"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. Based on the extensive coverage of real-time information each week, the Planet Daily also publishes many high-quality in-depth analysis articles, but they may be hidden among the information flow and trending news, passing you by.

Therefore, our editorial team will select some quality articles worth spending time reading and saving from the content published in the past 7 days every Saturday, providing you with new insights from the perspectives of data analysis, industry judgment, and opinion output, as you navigate the crypto world.

Now, let's read together:

Reflections and Insights on October 11

Sometimes, market liquidity is insufficient. The depth in the order book is not enough to close positions without exceeding the remaining funds of the original position. This becomes a problem: because it means that the cash in the fund pool is not enough to support the profit and loss settlement for everyone. The system will enter the next layer of the "waterfall model" — intervention by a "vault" or "insurance fund." It will step in and take on the counterparties of the forcibly liquidated positions. Typically, the vault is quite profitable over the long term. The ADL (Automatic Deleveraging) mechanism is the last line of defense in the entire "waterfall model," usually seen as a "last resort," as it does not occur through market matching but forces some traders to settle and exit their positions to restore balance to the entire system.

It occurs very infrequently.

Specifically, in order, the "big players" who earn the most, hold the largest positions, and use the highest leverage will be the first to be forcibly liquidated by the system.

During the weekend market crash, many were discussing Ethena's USDe experiencing a "depeg." Rumors suggested that USDe once dropped to about $0.68 before recovering. However, this claim is incorrect. USDe has not actually depegged.

The main liquidity venue for USDe is not centralized exchanges (CEX), but Curve. Binance was unusually unstable during this period, and market makers (MM) could not adjust their positions on the platform due to frequent API failures, and the deposit and withdrawal channels were nearly paralyzed. As a result, no one could enter the market for arbitrage.

Binance did not establish a primary dealer relationship with Ethena, so it could not directly mint or redeem USDe on the platform. Additionally, Binance's oracle implementation had flaws, leading to erroneous liquidation triggers. Therefore, this was actually a Binance-specific flash crash event (discount), rather than a depeg of USDe itself.

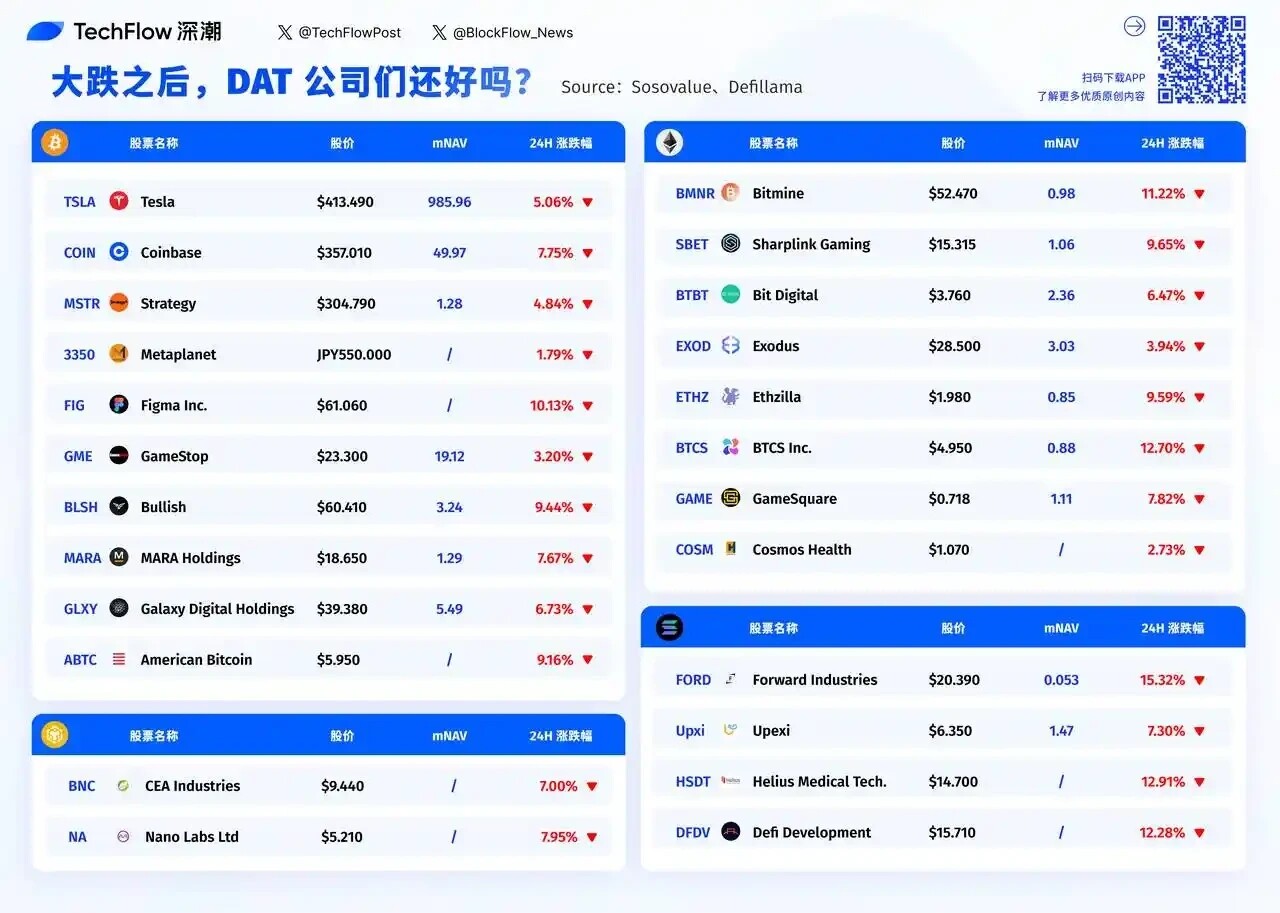

Crypto and Stock Market Double Whammy: How Are DAT Companies' Stocks Holding Up?

Due to differing liquidity, smaller companies are suffering more significant declines; companies with low mNAV are seeing even larger drops. For investors, when a business model itself is under scrutiny, being cheap is not necessarily a reason to buy.

Traders Using Perpetual Contracts as Hedging Tools Regret It: What Are the Alternatives?

Guiding principles for reducing (rather than eliminating) risk include setting capital requirements, enforcing stop-loss and take-profit measures, diversifying investments across multiple platforms, limiting leverage, closely monitoring, and using off-contract hedging methods.

Also recommended: 《Wintermute Founder’s Podcast: The Market Needs a Circuit Breaker Mechanism, No Altcoin Season in the Short Term》《When Liquidity Disappears: Micro Data Decoding the October 10 Flash Crash, Seeking Overlooked Market Signals》《Understanding How Market Makers Operate in the Crypto Space》《Black Swan Trader? Who Exactly Is Garrett Jin?》《Cold Thoughts After October 11: How Do Exchanges Balance "Relative Fairness" and "Absolute Transparency"?》。

Investment and Entrepreneurship

The Key to the Bull-Bear Transition: The Second S-Curve of Growth

The market is repricing risk, shifting from narrative-driven liquidity to income-supported yield data. Key shifts include:

- Perpetual decentralized exchanges maintaining dominance, with Hyperliquid ensuring liquidity at network scale.

- Prediction markets are emerging as functional derivatives of information flow.

- AI-related protocols with real Web2 application scenarios are quietly expanding revenue.

- Re-staking and DAT have peaked; liquidity decentralization is evident.

Three long-term inflation anchors still exist:

- De-globalization: Diversification of supply chains increases transformation costs.

- Energy transition: Capital-intensive low-carbon activities raise short-term input costs.

- Demographic structure: Structural labor shortages lead to persistent wage rigidity.

Polymarket's $9 Billion Valuation Secret War: A Hidden Gold Mine for Arbitrageurs

In the fertile land of Polymarket, there have not been many who have truly cultivated and reaped rewards over the years. For those who know how to make real profits on Polymarket, this is a golden age. Most people treat Polymarket as a casino, while smart money sees it as an arbitrage tool. The article lists some arbitrage methods through "first-hand accounts."

Those Who Refuse to Evolve Should Stop Fantasizing About Altseason

If you are still waiting for "altseason," you have already lost. The winners are the new generation of investors who entered the market in the past two to three years, evolving rapidly, keeping up with rotations, taking bold actions, and truly participating in the market. The era of universal altseason is gone; altseason appears in fragmented forms. So keep learning every day, build systems, and take action early; don’t be a bystander or a pessimist.

ZEC Rises 37% Against the Trend: Which Privacy Projects Are Worth Watching?

ZEC, XMR, Dash, Secret Network ($SCRT), Pirate Chain ($ARRR).

A Summary of the Four Hottest Launchpad Platforms Right Now

The explosive Echo: self-custody, switchable compliance model; Legion & Kraken: integration of reputation and regulation; MetaDAO: replacing marketing with mechanisms; Buidlpad: KYC threshold compliance channel for large-scale retail investors.

For investors, the advantage no longer depends solely on "early entry," but rather on the depth of understanding of operational mechanisms.

In a Time When "Even Dogs Don't Play" with Points, How Should Project Teams Set Airdrop Standards?

Behavior-based scoring (rather than transaction volume), progressive mastery systems, integration of social graphs, and alignment with the real economy will enhance user stickiness.

Also recommended: 《The $20 Million Entry Ticket: Ten Questions and Answers to Understand Hyperliquid HIP-3》《Who Is Kyle Wool, Who Helped the Trump Family Earn $500 Million?》《Crypto VC's Major Retreat: Who Is Killing the Dream Makers of the Primary Market?》。

Airdrop Opportunities and Interaction Guide

Review of October TGE Projects: Monad, Meteora, Limitless Lead the Way

Popular Interaction Collection | Aster's Third Phase is Live; Rayls Points Task Updated (October 13)

The Next Billion-Dollar Track? Analyzing Interaction Ideas for Prediction Market Platforms

The Hottest Testnets and Perp Projects in October

Meme

Chinese Memes Show Their Skills: Who Will Be the First to Land on Binance's Main Site?

Bitcoin and Ecosystem

Prediction Market

Is Polymarket About to Launch Tokens? A Comprehensive Overview of Eco Alpha Targets

The article introduces five Polymarket ecosystem projects that enrich the prediction market gameplay from various angles, including smart trading, sports betting AI, social trading, mobile terminals, and leveraged trading.

Introducing the creator economy and revenue sharing can not only drive the prediction market from negative-sum games to near-zero-sum games but also ignite its explosive growth.

Also recommended: 《Strategy Analysis: How to Achieve a High Win Rate on Polymarket Through Insiders?》。

CeFi & DeFi

High-performance CLOB DEX breaks the barriers of AMM, and with zero-fee models, security, accessibility, and market fairness, DEX is expected to ultimately achieve "market dominance." Future catalysts to watch include: on-chain CLOB expansion, composability and new product categories, regulatory clarity and convergence, on-chain dark pools and privacy protection, and innovations in brands and fiat currencies.

Curve Team's New Venture: Will Yield Basis Become the Next Phenomenal DeFi Application?

YieldBasis is a platform built on Curve that generates profits from price fluctuations using Curve liquidity pools while protecting liquidity providers' positions from impermanent loss. At launch, Bitcoin is the primary asset.

YieldBasis will redefine how liquidity providers profit: by converting volatility into returns and eliminating impermanent loss. YieldBasis represents one of the most innovative designs in liquidity provision since Curve's original stable swap model.

It combines proven mechanisms; voting escrow token economics, automatic rebalancing, and leveraged liquidity provision, integrated into a new framework that may set the next standard for capital-efficient yield strategies.

Meteora Airdrop Check Tonight: Which Is More Profitable, Claiming Tokens or LP?

The decision to participate in the Liquidity Distributor largely depends on whether you believe the returns from market trading volume (especially at the opening) can cover potential impermanent losses (especially around the $1.5 billion pre-market valuation, approximately 23% impermanent loss). Participants can estimate the opening price of MET and the trading volume on the first day based on their judgment and make the most suitable decision for themselves.

Also recommended: 《Lazy Investment Strategy|Farcaster Launches USDC Deposit Activity; Neutrl Pre-Deposit Opens Tomorrow Night (October 14)》。

Weekly Hotspot Recap

In the past week, the market recovered from the "October 11 crash" but dipped again on October 17;

Additionally, in terms of policy and macro markets, Federal Reserve Governor Waller: has successfully completed the interview for the position of Federal Reserve Chair; Federal Reserve Governor Waller advocates for gradual interest rate cuts; Florida legislative proposal aims to allow state government funds and pension funds to allocate Bitcoin and related ETFs; Trump is considering pardoning Zhao Changpeng; Japan will introduce new regulations to prohibit insider trading in cryptocurrencies; Japan's MUFG, Sumitomo Mitsui Financial Group, and Mizuho Bank will jointly issue stablecoins; The Governor of the Reserve Bank of India: hopes to promote central bank digital currency in India, rather than cryptocurrencies or stablecoins;

In terms of opinions and statements, Binance: will compensate users affected by the USDE, BNSOL, and WBETH price depeg events; Hyperliquid: platform traffic and trading volume have reached historical highs, and the blockchain network has not crashed or delayed; Lighter: platform services have been restored, and will release event analysis and initiate large-scale user compensation; Uniswap founder: today's trading volume on the platform is nearly $9 billion, and there has been no pressure or downtime; Crypto.com CEO and Wintermute team members respond to market FUD: institutions are operating normally, rumors of a crisis are false; Ethena founder confronts ZKasino founder: crisis rumors are purely false, beware of scammers misappropriating $30 million; crypto KOL Big Orange: WBETH, BNSOL, and other contract margins should not reference spot trading pair prices, the cascading drop could have been avoided; Hyperliquid co-founder: Hyperliquid's fully on-chain liquidation is transparent and verifiable, CEX liquidation data is severely underreported; Matrixport: this round of "surrender-style selling" is historically significant and has completely reshaped the crypto market's position structure; benmo.eth: the USDe depeg event was primarily a battleground for leveraged trading, and Binance's withdrawal mechanism unexpectedly locked in arbitrage paths; Garrett Jin responds to rumors for the first time: unrelated to the Trump family, the position change has no insider information, and the fund does not belong to him, but to clients; Ethena investor Dragonfly: USDe has not depegged, it was just a "local price dislocation" on Binance; 10x Research: the crypto market may introduce a "circuit breaker mechanism" to cope with extreme volatility; He Yi responds to the "data modification" controversy: Binance takes the marked price to avoid extreme market conditions, execution still needs refinement;

Wall Street Warns: High Valuations and Uncertainty in US Stocks May Trigger a New Round of Volatility; Analysts: The Federal Reserve Is Not Concerned About the Escalation of Trade Tensions, US Stocks May Face Tailwinds in the Future; Bank of America Survey: Going Long on Gold Has Replaced Going Long on the Seven Giants of US Stocks as the Most Crowded Trade; HSBC: The Dollar Is Likely to Weaken Again and May Hit Bottom Early Next Year; Arthur Hayes: The US May Launch a “Poor Man's QE4”, Favoring Bitcoin's Rise; Analysis: The US Government Shutdown Pushes the World into a Data Blind Spot, with Global Risks Increasing Over Time; Capital Economics: Political Uncertainty in Japan Is Unlikely to Weigh on the Country's Bonds and Stock Market; Eugene: Significant Trades Are Not Recommended at This Stage, as the Market Is at "Hell Difficulty"; Yi Lihua: Following Trump’s “Coin Trading” Without Thinking May Be a Good Strategy in the Short Term; BlackRock CEO: Bitcoin Is an Alternative Asset, but It Should Not Constitute a High Proportion in Portfolios; BlackRock CEO: Tokenization of All Assets Has Just Begun; Tom Lee: The Bubble of Digital Asset Treasury Companies May Have Already Burst; CZ: BNB Has No Market Makers; Arkham Analysts: The Hack of LuBian Is Likely Led by the US Government, Which May Become the Largest Financial Hacker in History; Arkham Analysts: The Hack of LuBian Is Likely Led by the US Government, Which May Become the Largest Financial Hacker in History; Uniswap Founder: High Listing Fees Charged by CEX Are Just Marketing Tactics, DEX Has Achieved Free Listings and Liquidity Support; He Yi: Binance Will Provide Complete Reports of All Marketing and Airdrop Activities to Project Parties, Listing Margins Will Be Refunded;

Regarding Institutions, Large Companies, and Leading Projects, JPMorgan Will Allow Clients to Trade Cryptocurrencies, Custody Services Are Not Yet Online; Tether Reaches Settlement with Celsius Bankruptcy Consortium and Pays $299.5 Million; Huaxing Capital Plans to Raise a $600 Million Fund to Invest in BNB, YZI Labs May Participate; Multiple Token Prices on Binance Real Original K-Line Charts Have Resumed Display; Binance Launches a $400 Million Industry Recovery and Confidence Rebuilding “Together Initiative”; Coinbase Will Include BNB in Its Listing Roadmap; Coinbase Launches the “Blue Carpet Program” (Interpretation); Bloomberg: Ripple Labs Plans to Lead a $1 Billion Fund to Build an XRP Reserve Strategy; Zerobase Founder: Adding Money to the Liquidity Pool Immediately, Users Can Withdraw Instantly; ZEROBASE Announces ZBT Token Economics, with a Total Supply of 1 Billion Tokens, 8% for Airdrop Shares; Polymarket Is About to Launch on MetaMask; Polymarket Launches “Up/Down” Stock Prediction Market, Allowing Users to Bet on Stock Price Trends; Eric Trump Announces Tokenization of Real Estate Through World Liberty Financial Tokenization; AC's New Project Flying Tulip Reveals Public Offering Details: Conducted in Four Rounds, Each with the Same Terms, Supporting Contributions on Six Chains; Binance Alpha Launches Chinese Meme "Cultivation" and "Hakimi"; Monad Launches Airdrop Claim Portal; Meteora Launches MET Airdrop Distribution Checker;

In terms of data, Forbes: Trump May Be One of the Largest Bitcoin Investors in the US, Holding Approximately $870 Million; Total Market Cap of Stablecoins Surpasses $310 Billion, Setting New Highs, Growing by About $10 Billion in the Past Three Weeks; Spot Silver Surpasses $53/Ounce, Setting New Historical Highs;

In terms of security, Paxos Will Destroy the Previously Incorrectly Issued 300 Trillion PYUSD… Well, it has been another eventful week.

Attached is the "Weekly Editor's Picks" series Portal.

See you next time~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。