that will go down in the history of cryptocurrency. On this day, over 1.6 million people in the crypto market were wiped out, with $19.3 billion in liquidations. Bitcoin fell by 13%, Ethereum plummeted by 17%, and altcoins saw a staggering drop of 85%, with several small tokens crashing to zero, marking a doomsday scenario with bodies strewn everywhere. However, just a short while ago during the National Day holiday, Bitcoin had just reached a new high of $126,200, and BNB was heading towards $1,300, with the crypto market showing a thriving momentum.

In summary, the intertwining of tightened liquidity, macroeconomic sudden events, and the high-leverage characteristics of the industry ultimately led to a major disaster, with exchanges being one of the significant driving forces.

The crypto market has become a disaster zone. BTC crashed to $101,500, ETH dropped to $3,373, and small-cap altcoins saw declines exceeding 90%. The total liquidation amount across the network surpassed $20 billion, plunging the market into extreme panic.

After the incident, two types of tokens were frequently discussed. The first was the collateralized W series. On the day of the event, the liquidity of WBTC, WBETH, and WBSOL on Binance was completely breached, with WBTC dropping to a low of $35,000, WBETH falling to $430.65, and WBSOL even dipping below $35. The second was the stablecoin USDe, which depegged, dropping from $0.99 to a low of $0.62 on Binance, leading to widespread speculation that it was the "LUNA 2.0."

It is worth mentioning that although these tokens were generated from staked original tokens, their liquidity depth is clearly not comparable. When ETH plummeted rapidly, WBETH, as collateral, was the first to be breached. During liquidation, the platform would automatically sell off WBETH, further creating a vicious cycle without liquidity support. WBETH ultimately fell from above $4,000 to $430, which undoubtedly meant that the vast majority of holders' positions were heading towards zero.

However, high profits always come with high risks. As the market rapidly declined, arbitrageurs' leveraged positions were forcibly liquidated, spot and USDe were sold off, oracle services lowered collateral valuations, triggering large-scale forced liquidations, and ultimately evaporating $19.3 billion in a liquidity vacuum. This scene is not unfamiliar in the crypto market; before USDe, the algorithmic stablecoin UST had already validated the destructive nature of leveraged lending in extreme market conditions.

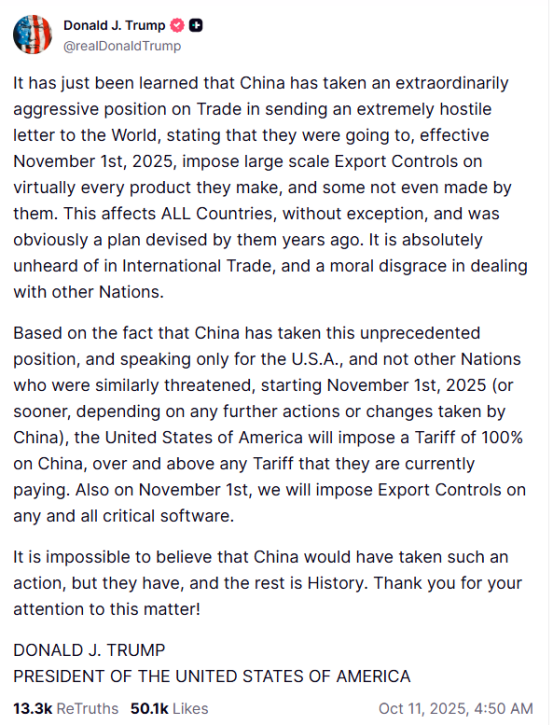

Conspiracy theories are not without basis. In the 30 minutes leading up to the remarks that triggered the major drop, a whale shorted 6,189 BTC on Bitcoin with 10x leverage, totaling approximately $752.9 million; they also shorted 81,203 ETH with 12x leverage, totaling about $353.1 million, making a total of $1.1 billion in short positions that successfully profited $190 million within 24 hours. On-chain detectives believe this whale is Garrett Jin, the former Chinese CEO of BitForex. On-chain detective ZachXBT stated, "Garrett Jin seems to have started collaborating with a Chinese whale who had previously kept ten-digit funds dormant on-chain until recently." According to Garrett's latest response, he stated that the fund belongs to his own clients and that he has no relationship with the Trump family or Donald Trump Jr., clarifying that this was not insider trading.

The turnaround came quickly. Just early this morning, Trump posted again to reassure the market, stating, "Don't worry about China, everything will be fine. America wants to help China, not hurt China," successfully restoring market confidence. This statement led the market to collectively bet on the "TACO" trade, an acronym for "Trump Always Chickens Out," implying that Trump always backs down at the last moment. The trading strategy is that when Trump's tariff threats cause the market to drop, investors bet that he will ultimately back down, leading to a stock market rebound, allowing investors to profit by buying the dip.

As a result, crypto assets quickly rebounded, with Bitcoin returning above $115,000, ETH briefly surpassing $4,200, currently reported at $4,186, and BNB seeing a remarkable rise of over 15%, reaching a new high of $1,351.

From the responses of domestic and international officials, the tariff crisis is likely another "loud thunder but little rain" macro event. However, behind this incident, who should the liquidated retail investors turn to for justice, and how should the lingering pain be healed? In the end, it seems that only the painful lessons remain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。