Original | Odaily Planet Daily (@OdailyChina)

AI and cloud computing are the underlying narratives of technology in this era. In early September, due to Oracle's AI/cloud contract performance exceeding expectations, Larry Ellison's net worth briefly surpassed Elon Musk, making him the world's richest person. The strong demand for high-performance computing and cloud services in the AI industry has intensified competition among upstream GPU computing providers. In the future, GPU computing providers that can offer cheaper and higher-quality computing resources and serve more small and medium-sized enterprises are bound to succeed in the market and gain favor from a wide range of investors.

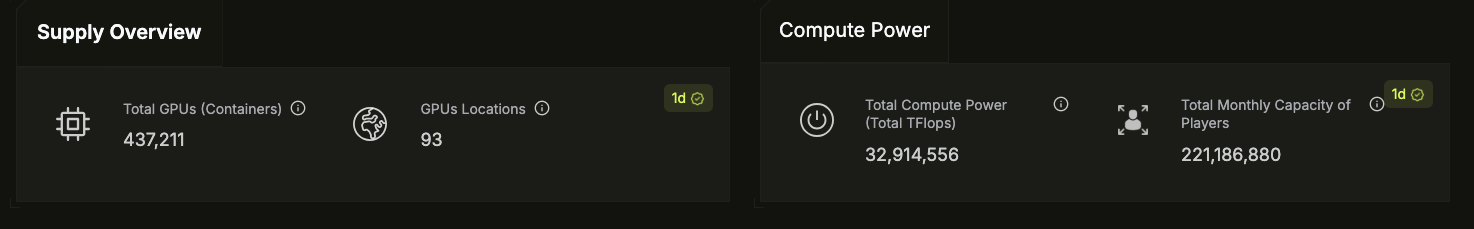

In this direction, the distributed GPU cloud computing provider Aethir is at the forefront of the industry. Aethir is dedicated to aggregating enterprise-level GPUs into a globally shared computing network, providing high-quality and cost-effective computing resources for AI and cloud gaming companies in need. Currently, Aethir has deployed over 435,000 high-performance GPU containers globally, covering 93 countries and regions, and serving over 150 enterprises and clients.

In the secondary market, Aethir is also gradually being recognized for its value. Throughout September, the price of ATH continued to rise, with an increase of over 63%, reaching a new high since February 2025. ATH also suffered a heavy blow on "10.11," dropping to $0.22, but the price subsequently recovered and temporarily stabilized around $0.045. The significant drop in the cryptocurrency market did not change Aethir's fundamentals; it remains in a value trough. As the traditional market gradually understands the advantages of decentralized cloud computing and global regulations no longer adopt a one-size-fits-all approach, clarifying the essential differences between utility tokens and securities, Aethir may grow to become the next "Oracle."

The Value Support Behind Aethir

In Web 3, the success of a project requires not only a good narrative but also a strong product-market fit (PMF), which is a crucial factor that can determine the life or death of a project from a business and long-term perspective. For a project, the short-term market FOMO driven by narrative will eventually dissipate. Without PMF support, a project lacking a stable and sustainable business model often ends up on the path of issuing tokens and reaching its endpoint.

Aethir is one of the few projects in the cryptocurrency space that combines an appealing narrative with PMF. Aethir does not rely on "selling tokens" for profit; its main revenue comes from enterprise clients in AI, cloud gaming, and other sectors with stable demand for high-performance computing resources. Therefore, Aethir's revenue capability does not depend on the bull and bear cycles of the cryptocurrency market, which has become an important value support behind its token price.

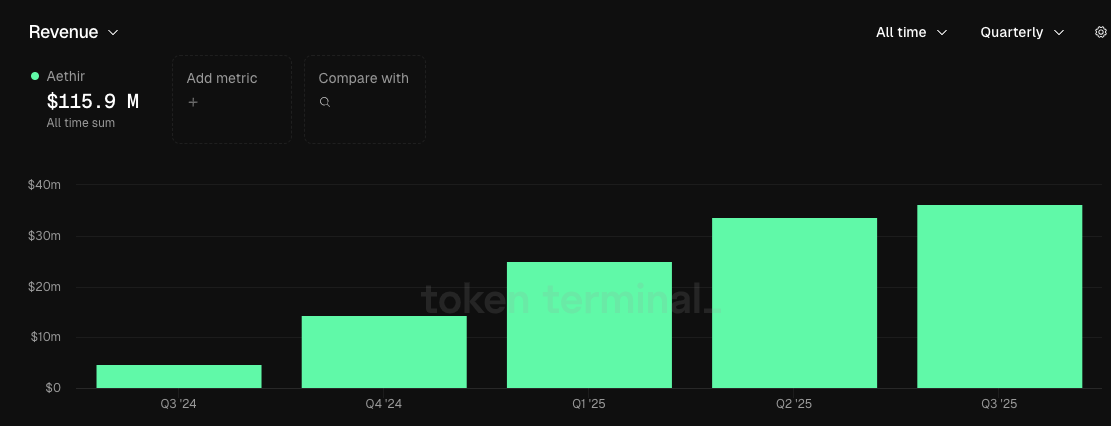

Although the narrative hotspots in Web 3 have shifted to DAT and RWA this year, Aethir has still delivered strong revenue results. Aethir's Q3 2025 revenue exceeded $39.8 million, a 22% increase quarter-over-quarter, with an average monthly revenue of $13.29 million, setting a new historical record for the company, and a revenue/market cap ratio of 14.46% (industry average: 8–23%).

From the perspective of annual recurring revenue (ARR), according to Aethir's GPU Dashboard data, its ARR has reached $166 million, a 13-fold increase compared to the same period last year. This proves that Aethir's distributed GPU cloud computing subscriptions have made a qualitative leap this year, and its customer base is continuously expanding.

According to Aethir's disclosure, in the first half of this year, the number of its partners and clients exceeded 150, including several innovative Web 2 AI companies such as Kluster.ai, Attentions.ai, and Mondrian AI. Currently, Aethir's computing infrastructure covers 93 countries and regions, with over 435,000 high-performance GPU containers deployed, including mainstream models such as NVIDIA H 100, H 200, B 200, and A 100, capable of meeting the needs of enterprise clients at different stages of development.

At the same time, according to Aethir's GPU Dashboard data, Aethir's distributed GPU cloud computing capacity reaches 32,914,556 TFlops, equivalent to having over 490,000 NVIDIA H 100 GPUs, valued at over several billion dollars. In terms of available GPU scale, Aethir is already comparable to a few global giants capable of large-scale LLM training and high-concurrency inference, ranking among the "top global enterprise-level" computing providers.

Depin Competitive Advantage: SLA Service Stability Reaches 99.31%

“Aethir is currently the only Depin project in Web 3 that can provide stability services for enterprise clients,” said Aethir co-founder Mark when discussing Aethir's competitive advantage in the Depin track.

Mark's confidence stems from the fact that, in addition to genuinely possessing enterprise-level computing resources, Aethir also has SLA service terms, with Aethir's SLA stability reaching 99.31% in Q3 2025. SLA service terms are written commitments between service providers and clients regarding service availability, performance, response, support, compensation, and other factors. They clearly outline "what level of service clients expect" and specify how to compensate or handle situations if the service does not meet the agreed standards.

SLA service terms are not just marketing jargon; for a company providing enterprise-level services, having SLA service terms means that the company has made a formal commitment to clients regarding service quality, response, and compensation rules. This is both a proof of trust and professionalism, as well as a legal/financial and operational responsibility. Enterprises tend to prioritize service providers with SLA service terms when making their choices.

In the traditional B2B sector, SLA service terms are almost standard, but in the emerging industry of Depin and decentralized cloud computing, service quality instability and poor performance have been widely criticized in the market. Aethir is the first decentralized cloud computing service provider to have SLA service terms, which not only indicates that Aethir has overcome the shortcomings of Depin and that its business model is maturing and systematizing, but also provides Aethir with a significant competitive advantage.

"Aethir does things very differently from other Depin projects. Io.net mainly uses distributed GPU resources to solve some simple AI or machine learning tasks; Render focuses on consumer-level computing connections for 3D rendering services; Grass utilizes distributed network resources for mining points, while Aster focuses on providing enterprise-level services in gaming and AI at the software level," explained Aethir co-founder Mark regarding the differences between Aethir and other Depin projects.

A complete business model also makes sustainable revenue from enterprises Aethir's core advantage. Aethir's annual recurring revenue (ARR) has reached $166 million, while according to DePIN Pulse data, Render's ARR is only $3,044, and io.net's ARR is only $11.31 million. Additionally, since Q3 2024, Aethir's protocol revenue has steadily increased, unaffected by the bull and bear cycles of the cryptocurrency market.

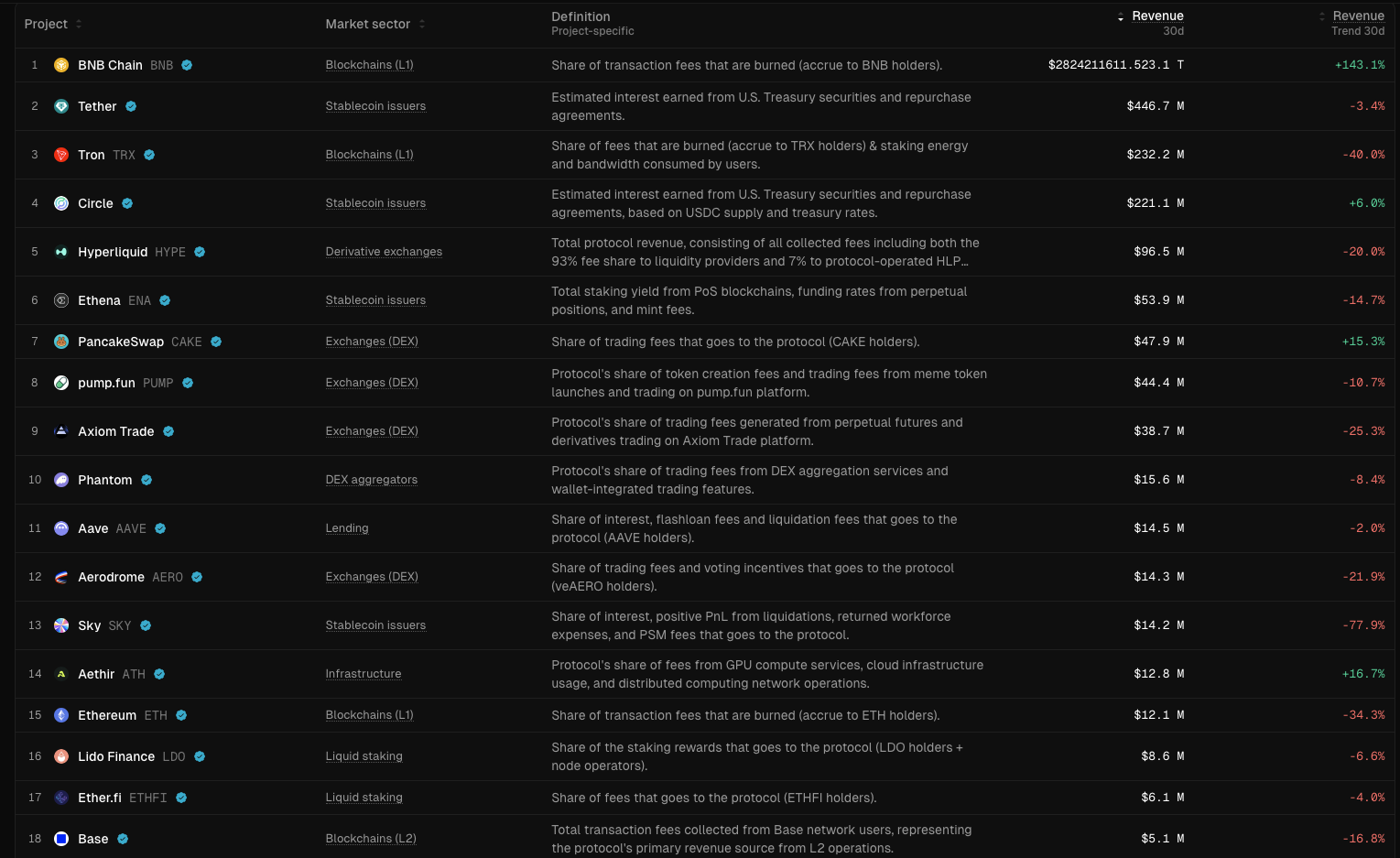

As of now, Aethir has generated $115.9 million in revenue, with its revenue over the past 30 days reaching $12.8 million, surpassing Ethereum and Lido.

Aethir's Pricing Advantage and the Trend of Financialization of Computing Power

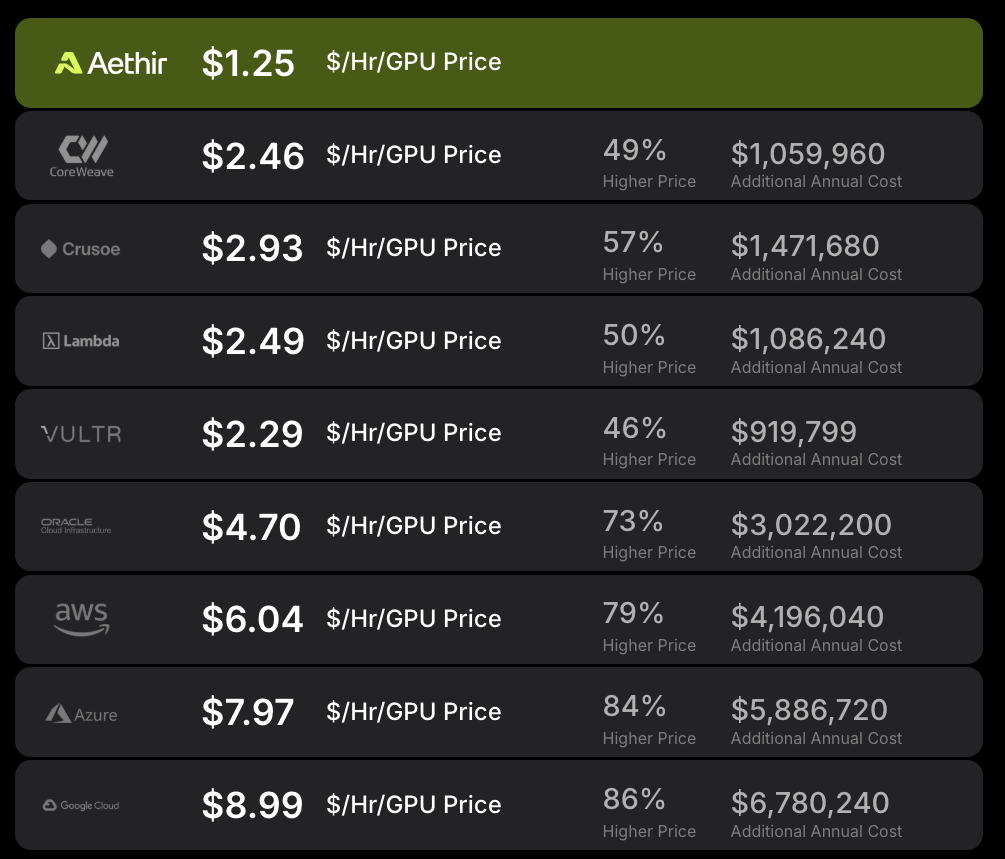

Aethir's true business competitors are centralized computing and cloud service companies in Web 2, and its biggest advantage lies in its competitive pricing. “For example, the prices on our platform are about 1/10th of AWS's prices.” As shown in the figure below, Aethir's hourly GPU pricing is significantly lower than that of Google, AWS, and Oracle, yet it also possesses the conditions for enterprise-level computing resources for large-scale LLM training and cloud gaming rendering.

This is mainly due to the advantages of Aethir's distributed network. The decentralized operating model allows Aethir to avoid purchasing GPU hardware and bearing the costs of building and operating data centers, as well as the corresponding company management expenses, which reduces its costs by 80% compared to traditional Web 2 computing providers. In traditional markets, these costs ultimately get passed on to enterprises purchasing/renting computing power, while in Aethir's network, enterprises connect directly with computing power providers, reducing intermediary costs and promoting fair competition, enabling small and medium-sized or startup enterprises to obtain the computing resources they need at lower prices.

Aethir's main service targets are Web 2 AI and gaming companies, but "good wine fears no deep alley." Although decentralized computing power has pricing advantages, some enterprises may fear risks due to a lack of understanding of the decentralized cloud computing mechanism. Additionally, from a compliance perspective, Aethir's model of using cryptocurrency for service payments also touches on the compliance boundaries for enterprises. For physical businesses, the varying definitions and regulatory attitudes towards cryptocurrencies in different countries mean that using cryptocurrency for settlement could involve issues related to anti-money laundering, payment licenses, and taxation.

This is essentially the fundamental difference between "tokenized pricing" and "financialization of computing power." In traditional computing markets, parties typically settle service payments in fiat currency; even if tokens are used internally for pricing, those tokens cannot circulate in the secondary market. However, in the Aethir network, the platform token ATH is used for service payment settlements, and ATH is a cryptocurrency that can circulate freely in the secondary market and has volatility. This represents the largest regulatory gray area in the field of decentralized cloud computing and creates resistance to Aethir's business expansion.

Fortunately, with the relaxation of U.S. regulations on the cryptocurrency industry this year, the SEC has gradually clarified the boundaries between securities and cryptocurrency utility tokens, leading to an increasing acceptance of decentralized computing power among AI companies. Although major Web 2 companies still have disagreements on whether computing power should be centralized, they have already explored using cryptocurrency for service payments. In 2022, Google piloted allowing some customers to pay for cloud services with cryptocurrency through Coinbase.

At the same time, in the context of the proliferation of DAT, traditional finance's acceptance of decentralized computing power tokens has also increased. Aethir is at the forefront of the financialization of computing power, announcing on September 29 that it has partnered with Predictive Oncology (NASDAQ:POAI) to launch a digital asset treasury (DAT) worth $344 million, which is the first strategic reserve supported by GPU computing power.

Aethir is rapidly expanding its GPU infrastructure from Q4 2025 to 2026, attracting new cloud hosts globally to meet the explosive growth in enterprise AI demand. By Q1 2026, Aethir plans to more than double its global computing power scale, further solidifying its position as a leading global GPU cloud service provider driving the AI economy.

The actual revenue generated will be used to repurchase ATH tokens. Aethir has initiated a $45 million DAT repurchase plan, which will last for 45 days starting from October 11.

Therefore, Mark states that Aethir DAT is a work of art, representing the true integration of capital markets and token economics, perfectly synchronized.

It is believed that in the near future, as the role of decentralized cloud computing in promoting AI enterprise development becomes more evident, global regulators will actively formulate relevant policies to facilitate healthy industry development. In this context, Aethir, as a leader in decentralized computing power, will have its value reassessed by capital.

The Positive Flywheel of ATH

The success of a Web 3 project involves not only narrative and PMF but also sound token economics. Aethir's token economics creates a positive flywheel for ATH, serving as a long-term value support for the ATH token price.

Firstly, ATH, as Aethir's computing power usage certificate, is deeply integrated into the operation of the Aethir network. On one hand, enterprise clients need to use ATH tokens for settling GPU computing resource usage, which gives the token utility and creates a fee digestion system similar to public chains. However, unlike traditional models, the training of AI models is a long-term process, and the demand for computing power and stability is also long-term, meaning that one client equals a long-term commitment to purchasing ATH.

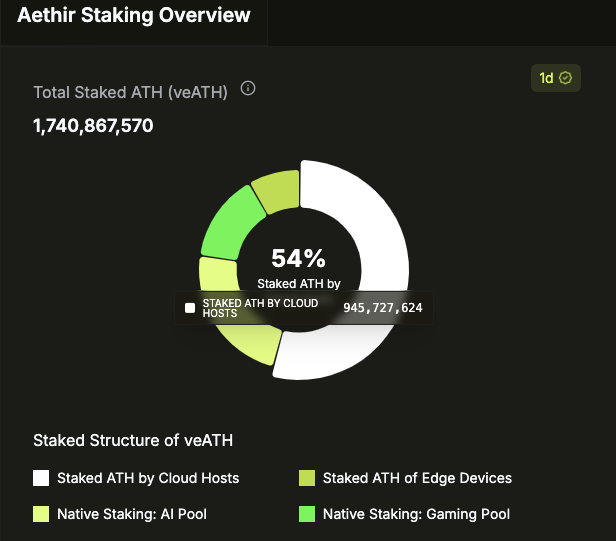

On the other hand, containers providing GPU computing resources in Aethir must stake ATH to offer services, cleverly integrating ATH into a reward and punishment system that maintains system security, thereby reducing the circulation of tokens in the market.

At the same time, Aethir will not sell the tokens repurchased from the DAT; instead, they will be transferred to the DAT treasury. These tokens will be used for staking to generate returns or to reserve computing resources for enterprise clients on the network, further reducing the circulation of ATH in the market.

The expansion of GPU computing power in the Aethir network also means that more Aethir tokens will be staked. According to Aethir's GPU Dashboard data, over 17.4 million ATH tokens have already been staked, with cloud hosts accounting for 54% of that.

Aethir's focus on designing an economic model for enterprise-level services greatly enhances the attractiveness of cloud hosts. Additionally, 80% of the revenue goes to cloud hosts, 20% to the Aethir Foundation, and with the continuous reduction in token circulation, the value of token rewards increases, allowing Aethir to rapidly expand the number of cloud hosts on its platform.

The influx of numerous cloud hosts, along with increased computing power and low prices, will attract more large clients, thereby generating more revenue and excellent ARR. The distribution of rewards to cloud hosts will increase, further expanding GPU supply, and enhancing the staking rate and intrinsic value support of ATH.

Aethir: A Viable Business Case Combining Web 3 and AI

AI represents the enhancement of productivity in this era, while Web 3 signifies the innovation of production relations. However, in the past, the combination of Web 3 and AI has been repeatedly disproven, and the market has experienced many bubble moments. Yet in the realm of GPU computing and cloud services, the source factory of AI, Aethir has found a viable business case for combining Web 3 and AI through a closed-loop business model, a global customer base, positive cash flow, and a sound token model.

Aethir possesses true cross-border scalability. As the cryptocurrency industry moves towards normalization and popularization, although the current market primarily focuses on stablecoins, RWA, and other areas of Web 3 transforming traditional finance, in the AI-driven era, people will eventually recognize the revolutionary significance of Web 3 for AI and the computing market. By then, Aethir, as a leader in decentralized cloud computing, will be the first to capture the attention of capital.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。