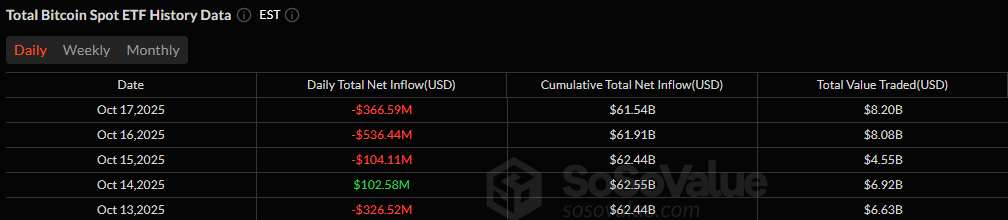

The week ended with more pain for crypto ETFs. After two days of heavy selling, both bitcoin and ether ETFs closed Friday, Oct. 17, deep in the red, marking a third consecutive day of outflows and sealing one of the toughest weeks since early summer.

Investors continued to trim their bitcoin ETF exposure, with total outflows reaching $366.59 million. The pressure was concentrated in four major funds. Blackrock’s IBIT, which has often been the main driver of inflows, led the exodus with a staggering $268.81 million in redemptions.

Fidelity’s FBTC followed with $67.37 million, while Grayscale’s GBTC saw $25.04 million leave its books. Valkyrie’s BRRR rounded out the exits with $5.57 million. Trading activity remained strong at $8.20 billion, but despite the liquidity, total net assets dropped sharply to $143.93 billion, underscoring continued investor caution.

Bitcoin ETFs only saw one day of inflows in a brutal week that saw four days of exits. Source: Sosovalue

Ether ETFs mirrored the sell-off with total outflows of $232.28 million, spread across six funds. BlackRock’s ETHA bore the brunt of withdrawals with $146.06 million in exits, while Fidelity’s FETH and Grayscale’s ETHE shed $30.61 million and $26.13 million, respectively.

Additional losses came from Bitwise’s ETHW (-$20.59 million), Grayscale’s Ether Mini Trust (-$4.69 million), and Vaneck’s ETHV (-$4.21 million). Despite a solid $2.49 billion in trading volume, net assets slipped to $25.98 billion. After weeks of inflow dominance, the tide has clearly shifted. Investors are bracing for next week, hoping the storm finally breaks.

FAQ

- What happened to bitcoin and ether ETFs this week?

Both Bitcoin and Ether ETFs experienced significant outflows, losing $367 million and $232 million, respectively, to conclude a volatile week. - Which bitcoin ETF saw the biggest redemptions?

Blackrock’s IBIT led the sell-off with $268.81 million in withdrawals, followed by Fidelity’s FBTC and Grayscale’s GBTC. - How did ether ETFs perform?

Ether ETFs saw broad outflows across six funds, with Blackrock’s ETHA losing $146.06 million, the largest loss on the day. - What’s the market outlook after these outflows?

With total ETF assets falling to $143.93 billion for BTC and $25.98 billion for ETH, investors are watching next week for signs of recovery.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。