Original | Odaily Planet Daily (@OdailyChina)

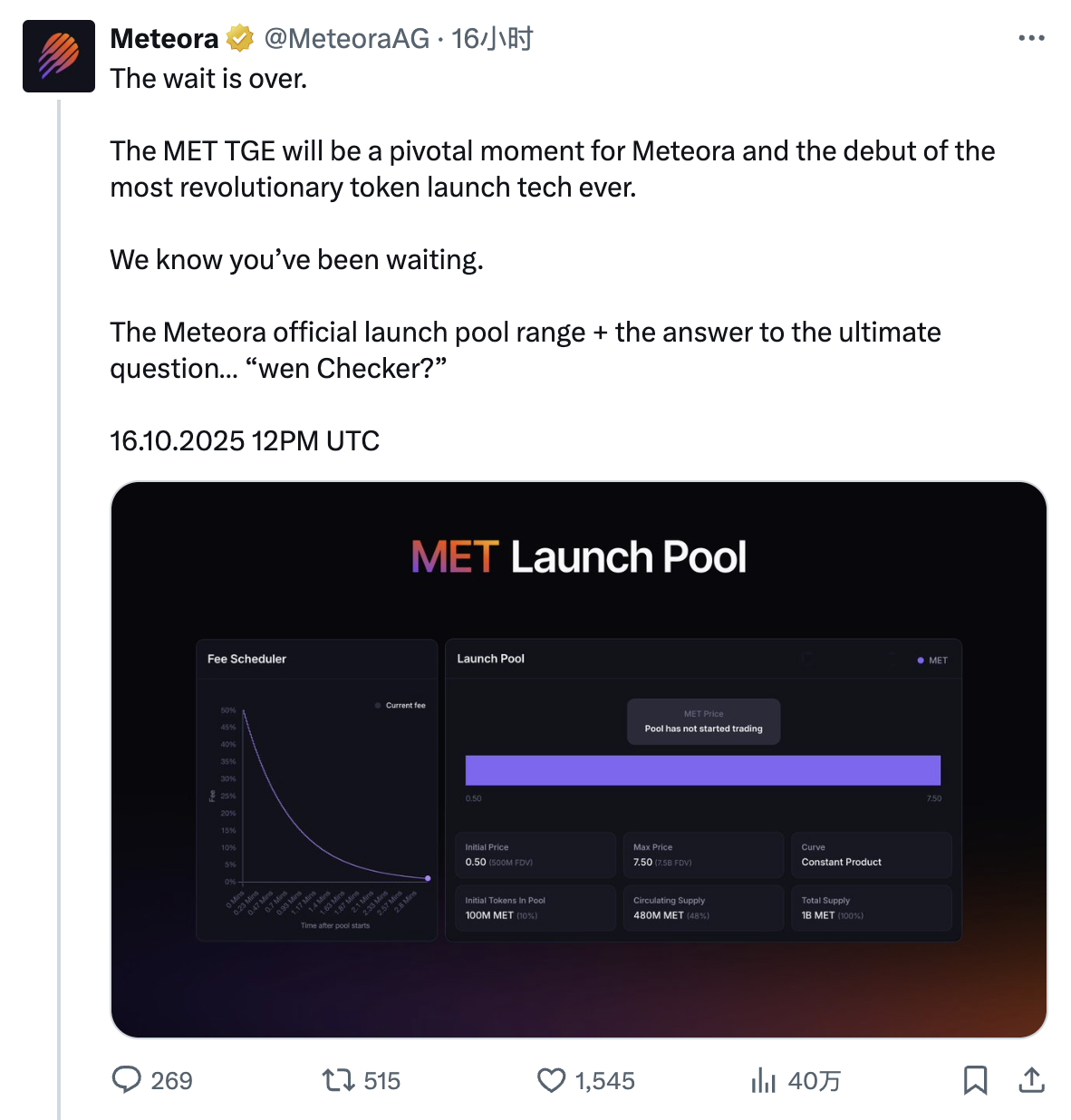

The popular DeFi project Meteora in the Solana ecosystem is about to officially launch the airdrop of its token MET.

According to the content of Meteora's conference call last night, the protocol will officially open airdrop queries at 20:00 Beijing time tonight. However, from the latest updates from the official this morning, it is known that Jupiter (note: Meteora is incubated by Jupiter) has now allowed users to check their airdrop eligibility in advance through the Jupiter Mobile wallet (only eligibility can be checked, not the amount). Users can import other wallet addresses into Jupiter Mobile for this query.

Pre-Market Valuation and Token Economic Model

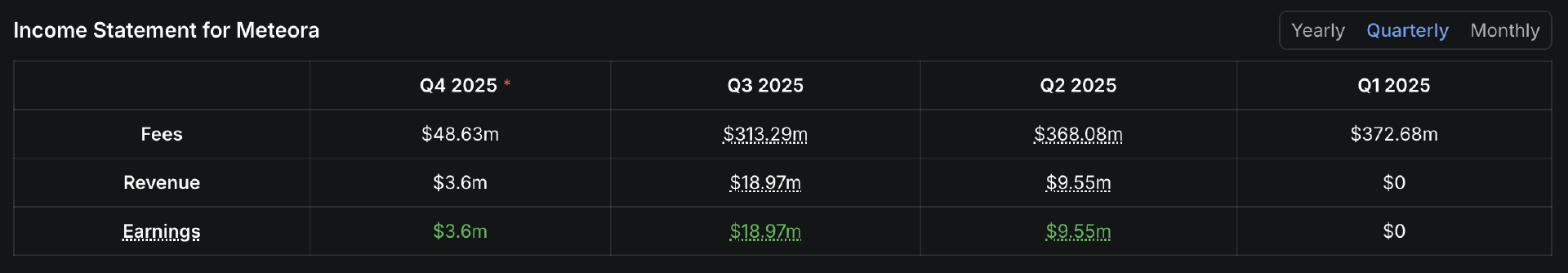

As one of the most profitable protocols in the entire DeFi world of the Solana ecosystem (DeFillama data shows that profits have exceeded $32 million this year), the market has given a relatively optimistic valuation for Meteora.

As of around 11:30, the valuation expectations for Meteora in major pre-market trading markets are as follows:

- MET is currently priced at $1.5 on Whales.Market, corresponding to a protocol valuation of $1.5 billion;

- MET is currently priced at $1.39 on Ranger, corresponding to a protocol valuation of $1.39 billion;

- MET is currently priced at $1.35 on MEXC, corresponding to a protocol valuation of $1.35 billion;

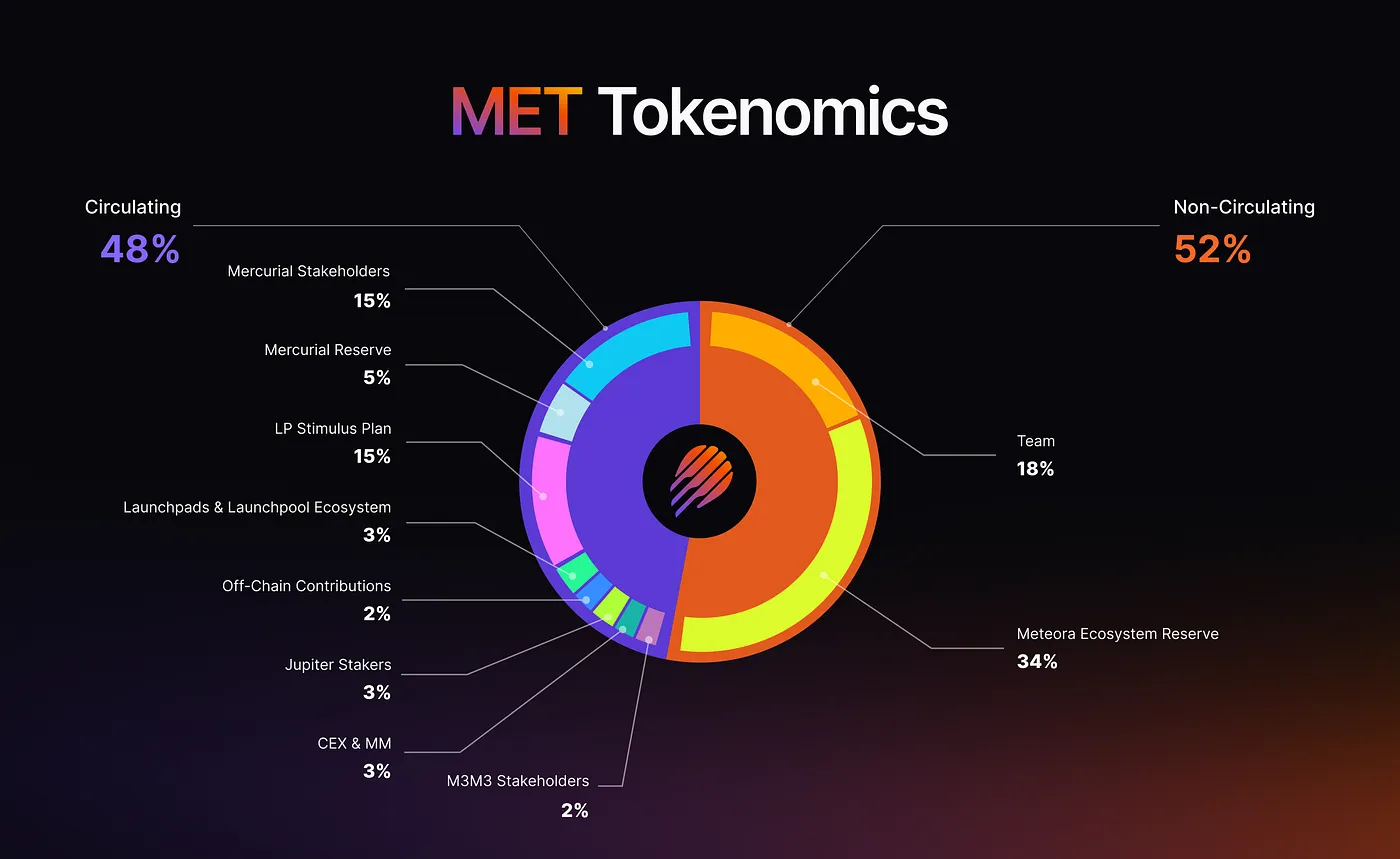

On October 7, Meteora officially announced the token economic model for MET, with a total supply of 1 billion tokens, distributed as follows.

48% of MET will be fully unlocked at TGE:

- 20% of MET is allocated to Mercurial stakeholders — later adjusted to 15% for Mercurial staker rewards, with an additional 5% allocated to Mercurial reserves. The latter will still count towards the total circulating supply but will not be released immediately at TGE.

- 15% of MET will be distributed to Meteora users through an LP incentive program;

- 3% of MET is allocated to Launchpads & Launchpool ecosystems.

- 2% of MET is allocated to off-chain contributors, i.e., those who contribute to the development of the Meteora ecosystem.

- 3% of MET is allocated to Jupiter (JUP) stakers, aimed at expanding the core LP camp by 10 times, with this portion of funds coming from TGE reserves.

- 3% of MET is allocated to CEX, market makers, and other ecosystem partners, making up the remaining part of the TGE reserves.

- 2% of MET is allocated to M 3 M 3 stakeholders.

The remaining 52% of MET will remain locked at TGE:

- 18% of MET is allocated to the team, released linearly over 6 years.

- 34% of MET is allocated to Meteora protocol reserves, also released linearly over 6 years.

Airdrop Design: Claim Tokens or Claim Liquidity Positions

After reviewing the basic information, it's time to discuss the most important content, which is Meteora's unique airdrop design.

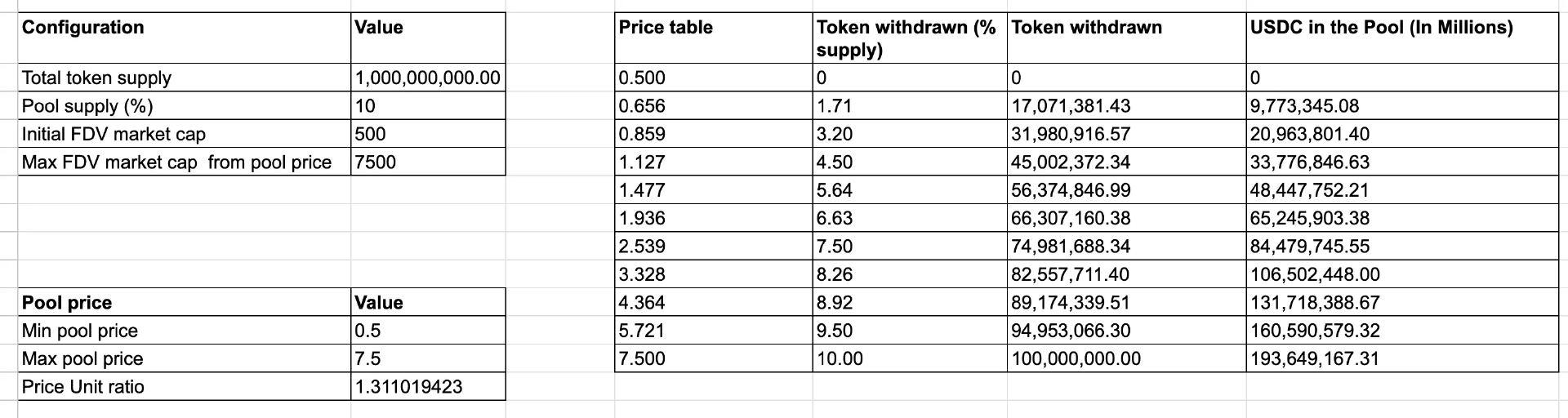

According to the information disclosed by Meteora last night, 10% of the initial token supply of 48% will be distributed through the Liquidity Distributor mechanism to guide the initial liquidity of MET. The so-called Liquidity Distributor allows users to claim airdrops in the form of liquidity positions (represented by NFTs that signify liquidity positions), directly investing their original airdrop allocation into a unilateral DLMM pool ranging from $500 million to $7.5 billion at TGE.

- Note from Odaily: A brief explanation of the DLMM pool is needed here; it is one of Meteora's core products. The characteristic of DLMM is that it allows liquidity providers (LPs) to dynamically adjust liquidity depth within a specific price range, similar to placing "limit orders," providing liquidity in segments across different price ranges — in tonight's airdrop case, the DLMM range is from $500 million to $7.5 billion, so the corresponding "limit order" price range for MET is from $0.5 to $7.5.

In simple terms, Meteora allows users to claim airdrops in two ways. One is to directly claim tokens, which requires no action; just wait for the claim to open. The other is to claim liquidity positions, which requires registration tonight. The advantage is that users can earn anti-sniping fees and trading fees right at the start of TGE, while the downside is the potential for impermanent loss. After choosing to claim liquidity positions, users can withdraw liquidity at any time, and the withdrawn funds will be in the form of a combination of MET and USDC (as some MET will be sold off due to market price fluctuations).

Based on Meteora's scale, the total amount for the Liquidity Distributor is 10% of the total token supply (i.e., 100 million MET), but since 3% of the airdrop share for Jupiter stakers will be forcibly included in the Liquidity Distributor, the remaining amount is 7%. Other airdrop users can freely choose whether to join, on a first-come, first-served basis. In other words, as long as your airdrop does not come entirely from JUP staking, you need to consider which claiming method will maximize your returns.

Which option is more profitable?

To understand whether to "choose tokens" or "choose liquidity positions," one must first grasp the logic of gains and losses when claiming liquidity positions.

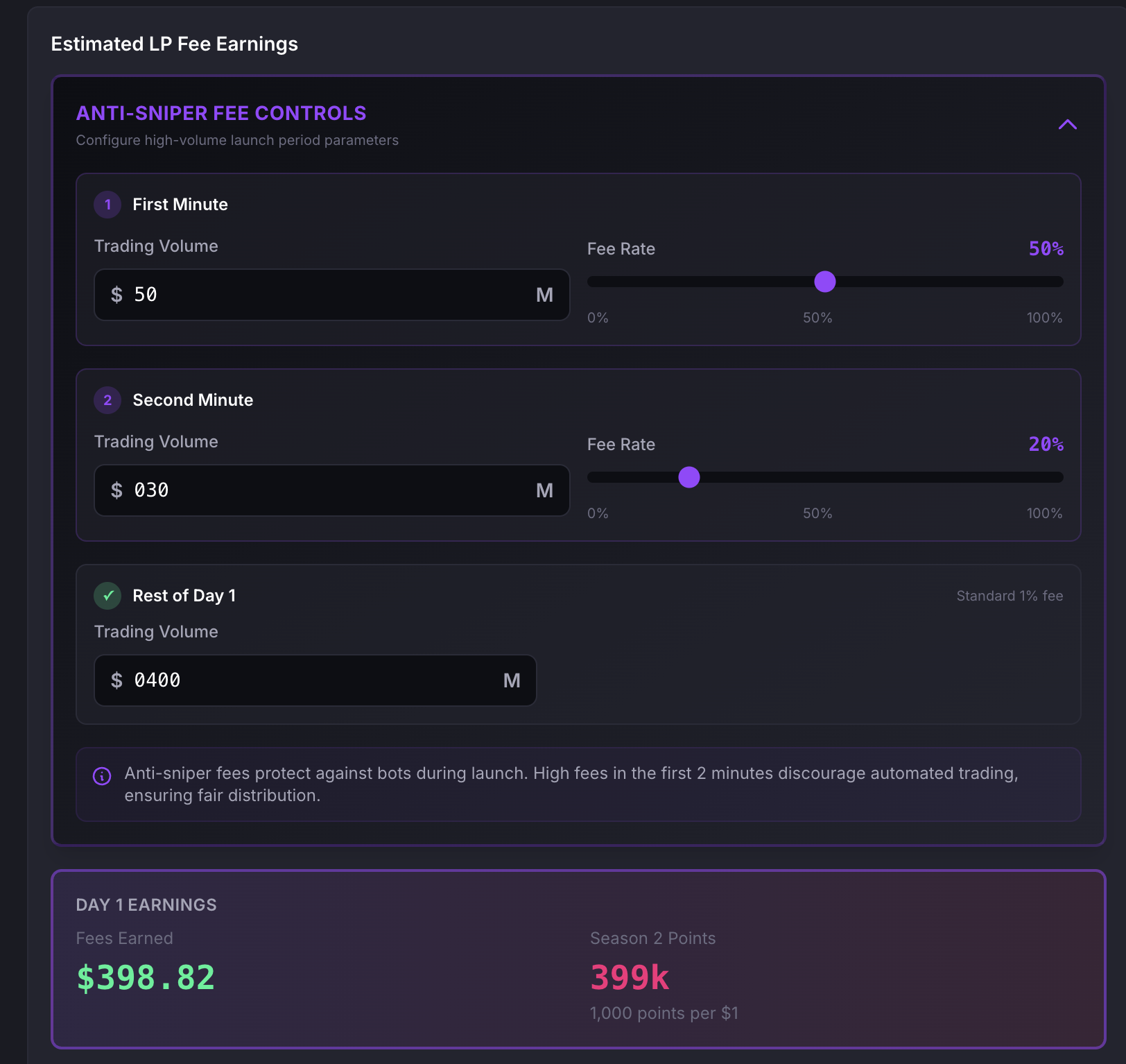

First, let's look at the gains. The main source of income from participating in the Liquidity Distributor comes from anti-sniping fees and trading fees. The anti-sniping fee, as the name suggests, aims to mitigate the possibility of being sniped during the issuance of MET. Meteora has designed the anti-sniping fee for MET to start at 50% from the first block, quickly decaying to about 1% in approximately 3 minutes. This revenue is expected to be a major source of fees on the first day; trading fees do not need much explanation — if you do not plan to withdraw liquidity and sell MET on the first day, this income will be a continuous source of fees for participating in the Liquidity Distributor.

Next, regarding losses, it is important to emphasize that the losses here refer to the "impermanent loss" relative to directly claiming MET, not actual losses. To explain simply, since the DLMM price range for MET is from $0.5 to $7.5, some MET will start to be sold off from $0.5 — assuming MET later rises to $1, compared to selling all at that time, those MET sold off at a lower price will incur a certain degree of "impermanent loss."

In the official announcement, Meteora listed the proportion of MET that will be sold at different price points (up to 10%, corresponding to a price of $7.5). Taking the data closest to the pre-market valuation (1.477 USD) as an example, if the FDV of MET after issuance is about $1.477 billion, approximately 5.64% of MET will be extracted from the pool and sold. This means that if your airdrop share is 100 MET, about 56.4 MET will be sold at a price of 48.4 USDC — compared to the $147.7 you would get from selling all at $1.477, if you withdraw liquidity at this point, the value of the airdrop MET would only be $64.4 (33.6 * 1.477), plus the total value of USDC would be about $112.8, resulting in an estimated 23.6% impermanent loss — however, in practice, users participating in the Liquidity Distributor can also share the aforementioned anti-sniping fees and trading fee revenues, the estimation of gains versus potential losses here is the core point of the decision to participate in the Liquidity Distributor.

In summary, the choice of whether to participate in the Liquidity Distributor largely depends on whether you believe the income from market trading volume (especially the trading volume at the opening) can cover the potential impermanent loss (especially around the $1.5 billion pre-market valuation, approximately 23% impermanent loss).

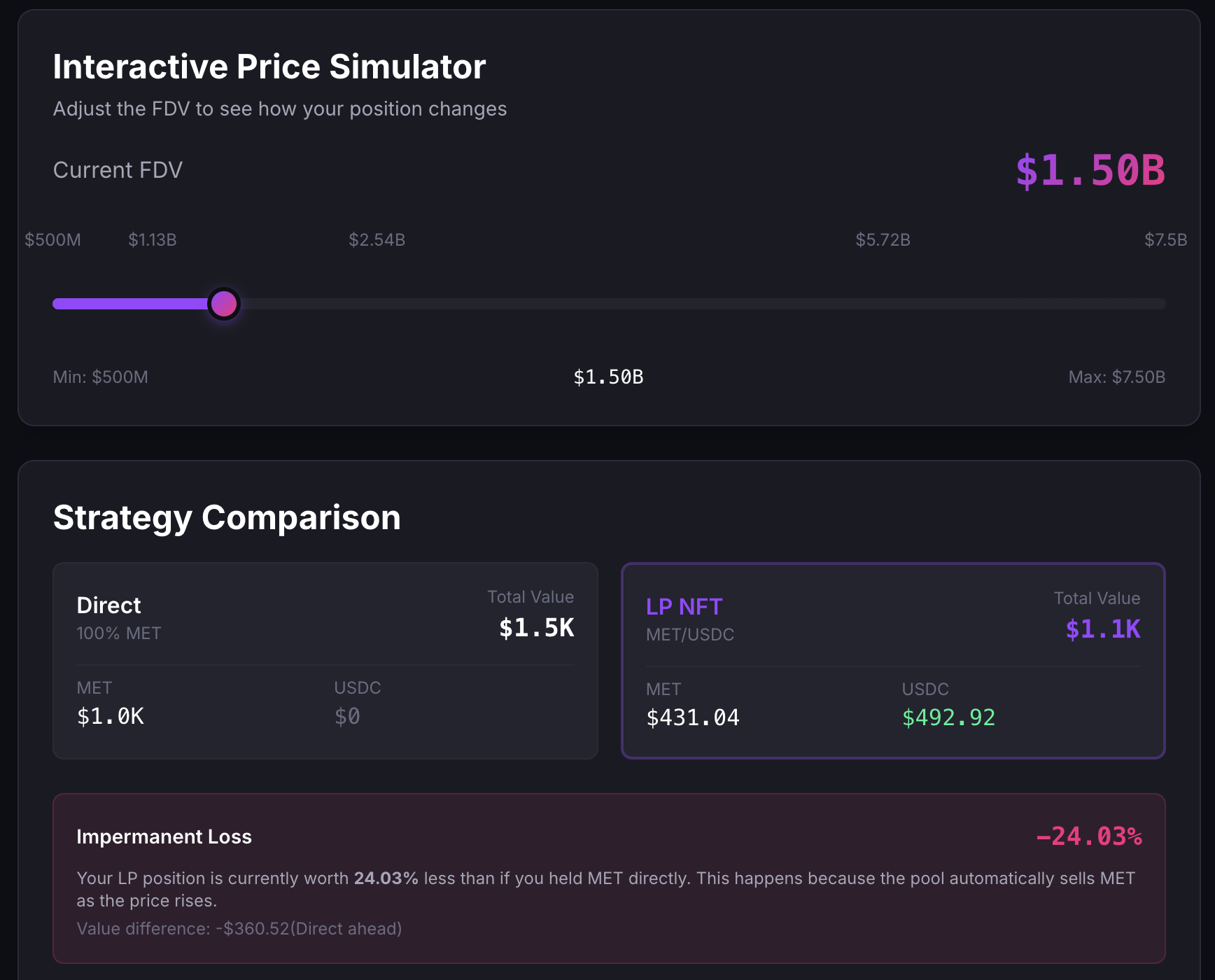

Overseas KOL Swishi.eth (@swishi_eth) has created a very intuitive loss and gain calculator for MET's opening (https://met-calculator.swishi.xyz/), and you can directly estimate whether choosing the Liquidity Distributor is worthwhile based on your expectations for MET's valuation and predictions for the first-day trading volume.

To illustrate with another example based on this calculator, suppose your airdrop amount is 1000 tokens, and you estimate the price of MET after listing to be $1.5. If you choose to directly claim tokens, the selling value would be about $1500; if you choose the Liquidity Distributor, the remaining value of the position without considering gains is expected to be about $1100.

Assuming the trading volume in the first minute after MET's opening is $50 million; the trading volume in the second minute is $30 million, and the remaining trading volume for the first day is $4 million, the corresponding first-day mining income is about $398, roughly equal to the previous impermanent loss.

So what you need to do is to estimate MET's opening price and the trading volume situation on the first day based on your judgment, and make the decision that best suits you based on that judgment. The algorithm is transparent, but the decision relies solely on you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。