Crypto Market Faces Decline Amid Global Instability and $19B Loss

The crypto market dropped by 1.02% over the last 24 hours, continuing its downward slide for the week. This recent decline adds to a total weekly loss of 10.4%, reflecting both technical pressure and broader global instability.

Crypto Market Faces Fresh Decline Amid Global Uncertainty and Market Instability

Today in the crypto market , investor confidence continues to deteriorate as macroeconomic concerns weigh heavily. Ongoing trade disputes between China and the United States are contributing to heightened caution. This global uncertainty has pushed investors toward lower-risk assets, dampening demand for high-risk holdings like digital currencies.

The crypto market is still reeling from a major derivatives wipeout that occurred earlier this week. Over $19 billion in cryptocurrency derivative positions were liquidated between October 10 and 11. This sudden loss sparked a significant wave of deleveraging, triggering additional downward movement across leading cryptocurrencies.

This markets event added momentum to already declining prices, creating a ripple effect. Bitcoin dropped sharply and is now trading at around $111,000, while Ethereum has declined to near $4,000. Other major tokens, including BNB, XRP, and SOL, have followed suit, reflecting the overall weakness across the sector.

Stablecoin Security Questioned After Paxos’ $300 Trillion Error

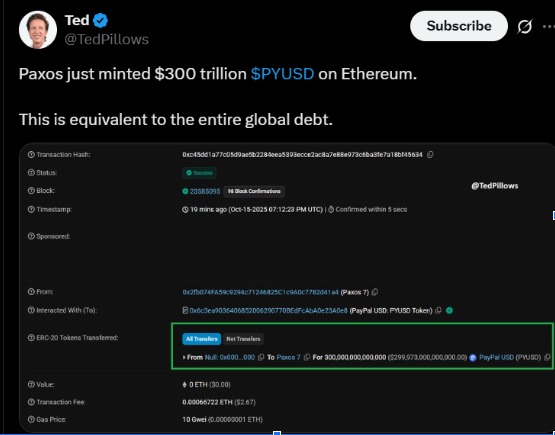

Paxos , the issuer of the PayPal USD (PYUSD) stablecoin, came under intense scrutiny this week following a technical mishap. On October 15, the company mistakenly minted $300 trillion worth of PYUSD due to an internal error. The mistake was quickly detected by members of the cryptocurrency community, and the funds were burned just 22 minutes later.

Paxos confirmed there was no security breach, stating that the error stemmed from a technical fault, not a compromise of user funds. The incident triggered temporary action from platforms like Aave, which paused PYUSD trading as a precaution. Despite the error, PYUSD maintained its dollar peg but experienced a brief 0.5% dip in price.

Industry leaders responded by highlighting the blockchain’s ability to detect and correct such errors quickly. Kate Cooper, CEO of OKX Australia, emphasized the transparency that blockchain offers, noting that it is a strength, not a flaw. Others echoed that blockchain's openness could serve as a model for traditional banking systems.

In related developments, Coinbase Ventures announced a new investment in Indian cryptocurrency exchange CoinDCX. The platform, now valued at $2.45 billion, has expanded into the United Arab Emirates following its acquisition of BitOasis. CoinDCX reports over 20 million users and $1.2 billion in assets under custody, further strengthening its presence in global crypto markets.

The crypto market remains fragile as macroeconomic uncertainty, technical mishaps, and recent liquidations continue to shape investor behavior. Despite these challenges, some industry leaders are pointing to blockchain transparency as a vital strength during turbulent times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。