The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and reject any market smoke screens!

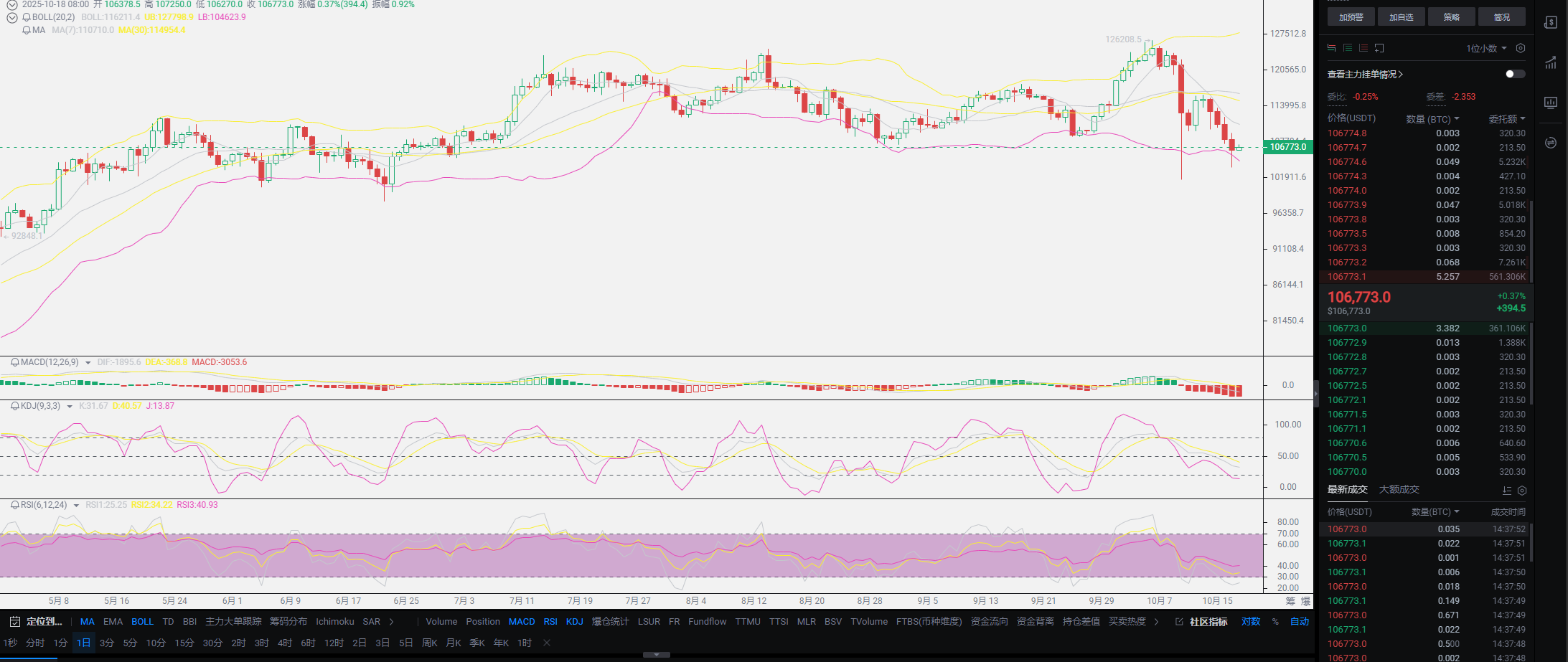

Recently, I have been emphasizing the trend-level movements. Today, let's talk about short-term strategies. The market trends of the past two days have approached the low points we previously estimated. Still using Bitcoin as the target for prediction, the previous lower shadow line is basically close to a solid state, located at 101516. The new low yesterday was 103470, just 2000 points away. This solid state has an upper and lower error of about 1000 points, which is within the normal error range. After solidifying, there will be two scenarios: one is another spike down, and if this happens, it will prove that this round of trend will completely go bearish. However, it is unlikely that this will occur; the new low from the previous round, after solidifying this time, will likely lead to a recovery, with a higher probability of breaking upwards. So far, only Bitcoin's pattern in the trend has not shown signs of being broken. If we look at other cryptocurrencies with this mindset, they have basically started to trend bearish, so the indicators you refer to should still return to Bitcoin.

Many friends are confused about this point; what I talked about yesterday wasn't very clear. On the surface, it seems that there are almost all positive news for the crypto circle, so why is the current trend all contrary? Especially in terms of news, the future market can almost only trend bullish, including on-chain data. The SOL network continues to issue USDC, and trading data is repeatedly breaking historical highs, indicating that SOL's network is gradually improving and receiving some capital support. The reason for this is easy to understand: there are too many retail investors, and the profits pulled by the big players are surprisingly not greater than those of retail investors. In this situation, no large funds are willing to pump the market; isn't this just making clothes for others? Even up to now, basically anyone trading spot will have some SOL tokens in hand, and this washout is still not thorough enough. This is also related to SOL's performance over the past two years; the previous high of 295 has retraced to below 100, yet the funding rate is still positively growing, which can only indicate that retail investors have not exited.

This point is enough to show that almost all negative news in the crypto circle will drive SOL down; this is a premeditated dump. From a personal holding perspective, this dump has only reached near Lao Cui's cost price, not to mention a large number of users holding around 100. As long as the washout is not thorough enough, there will be no violent surge. The biggest positive news this month may soon happen; with SOL's listing imminent and the cooperation of interest rate cuts, it will not be easy to dump the market again with just 1-2 billion. The big players will definitely take this opportunity for a thorough cleanup. For everyone, as long as you hold on, there won't be too many problems. Just don't focus on short-term fluctuations; now that there are enough tokens, the main strategy should be to hold. I also remind those who want to short: the closer it gets to Bitcoin's new low, the calmer you should be. The key support at 101516 will not break too much, and a reversal may occur around this area. If you have profits, make sure to exit in time.

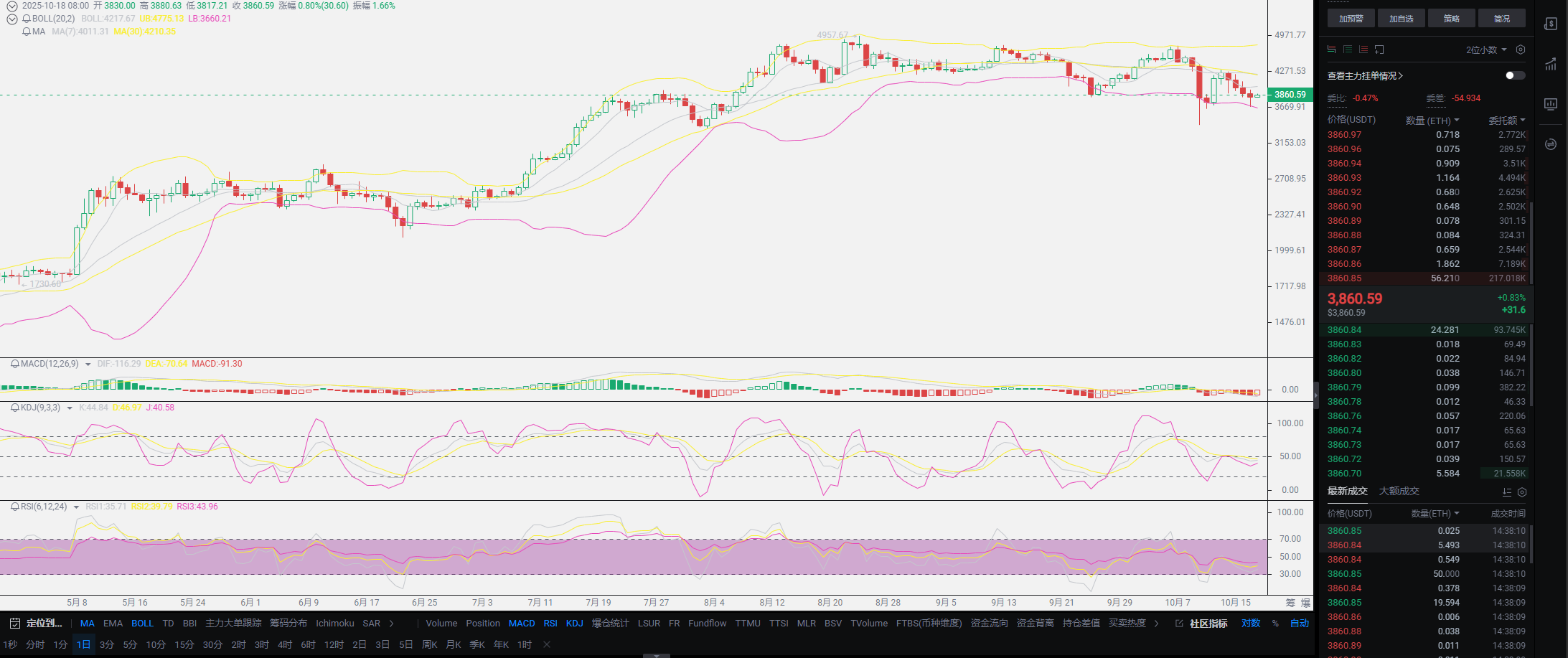

Most people feel that this decline is unreasonable. In Lao Cui's view, it is more about the inflow of funds. If I were capital, I wouldn't dare to invest too much in the crypto circle, as the current price range of cryptocurrencies is at historical peaks. One thing we cannot confirm is whether Bitcoin and Ethereum can maintain their current prices in the future. The rise must fall; this is an inevitable historical trend that cannot be avoided. Lao Cui is not optimistic about Bitcoin's development and even thinks that it is very difficult for Bitcoin to stabilize at its current price. Perhaps influenced by Buffett's theory of value investing, it is hard to make an objective evaluation of Bitcoin based on its value. You can also see that in the current crypto circle, the issuance of new coins is basically along three chains: SOL, BNB, and Ethereum. These are the ones that can see the actual value reflected. Secondly, there is business expansion, whether in gaming, MEME, or even DEFI, new coins are playing, while the old generation of technology is indeed being eliminated.

Especially in an industry like blockchain, which is a high-tech product of technological iteration. If Bitcoin remains stagnant, the growth of other coins is actually a consumption of it. People cannot regard Bitcoin as a collectible art piece, nor does it possess antique-level collectible value. Just claiming to be the pioneer of blockchain and achieving a market value of trillions, while maintaining stability, is a very difficult task. The charm of Bitcoin lies in maintaining a high growth state, and once this high explosion and high yield situation stagnates, it is what people commonly refer to as the later comers taking over. Once they can no longer take over, the hidden dangers may be too great. Looking at a market value of two trillion, if you need to double it, you need to invest the same value. If the doubling funds of two trillion can be solved, what if it is four trillion? You can refer to our article from yesterday; a single expansion of the balance sheet brought in over a trillion in funds. Even if all of it flowed into the crypto circle, it would only push Bitcoin to a price of 150-180K. Therefore, at this stage, everyone should not try to equate Bitcoin's returns with those of smaller coins; that would be unfair.

So, having said that, everyone should learn to think: if Bitcoin cannot be driven up, and the crypto circle needs to survive, what will you do? This is the current trend; the big players will choose to bring in more investors through the emergence of other coins, such as Ethereum, BNB, and even OKB this year. The crypto circle must create miracles to maintain competitiveness among numerous financial markets. According to this rule, SOL has a great opportunity. With a market value of just over a trillion, even if all are held by retail investors, it is not difficult for the big players to double it, and the dump for the SOL team has not yet reached the expected target. With investments reaching over a hundred billion, even if now the assets in the SOL team’s hands are all over a trillion, they won't earn much after dumping. They will definitely absorb more funds to enter, and SOL indeed needs a wave of violent growth to alleviate the current predicament. The time won't be too far off. If Lao Cui were the decision-maker, I would also make good use of the few opportunities to achieve this goal.

Lao Cui's summary: The above explanation is only aimed at future trends, and everyone should not be misled. The current trend will still target the previous new low, and only by gradually solidifying will there be a reversal signal. This year, Lao Cui will not be fully bearish, at least not until next year, and next year may be in a period of ending balance sheet reduction, or even have the possibility of balance sheet expansion. Coupled with next year still being a rate-cutting cycle, it is unlikely to see a bear market-level depth of correction. At most, it will be similar to this year, with a halving followed by a recovery until a new high appears. Letting everyone short contracts is not to do it blindly; at least it should be above the new low of 2000 points daily, and Ethereum should stay above 150 points. Try not to get stuck in short positions; this year, it is very difficult to exit fully from stuck short positions. The current price is suitable for spot buying; remember to manage your position, doing it in batches of 10-20-30-40!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。