Master Discusses Hot Topics:

Last night was a bit frustrating. While the US stock market was rising happily, the crypto market was instead timid. Especially Bitcoin, which not only failed to strengthen but also slightly retraced. In my view, this short-term divergence seems harmless on the surface, but it actually reveals a decline in the liquidity of the crypto market.

The last flash crash nearly emptied the trust of institutions. How can you expect those institutions with ETF approvals to promote an asset that can drop 50% in an hour to others? Wouldn't they just run away? That's the problem; traditional funds now view the crypto market as a high-risk pool.

Currently, the US stock market is almost recovering the losses from the past few weeks, but Bitcoin is still grinding at the bottom for support. The entire crypto atmosphere has become dull; in fact, the wave of upward movement since April 7 has already completed. Both technical and emotional indicators tell us that the bull market ending is just a matter of time.

The surge on October 10 was just the last gasp. The crash on October 11 was only the first wave; who can guarantee that a second wave won't occur? We've seen the behavior of the main players before; if they don't clean up, how can they pull it up again?

The current reality is that most retail investors are still shouting to buy the dip and predicting a big rise in the fourth quarter, which indicates that we are still far from the bottom. But the real bottom is when no one dares to shout.

Returning to the market, from a daily perspective, Bitcoin's price hasn't changed much, still hovering in the range of 107K to 124K. The price is repeatedly consolidating below 116K, and the pattern is clearly weak. I still see some people fantasizing that this is a bottom formation, but it actually looks more like a calm before being plundered.

As long as 116K cannot be stabilized, 107K will eventually be breached. Even if it briefly stands above 116K, it would just be a trap for the bulls; if the structure doesn't break, everything is in vain. 126.2K is the mid-term top for this round; the current upward movement is merely a rebound from a decline.

After the rebound, there will be another leg down, with the short-term range being 109.5K to 115.7K. If the price breaks below 108K, it means the consolidation is over, and a downward trend will restart.

Ethereum isn't doing much better either, with support at 3895, 3724, and 3605, and resistance at 4495 and 4735. The price is currently hovering around 4000, showing typical weakness in the rebound. It looked promising in the first half of the night, but by 1 AM, there was no movement, and many were scared off by those few bearish candles earlier.

Recently, Ethereum can be summed up in one word: grinding. The upper resistance at 4200 to 4300 remains strong, with the Bollinger middle band and Fibonacci retracement all blocked there. If it can't break through, there's no point in discussing any counterattack. It needs to close above 4300 on the daily chart for the trend to have a chance to reverse.

The lower level of 3930 is a dividing line for strength; if it can't hold, it will test 3866 or even 3800. If it crashes again, the range from 3744 to 3510 is the last line of defense, as it is the previous crash low and the 200-day moving average support. If it can't hold, be prepared for a new round of deep squats.

Master Looks at Trends:

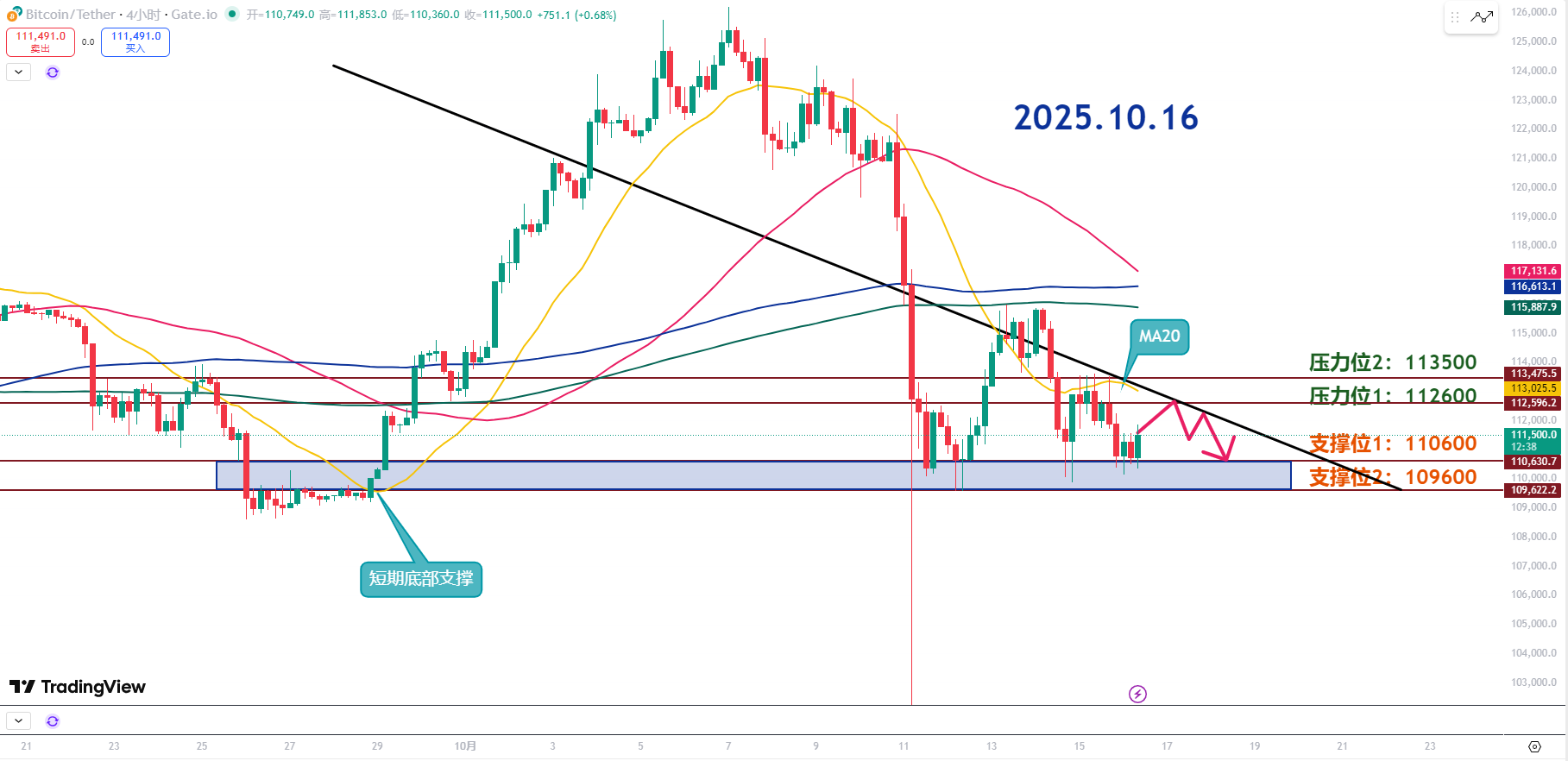

Resistance Level Reference:

Second Resistance Level: 113500

First Resistance Level: 112600

Support Level Reference:

First Support Level: 110600

Second Support Level: 109600

From the 4-hour level, Bitcoin still shows a clear downtrend. The short-term support is around 109.6K; as long as this level holds, there may be some rebound, but a rebound does not equal a reversal.

First, 110.6K is currently a very critical support level, having been tested for the fourth time. If it can't hold this time, prepare for a panic sell-off in the market. Once this price breaks, many will completely lose confidence, and a chain reaction of stop-loss orders will accelerate the decline.

The potential for a rebound is also limited; around 112.6K, combined with the 20MA moving average, is the first strong resistance. At most, it might touch that level before being pushed down again. Unless there is a strong breakthrough of the short-term downtrend line, don't talk about turning bullish.

Currently, neither bulls nor bears have a clear advantage; anyone can be washed out. If you want to trade, you need to think short-term and take a little profit before leaving.

The first resistance at 112.6K has already been suppressed multiple times; if the trading volume doesn't increase, don't expect it to break through. A short-term spike could also be a false breakout.

The second resistance at 113.5K is a point that has been pushed back four times during previous rebounds; it is a true iron ceiling. If you really want to see a rebound, you must at least stabilize above 113K; otherwise, everything is just wishful thinking.

The first support at 110.6K is the area defended four times and is the last lifeline for the short term. If it fails to hold this time, the market will enter an accelerated decline phase. The second support at 109.6K is the upper boundary of the key range formed after the previous crash; once it breaks, the downward trend will open up.

10.16 Master’s Trading Strategy:

Long Entry Reference: Not currently applicable

Short Entry Reference: Short in the range of 112600-113300 in batches, Target: 110600-109600

If you truly want to learn something from a blogger, you need to keep following them, rather than making hasty conclusions after just a few market observations. This market is filled with performers; today they show screenshots of long positions, and tomorrow they summarize short positions, making it seem like they "catch the tops and bottoms every time," but in reality, it's all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don't be blinded by exaggerated data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). If you want to learn more about real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official public account (as shown above); other advertisements at the end of the article and in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, and thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。