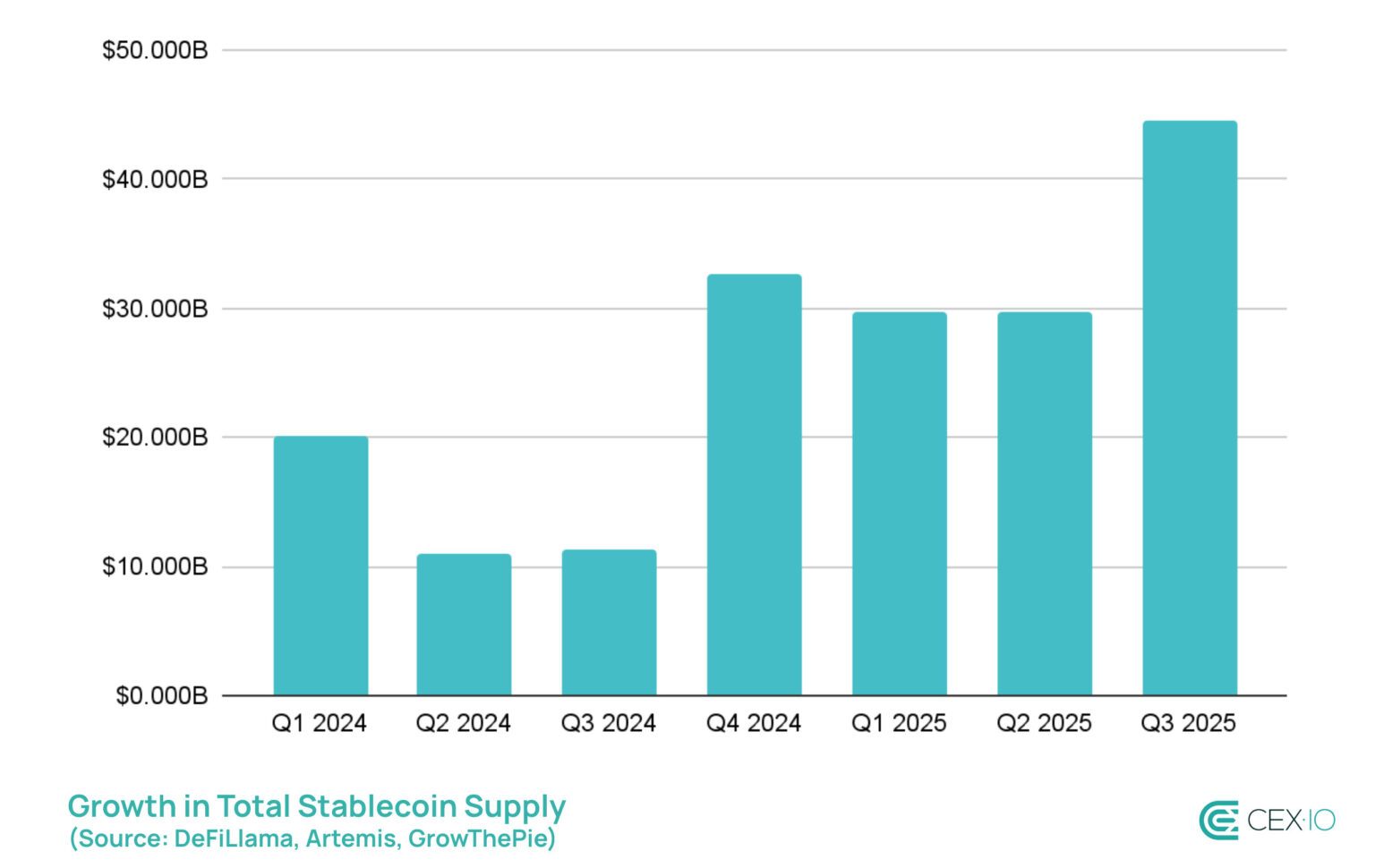

Q3 2025 shattered records for the stablecoin market, marking the most active period in its history. According to a new report by Cex.io with data aggregated from Defillama, Coingecko, and other analytics firms, stablecoin supply expanded by $45 billion during the quarter, an 18% increase, bringing the total market to over $300 billion.

The surge was powered by USDT, USDC, and USDe, which accounted for 84% of new issuance. Despite U.S. restrictions on yield-bearing tokens under the Genius Act, USDe and Paypal’s PYUSD were the fastest-growing assets, rising 173% and 152%, respectively. Much of this growth stemmed from decentralized finance (DeFi) strategies and cross-chain integrations through networks like Layerzero’s Stargate Hydra.

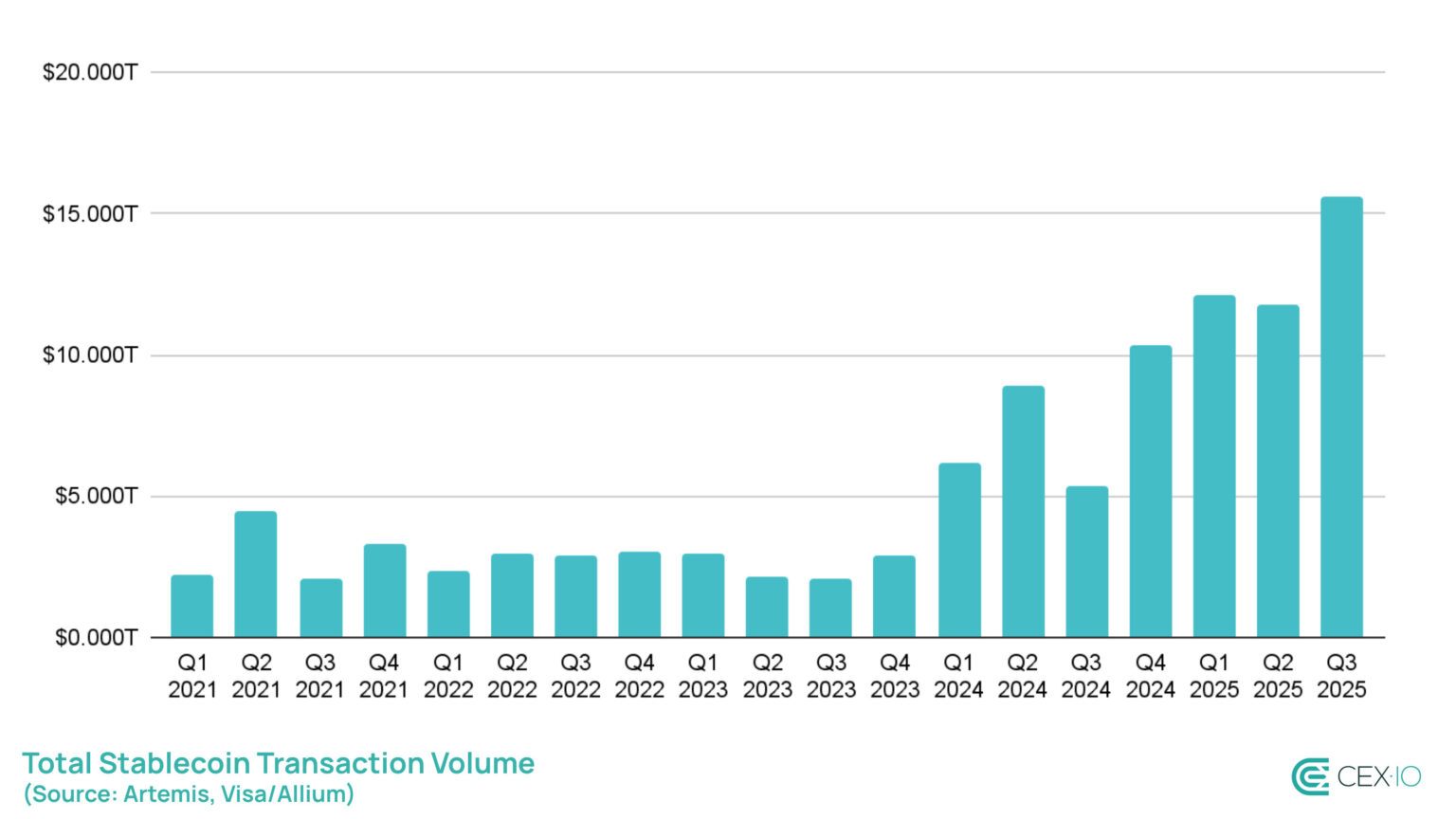

Onchain transfers hit a record $15.6 trillion, with bots accounting for 71% of transactions. Yet retail engagement also grew, as sub $250 transfers reached all-time highs in September, setting 2025 on pace to exceed $60 billion in small transaction volume.

Ethereum re-emerged as the dominant network, hosting 69% of all new stablecoin issuance after retaking share from Tron, which saw a rare supply contraction. Layer 2 networks like Arbitrum also surged, fueled by perpetual trading platforms and liquidity migration.

Trading activity soared to $10.3 trillion, the highest since 2021. USDT extended its dominance, surpassing $100 billion in monthly DEX volume for the first time and overtaking USDC as the leading trading pair across decentralized exchanges, driven largely by BSC’s explosive growth in trading activity.

The data confirms that stablecoins have evolved beyond trading tools into essential infrastructure for payments, liquidity, and DeFi settlement. As Q4 approaches, historically the strongest quarter for stablecoin activity, the question isn’t whether growth continues, but how concentrated it remains around USDT, USDC, and Ethereum’s expanding ecosystem.

FAQ 🧭

Why was Q3 2025 a record-breaking quarter for stablecoins?

Stablecoin supply surged by $45 billion, with total onchain transfers exceeding $15.6 trillion amid booming global demand.Which stablecoins led the market growth?

USDT, USDC, and USDe drove 84% of new issuance, with USDe and PYUSD posting the fastest growth rates.What networks dominated stablecoin activity?

Ethereum reclaimed dominance with 69% of new issuance, while Tron saw a rare contraction and Arbitrum gained traction.How did stablecoin trading and retail usage perform?

Trading hit $10.3 trillion, while small retail transfers under $250 reached record highs, signaling broader adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。