Author: Deng Tong, Golden Finance

On October 14, CJ Hetherington, CEO of Limitless Labs, posted on X (his company is supported by Coinbase Ventures), directly addressing the issue of Binance charging high listing fees.

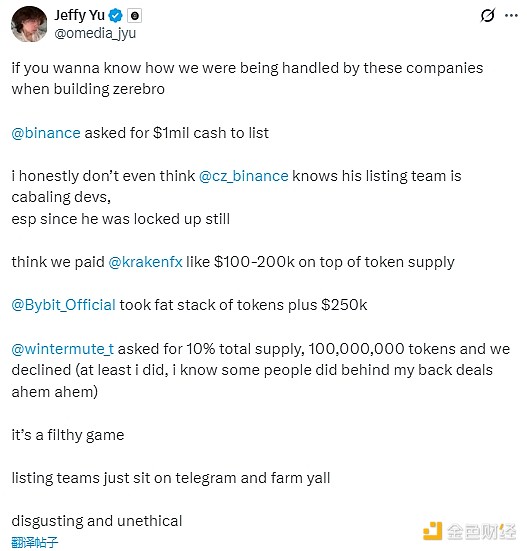

On October 11, Zerebro co-founder Jeffy Yu revealed the issue of exchange listing fees on X, claiming it was a dirty game, disgusting and unethical. He listed several exchanges with high barriers to listing.

Especially after the news on the 14th was released, it continuously stirred discussions in the industry, with major exchanges like Binance, Hyperliquid, and Uniswap responding to the "listing fee" issue. Going back to mid-September, Coinbase also posted on X addressing the "listing fee" issue.

I. The Controversy Over "Listing Fees" Triggered by Two Tweets

On October 11, 2025, Zerebro co-founder Jeffy Yu was the first to reveal the issue of exchange listing fees on X:

If you want to know how we were treated by these companies when creating zerebro, @binance demands $1 million in cash to list a token.

To be honest, I don't even think @cz_binance knows that his listing team is secretly manipulating developers… I even think we paid @krakenfx $100,000 to $200,000 besides the token supply.

@Bybit_Official took a bunch of tokens plus $250,000.

@wintermute_t asked for 10% of the total supply, which is 100 million tokens, but we refused (at least I refused; I know some people did it behind my back, cough cough).

This is a dirty game; the listing team just sits on Telegram making money. You are disgusting and unethical.

In response to this tweet, Binance's official account replied:

Hello, after verifying with our listing team, we confirm that there are currently no communication records regarding your token listing. We advise you to proceed with caution and confirm whether the person you are in contact with is a scammer.

Other users commented:

Many projects have been stifled due to listing fees/lock-ups.

Exchanges hold all the power; unfortunately, this is a one-sided relationship. It needs to change.

Why are you lying, haha. Kraken and Binance are free, fool.

Subsequently, the issue of "listing fees" continued to escalate, with major exchanges embroiled in the "listing fee" controversy.

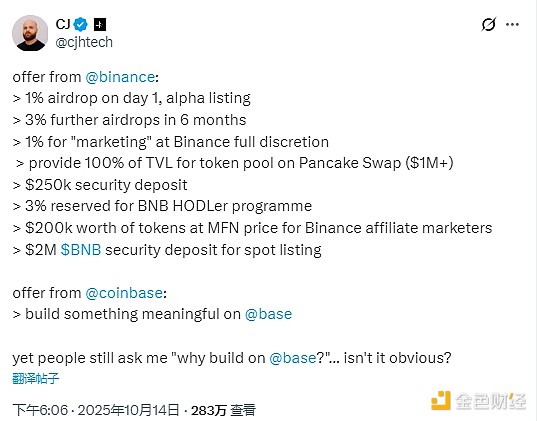

On October 14, CJ Hetherington, CEO of Limitless Labs, posted again on X, directly addressing the high listing fees charged by Binance.

· Airdrop 1% of tokens on the first day (Alpha launch phase)

· Airdrop an additional 3% within 6 months

· Allocate 1% of tokens for "marketing," specifically determined by Binance

· Provide 100% of TVL (Total Value Locked, over $1 million) for the token pool on PancakeSwap

· Pay a $250,000 margin

· Reserve 3% of tokens for the BNB holder program

· Provide $200,000 worth of tokens to Binance's affiliate marketers at the best price

· Pay an additional $2 million worth of BNB as margin for spot listing

II. Responses from Major Exchanges

1. Binance

On October 15, Binance's official account Binance Customer Support posted on X:

"We noticed the post by CJ on X on October 14, 2025, which contains false and defamatory allegations against Binance. These allegations are clearly intended to mislead the community and undermine the fairness of Binance's listing process.

Binance does not profit from its listing process—token distribution is aimed at Binance users. Binance does not charge listing fees but requires a margin to protect user interests. This ensures that projects can continue to operate after being listed. The margin is usually refundable under certain conditions within 1-2 years. CJ's allegations contradict the terms of the Binance proposal he himself published.

Allegations that Binance and its founders have been dumping tokens are also completely false and unfounded.

We are shocked by CJ's illegal and unauthorized disclosure of confidential communications with Binance; such public behavior undermines the confidentiality of sensitive information recognized by the industry and the community. Given CJ's extremely bad and unforgivable behavior, Binance explicitly reserves all rights, including taking legal action to protect its interests."

CZ posted on X:

Regarding listing "fees" (have seen this a few times recently)

- If your project complains about listing airdrops or "fees" (to users), don’t pay.

If your project is strong, exchanges will compete to list your token.

If you have to beg an exchange to list, then… you need to ask yourself why, and who is providing value to whom.

- If you complain about listing fees from competing exchanges, then set your listing fees to 0 anyway and be happy.

In fact, why not set all your fees to 0? Including trading fees?

In a decentralized world, businesses are free to have their own business models. No one forces you to adopt a certain model.

Focus on treating your users well. Don’t focus on your competitors.

If you are a holder of a token, complain to the project, not the exchange. Or use decentralized exchanges.

PancakeSwap does not charge listing fees, and the trading volume is quite substantial.

Furthermore, exchanges adopt different listing models.

List everything on all blockchains. Most tokens are scams. Most projects that "try hard" fail. Only a few projects succeed.

Selective listing and using listing fees as a source of income. If you can attract enough projects to list, it’s a good business model. Many small exchanges adopt this model because their trading fee income is insufficient.

Selective listing. Require airdrops to users. Charge margins to increase the implementation costs of scams and failed projects. Protect users.

These models are not black and white; many exchanges use a combination of spot listings, futures listings, alpha version listings, Web3 wallet purchases, etc.

Focus on your project, not others.

2. Hyperliquid

On October 15, Hyperliquid disclosed:

On Hyperliquid, there are no listing fees, no listing departments, and no "gatekeepers." Deploying spot trading on Hyperliquid is permissionless. Anyone can deploy a spot asset by simply paying gas fees in the form of HYPE. Deployers can choose to receive up to 50% of the trading fees from their spot trading pairs. All processes are conducted on-chain, publicly transparent, and verifiable. The complete DeFi lifecycle includes: creating projects, issuing tokens, and trading those tokens. On Hyperliquid, every step of this process can be completed permissionlessly.

3. Uniswap

On October 15, Uniswap founder Hayden Adams stated:

"Decentralized exchanges (DEX) and automated market makers (AMM) have enabled the ability to provide free listing, trading, and liquidity support for any asset. If a project is willing to pay high listing fees, it is for marketing purposes, not to meet market structure needs. We are proud to play a role in achieving this goal."

4. Coinbase

As early as September 14, Coinbase CEO Brian Armstrong mentioned the listing fee issue in a post on X:

We have received a lot of questions about how and why assets are listed on Coinbase. We have now written a guide aimed at explaining how this all works more transparently. Listing is completely free and based on metrics; all assets are evaluated according to uniform standards. According to Coinbase's digital asset listing process guide, the time for listing applications can vary greatly, from a few hours to several months, depending on factors such as the complexity of the asset and the completeness of the submission. A complete and well-prepared application is crucial for effective review, typically following: application submission, business assessment, core review, communication with the issuer, and approval.

After Jesse Pollak, head of Coinbase's Base network, stated that exchange listing "fees should be 0%", there were calls for Coinbase to list BNB to "lead by example." In response, on October 16, Coinbase included BNB in its listing roadmap.

Subsequently, CZ responded to the "Coinbase listing BNB" matter by addressing Justin Sun: "Thanks to all my peers for the support. Listing the third-largest cryptocurrency by market cap should be a piece of cake. It has excellent liquidity, trading volume, and ecosystem. Not listing it is also a loss for the trading platform itself."

He suggested that Coinbase list more tokens from the BNB Chain. CZ stated that Binance has already listed several tokens from Base chain projects, while Coinbase seems to have yet to list any tokens from the BNB Chain, which is a more active public chain ecosystem.

III. Industry Discussions Triggered by "Listing Fees"

1. "CEX Has Too Much Power"

Some industry insiders believe that this phenomenon indicates that centralized exchanges (CEX) hold too much power over new projects.

Mo Ezeldin from Animoca Brands pointed out, "The power of exchanges is too great." He believes that listing fees and token demand create an unhealthy cycle that ultimately harms projects and drains positive momentum.

Alex Davis, founder of Mavryck Network, expressed support for DEX, believing they can provide a more sustainable model for the future. Davis stated, "All these antics surrounding CEX highlight the necessity of DEX and further increasing transparency. Clear listing rules and reasonable listings are essential. The essence of cryptocurrency is to eliminate third-party intermediaries, not to create new intermediaries to earn fees."

2. The Justification for "Listing Fees"

Some CEXs charge "listing fees" due to operational costs, which can help generate initial publicity for projects and attract new users. As a leading exchange in the industry, Binance can bring significant traffic and user attention to new projects. The so-called "listing fees" are essentially compensation that project parties voluntarily pay for liquidity and to reach more users. Moreover, Binance charges a "margin," which is typically refundable within 1-2 years under certain conditions. It is reasonable for projects to pay for industry visibility.

In contrast to CEXs, DEXs allow projects to list freely without permission, without intermediaries or large token distributions, potentially providing a pathway for fairer access. However, aside from a few high-quality projects like Hyperliquid that do not need to list on CEXs, most project parties face challenges on DEXs, such as lack of market attention, low liquidity, and competition from numerous tokens. Listing on DEXs tests the quality and operation of projects more rigorously. For most projects, the "listing fees" of CEXs are essentially a win-win game of "one side is willing to pay, and the other is willing to accept."

3. Is "Zero Listing Fees" Really Good?

Is the "zero listing fee" emphasized by Coinbase, Hyperliquid, and Uniswap really beneficial? Clearly, under this model, listing has advantages such as transparency, openness, and fairness. However, there are also issues with junk coins and air coins, and the lack of risk control may pose greater risks to users. Therefore, for most exchanges, while "listing fees" are criticized, they also serve as a filtering mechanism to some extent, and it may not be feasible to implement this universally across all exchanges in the short term.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。