Original authors: Annie Massa, Zachary R Mider, Bloomberg

Original translation: Luffy, Foresight News

One of the latest tenants of Trump Tower in New York is a startup investment bank named Dominari Holdings Inc. It is located two floors below the Trump Organization's headquarters, and Dominari President Kyle Wool takes pride in this "close proximity."

Wool has spent years maintaining a relationship with the Trump family. Since last year's election, he has gradually become a financial advisor to the president's two sons and several executives at the Trump Organization, collaborating to facilitate a series of high-profit deals.

Dominari's office space is located on the 22nd and 23rd floors, a glamorous area that was once the site of the Tommy Hilfiger family office. On a July afternoon this year, a television at the entrance was playing Fox Business, and a nearby shelf displayed transparent trophies commemorating successful fundraising for corporate clients. Most of these clients are not household names—Dominari focuses on financing micro-cap companies. These companies are publicly traded but have small market capitalizations, with stock prices that fluctuate wildly, driven more by market enthusiasm than by profit expectations. This also explains why Wool's collaboration with the Trump family has been so "fruitful."

The Trump Name: The Heat Engine for Micro-Cap Stocks

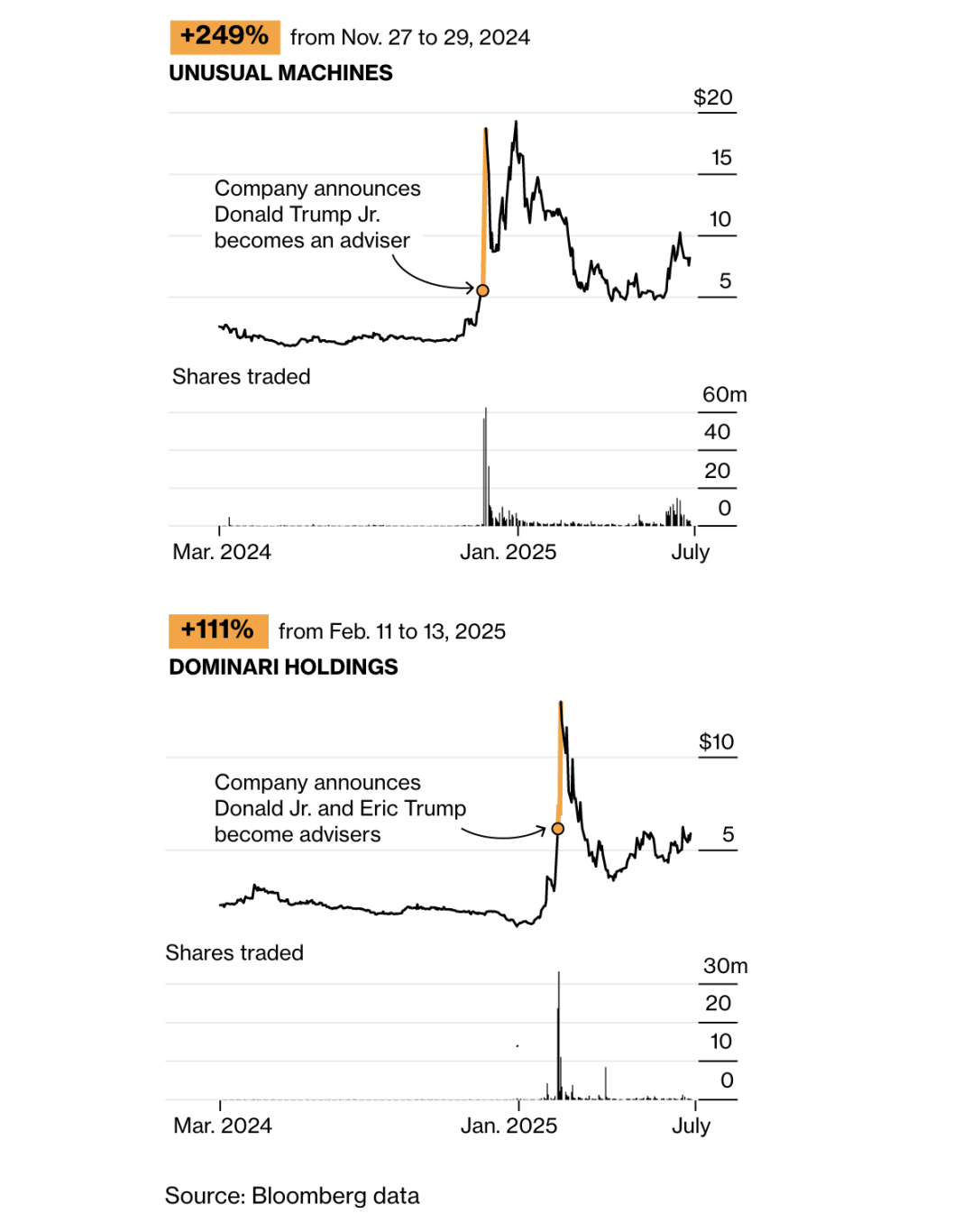

The name Trump happens to provide stock promoters with the heat they crave. Take the example of Unusual Machines Inc., a loss-making drone company in Orlando. Three weeks after the 2024 election, it was reported that Donald Trump Jr. would serve as a paid advisor and investor for the company, a collaboration facilitated by Wool. Securities filings show that the company's stock price more than doubled within three days, bringing $4.4 million in paper gains to the president's eldest son.

Since then, similar collaborations have emerged: linking members of the Trump family with previously obscure stocks and leveraging the resulting exposure to drive up stock prices.

When Trump's son became an advisor, the stock prices of Unusual Machines and Dominari Holdings soared.

One such collaboration involved Dominari itself. In February of this year, the company announced that Donald Trump Jr. and Eric Trump would serve as advisors and investors, with their stakes exceeding those of any other external investors. The announcement did not mention their father, President Trump, but stated that the two would provide consulting in the fields of artificial intelligence and data centers—despite their lack of apparent experience in these areas. Nevertheless, Dominari's stock price surged, bringing millions of dollars in wealth to Wool and the Trump brothers.

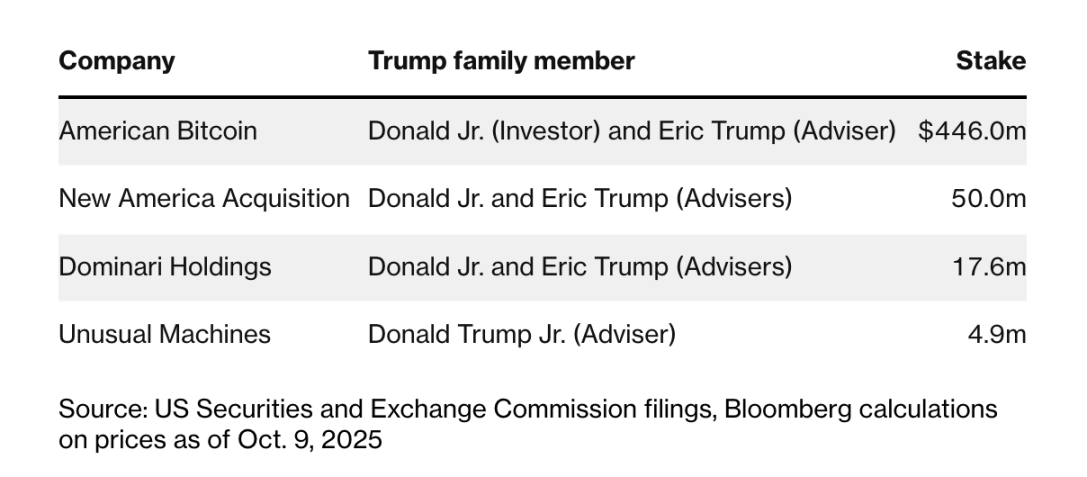

As of October 9, the Trump brothers' holdings in Dominari were valued at over $17 million; Eric's stake in a Bitcoin mining company established with Dominari was worth nearly $500 million, a substantial windfall even by Trump family standards.

A spokesperson for the Trump Organization did not respond to requests for interviews with Eric and Donald Jr. In February, after the Trump brothers were appointed as advisors to Dominari, Wool stated in an interview that they were excellent businessmen, but he declined to comment for this article. After receiving a summary of the Bloomberg Businessweek report, Dominari claimed it "contained inaccuracies and misinterpretations," but did not specify the issues or arrange for executives to be interviewed. The White House also did not respond to requests for comment.

Eric and Donald Jr. outside the Nasdaq in New York in August.

Dominari's collaboration model is a new variant of the Trump family's tradition of "monetizing their reputation." The Trump Organization's real estate business has long since shifted from construction projects to selling the rights to use the Trump brand; collaborations with Wool and micro-cap stocks are similar to their recent forays into cryptocurrency, both paths trading on reputation for wealth.

"The typical characteristic of micro-cap companies is that they are always trying to attract attention," said Stephen Kann, author of "Microcap Magic: Why the Biggest Returns Are in Stocks You've Never Heard Of," who worked at Dominari for several months last year. "Being associated with the Trump family is like putting a spotlight on them."

For other presidential families, venturing into the micro-cap space might be seen as a reputational risk, as these companies have long been known for "losing investors' money." As Warren Buffett put it, if American capitalism is a cathedral with a casino attached, then micro-caps are like roulette and slot machines.

About half of the IPO projects at Dominari involve small companies based in mainland China or Hong Kong, where stock price volatility and fraud issues are particularly pronounced. Supporting this ecosystem are a steady stream of small investors eager to make quick profits in the micro-cap casino. Now, under Wool's influence, America's first family has joined their ranks.

This collaboration also comes with potential conflicts of interest. During Trump's first term, public scrutiny of conflicts of interest primarily focused on family real estate projects, where lobbyists and foreign government officials could indirectly enrich the president by hosting events or booking rooms at Trump hotels.

In this term, the Trump family's business interests have become even more diverse, encompassing media, mobile phones, and cryptocurrency. Eric and Donald Jr. insist they are private businessmen, but their father's policies as President of the United States will inevitably influence the companies they collaborate with. Dominari has become a channel for the family to seize these new opportunities, significantly increasing the likelihood that official decisions will boost the Trump family's wealth.

Kyle Wool: The Network Operator from Rural New York

Wool grew up in the rural town of Candor, New York, with a population of about 5,000. After graduating from college, he entered the brokerage industry and quickly managed assets for the wealthy at firms like Oppenheimer and Morgan Stanley. His clients included a South Korean professional golfer, a timeshare mogul (whose 90,000-square-foot mansion appeared in the 2012 film "Queen of Versailles"), and even a company co-owned by Hunter Biden, the son of then-Vice President Joe Biden.

This job itself was unremarkable, but Wool stood out in other ways. He appeared in fashion magazines with friends, showcasing a $165,000 watch; he also maintained close ties with the Serbian royal family and participated in humanitarian charity work in the country.

In October 2018, Wool attended the annual charity luncheon of the Lidkran Foundation with Serbian Crown Prince Alexander.

In 2022, Wool became president of Rivell Securities, a small brokerage firm in New York that focuses on financing micro-cap stocks (typically defined as companies with market capitalizations below $250 million, which regulators often warn carry higher risks and potential for fraud). His clients included Anthony Hayes, a lawyer friend who had appeared in fashion magazines with him.

At that time, Hayes was the CEO of a Nasdaq-listed company that had undergone multiple transformations over the years, from food sweeteners and pesticides to patent litigation and cancer drugs, accumulating losses of tens of millions of dollars. At Wool's suggestion, the company transformed again into an investment bank and rebranded as Dominari—Latin for "to control." According to a former colleague, Wool was very fond of the word, often repeating, "I control, I control, I control." Soon after, Wool was appointed president and head of the securities division at Dominari.

Meanwhile, according to two people who worked with Wool, he began to build relationships with the Trump family. He moved the company's headquarters to Trump Tower, investing time and money in Trump-owned properties—he is a member of the "Trump Club" in Jupiter, Florida (with a current membership fee of $500,000) and has organized events at another Trump golf course. Shortly thereafter, he began hosting private fundraising events with Trump's sons and other executives from the Trump Organization.

"Dominari has brought us many opportunities in the past, and many have been remarkably successful," Eric said in an April interview with cryptocurrency media Fintech.TV. "Every time I see them, I get particularly excited."

The Trump Brothers: From Avoiding Conflicts to Unrestrained

As executive vice president of the Trump Organization, Eric is responsible for the day-to-day operations of the family business; Donald Jr. also serves as executive vice president but is more active in media activities related to "MAGA" (Make America Great Again). The two have complained that during their father's first term, they tried to avoid conflicts of interest by giving up new overseas real estate projects but still faced criticism. "In 2016, I tried to do everything right, but I got almost no recognition," Eric told The Wall Street Journal last year. In this term, their restrictions have been significantly reduced.

Like the Trump brothers, Wool frequently travels between New York and Florida's MAGA strongholds, as evidenced by his sun-kissed complexion from frequent appearances on Fox Business. His hair is slicked back, reminiscent of the Wall Street elite of the 1980s who "controlled the universe." On the show, he always manages to deliver mainstream investment rhetoric (AI stocks are hot, the market will rise) and praises President Trump.

Kann, a micro-cap expert who worked at Dominari, described Wool as a "very sociable person," willing to drink and joke, but also hardworking and fully committed to the company's development. Unusual Machines CEO Allan Evans remarked, "He is the typical New York banker, willing to go all out to get the job done, whether it's Saturday, Sunday, or even 2 a.m.—if there's work to be done, he'll do it."

Over the years, Wool has received five customer complaints from the Financial Industry Regulatory Authority, alleging "investing funds in unsuitable investment projects" and "unauthorized trading," among other issues. Two complaints were withdrawn, two were settled, and one is still pending. Wool denies all wrongdoing and referred to these complaints as industry norms in a February interview: "Having been in this industry for so many years, it's inevitable."

Evans at the Unusual Machines store in Orlando

The Trump Effect on Unusual Machines

Unusual Machines is located in Suite J of a warehouse in an industrial area of Orlando. When reporters visited in late June, the company was in the midst of a major hiring spree, with new desks and workstations crowding the office, alongside boxes filled with equipment. At that time, the company had fewer than 20 employees, most of whom worked in retail, selling primarily Chinese-made drone parts to hobbyists. However, CEO Evans plans to more than double the workforce and open a factory to produce parts in-house while seeking new clients in the industrial and government contracting sectors.

Near the loading area, an employee started up the company's smallest product—a buzzing white square drone, slightly larger than a slice of bread, that flipped agilely in the air. Earlier this year, when Evans visited Mar-a-Lago, Donald Trump Jr. had operated a similar drone in the banquet hall to demonstrate its capabilities. "He flew it pretty well," Evans said.

Without Donald Jr., the company's prospects might be much dimmer. Unusual Machines was originally a neglected business: last year, its former owner decided to focus on military sales, divesting the consumer business, and Wool assisted in taking it public at $4 per share. However, after going public, investor response was tepid, and the stock price fell below $2, with the company's cash reserves dwindling.

An employee assembling drone parts at Unusual Machines

As Wool was scrambling to raise more funds, he recommended the stock to Donald Jr. Evans stated that the president's son was intrigued; Donald Jr. holds a pilot's license and has experience using drones for deep-sea fishing. A securities filing shows he paid $100,000 to purchase stock and warrants and ultimately agreed to sign on as an advisor.

After the announcement of Donald Jr.'s involvement in November, the company's stock price soared to over $20, with its investment value increasing by 30 times at one point. Since Donald Jr. is not an executive or board member of Unusual Machines, he is not required to disclose the timing and amount of his stock trades. However, Evans noted that Donald Jr. still has investments in subsequent funding rounds.

In the micro-cap space, it is not uncommon for "eye-catching announcements to drive up stock prices, followed by insiders selling off, leading to a crash." But Evans claims they are not doing that: "If we were 'pumping and dumping,' we would have raised funds when the stock hit $20, or I would have sold shares. But in reality, I have been buying in every funding round and have never sold. Our team firmly believes in the company's future."

Unusual Machines is involved in domestic manufacturing and is one of dozens of American startups betting on demand from government and commercial buyers, who are wary of major drone manufacturers in China. Some competitors have well-funded backers or valuable patents, while Unusual Machines' advantage is Donald Trump Jr. But Evans stated that he has not lobbied the White House or sought to curry favor with Defense Department officials: "Donald Jr. has a sharper sense of macro trends than I do. When you have lunch with Elon Musk on a private jet, you get a clearer picture of the direction of automation." (Evans made this remark just days before Musk publicly fell out with the White House.)

Evans believes Donald Jr.'s greatest contribution is his public support for the company. He stated that meetings with potential business partners have become easier, and the company has raised over $80 million from investors this year. "Just this association has brought us more credibility and helped us stand out. It's like Oprah joining the WeightWatchers board—does Oprah need to do anything? Almost nothing."

$500 Million Wealth from American Bitcoin

Wool also helped the Trump family amass a significant fortune in the cryptocurrency space—American Bitcoin. During Trump's second term, his two sons became involved in multiple cryptocurrency projects: traveling the globe to attend industry conferences and promoting their father's friendly stance on cryptocurrencies.

Earlier this year, the Trump brothers, along with Wool and Dominari, acquired a 20% stake in a mature Bitcoin mining company with operations in Texas, New York, and Alberta, Canada. The company then went public through a merger with a micro-cap firm, rebranding as American Bitcoin.

In May, the Trump brothers appeared at the largest Bitcoin industry conference in Las Vegas, promoting the company's prospects and emphasizing its alignment with their father's vision of supporting cryptocurrencies. Eric stated on stage, "We have a president who loves this industry and supports it 100%. I can tell you, our family is incredibly excited about this company and its future."

This deal brought Wool substantial profits. As of October 9, the shares held by Dominari were valued at over $150 million; Eric's stake was worth nearly $450 million.

"I am incredibly proud of American Bitcoin," Eric stated in a text message, "This is an amazing success." He did not respond to questions about other aspects of his relationship with Dominari, and American Bitcoin also did not respond to separate requests for comment.

Value of the Trump brothers' holdings in Dominari-related transactions

Obvious Conflicts of Interest

Like the drone sector, conflicts of interest in the cryptocurrency space are also apparent. Although there is no evidence that the Trump brothers' investments have influenced policy decisions, the value of these companies could fluctuate due to government actions. In July, the White House suggested that the IRS consider revising long-standing tax guidelines for cryptocurrency mining, a change that the crypto industry has long advocated and would benefit companies like American Bitcoin.

Meanwhile, the computers used for mining by the company are sourced from a manufacturer based in China. Recently, a Republican congressman called for the U.S. Treasury to review such imports from a national security perspective, and the decision on whether to conduct such a review lies with the Trump administration.

In the drone sector, the Trump administration is also promoting domestic production, continuing bipartisan initiatives from the Biden administration. In June, Trump signed an executive order to expedite the introduction of long-sought flight rules; in July, the Pentagon issued guidance aimed at accelerating U.S. drone procurement. Both initiatives have boosted the stock prices of American drone companies this year.

Conflicts of interest have not hindered Wool's collaboration with the Trump brothers. In August, they launched their latest joint venture: a blank check company named New America Acquisition I Corp. (a special purpose acquisition company, or SPAC). The company will raise funds in the stock market and then acquire a domestic manufacturer, aligning with "Trump's vision for American manufacturing."

As part-time advisors, the Trump brothers will receive shares worth up to $50 million after the company goes public. In a securities filing, New America Acquisition stated that it would seek acquisition targets that could benefit from federal or state-level incentives (such as subsidies, tax credits, government contracts, or priority procurement programs). However, after the Associated Press inquired about this matter, the company removed that statement, attributing it to a "filing error." New America Acquisition did not respond to requests for comment.

Dominari's IPO Controversy: Successes and Disasters

Dominari executives expressed satisfaction with the company's rapid pace of transactions. In a letter to shareholders in June, CEO Hayes declared that he was "very proud of the company's achievements": revenue growth, rising stock prices, and he attributed part of the credit to the advisory board—composed entirely of Trump Organization executives at the time, including Donald Jr., Eric, and relatively lesser-known company veterans Lawrence Glick, Alan Garten, and Ronald Lieberman.

Hayes also boasted about the 12 IPOs recently completed by Dominari, including companies operating two golf courses in Florida and a company building roads in Hong Kong. He wrote, "Some media have unfairly described some of our recent IPOs, suggesting low-quality clients, and we strongly oppose that characterization."

Indeed, some investments have brought significant returns to investors (like Unusual Machines), but among the 12 transactions mentioned by Hayes, five can be considered disasters, with these companies' stock prices nearly halving after going public. Although "most companies assisted by the Trump family and Dominari are unrelated," under Wool's leadership, these IPOs have become an important part of the company's business.

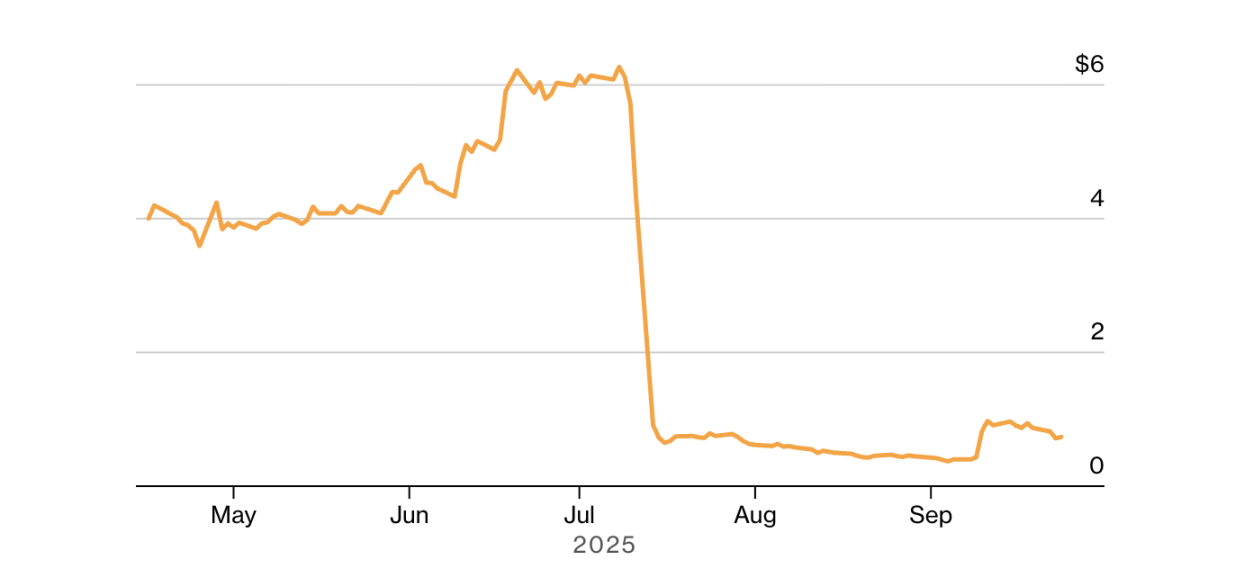

Among the 12 IPOs Hayes touted was Everbright Digital Holding Ltd.—a Hong Kong marketing company with only seven employees, claiming deep involvement in the metaverse. Dominari assisted it in going public on Nasdaq in April this year, with an offering price of $4 per share, but investor response was lukewarm; until June, trading volume suddenly surged, and the stock price soared above $6.

This surge was driven by a stock-picking club. Such clubs are becoming increasingly popular, with so-called "experts" often masquerading as U.S. fund managers, encouraging American investors to buy stocks for quick profits on social media platforms. Artsyom Yefremenka, a 31-year-old auto mechanic from Fresno, California, stated that he joined a stock-picking club on the messaging app Viber. The club leader, known as "Mr. James," had previously provided several profitable stock recommendations. Therefore, when Mr. James urged members to "buy Everbright Digital Holding in large quantities," Yefremenka invested about $20,000, nearly half of his six-month salary.

In mid-July, Everbright Digital Holding's stock price collapsed, falling below $1. During his lunch break, Yefremenka watched helplessly as his investment evaporated: "At that moment, I thought, 'I can't be this stupid, to be scammed so badly.' Greed has harmed us all." Everbright Digital Holding did not respond to inquiries.

Everbright Digital Holding stock price collapse

Micro-cap stocks have long been a hotspot for fraud and manipulation, and the recent phenomenon of hyping micro-cap stocks through instant messaging apps has drawn the attention of U.S. regulators and law enforcement. Criminals sometimes "acquire a large number of shares in a company and then sell them at high prices through stock-picking clubs." The FBI reported in July that complaints related to pump-and-dump scams involving instant messaging apps had increased by 300% compared to last year, with estimated losses to U.S. investors reaching billions of dollars.

Last month, the U.S. Securities and Exchange Commission (SEC) announced the establishment of a special task force to investigate "cross-border pump-and-dump scams," including reviewing underwriters that may help market manipulators enter the U.S. listing system. Since Dominari's inception, 18 of its 38 IPOs have involved small companies based in mainland China or Hong Kong. The reasons for some companies going public in the U.S. are unclear: one company operates three hot pot restaurants, while another is a luxury watch dealer with only seven employees. Several companies saw their stock prices skyrocket after being hyped in stock-picking clubs, only to plummet afterward, such as healthcare company Pheton Holdings Ltd. (which lost over 80% of its market value post-IPO) and Skyline Builders Group Holding Ltd. (which saw a single-day drop of over 87% in July).

Currently, there is no indication that Wool or Dominari is connected to stock-picking clubs or involved in manipulating stock price fluctuations. The company's revenue comes from fees for assisting companies with their IPOs, after which it typically does not participate in company affairs; there is also no evidence that Dominari is under investigation by the SEC. It is merely one of several investment banks assisting small speculative companies from China in going public in the U.S., but this practice effectively aids fraudsters.

"These companies keep going public, their stock prices soar, and then they crash," said Michigan micro-cap investor and blogger Michael Goode. "This either means that some investment banks are turning a blind eye to this phenomenon, or that these fraudsters are very good at hiding their tracks and covering their actions."

According to former colleagues, Wool has been telling people over the past few months that "this period has changed his life." The successful collaboration between Dominari and the Trump family has opened more doors for him. In June of this year, Wool assisted a micro-cap toy manufacturing company in transforming into "a holder of cryptocurrency created by billionaire Sun Yuchen." Although this deal did not directly involve the Trump family, Wool revealed to The Wall Street Journal that Eric Trump had endorsed him, telling Sun Yuchen that "Wool is a good guy."

Wool also told The Wall Street Journal that hedge funds and executives have suddenly been reaching out to him, hoping to participate in deals: "Now they want to be friends with me? I don't need that."

When Wool traveled to South Korea for business this year, he received treatment akin to that of an unofficial ambassador. He shared his insights on the new U.S. government in a television interview and met with former South Korean lawmaker Yang Ki-dae. Yang referred to Wool on Facebook as "a potential bridge between South Korea and President Trump," and mentioned that Wool invited him to "visit Trump Tower the next time he comes to the U.S."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。