Crypto Market Decline Driven by Liquidations, Bhutan Ethereum ID Move

The cryptocurrency market has experienced a significant downturn, with a 3.41% drop in the last 24 hours, extending a 7-day losing streak of 11.42%. A key factor in the market's decline is a $19 billion liquidation cascade, which has triggered widespread selling pressure. Traders have increasingly rotated into Bitcoin , causing a de-risking movement and contributing to the overall market weakness.

Crypto Market Faces Steep Decline Amid Liquidations and Macro Instability

The unwinding of leverage has been the main factor in focus, with the open interest in the futures reducing by 10% as traders stampede to unwind their positions. This has continuously increased volatility in the market. To make it even worse, the current Sino-U.S. tariff tensions have resulted in larger cross-asset volatility into the crypto markets as well.

The shaky nature of some stablecoins has also shook investor confidence. The USST token of STBL has particularly become depegged, and it has fallen by 7.99, leading to the question of whether the stablecoin market is stable.

As a result, Bitcoin’s price hovers around $112,000 after a brief cooling-off period. Ethereum (ETH) has seen a 4% decrease, currently maintaining its value around the $4,000 mark. Binance Coin (BNB) has also faced a challenging period, with a 9% drop, following a bearish trend.

In the crypto market today, Bhutan has completed the migration of its national ID system to Ethereum, California has enacted new laws regulating AI chatbots, and concerns have surfaced about the underreporting of liquidations on centralized exchanges.

Bhutan Moves National ID System to Ethereum

Bhutan has also moved the national identification system Polygon to Ethereum, which gives its citizens the opportunity to identify themselves safely and obtain the government services.

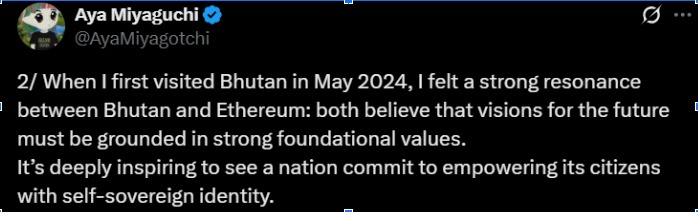

This has already been integrated with Ethereum, and the transfer of all resident credentials is set to be done by the first quarter of 2026. The development was celebrated by Ethereum Foundation president Aya Miyaguchi as a world-first.

This change to blockchain technology is viewed as a significant step towards helping citizens to have a self-sovereign identity, and one where individuals have control over their personal data.

The transparency, immutability, and privacy capabilities of blockchain are likely to increase the safety and credibility of the national ID system. The action of Bhutan would lead to a precedent for other countries to look into blockchain technology as an infrastructure solution for the government.

California Implements AI Safeguards for Children

In the U.S., California has taken significant steps to regulate AI-driven chatbots with the signing of several new laws. Governor Gavin Newsom announced the introduction of SB 243 that requires social media and AI companion bots to have a system of age verification and clear warnings when communicating with minors.

This law was influenced by the news that AI chatbots were affecting children to engage in negative activities, such as suicide.

The new legislation does not only demand AI sites to notify children about working with bots but also to make sure that such solutions are not utilized in a manner that may harm the mental well-being of children.

It also establishes guidelines of dealing with self-harm and suicide danger. These rules, effective January 2026, will cover a broad group of online services, possibly even decentralized networks that provide AI services.

Concerns Over Underreporting of Crypto Liquidations

In the crypto market , volatility was high in the recent past, with Bitcoin and Ethereum registering drastic price declines. Issues have also been raised about the reporting of liquidation data by the centralized exchanges.

In this regard , isolated exchanges, especially Binance CEO and leader of Hyperliquid, Jeff Yan, noted that the reporting system of Binance could be vastly overstating the number of liquidation events by reporting the final liquidation per second. This matter is notably challenging when large-scale market sell-offs are taking place and the liquidations are made in bursts.

According to the data of CoinGlass , the latest market crash resulted in long liquidations of about 16.7 billion and short liquidations of more than 2 billion, which is one of the largest liquidation events in crypto history.

Yan has stated that the existing reporting system may overlook several liquidations and may underreport the actual magnitude of the losses. The liquidity of liquidation information is a pressing concern to the traders because the underreporting might have an impact on decision-makers and transparency in the market of crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。