Bitcoin Funds See $104 Million Exit, Ether Stays in Green

The exchange-traded fund (ETF) market took a turn midweek, with bitcoin products cooling off while ether ETFs pulled in fresh inflows for a second day running.

Bitcoin ETFs registered $104.11 million in net outflows, suggesting investors took a breather after a stretch of inflows earlier in the week. Grayscale’s GBTC led the exodus with a hefty $82.90 million exit, followed by smaller redemptions of $11.10 million from Invesco’s BTCO and $10.11 million from BlackRock’s IBIT.

Trading remained active, with $4.56 billion in total volume. However, net assets dipped modestly to $151.32 billion, hinting at some cautious repositioning rather than widespread risk aversion.

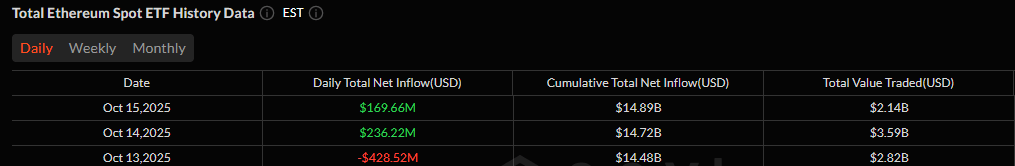

Two days of inflows for ether ETFs have almost reversed the heavy Monday outflow. Source: Sosovalue

Ether funds, meanwhile, saw a clean sweep of inflows totaling $169.66 million. Blackrock’s ETHA continued to dominate with an impressive $164.33 million, reaffirming its growing dominance in institutional flows. Bitwise’s ETHW added a healthy $12.31 million, while Fidelity’s FETH contributed nearly $1 million, maintaining the green streak for ether ETFs.

An outflow of $7.98 million was seen on 21Shares’ TETH, but it did little to affect the solid inflows. Total value traded reached $2.14 billion, with net assets stable at $27.37 billion, reflecting steady institutional interest.

As bitcoin ETFs took a brief step back, ether quietly extended its run. The divergence may be short-lived, but for now, ether’s ETFs are stealing the spotlight.

FAQ

- What happened to crypto ETF flows midweek?

Bitcoin ETFs saw $104 million in outflows, while ether ETFs drew $170 million in new inflows. - Which bitcoin ETF led the outflows?

Grayscale’s GBTC topped the exits with $82.9 million in redemptions. - Who led the inflows on the ether side?

Blackrock’s ETHA dominated with $164 million, continuing its strong institutional momentum. - What does this divergence suggest about investor sentiment?

Investors are rotating capital toward ether ETFs while taking profits from bitcoin positions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。