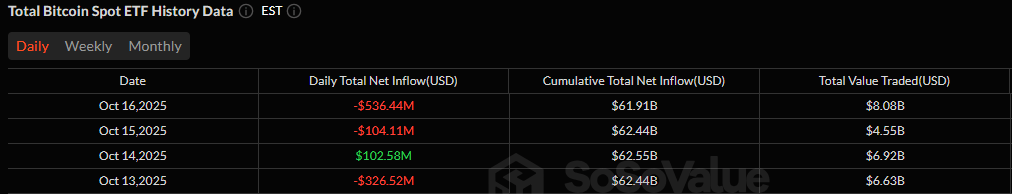

The ETF market turned red again as investors rushed to the exits. What began as a cautious pullback earlier in the week erupted into full-blown outflows on Thursday, Oct. 16, with both bitcoin and ether ETFs facing intense selling pressure.

Bitcoin ETFs suffered $536.44 million in net outflows, their largest daily loss in weeks. The damage was widespread, hitting eight of the twelve funds tracked. Ark & 21Shares’ ARKB fund led the exodus with a $275.15 million withdrawal, followed by Fidelity’s FBTC with $132 million in losses. Grayscale’s GBTC saw $44.97 million leave its coffers, while Blackrock’s IBIT and Grayscale’s Bitcoin Mini Trust lost $29.46 million and $22.52 million, respectively.

Further redemptions were seen across Bitwise’s BITB (-$20.58 million), Vaneck’s HODL (-$6.12 million), and Valkyrie’s BRRR (-$5.65 million). Despite heavy trading activity totaling $8.08 billion, overall net assets plunged to $146.44 billion, underscoring the sharp market retreat.

Mixed trading week for bitcoin ETFs. Source: Sosovalue

Ether ETFs didn’t escape the storm either, recording a total of $56.88 million in outflows. Grayscale’s ETHE led with $69.03 million in redemptions, followed by Bitwise’s ETHW (-$15.83 million) and Fidelity’s FETH (-$11.60 million). Smaller exits came from Grayscale’s Ether Mini Trust (-$4.37 million) and Franklin’s EZET (-$2.94 million).

A lone bright spot emerged in Blackrock’s ETHA, which attracted $46.90 million, softening the blow from the day’s heavy withdrawals. Trading volume reached $2.90 billion, with net assets totaling $26.51 billion. It was a sobering trading session for crypto ETF investors, a reminder that after weeks of inflows, the market can still turn on a dime.

FAQ

How severe were the crypto ETF outflows on Oct. 16?

Bitcoin ETFs lost $536 million and ether ETFs shed $57 million in one of the sharpest sell-offs in weeks.Which Bitcoin ETF saw the biggest redemptions?

Ark 21Shares’ ARKB led the outflows with a $275 million withdrawal, followed by Fidelity’s FBTC.Did any ether ETF see inflows during the sell-off?

Yes, Blackrock’s ETHA attracted $47 million, partly offsetting broader market losses.What does this sell-off suggest about current market sentiment?

It reflects a sharp shift to risk-off behavior as investors locked in profits after weeks of inflows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。