From the current major direction, it seems that the trade friction between China and the United States will not be as exaggerated as in April for the time being. Both sides are still maintaining a certain level of restraint. Although they are both making tough statements, in reality, further confrontation has not occurred. Especially today, Bessent indicated that Trump is still prepared to meet with Xi Jinping, suggesting that there is still room for easing relations between the two sides. Therefore, although U.S. stocks have seen some pullback, the overall trend remains upward.

What has made it difficult for some friends today is that while U.S. stocks are rising, cryptocurrencies, especially $BTC, have experienced a slight decline, triggering many investors to declare the end of the bull market. From my personal perspective, U.S. stocks, especially tech stocks, and Bitcoin are still highly correlated. The temporary divergence may be due to the market's emotional need for correction, especially since the drop on October 11th drained some "liquidity."

I would suggest that for friends who adhere to the bull-bear theory, it is important to have a clear understanding of their own thoughts. What are the reasons for artificially pushing the market bearish or maintaining a bullish trend? Can these reasons convince oneself to place orders in the market?

Looking back at Bitcoin's data, the turnover rate has decreased, indicating that most investors are gradually returning to a calm state. However, the main contention is still around the China-U.S. trade conflict. If it escalates, it may intensify investors' panic. Therefore, I currently recommend that waiting and observing is the best approach. After all, on one hand, both sides may escalate their rhetoric and become more agitated, while on the other hand, it is difficult for both sides to truly become adversarial. Reconciliation should be highly probable; it’s just a matter of time.

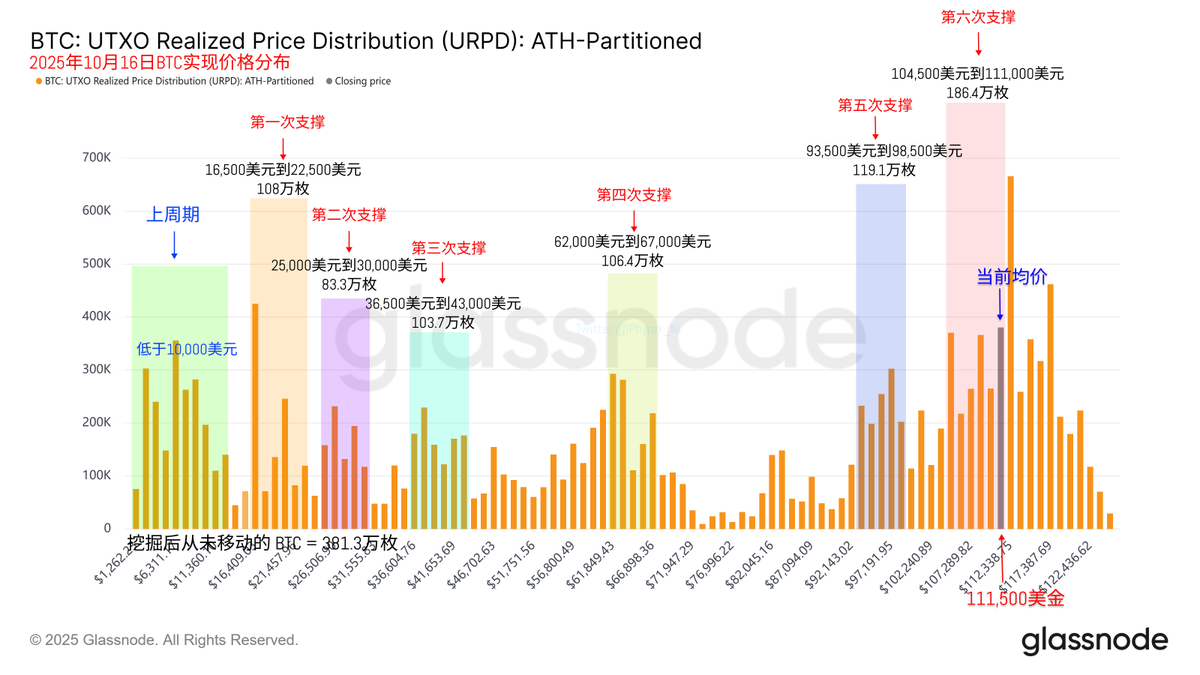

If it really escalates into a trade war, then there would be no need to gamble on the entire market, as it would not be good for either China or the United States. From the current chip structure, I have not seen signs of investors panicking and exiting the market. The top weekly report also states quite clearly that we have not yet entered a phase of systemic risk.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。