Written by: Glendon, Techub News

In the recent market turmoil, cryptocurrency giant Ripple continues to steadily advance its business plans.

Today, according to Bloomberg, Ripple Labs is actively leading efforts to raise at least $1 billion in funding, aimed at accumulating XRP. According to insiders, this funding will be raised through a special purpose acquisition company (SPAC) and deposited into a newly established Digital Asset Treasury (DAT), with Ripple Labs possibly contributing some of its own XRP. Just last night, Ripple made a significant move by announcing a $1 billion acquisition of financial management system company GTreasury, officially entering the corporate finance sector.

Ripple stated in an official announcement that this acquisition marks a significant expansion for Ripple, which will immediately open up a corporate finance market worth trillions of dollars and reach many of the largest and most successful corporate clients. Looking back to early April, when Ripple acquired cryptocurrency-friendly major broker Hidden Road for $1.25 billion, it also stated that this acquisition aimed to expand the services it provides to institutional investors.

It is clear that Ripple's recent business plans clearly reflect its strategic direction—expanding its cross-border payment business and strengthening its position in the financial infrastructure sector.

It is worth mentioning that on August 7, the U.S. Securities and Exchange Commission (SEC) reached an agreement with Ripple to jointly withdraw their appeal in the Second Circuit Court, marking the end of a nearly five-year regulatory "tug-of-war." Having freed itself from long-standing regulatory constraints, Ripple is now moving into a new phase. So, in which areas is Ripple making significant strategic layouts today?

Core Layout: A Panorama of Ripple's Institutional-Oriented Strategy

Ripple's core strategic layout this year undoubtedly revolves around the cross-border payment sector, with the USD stablecoin Ripple USD (RLUSD) being the most critical component. On December 17 last year, after receiving final approval from the New York Department of Financial Services (NYDFS), Ripple officially launched RLUSD. This stablecoin, tailored for enterprise use cases, is issued simultaneously on the XRP Ledger and Ethereum, focusing on stability, efficiency, and transparency, and precisely meeting the market demand for dollar-denominated transactions, becoming a powerful "booster" for Ripple's cross-border payment solutions.

At the beginning of this year, RLUSD quickly established deep partnerships with well-known crypto projects such as Chainlink and Zero Hash, building a collaborative network in the crypto ecosystem.

Subsequently, Ripple began to accelerate its integration into regulated financial markets: in April, Ripple spent $1.25 billion to acquire broker Hidden Road, leveraging this move to use RLUSD as collateral for its main brokerage products, significantly enhancing its market application value; by June, Ripple pushed for RLUSD to receive regulatory approval from Dubai's financial regulatory authority, becoming a stablecoin usable in the Dubai International Financial Centre (DIFC), completing its key layout in the Middle East market.

On July 3, Ripple even submitted a national bank charter application to the Office of the Comptroller of the Currency (OCC) in the U.S., aiming for dual state and federal regulation of its stablecoin RLUSD. Around the same time, Ripple's subsidiary Standard Custody & Trust Company also applied for a Federal Reserve master account, planning to allow Ripple to directly hold RLUSD reserves at the Federal Reserve. This series of actions undoubtedly reflects Ripple's emphasis on compliant operations.

At that time, CoinGecko data showed that RLUSD's market capitalization had reached $500 million, ranking among the top 20 USD stablecoins, with a daily trading volume of about $26 million. Subsequently, Ripple's layout did not stop there but continued to "conquer" globally:

On August 7, Ripple planned to acquire the Toronto-based stablecoin payment platform Rail for $200 million, with the transaction expected to be completed in the fourth quarter of this year. This acquisition aims to further enhance Ripple and its stablecoin RLUSD's payment solution capabilities.

On August 22, Ripple signed a memorandum of understanding with Japanese financial services company SBI Holdings and its subsidiary SBI VC Trade, planning to issue enterprise-level RLUSD in Japan in the first quarter of 2026.

On September 4, Ripple promoted the stablecoin RLUSD to institutional users in Africa through new partnerships with distributors such as Chipper Cash, VALR, and Yellow Card.

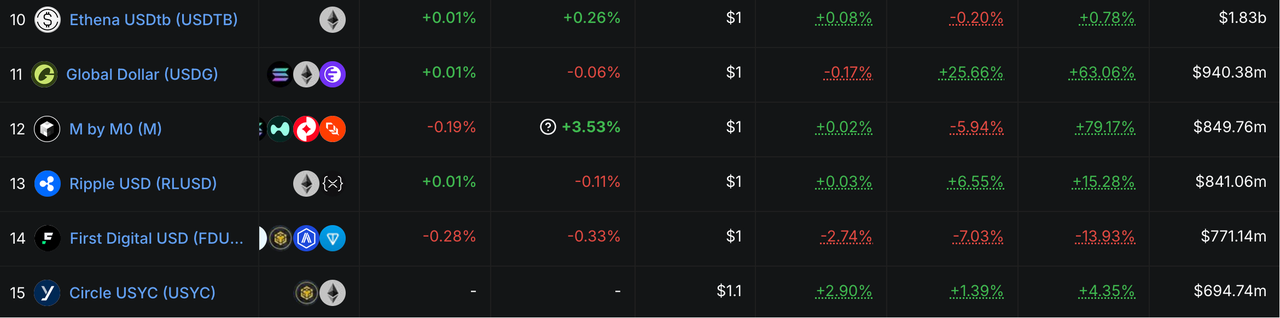

With multiple layouts, until the market crash on "10.11," CoinMarketCap data showed that on October 5, XRP's market capitalization once reached $183.4 billion, briefly surpassing the market capitalization of the world's largest asset management company, BlackRock (approximately $180 billion). Analysts believe that the support for this round of price increase and bullish sentiment may stem from Ripple's accelerated application for a national trust bank license in the U.S. and its cross-border payment business for stablecoins, thus being seen by the market as a long-term positive catalyst for XRP. As of the time of writing, DefiLlama data shows that RLUSD's market capitalization is approximately $840 million, with a monthly increase of over 15%, ranking 13th.

Another major core strategic layout of Ripple precisely focuses on the tokenization field, a decision backed by profound industry insights. As clearly stated in its official announcement, financial executives at Fortune 500 companies urgently need the ability to manage new asset types such as stablecoins and tokenized deposits. Ripple's acquisition of GTreasury is precisely aimed at addressing this market demand, helping corporate clients achieve digital asset management and efficient operations.

At the same time, this acquisition of GTreasury also possesses strong payment empowerment effects, capable of supporting instant fund transfers and enabling real-time, round-the-clock cross-border payments at competitive prices, which aligns highly with Ripple's overall payment strategy.

In the advancement of its tokenization strategy, Ripple has engaged in multi-dimensional collaborations to expand its business boundaries. On September 18, Ripple partnered with Singapore's DBS Bank and Franklin Templeton to launch trading and lending solutions driven by tokenized money market funds and the RLUSD stablecoin. Earlier, in mid-July, Ripple had already reached a partnership with UAE virtual asset service provider Ctrl Alt to provide tokenization services for real estate in Dubai using XRPL.

From the substantial cooperative results achieved by Ripple, its strategic intent is clear and defined: to fully promote the XRP Ledger (XRPL) as the core infrastructure for institutional-level asset tokenization. If XRPL is an important cornerstone of the Ripple ecosystem, then XRP is the native fuel of the XRPL network, and its long-term utility value is closely related to the tokenization market, whose robust development will also provide solid price support for XRP.

However, currently, the entire tokenization market is still in its early developmental stage, requiring long-term market validation and ecological sedimentation. In this process, Ripple will undoubtedly face fierce competition from multiple fronts, with its biggest competitors being Ethereum, which has significant ecological advantages, and Solana, which boasts high-performance infrastructure.

Compared to the stablecoin and tokenization fields, XRP's performance in the Digital Asset Treasury (DAT) sector appears somewhat lackluster. Institutional investors show a clear lack of interest in XRP when allocating assets. Not to mention Bitcoin, Ethereum, and Solana, even compared to other altcoins, XRP does not possess a clear advantage. This phenomenon may be related to the long-standing issue of XRP's high centralization.

However, Ripple Labs seems unwilling to sit idly by in the DAT sector, as it is actively leading efforts to raise at least $1 billion today to establish an XRP treasury. This may indicate its determination to make strides in this sector, thereby promoting the deep integration of XRP and financial infrastructure into regulated financial markets to break down barriers between different businesses.

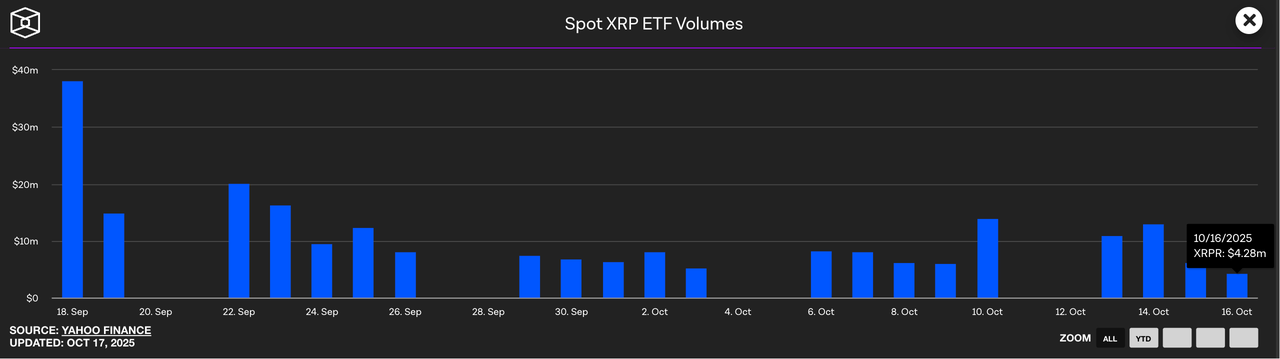

In the highly watched ETF sector, Ripple has not fallen behind other altcoins. Its first spot ETF, the "REX-Osprey XRP ETF" (stock code XRPR), was listed in the U.S. on September 18, opening a compliant entry point for institutional funds. On its first day of trading, XRPR's trading volume reached $37.7 million, briefly becoming the product with the largest first-day trading volume among funds listed in 2025.

This impressive data undoubtedly sends a positive signal to the market, confirming a certain demand for XRP from institutions and bringing sufficient market expectations for the approval of more Ripple ETFs. Currently, the U.S. SEC has received over 11 pending applications for XRP ETFs, with applicants including well-known financial institutions such as Franklin Templeton, Bitwise, and Canary. If these applications are approved, they are expected to bring considerable capital inflows to the XRP market.

However, regrettably, the brilliant performance of the REX-Osprey XRP ETF on its first day seems to have been short-lived, as its trading volume has continued to decline since then, failing to regain its former glory. The Block data shows that on October 16, XRPR's trading volume was approximately $4.28 million, marking the lowest level since its listing.

From Ripple's series of layouts in the digital asset field, it is not difficult to see that its strategic direction is clear and determined, focusing comprehensively on the institutional market. From exploring institutional-level stablecoins and the tokenization market to actively practicing cross-border payment business and proactively entering the DAT and ETF markets, Ripple is steadily developing in an orderly manner. However, on the road ahead, Ripple also faces numerous challenges. Market volatility, regulatory uncertainties, and competitive pressures may all impact its development strategy. So, what specific challenges does Ripple face in the current market environment?

Challenges Abound: Ripple's Development Path is Thorny

For a long time, Ripple Labs' high concentration of control over the XRP token has been a key point of criticism and controversy surrounding the project.

The total supply of XRP tokens is set at 100 billion, with no plans for inflation. However, over 40% of the supply is firmly controlled by Ripple Labs. According to data from Cointelegraph, of the XRP held by Ripple Labs, 4.5 billion are used as liquid assets to maintain daily operations, while another 35 billion are locked in custodial accounts. Crucially, Ripple has a unique custodial release system that theoretically allows it to release up to 1 billion XRP to the market each month through a smart contract mechanism, thereby regulating supply and stabilizing prices.

However, Ripple has not injected new XRP into the market each month; instead, it chooses to re-lock 60% or more of the funds that are unlocked each month. While this move avoids a large influx of XRP into the market, it further solidifies Ripple Labs' position as the largest holder of XRP tokens. As a result, Ripple itself remains a potential source of supply pressure in the market, a situation that continues to cause concern among investors.

Take Ripple co-founder Chris Larsen as an example; as the largest individual holder of XRP, he still controls a substantial amount of XRP that could sway market conditions. According to data disclosed by on-chain detective ZachXBT, as of July 25, the addresses controlled by Larsen still held approximately 2.81 billion XRP, which, at the current price of $2.20, is valued at around $6.18 billion. Such a massive holding undoubtedly adds a great deal of uncertainty to XRP's market performance.

In addition to the issue of XRP's high centralization, Ripple still faces the risk of regulatory uncertainty. Previously, in the regulatory case with the U.S. SEC, U.S. Judge Analisa Torres ruled that XRP trading in the secondary market does not constitute a securities transaction, but large sales to institutional investors are considered illegal securities offerings. This means that Ripple has only partially won the case and has not achieved a complete victory.

Compared to other altcoins, the shadow cast by this five-year regulatory dispute is unlikely to dissipate overnight, which means that if new legal disputes arise around Ripple, it will inevitably undermine investor confidence again, further impacting XRP's price.

Finally, XRP's price performance is also heavily influenced by the volatility of Bitcoin and the entire cryptocurrency market, which is undeniable.

For example, during the recent "10.11" flash crash, the liquidation of leveraged contracts for mainstream cryptocurrencies like Bitcoin and Ethereum triggered a chain reaction in the market, and XRP was not spared, following the market with a significant drop. However, shockingly, XRP's decline far exceeded that of Bitcoin and Ethereum, plummeting from $2.83 to $1.2543, a drop of over 125%. This devastating data fully exposes that, despite Ripple's strong focus on institutional direction, it still lacks solid application scenarios and price support due to its "altcoin" positioning. As mentioned earlier, important sectors such as the DAT and ETF markets remain weaknesses for Ripple. In the current institution-led market environment, Ripple's path to rapid development and deep integration into the financial market remains a long and challenging journey.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。