Original | Odaily Planet Daily (@OdailyChina)

Author|jk

A month ago, the owner of Odaily Planet Daily had a whim and decided to give every willing participant in the company 200U as startup capital, allowing everyone to trade freely from September 15 to 30 for two weeks, to see who could create the highest return. This "200U War God" challenge had no restrictions—contracts, spot trading, meme coins, and even staking based on annualized returns were all allowed. 20 participants, each with their own calculations and big dreams, embarked on this financial (speculative) adventure destined to be full of drama.

Unfortunately, our trading competition cleverly avoided all recent major market movements: Aster, Binance Life, and the crash on October 11. While it’s hard to say whether this was good or bad, it allowed us to glimpse the myriad aspects of the secondary market trading world against the backdrop of (99% of the time) ordinary market conditions.

Through in-depth observation of this competition, we arrived at several harsh truths about crypto trading:

• Even without major market movements, high returns are not impossible; the top three participants achieved returns of 9x, 4x, and 2.5x respectively;

• For 80% of the time, everyone was just making small profits or small losses; the remaining 20% of operations were the real game-changers, whether it was huge profits or liquidation, often resulting from just a few key trades;

• Those who can make money are always in the minority. Out of 20 people, only 6 were able to break even or make a profit. The owner has expressed regret several times in the office.

Next, let’s delve into the inner world of these traders and see how they wrote their own legendary stories (or tragicomedies) in this money game.

Group Portrait: How Editors Lost Their 200U

There’s the fastest man in Odaily (to lose it all) @Golem, who on the first day got hooked on Pumpfun live streaming coins, and was successfully lured by the lively hosts, resulting in a 60% drop in his position on the first day. The next day, he angrily shorted Pump and made back a good amount; however, after tasting success in shorting Pump, he began looking for similar coins, and unexpectedly shorted Aster… The rest of the story is well-known;

Then there’s the editor @Ethan, who focused solely on one coin, Merlin. He made small profits on three occasions trading Merlin, but when he tried to short it, Merlin taught him a lesson, leaving him with only 50U to return to the boss;

Our editor-in-chief @Fangzhou took a different approach, determined to make a name for himself in the US stock market, initially trading US stock tokens including Pop Mart, Nvidia, Tencent, Alibaba, and the Nasdaq index, but due to low positions, he only made 10U; on the second to last day, feeling too stable, he decided to go all-in on XPL to surpass the second-ranked BC brother, but unfortunately got liquidated;

Our deputy editor @Qin Xiaofeng, adopted a style reminiscent of Su Shi in the crypto world, experiencing ups and downs, trading multiple coins and options simultaneously, going long on F and ZKC, buying various put options, and ended up losing half of his principal in just two days; however, a day later, the ETH contract returned all his losses. On the 19th, put options again brought his position down to 70U, but he managed to recover his principal by going long on FF contracts; yet a few hours later, just before the deadline, a sudden pullback caused this portion of his principal to get liquidated again.

Of course, there’s also the editor @Wenser, who focused on the Polymarket prediction market and gold spot trading, using his extensive esports knowledge to repeatedly compete in League of Legends-related markets on Polymarket, earning over 140U, while also going long on gold, ultimately ending with a position close to 400U.

The most exciting part is the top three of our trading competition; let’s review how they made their money.

First Place - BMer (@Bmer_19): Achieving 9x Returns in 15 Days Without Major Meme Movements or Market Fluctuations

CMO BMer's trading career showcased something extraordinary from the start. On the first day, BMer directly went long on one XPIN, making a whopping 235U, jumping her capital from 200U to 435U. In the following days, she continued this magical touch, earning another 210U through swing trading contracts TST, bringing her total capital to over 600U.

In the next few days, BMer had both gains and losses in various contract operations: Eigen +57; TST -153; SUN +120, and by September 22, her total capital was fixed at 632U.

The real turning point came on September 23, when BMer encountered an unexpected surprise. She forgot to close her position on HEMI, and combined with the swing trading on 0G, this "accident" caused her daily earnings to skyrocket to over 600U, doubling her capital overnight to 1212U.

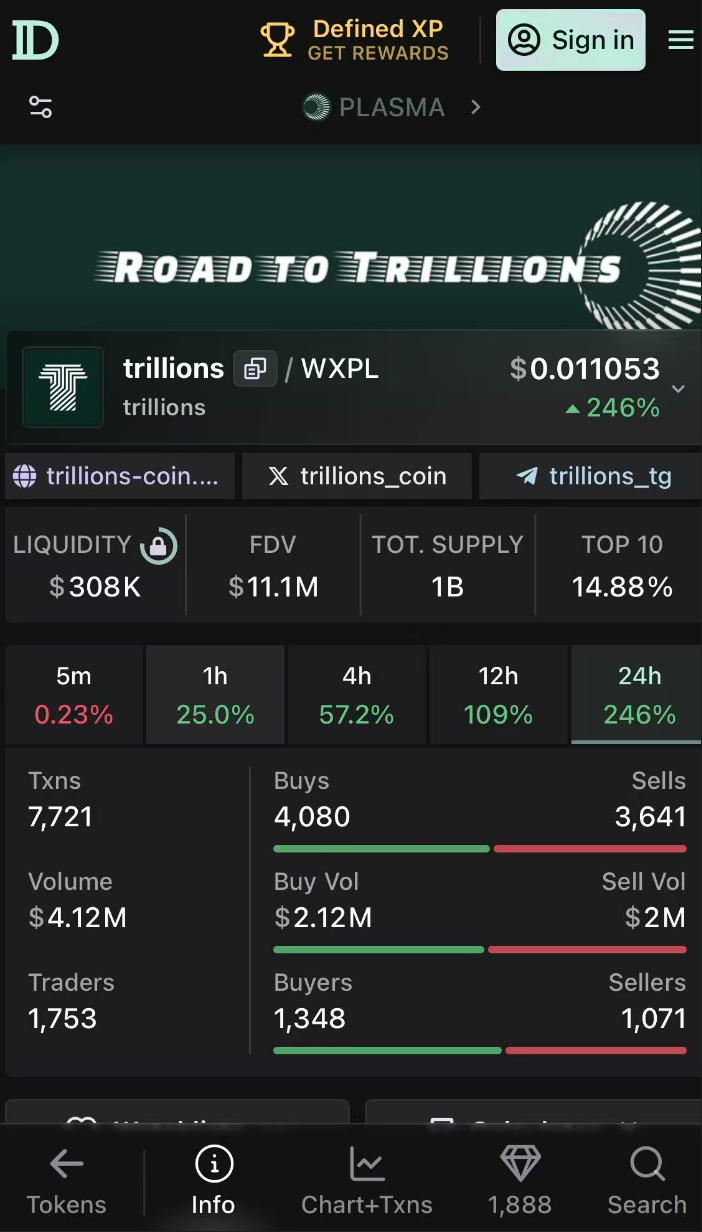

From that point on, BMer seemed to have found the key to wealth, especially with XPL becoming her cash cow. Starting September 26, BMer began trading various XPL contracts, netting 800U.

A portion of the XPL contracts traded by BMer

Finally, on September 27, through a combination of contracts MIRA and XPL, she earned 362U in a single day, bringing her total capital to 2221U, achieving an astonishing return of over 10 times.

Looking back, BMer successfully achieved 9 times the return, ultimately ending with a position of 1778 USDT, decisively taking first place in this trading competition.

Second Place - BC Brother (@bcxiongdi): Success and Failure with Meme, Ending with 4x Returns

BC Brother's trading included a lot of memes, and his trading career started off perfectly. With a keen market sense, he shorted AVNT on the first day, easily earning 160U in profit, nearly doubling his starting capital. Faced with such a strong start, he remained quite calm, choosing not to trade the next day, later adding, "Actually, I was in a cooling-off period and had no moves left."

In the following days, BC Brother displayed textbook trading skills. His trading record included:

- All-in on jobless, ultimately breaking even with just a 5U profit, but successfully avoiding a loss.

2. Going long on TWT for 19U, then going long on tut for a big profit of 106U.

Through various contracts, he earned another 129U, and by September 22, his capital had grown to 621U.

On September 23, he accurately shorted UXLINK, earning 212U in a single day, pushing his capital over 800U.

On September 24, he made a brilliant move, going long on a combination of aster and bless, earning 470U.

In less than ten days, he achieved over 6 times the return, with total capital reaching 1322U.

However, on September 25, he began to become slightly aggressive, bottom-fishing GAIN with 100U but only making 80U, resulting in a direct loss.

The turning point came on September 27, when he accumulated a loss of 1386U in contracts; although he recovered 400U through Light spot trading, the single-day loss of 986U hit hard, bringing his capital down to around 500U.

On September 28, he seemed to regain his footing, earning 839U through swing trading Trillions and other XPL memes, pushing his capital back over 2000U.

BC Brother successfully entered Trillions at this position

However, two days before the deadline, on September 29, he began trading contracts: losing 1000U on XAN contracts and 500U on Sol meme coins. In just a few hours, he fell from a peak of 2327U to 827U, with high-leverage contract trading records causing his profits to retract from over ten times to four times.

From 200U to 2327U and then to 827U, BC Brother performed a complete trading tragicomedy in two weeks, falling from a solid first place to a distant second.

Of course, this is still better than many of the remaining participants.

Third Place - Jerry: A Thrilling Journey of a P Newbie, From Near Bankruptcy to Third Place Overall

Jerry's trading career did not start smoothly, losing 30U on the first day with "200U OKB dog," and then shrinking directly to 100U over the next few days, choosing not to execute any trades for four consecutive days, lying still.

However, just when everyone thought this brother was going to completely give up, he suddenly sent a screenshot in the group:

The turning point in Jerry's career

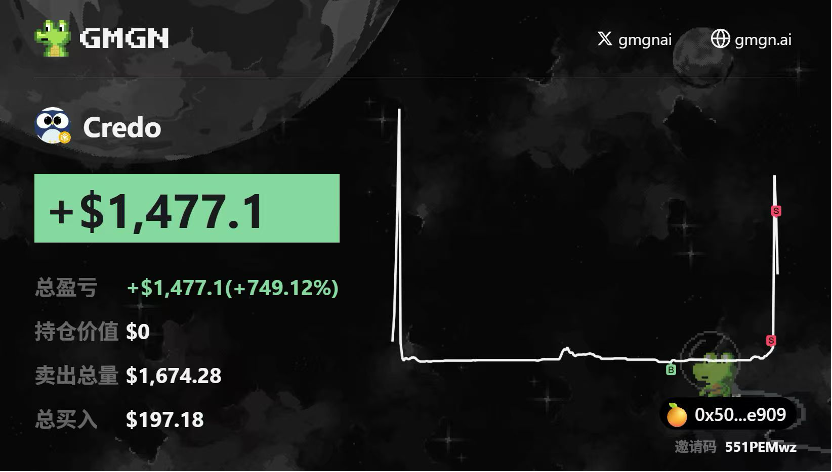

On September 20, he made a full recovery, not only bringing his capital back to 500U (we only calculate based on the initial 200U starting effective capital), but also starting his legendary BSC PVP journey.

On the 23rd, he continued to be a loyal P newbie on BSC, claiming "the biggest gain was from Forgiveness," and this operation allowed him to earn profits from a market cap of 2.5b to 5b, with screenshots shared in the group showing he made around 5 times the return.

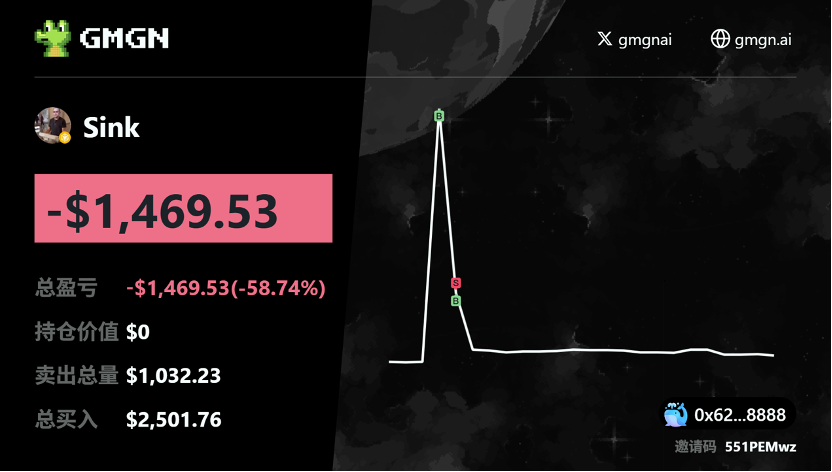

In the following days, Jerry was completely immersed in the crazy world of BSC memes. He continued PVP, mainly profiting from ROSE, cster, wrinkles, etc., steadily growing his capital to 600U. But the world of memes is always full of surprises, and on September 25, a project called Sink caused him to incur his largest single-day loss, losing 1000U.

However, Jerry clearly found the key to surviving in this crazy market. On September 29, he began trading BSC dog coins and Alpha, achieving a rebound of 1200U through BOODLE single coin. Finally, on September 30, he bottomed FF with a total loss of 900U, ending with 530U.

From 200U to nearly 1500U and then back to 530U, Jerry fully experienced the excitement and cruelty of the BSC Meme world in two weeks, vividly illustrating "GMGN big stage, come if you dare."

Conclusion: In the Face of the Market, We Are Always Students

The two-week trading competition proved that technical analysis may be useful, luck is indeed important, but what truly determines success or failure are often those seemingly simple yet extremely difficult principles: reasonable position management, timely stop-loss and take-profit, and maintaining a rational mindset between getting rich and getting liquidated.

When the noise subsides and the numbers return to zero, this small experiment of 200U allowed us to see various manifestations of human nature in the face of money. Greed, fear, luck, impulse—these primal emotions are infinitely magnified in the fluctuations of candlestick charts. True wealth has never been about those fluctuating numbers, but through such experiences, we can gain a clearer understanding of ourselves, comprehend risks, and learn to respect the market. After all, "the market is always right; the wrong one is always ourselves."

Note: All records in this article do not constitute investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。